CONTENT

- GENERAL INFORMATION

- FUNDS TRADING AND SECURITY

- TRADING ACCOUNTS

- SPREADEX TRADING CONDITIONS

- TRADING PLATFORM

- SPREADEX’S TRADING PRODUCTS

- CUSTOMER SERVICE

- CONCLUSION

New Broker on the Horizon: SpreadEX

SpreadEX: General Information

Although SpreadEX financial services have been around for a while, the company never stopped moving forward and innovating. As such, it has managed to avoid the trap most established companies fall in. You’ll often see a firm that stops updating its services, which leads to newer competitors with fresh ideas simply overtaking it. SpreadEX didn’t let that happen, always following shifts in the finance world and online brokerage services. That, coupled with a robust integral service, allowed them to gather and maintain a loyal userbase.

Especially in the finance world, keeping a loyal customer base for a prolonged period is quite a feat. In recent times, brokerage services have been continuously revolutionized, with many firms falling into obscurity. Only the sharpest and quickest to innovate and accommodate customers to survive, as traders will gladly jump to a different service if they’re dissatisfied with their receiving. That’s simply a downside that the variety of choices on the internet brings online brokers. However, SpreadEX financial services have managed to persevere for over a decade.

As such, SpreadEX has already impressively accumulated experience, and continued success tells us a lot about the firm’s quality. That much is apparent even when you open up the broker’s website. You can see the blend of old and new in their air-tight, slightly retro design. Everything runs smoothly, and the information you need to know is never more than a few button presses away. The company also avoided the usual mistake of informational overload, cutting out or separating a lot of excess info.

However, all that would fall apart if the overall trading experience wasn’t satisfactory. Luckily, the broker ensured that it would provide cutting-edge conditions for its customers. Let’s start our SpreadEX review by inspecting some of their key features:

-

ASSET DIVERSITY

While many traders consider a comprehensive asset library to be a luxury feature, having a bigger trading product pool to choose from also has practical uses. Greater choice diversity, for example, leads to higher average choice quality. There are bound to be more top-quality assets when there are more instruments, in general, to pick from. Also, many experts consider diversification a crucial safety strategy any aspiring trader should master. Diversifying is naturally much simpler when you have a wide array of assets to buy or sell.

