Have you ever wondered what Swing Trading Checklist in Forex includes? How important is it for an ambitious trader who aims to make serious profits to learn all the secrets of this particular strategy on the volatile Forex market?

First, all those who want to engage in swing trading should understand that it is one of the most profitable Forex strategies that many use to increase their chances of profit. As a swing trader who wants to stay in the market for many years, you should understand the importance of understanding what a swing trading checkbox entails.

But before we give you that list, let’s see what swing trading means in Forex, especially when it comes to trading for beginners, and how crucial it is to be properly utilized by traders, shall we?

What is swing trading exactly?

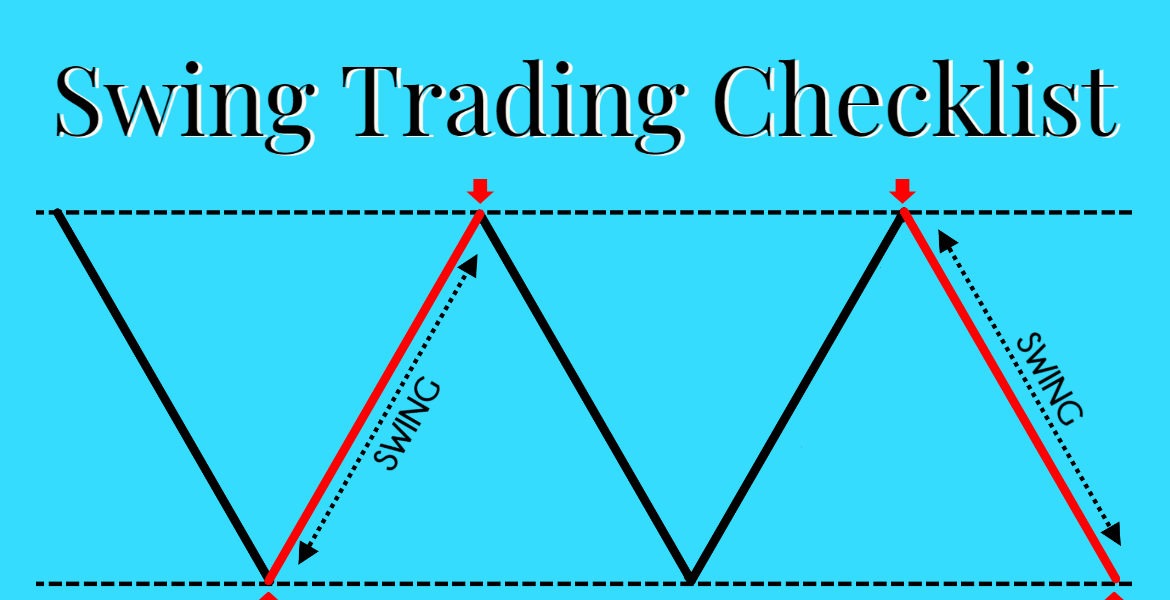

Swing trading is a medium-term investment strategy employed by currency traders seeking to capitalize on fluctuating prices. This approach demands forbearance as positions are held for multiple days.

Situated between shorter-term day trading and longer-term position trading, swing traders pinpoint potential trends and maintain their trades for a minimum of two days to a maximum of several weeks.

This method is well-suited for individuals who cannot continuously monitor their charts during the day but can spend a few hours each evening analyzing the market.

For whom is swing trading best suited?

Swing trading is well-suited for those with other primary engagements such as full-time employment or education but still have sufficient leisure time to keep abreast of the current events in the global economy.

Swing trading techniques use either fundamental or technical analysis to forecast the potential direction of a currency pair shortly.

