Have you ever thought about what ChoCh is in Forex and why it seems that numerous traders have gone crazy about it? What is the new hype in this volatile market that makes thousands of ambitious traders look for the ChoCh meaning?

Regardless of your previous trading expertise and experience in the dynamic Foreign Exchange market, it is crucial when you ask yourself, “what is ChoCh in Forex” to understand the essence.

ChoCh term has to be an abbreviation because the word implies nothing. Well, let’s see what it stands for, what it means, and how important it is in Forex, shall we?

ChoCh meaning – what is ChoCh in Forex exactly?

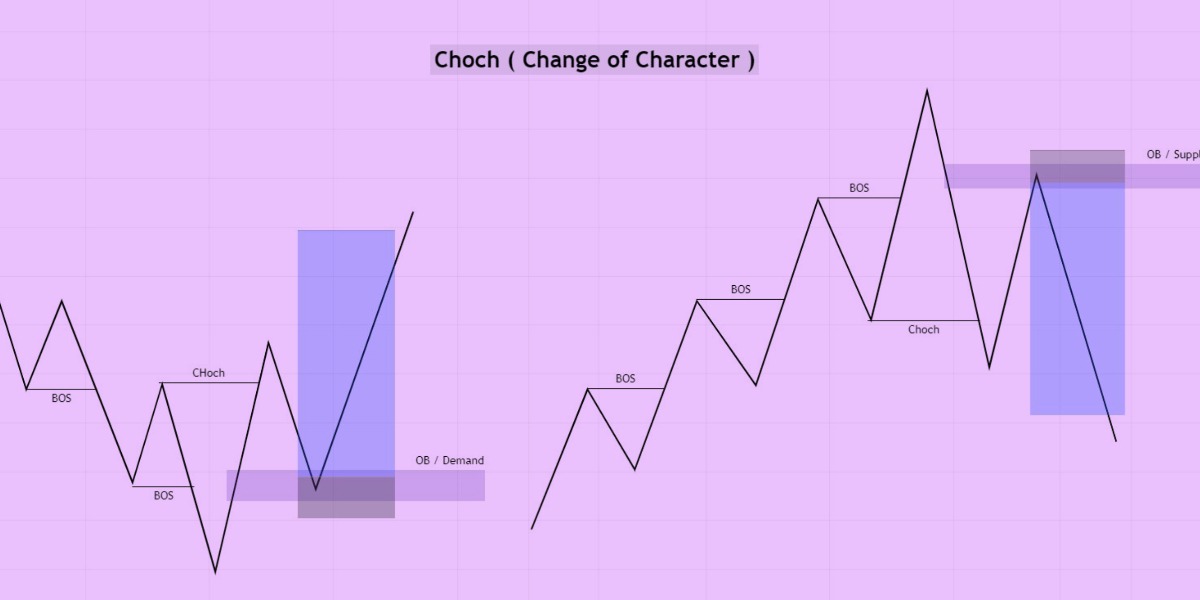

ChoCh is the abbreviation for Change for Character, representing a reversal of either a trend or a change of the trend’s direction. It’s an initial movement in orderflow that’s able to indicate long or short-term price reversal of an item, certain currency pair, or equity.

It’s observed as a reversal pattern that is usually utilized on the higher-time frames for the direction of the market. Besides that, traders also utilize ChoCh on the lower time frames to begin searching for valuable trades within one minute.

Numerous Forex traders prefer using ChoChs on every type of timeframe because, in that way, they’ll get a sense of the market’s direction and begin searching for intraday reactions or reversals to 15m points of interest.

For those of you still wondering, “What is ChoCh in Forex,” here’s a brief explanation.

Understanding ChoCh Better

A Change of Character typically refers to when there’s an uptrend in the Forex market, and once the price gets back, instead of clenching a zone of demand, or order block in whichever way you trade, the price breaks straight through, breaking the structure. That’s how we’ve got a change of character, i.e., a change of trend.

Experienced traders will get to know that it’s nothing extraordinary or new. It’s just a hyped-up methodology that is able to assist Forex traders in increasing their chances of gaining profits.

ChoCh, meaning, as mentioned above, is the change of character that enables traders to spot prices and break internal structures in which a relatively small level of demand or supply zone malfunctions.