-

AMAZING BEGINNER EXPERIENCE

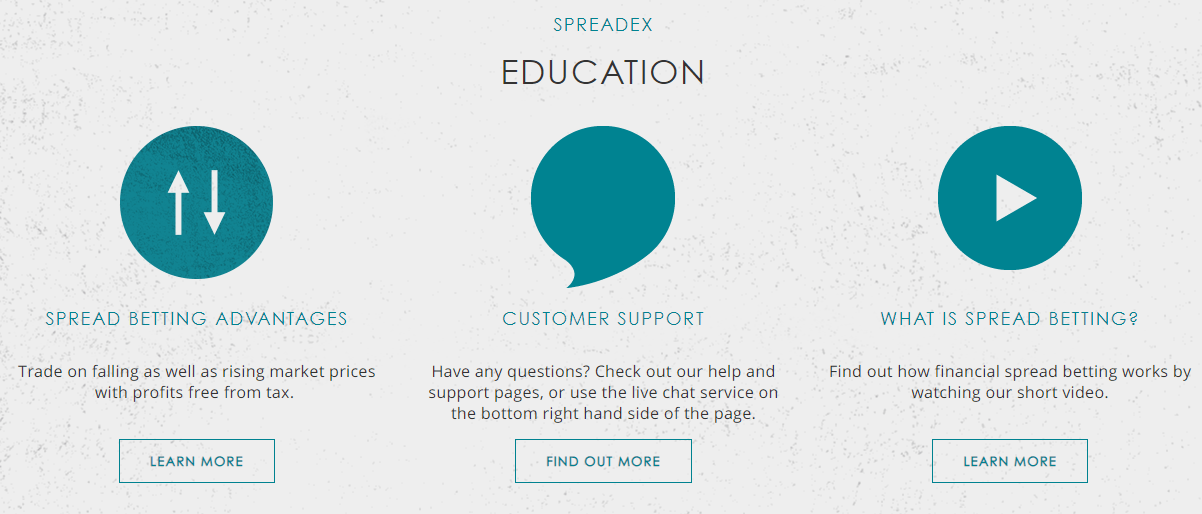

SpreadEX has ensured that newer traders, or even people trying trading for the first time, have a smooth entrance into the finance world. There are multiple reasons for that, the first being the comprehensive learning materials. They start from the ground and move upwards slowly, building essential trader skills. Beyond that, there’s the shallow requirement to deposit funds for a live account, starting at less than a dollar. Naturally, that’s an advantage for traders of all skill levels, but especially so for those still unsure whether they’ll enjoy or be good at trading.

-

DETAILED ANALYSIS

There were multiple cases where SpreadEX offered traders help, even if the mistake was on the customers’ end. The company is willing to take financial hits to maintain client satisfaction, which speaks volumes about integrity. Each client’s specific approach also shows a level of care that many brokers seem to have left behind. Other modern brokerages seem to favour more standardized customer support solutions. As a contrast, it’s quite refreshing to see that SpreadEX still offers solutions on an individual basis.

-

PERSONALIZED SERVICE

One advantage online brokers had when their userbase was smaller on average was increased care for individual traders. When you have fewer customers on average, one customer is more valuable, and it’s simpler to communicate with them. Over time, as online trading inched towards the mainstream, many brokers have stopped caring for a single client. Some have done that because it’s simply too challenging, while it’s a numbers game for others. However, SpreadEX kept the vintage online broker mindset and doesn’t hesitate to offer custom solutions to users’ problems and requests.

Funds Trading and Security

Security is one of the primary concerns anyone should have when finding a new brokerage to begin working with. Even the best service is only one misstep from the brokerage away from turning into a miserable one. There are few worse feelings in trading than losing your money to a scam broker’s tricks. The safety issues have been boosted even further with the recent increase in new traders. As more novices enter the finance world, scams are trying to exploit their inexperience increase as well.

However, we’re confident that SpreadEX doesn’t fall into that group and is adversely one of the most trustworthy firms on the market. We aren’t just saying that on a gut feeling either, as the company has regulation and past behaviour patterns to back that up. The broker operates under the UK’s FCA, famous as one of the most stringent watchdogs worldwide. Even recently, they’ve had a burst of regulatory activity, fining and blacklisting a multitude of misbehaving brokers.

The Financial Conduct Authority (FCA) license alone wouldn’t be enough to convince us of the broker’s well-intendedness. There have been multiple cases in the past of brokers slipping through loopholes or license givers turning a blind eye to foul play. However, SpreadEX’s history shows us that they are among the most customer satisfaction-focused brokerages out there.

Traders are content with what the broker provides and how it interacts with them. Additionally, the firm often makes compromises even though customers were technically at fault. That shows a level of individual appreciation that most brokers have stopped showing since online financial trading made it into the mainstream.

SpreadEX Account Opening Process

As a top-notch broker, SpreadEX is pushing the limits of the old online service technology. The brokerage has created an easy account opening system. It only takes a couple of the most straightforward steps: filling an online application and waiting to confirm the approval. So, we’ve already stated in our SpreadEX review, opening a live account requires nearly no time investment. Double click and you are ready to go!

One of the most notable things is that the trading experience is equal across the board. As the broker offers fair usage of one standard account, it provides—the account has all the possible featurettes and instruments that any broker would need. Moreover, traders will not need to worry about features locked behind different accounts or other specifications made worse to force upgrades.

The single account type that SpreadEX offers means that the broker is all for fair use and does not need to stagger its services. Having one ultimate account variation eliminates any financial motivation behind having a weaker service, which adds to the broker’s strength to provide the best services to its clients.

However, the broker adheres to MiFID II, meaning it has to cap leverage for newer traders. It does that by creating a retail/pro trader split, where the first is the default account, and the other is the step-up. Even with that division, SpreadEX financials is entirely fair, as anyone can get a pro account. Naturally, you need to fulfil certain conditions that are out of the broker’s control. Still, we believe that the split is a net positive as, although it may hamper the experience for some, it protects newer traders.

