How to Perform Technical Analysis Using Multiple Time frames

There are a number of types of forex analysis. The vast majority of forex traders know about fundamental analysis, market sentiment, as well as technical analysis. However, not many traders understand the importance of the forex multiple time frame analysis (MTFA.) Unfortunately, the MTFA is easily forgotten by forex traders as they pursue more specific markets.

Are you interested in technical analysis using multiple timeframes?

This article aims to help you better understand the role of MTFA.

When specializing as a momentum trader, an event risk trader, a breakout trader, or a day trader, the vast majority of forex market participants lose sight of the larger trend and may miss clear levels of support and resistance. Participants may also fail to spot high-probability entry-stop levels.

You need to pay attention to various details when it comes to technical analysis using multiple timeframes.

What is the meaning of MTFA?

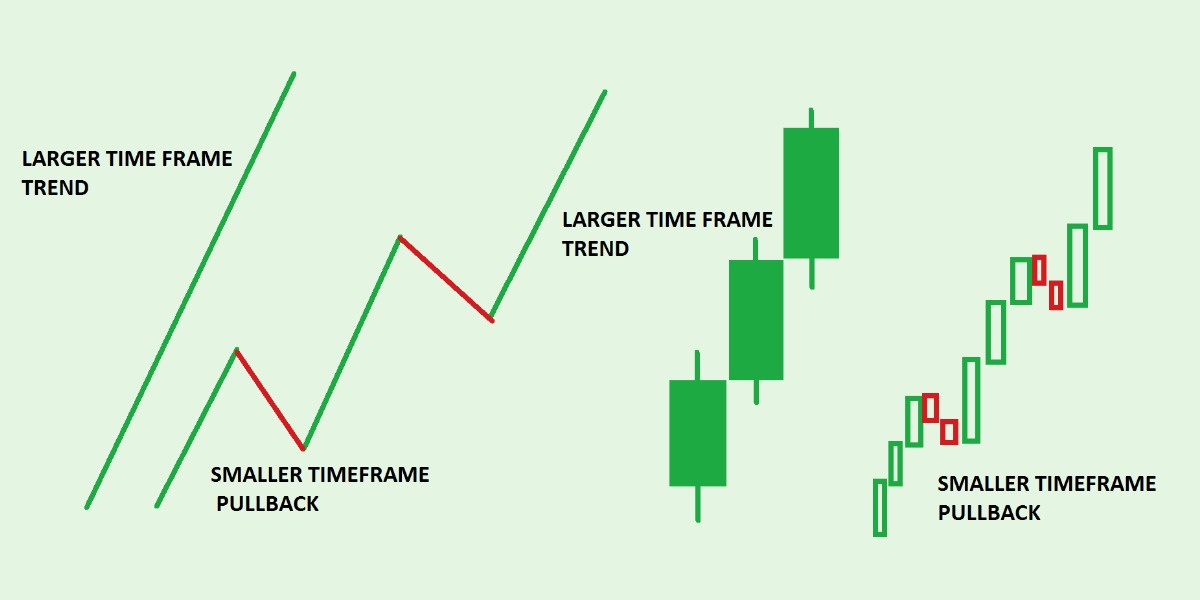

MTFA in forex trading includes monitoring the same currency pair across various frequencies.

It is noteworthy that MTFA trading is a process of taking a look into various timeframes and aligning both trend, momentum, as well as direction. As a reminder, there is no limit when it comes to monitoring frequencies. However, there are general guidelines that the vast majority of forex traders follow.

Using three different periods is mostly enough in order to provide a wide enough reading on the forex market. When selecting the three-time frequencies, an easy strategy is to follow the rule of four.

This implies that a medium-term period must be first spotted, and the medium-term period should illustrate a standard as to how long the average trade is held. From there, a shorter frame of time should be picked, and the shorter time frame should be at least a quarter of the intermediate period.

Utilizing an identical calculation, according to multiple time frame trading, the long-term time frame must be at least four times greater compared to the medium-term period.

It is very important to select the right time frame when picking the range of the three periods.

Famous forex traders

Now, you know what to answer when someone asks about “technical analysis using multiple timeframes.”

The forex market is the world’s largest financial market. So, it makes sense to learn more about it. So, let’s continue our journey in the world of the forex market.

There are many forex traders. However, not all of them are equally successful. Let’s learn more about world-famous forex traders.

We can start with George Soros. He is considered as one of the best forex traders ever. He was born in 1930. The world’s one of most recognizable forex traders worked at a series of financial firms until Soros established Soros Fund Management a very long time ago, in 1973.

George Soros rose to international fame in the 1990s as the forex trader who broke the Bank of England.

Even after so many years, Soros remains one of the most well-known traders in the world. So, it is desirable to gather more information about his accomplishments in order to learn from one of the best forex traders.

Have you heard about Stanley Druckenmiller?

Druckenmiller began his financial career in the 1970s. In 1980, Druckenmiller founded his company, Duquesne Capital Management.

It is noteworthy that Druckenmiller gained popularity thanks to his book, The New Market Wizards.

Druckenmiller even survived the 2007-2008 world financial crisis. His hedge fund survived the financial crisis. However, he closed his hedge fund.

Andy Krieger, Bill Lipschutz, and Bruce Kovner

We can forget about Andy Krieger and Bill Lipschutz when it comes to the most famous forex traders.

Andy Krieger knows what it means to be a forex trader. In 1986, he joined Bankers Trust. What’s important, Krieger acquired an immediate reputation as a successful trader.

As a reminder, the company rewarded Krieger by increasing his capital limit to $700 million, significantly more compared to the standard $50 million limit.

Bill Lipschutz understands the importance of the forex market. He started trading in the late 1970s. He was studying at Cornell University when he turned $12,000 into $250,000. Nevertheless,

Lipschutz lost the entire stake due to one poor trading decision. However, his decision helped him to become a better trader.

In 1981, Lipschutz began working for Salomon Brothers in 1981. He migrated into the company’s newly-formed foreign exchange division at the same time forex markets were exploding in popularity. Interestingly, Lipschutz helped his company to earn millions of dollars.

Lipschutz left the company in 1990. For the last six years, he was the principal trader for

the firm’s forex account. He is the co-founder and director of portfolio management at Hathersage Capital Management.

We can’t finish this article without mentioning Bruce Kovner. It is noteworthy that Kovner made his first trade when he was 32 years old. Kovner borrowed against his personal credit card in order to buy soybean futures contracts.

In 1983, Kovner founded Caxton Associates. He helped to make Caxton Associates one of the most successful hedge funds in the world. The fund’s profits, as well as management fees, made Kovner one of the biggest players in the forex world. He retired in 2011.