An example of ChoCh

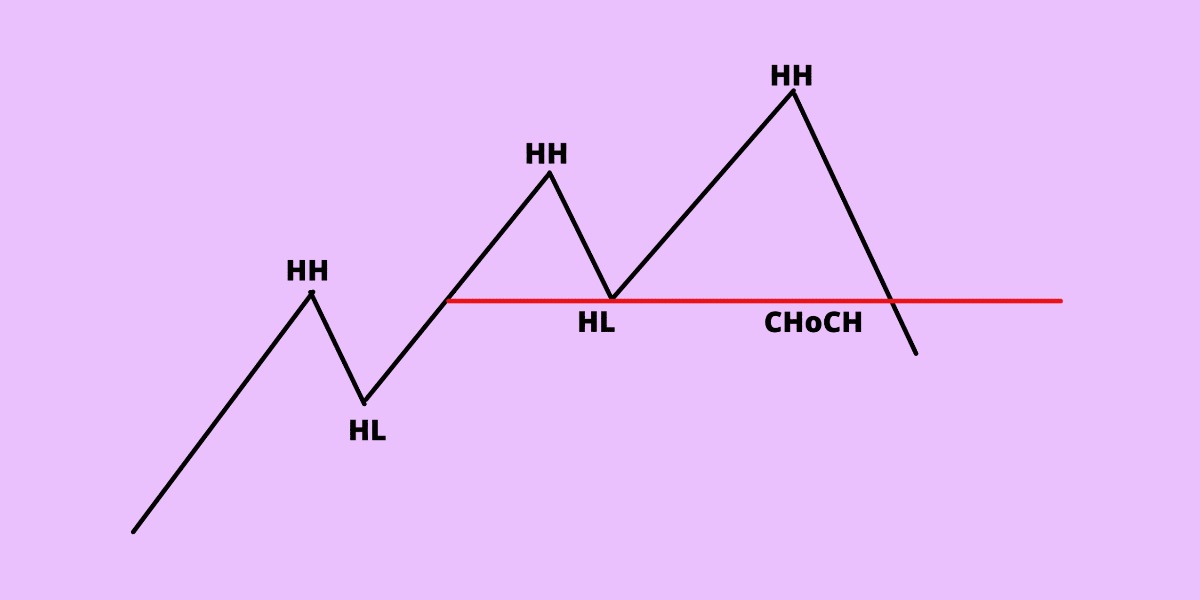

For example, if a trader spots an uptrend in the Foreign exchange market that’s identified by higher lows and highs, it means that the total trend is still bullish. Nonetheless, once a new high is established and then instinctively broken to the downside, it usually indicates that a bullish trend may collapse soon. It also means that the ChoCh transaction is about to happen.

With the proper answer to a common question: “What is ChoCh in Forex” traders can identify possible shifts in market trends that allow them to make more thought-through decisions.

By observing these transitions regarding the Forex market action and reacting properly, motivated Forex participants are able to increase their chances of acquiring huge profits in the long run. For that particular reason, those wondering “What is ChoCh in Forex” should understand that it’s not as complex a concept as it seems in the first place.

Instead, it’s a shifting character of the Foreign exchange market over some period, i.e., the one that every Forex trader needs to be aware of as they’re looking to maximize their trading potential.

How can traders utilize ChoCh the best?

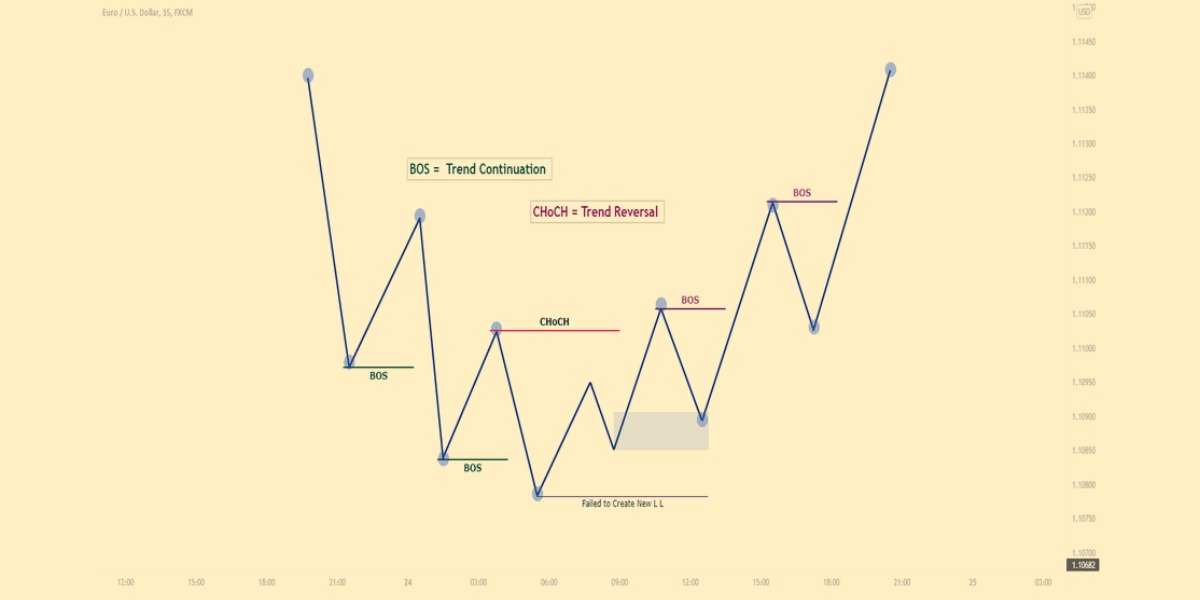

What is ChoCh in Forex could best be understood once you’ve got to know how traders use it most effectively. To successfully use the ChoCh in the currently biggest financial market on the planet, it’s essential to look for a shift in orderflow.