SpreadEX Trading Market & Products

In our reviews, we always try to pay close attention to the range of markets that the broker provides, as it shows how much of the freedom the client can have in their everyday trading menageries.

SpreadEX offers a wide range of financial markets, including indices, shares, forex currency pairs, commodities, ETFs, interest rates, bonds, Cryptocurrencies, options, and Speed Markets.

However, the broker specialized in spread betting more. Spread betting is much more uncommon in online brokerages. Please do not fret; even though it is something quite rare to the trading activity, spread betting is based on the difference between buying and selling price, also called an ask and bid. In case you want to find out more about spreads, SpreadEX has provided excellent educational explanations on its website, so in case you need to, check it out!

The total asset count as SpreadEX is impressive, coming in at over 15000. Some markets you can trade on are copies of each other, but even a third of SpreadEX’s number would be fascinating. As such, we doubt any trader will have a difficult time finding an asset to trade on. SpreadEX financial markets are spread over more than a few categories, meaning it’s not singularly focused. Because of that, traders shouldn’t have any issues in creating a healthy and diverse portfolio.

Fees and Funding on SpreadEX.com

While fees are a part of a broker’s overall trading conditions, we still feel like they deserve a separate category. When using a broker, additional costs can shape the experience and even completely ruin it if they go overboard. It’s not uncommon to see a brokerage destroy their customers’ experience by imposing hefty charges. Trading commissions are especially noticeable because of how often they impact users. Sometimes, those can invalidate specific strategies, alienating users that employ them entirely.

Luckily, the broker is quite reasonable, without any trading or withdrawal fees, as we mentioned earlier in our SpreadEX review. On top of that, the deposit fees are entirely appropriate, only coming in for card transfers for users outside the UK. It’s entirely possible that those charges were out of the broker’s hands, but even then, they’re far from severe. That means each trading tactic is equally viable on SpreadEX.com, and the trading experience is authentic.

However, the broker still needs funding options to back up the overall trading and charge structure. Most experienced traders have felt the frustration of long waits for deposits and withdrawals. Those periods can be quite frustrating, especially when you miss out on a good trading opportunity because of them. Luckily, the SpreadEX financial service has quick deposits and withdrawals, avoiding such situations altogether.

Lastly, we need to go over how you can fund your account, as it’s also quite important. After all, you can’t even initiate trade without any funds on the account you wish to trade from. Luckily, the broker’s payment options cover all of the significant options traders usually fund their accounts with. That includes cards, eWallets, and direct bank transfers.

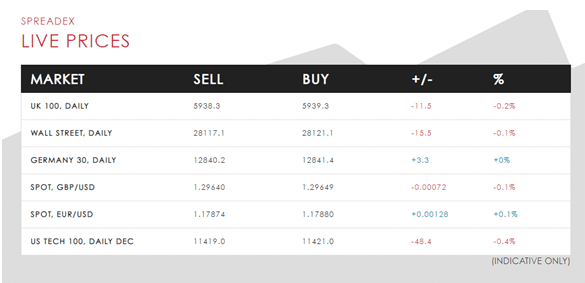

Trading Conditions

SpreadEX offers many different kinds of trading and a massive variety of markets. However, solely relying on its asset variety wouldn’t have gotten the broker where it is now. For that, it needs to provide a complete, well-rounded trading experience that satisfies many traders’ needs. Fortunately, we consider the broker’s trading conditions good enough to please most online traders.

The broker is one of the few spread betting companies out there, meaning it stands out right away. But even beyond that, it offers trading on a multitude of different assets, meaning there’s something for everyone. The leverage, once you uncap your account by going pro, goes up to 1:200. Although that involves risk, margin trading creates the potential for massive profit with a small investment. There are no fees when trading, which means the experience is transparent, and you get your full money’s worth.

The spreads are tight as well, meaning the trading experience is beneficial towards users. Furthermore, execution via their excellent proprietary platform is lightning-fast, eliminating the chance of delay-based mistakes. Other secondary factors, such as the great deposit and withdrawal methods, security, and customer support, also support excellent conditions.