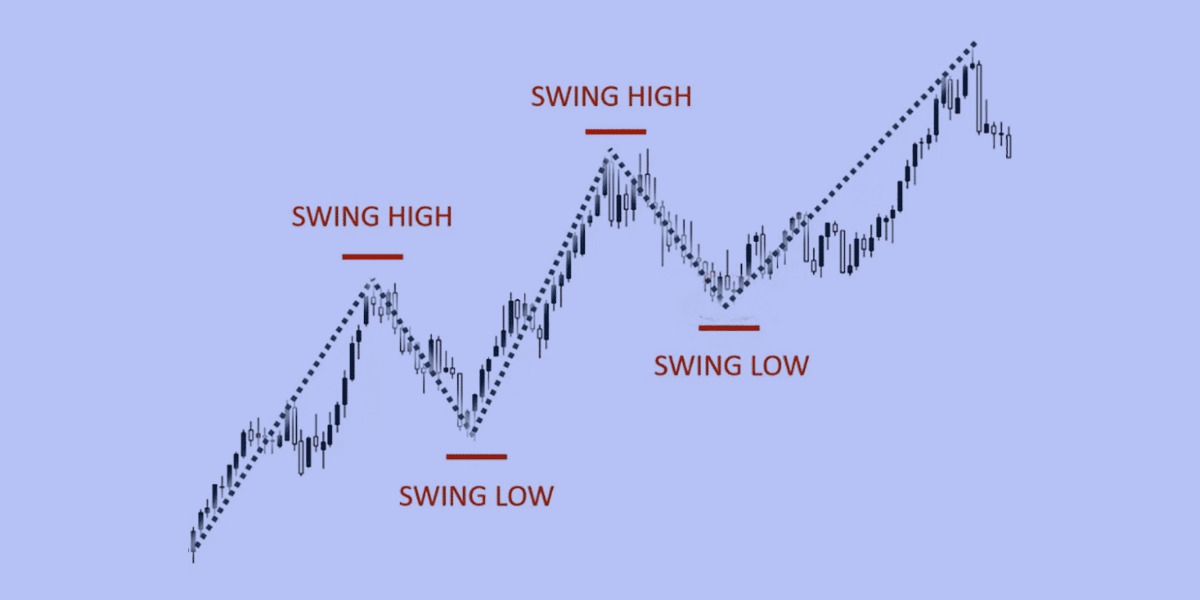

Those interested in a swing trading checklist should understand that the main goal of swing trading is to recognize medium-term fluctuations, or “swings,” in the market and enter trades only when the probability of success is deemed high.

For instance, in an upward trend, the objective is to buy at “swing lows” and, conversely, sell at “swing highs” to take advantage of temporary counter movements in the market.

What does a quality swing trading checklist look like?

If you were wondering what a high-quality and meaningful swing checker looks like, we have prepared for you a few important things that no serious and ambitious swing trader should forget:

Liquidity

Generally speaking, liquidity plays a huge role, not just in swing trading but in many other strategies and situations. The ability to easily buy and sell is known as liquidity, which attracts traders and investors to a market.

A market that is not liquid tends to be more volatile due to a lack of trades, resulting in less stable pricing. The primary benefit of liquidity is that it reduces the cost of trading or investing. Particularly swing trading requires that a swing trader either enter or exit from trades very quickly.

Time frame

Another crucial element that should be included in every serious swing trading checklist is the time frame. Serious swing traders are advised to utilize various time frames, from hours and days to weeks, months, etc.

To successfully measure all of the crucial market sentiments with additional accuracy. Remember that usually, one-minute, five, or fifteen-minute candlesticks aren’t good examples for measuring the sustainability of the trade since they’re too small.

These small time frames are best employed by professional day traders who are generally expected to square off all of their positions once the day finishes.

Volume

The amount of currency bought and sold, or the number of lots usually traded in a currency pair over a specific period is known as a volume in Forex. The volume provides little information on its own, but when considered in conjunction with price movements and momentum, it can indicate whether trends are likely to persist.

Thus, it’s unsurprising that volume is also a crucial part of the high-quality swing trading checklist. Remember that any trend followed by high volumes represents a great indicator of a trend continuation.

Entry and exit points

A well-constructed and decisive plan is essential for a successful forex entry and exit strategy. This entails clearly understanding the ideal times to enter and exit the market. Entry and exit points are also crucial for every swing trading checklist because swing traders should have a strategy for deciding the entry point of their trade.

To ensure steady profits, swing traders must pick accurate entry points established on their proper chart analysis. In most situations, once the swing traders are after a certain trend in the market after some retracement, they enter into trades.

Exit strategy

Similarly, exit points should also be taken into account and pre-determined by traders. It’s called “the exit strategy,” It should be based on the crucial technical price levels. It could also be pre-determined by the particular risk-reward ratio.