For complete newbies, the orderflow is made once sellers and buyers in the Forex marketplace set their intended orders. This particular orderflow is essential for buyers since it mirrors the momentum of a specific currency pair’s movement.

In other words, when traders observe the shift in orderflow, they look at the last level of supply or demand falling on the timeframes that the trader trades.

However, keep in mind that more is needed to rely on acquiring the direction of the market or to seek inadequate confirmations on the lower timeframes.

How to utilize ChoCh in the 15-minute timeframe?

For those wondering how to utilize ChoCh in the 15-minute timeframe effectively, it’s crucial to comprehend that these Changes in Characters could be a very handy tool in recognizing the POIs of high probability on the famous 15-minute to trade straight.

It is done by getting into the 15-minute timeframe and choosing POIs to search for the 1-minute confirmation entries on the timeframe.

What’s the core problem of relying solely on ChoCh?

Relying solely on ChoCh in Forex might have certain issues. The key issue with it is that, even with breaking the last point of demand or supply, the price could easily sweep the zone prior to continuing in the same direction as the present trend in the Foreign exchange market.

It means that for traders who don’t utilize the extra convergence to choose high-probability zones, there’s a great danger for them since ChoChs can create an increasing number of false signals that the price will likely go to reverse.

How to effectively trade ChoCh in the Forex market?

Besides the main question: “What is ChoCh in Forex” we’ve also got a common question: “How to effectively trade it in the Forex market”? As it is essential to pick the right moment to either sell or buy a certain currency, it’s also crucial to pick the right moment to start trading in the market.

It’s recommended to avoid jumping in, and out of the volatile Forex market anytime you wish and wait for the profit to happen itself. It’s not functioning like that. Instead, it’s crucial to have a more methodological and strategic approach regarding CoCh in the Forex market.

Beneficial key principles

Clearly, no universally accepted “most successful” ChoCh strategy will enable you with huge profits. However, some key principles might be helpful to any motivated Forex trader.

Here are these beneficial key principles that will explain to every individual Forex trader what to keep in mind while trading with the ChoCh pattern and how it can enhance their success:

- Once ChoCh is set properly, it will enable traders with the change in trend confirmation

- Utilizing a ChoCh pattern is able to be applied in lower and higher time frames.

- Establishing the ChoCh pattern once the price encounters a crucial market structure level is crucial.

- Also, it’s not recommended to trade the ChoCh pattern, excluding other crucial confirmations like supply and demand trading.

What should traders be cautious of when using a ChoCh pattern?

When using a ChoCh pattern, traders should remember that ChoChs are unreliable, especially if used alone in isolation. Since they occur quite frequently, traders should be cautious, especially because ChoChs don’t play out in 100% situations.

To successfully trade ChoChs without any issues, it’s crucial to utilize a stack of confluences to ensure that you’ve picked the best possible POI and that you’ve possessed a great deal of Forex market’s direction and overall knowledge.

It’s not that rare seeing Forex traders desperately trying to trade these Change of Characters whenever they spot them. However, it’s only sometimes the most effective solution since it might result in poor trading performance in general and poor confidence.

What’s crucial for traders to ensure?

In this situation, traders must ensure that they’re exclusively using only ChoChs or what’s known as the “internal breaks in structure” in very particular situations where you’re searching to exploit a reversal of the market.

How is ChoCh best used as a confluence?

Another question besides “What is CoCh in Forex” is how they are best used as a confluence. To successfully utilize them as the confluence is to search for them as the final phase after you’ve pinpointed a superior POI by conducting a thorough market examination and searching for the following convergences:

- Is it counter-trend or counter-orderflow if a trader enters a zone?

- Is the zone included in the chain of supply and demand?

- Did this zone manage to glide liquidity or not?

- Can traders spot clear liquidity between a place where the price is re-testing the zone and the zone?

- Can traders spot an understandable character change, or are they able to start the search for the entries?

Bottom Line

In conclusion, ChoCh is a powerful tool for traders in the financial market. Its ability to indicate long or short-term price reversal of an asset, currency pair, or equity makes it a valuable tool for identifying market trends and potential trades.

Its flexibility in being used on different time frames, from higher to lower, allows traders to gain a comprehensive understanding of the market and make informed decisions. With its ability to detect intraday reactions and reversals, ChoCh is a valuable tool for traders looking to capitalize on short-term opportunities in the market.

Furthermore, it is crucial to note while considering trade characters, that ChoCh is limited to Forex trading and can also be used in other markets, such as stocks and commodities. Traders should keep in mind that ChoCh is just one of the many technical indicators available and should be best utilized in combination with other analysis methods to make more informed trading decisions.

As ChoCh is an initial movement in orderflow, it can be utilized to gather information about the market and make wise choices.