SpreadEX review: Trading Platform

The broker offers a fully-customizable, fast, and reliable proprietary platform on the web, iPad, iPhone, and Android. The platform provides advanced order executions, advanced charting, and price alerts. Although some traders have negative opinions of proprietary platforms as scams often use them, SpreadEX is different.

Namely, the company started its foray into the brokerage world as a simple iPhone app. That means it had over a decade to perfect its service and rival more standard options. If the software couldn’t have held its own, the firm would’ve gone under quite a long time ago. Additionally, since the platform was the broker’s bread and butter, it had to perfect it.

The result is a platform that can compete even with market leaders, such as MT4. Many traders that use SpreadEX even claim to have a more enjoyable experience on the proprietary platform than MetaTrader. The trading app is in the browser and mobile forms by default, making accessing SpreadEX financials simpler. Overall, the platform does wonders in improving the trading experience and is among its primary components.

- Here are some features of the SpreadEX trading app:

- Spread bets and CFDs from one account

- Price Alerts by text, push, or email.

- Fast and fair execution

- Macro-data directly available on charts

- Automated Pro Trend lines and Pattern Recognition

- Extensive price history of over ten years

- Guaranteed stops

- One-click dealing

SpreadEX.com Client Support

SpreadEX’s customer support improves over the usual structure by working every day of the week. In return, they don’t work around the clock but rather on a fixed schedule spanning more than 8 hours each day. That creates a structure where they can resolve issues quicker than brokers with a 24/5 system. The methods you can use to reach the broker are usual, with email, live chat, and phone line options. You can call two lines, an international one and a local (UK) toll-free one.

As we mentioned, the broker’s support team is available any day of the week. However, its worktime spans from 8 am – 5:30 pm UK time. That coincides with the time most traders conduct their business, meaning issue resolution is simple. Here’s some of the basic information regarding SpreadEX:

- Address: Freepost RRRS-GTBG-HGZB, SpreadEX Ltd., Churchill House 26-30, Upper Marlborough Road, St Albans, Hertfordshire, AL1 3UU

- Phone number: +44 1727 895 000

- Email: [email protected]

SpreadEX Review: Final Verdict

So what can we say as the ultimate conclusion for our SpreadEX.com review? We think SpreadEx is quite an impressive broker. It is quite rare to see such an astoundingly reliable, experienced, and modern broker, functioning correctly in the financial market. It offers some innovative functions, such as spread betting while remaining true to themselves.

The amount of hard work that they put in their functionality and spread trading is marvellous.

However, before you decide what to do, make sure to go ahead and do your research. After all, you’ll be trading with your own hard-earned money, and it’s always better to be safe than sorry.

Undeniably great

Undeniably great. I traded with them and get profit that is unexpectedly huge. They know what to do and how to do it right.

Did you find this review helpful? Yes No

Reliable brokers

I am at ease because my forex broker is so much reliable. I can fully depend on signals and services.

Did you find this review helpful? Yes No

Amazing support

Amazing customer support. I am trading worry-free because I always got their back.

Did you find this review helpful? Yes No

Fantastic broker

Fantastic broker company. Services are really pleasant and there are so many ways to earn money.

Did you find this review helpful? Yes No

Responsible and professional

Responsible and professional people. They are very transparent on all transactions. I am gaining good profit and satisfied with the services.

Did you find this review helpful? Yes No

Effective services

Effective trading services, good customer service and fast withdrawals. I highly recommend this broker.

Did you find this review helpful? Yes No

Efficient services

Efficent services for online trading. Withdrawal is always process smoothly and swiftly.

Did you find this review helpful? Yes No

Good services

Services are all good. People are very professional. I could not ask for more.

Did you find this review helpful? Yes No

Trusted broker

My trusted trading broker. Signals are profitable.

Did you find this review helpful? Yes No

Highly recommended

The worthwhile opportunity of earning good money. Highly recommended.

Did you find this review helpful? Yes No

Smart trading tools

Smart trading platforms and tools for daytrading. I have traded with several companies in the past but this one got the best tools.

Did you find this review helpful? Yes No

Undeniably great

Undeniably great. I traded with them and get a profit that is unexpectedly huge. They know to do and how to do it right.