Risk-reward ratio

A risk-reward ratio calculates the dissimilarity between a trade’s entry point and its stop-loss and take-profit orders. By using these ratios, traders can evaluate a trade’s likely profit or loss. For example, a ratio of 2:1 would mean two units of projected gain for every one unit of the potential loss.

It’s the fundamental requirement of any possible trading strategy. Swing traders should keep an eye out for the risk-reward ratio while executing their swing trading strategy in the Forex market.

Stop loss

A stop-loss order refers to an automated system designed to close a trade within the trader’s acceptable level of risk. It is a protective measure to prevent significant losses, including closing a margin account.

Swing trading includes a huge amount of so-called “overnight risk” since traders are usually held for more than one day. If the proper stop loss is excluded, traders might experience runaway gaps, downs, or ups, resulting in capital erosion.

Risk management

The key to overcoming the hazards inherent in trading is to decrease loss. Managing risk in trading involves formulating a plan considering the proportion of wins and losses and the typical size of wins and losses. Additionally, averting ruinous losses that can entirely wipe out your trading account is vital.

Usually, a combination of exit on stop/loss target and trailing on stop loss is vital.

Persistence and consistency

Certainly, the most important thing when it comes to a swing trading checklist is that traders should be as persistent and consistent as possible with their trading plans. When the strategy has been created and back-tested, it shouldn’t be changed. Sticking to your trading plan is crucial until you start gaining significant profits.

How to successfully start swing trading?

- Formulate a trading strategy: Before engaging in the foreign exchange market, it is imperative to have a clearly defined strategy that includes your approach, risk management techniques, and objectives.

- Acquire market knowledge: Obtain a thorough understanding of the market conditions, patterns, and economic factors influencing currency prices. Stay informed with the latest news and insights.

- Select a currency pair: Choose a currency pair that aligns with your trading strategy and has a high level of liquidity.

- Locate swing points: Utilize technical analysis to locate swing points, which are the peaks and valleys of short-term price movements.

- Utilize protective measures: Implement protective measures, such as stop-loss orders, to limit potential losses by automatically closing a trade when it reaches a certain point.

- Control your emotions: Avoid hasty decisions and maintain discipline by adhering to your strategy and managing your emotions.

- Be persistent: Swing trading necessitates persistence, as trades may be held for multiple days or weeks.

- Test on a simulated account: Before investing real money, test your strategy using a simulated account.

- Continuously improve: Stay current with market conditions and enhance your knowledge and skills.

- Maintain a pragmatic perspective: Remember that there is no guarantee of success in trading, but having a solid strategy and discipline can increase your chances of success.

Why is swing trading beneficial for Forex traders?

Swing trading is a highly advantageous method for Forex traders as it allows them to capitalize on medium-term trends in the market. This technique involves holding trades for several days to a few weeks, which is shorter than position trading, but longer than day trading.

This time frame offers the potential to capture larger price movements while minimizing exposure to the market for prolonged periods. Additionally, swing trading requires less time commitment than day trading, making it suitable for traders with other responsibilities.

Furthermore, it is able to be combined with both fundamental and technical analysis, providing traders with multiple options for making informed decisions about entry and exit points. Overall, swing trading offers a profitable and manageable approach for Forex traders.

What are also crucial checkpoints for swing traders?

To ensure success in swing trading in the Forex market, it is essential to have a comprehensive checklist that includes the following:

- A well-constructed plan for trading that takes into account the ratio of wins and losses, as well as the average of both.

- Using risk management strategies to keep losses to a minimum and safeguard against complete ruin.

- Closely monitoring market trends and conditions to identify the most favorable entry and exit points.

- Setting specific objectives for each trade and regularly evaluating performance.

- Keeping up-to-date with global economic events that may affect the market.

- Continuously seek new learning opportunities and stay current with the latest trading tools and techniques. By adhering to these fundamental principles, traders can improve their chances of success in swing trading in the Forex market.

Bottom Line

Swing trading in the Forex market can be a highly beneficial strategy for traders. It requires a well-structured plan, risk management, and an understanding of market trends to be successful. By following a comprehensive checklist and continually seeking out new learning opportunities, traders can improve their chances of success in swing trading.