Did you find this review helpful? Yes No

Transparent broker

There transparency is outstanding. I trust them high enough with my investment. They did well in what they do and works efficiently than any other broker I have dealt with.

Did you find this review helpful? Yes No

Profitable trading

All of their services are reliable and effective. I love trading with them, very profitable.

Did you find this review helpful? Yes No

Easy and quick withdrawals

What I like about this broker aside from its profitable signals is that all transactions here are smoothly processed. That includes withdrawal which is very easy and quick.

Did you find this review helpful? Yes No

Consistent profit

One of the most desirable forex brokers. I gain good profit consistently.

Did you find this review helpful? Yes No

Good services

I have been trading with this broker for more than six months and based on my observations, I know they are good brokers. Signals are profitable and services are good.

Did you find this review helpful? Yes No

Reliable signals and services

Reliable trading signals and services. I am very satisfied with my profit and with all of their services so far.

Did you find this review helpful? Yes No

Good trading company

Good trading company. Signals are accurate and profitable.

Did you find this review helpful? Yes No

Amazing broker

I am truly amazed with their services. I can withdraw easily and I gain good profit, too.

Did you find this review helpful? Yes No

Great profit

Great broker and customer service. They also process withdrawals swiftly. Profit is set at a 10 percent minimum sometimes it is even more than that depending on the market movement of course.

Did you find this review helpful? Yes No

Trusted broker

My trusted trading broker. Very honest and dedicated.

Did you find this review helpful? Yes No

Excellent signals

Excellent broker signals. Trading advice are something that I like about them, I can fully rely on their services.

Did you find this review helpful? Yes No

Good services

Consistently good services. I have been using their services for over six months now and they never fail to amaze me.

Did you find this review helpful? Yes No

Good signals

Good trading signals. The advice is reliable and the profit is good.

Did you find this review helpful? Yes No

Great customer service

Great customer service. They are always there for me and really helped me in all of my trading needs.

Did you find this review helpful? Yes No

Quick withdrawals

Easy and quick deposits and withdrawals. Services are more than great than what I expected.

Did you find this review helpful? Yes No

Good broker

Good trading services. I always get my money on time.

Did you find this review helpful? Yes No

Trusted forex broker

I can fully trust this forex company. They seem to be very honest and their services are reliable.

Did you find this review helpful? Yes No

Undeniably great

Undeniably great. I traded with them and get profit that is unexpectedly huge. They know to do and how to do it right.

Did you find this review helpful? Yes No

Great broker

I have been with this broker for around 8 months, within this time I have built up a good relationship with my accounts manager and with my broker. They treat me all concerns with high importance and I feel valued as a trader.

Did you find this review helpful? Yes No

Excellent broker

Thanks to this broker. They’ve been very good to me since day 1. Been using their services for a few months and I am satisfied.

Did you find this review helpful? Yes No

Attentive brokers

Very attentive brokers and customer service. I get the prompt and efficient support that I need to succeed in trading. All transactions are hassle-free and that includes withdrawals which are processed very quickly.

Did you find this review helpful? Yes No

Good trading company

Good trading company. Signals are accurate and profitable.

Did you find this review helpful? Yes No

Good profit

I gain good profit. I am satisfied with the services and tools.

Did you find this review helpful? Yes No

Great broker

Great trading broker. I can give them the highest ratings possible base on the trading results they give me.

Did you find this review helpful? Yes No

Good profit

I gain good profit. I am satisfied with the services and tools.

Did you find this review helpful? Yes No

Great trading services

Extremely great services and fast withdrawal process. Have just started trading with this broker for a few months now and really it is a good one to deal with.

Did you find this review helpful? Yes No

Good platform

Simple and easy to use website and trading tools. I have never experienced latency and confusion.

Did you find this review helpful? Yes No

Exemplary broker performance

Exemplary forex trading broker.I get amazing profit and is dealing with amazing people.

Did you find this review helpful? Yes No

Consistent profit

One of the most desirable forex broker. I gain good profit consistently.

Did you find this review helpful? Yes No

Good services

I have been trading with this broker for more than six months and based on my observations, I know they are good brokers. Signals are profitable and services are good.

Did you find this review helpful? Yes No

Good profit

They have so many trading assets to chose from. I enjoy trading with them. Profit is good and people are very professional.

Did you find this review helpful? Yes No

Efficient services

Very efficient services. Signals are profitable and withdrawal is always fast. Had been using their service for quite some time and I am by far satisfied with my trading results.

Did you find this review helpful? Yes No

Skilled broker

Skilled forex brokers. Been dealing with them for quite some time and by far I am happy with my trading results.

Did you find this review helpful? Yes No

Awesome performance

Awesome broker performance. For a short span of time, I can see good profit from my trades.

Did you find this review helpful? Yes No

Great trading partner

Great trading partner. They are dedicated in providing sound trading advise.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Effective broker

Proven and tested to be a very effective trading broker. Highly recommended, too.

Did you find this review helpful? Yes No

Good broker

They have given me so many opportunities to earn good income. I am happy to deal with its happy people everyday as well.

Did you find this review helpful? Yes No

The best broker

The best forex broker They’ve been my trading broker for a while and I am always impressed with the services.

Did you find this review helpful? Yes No

Amazing broker company

They are simply amazing broker company. I get the tools and services that I need.

Did you find this review helpful? Yes No

Efficient broker company

Highly recommended broker in terms of signals and services. All are proven efficient.

Did you find this review helpful? Yes No

Awesome broker

Fast execution,reliable signals and good services. I would definitely promote this broker.

Did you find this review helpful? Yes No

Professional broker

I am dealing with very professional people.I love the people and I love the services.

Did you find this review helpful? Yes No

Excellent services

Excellent services. The are efficient forex brokers.

Did you find this review helpful? Yes No

Great broker

I have been with this broker for around 8 months, within this time I have built up a good relationship with my accounts manager and with my broker. They treat me all concerns with high importance and I feel valued as a trader.

Did you find this review helpful? Yes No

Extremely good broker

Extremely helpful customer service and great trading signals. I am so much happy with my profit and satisfied with their tools and services.

Did you find this review helpful? Yes No

Good customer service

Good customer service. They are very responsive and attentive to all my trading needs.

Did you find this review helpful? Yes No

Great company

Great trading company to deal with. They are very professional all the time.

Did you find this review helpful? Yes No

Dedicated forex broker

Very dedicated in doing thorough market research. I always get good trading advice from them.

Did you find this review helpful? Yes No

Professional broker

Very professional trading broker. Their approaches are always very decent.

Did you find this review helpful? Yes No

Worth keeping

Excellent spreads offered minimal slippage and good trading profit. I will surely keep them as my forex broker.

Did you find this review helpful? Yes No

Great services

For me, this is the best trading company to partner with. Services are always great and signals are amazing.

Did you find this review helpful? Yes No

Excellent signals

Excellent trading signals. They always come up with the best and most accurate market forecast that serves as a trading guide.

Did you find this review helpful? Yes No

My favorite broker

This is my favorite broker. People always assist me very nicely. Withdrawal is fast and best of all signals are so much more profitable.

Did you find this review helpful? Yes No

Excellent signals

Worth my money and time, they are so dedicated in providing excellent signals.

Did you find this review helpful? Yes No

Professional ,broker

Professional in all dealings. I will never switch brokers, this one works good for me.

Did you find this review helpful? Yes No

Good offers

I am certain that I will get better profit. have tried small deals and I can see potential in their offers.

Did you find this review helpful? Yes No

Good customer service

Good customer service. I am happy that they attend to all of my trading needs promptly.

Did you find this review helpful? Yes No

Good broker

Good trading broker. They perform very well.

Did you find this review helpful? Yes No

Outstanding broker

Oustanding broker services. They outperform most of the big broker companies.

Did you find this review helpful? Yes No

Happy and satisfied

Great broker services and excellent trading signals. I am happy and satisfied.

Did you find this review helpful? Yes No

Fast withdrawals

Fast and easy to withdraw money. They respond quickly, too.

Did you find this review helpful? Yes No

Fantastic broker

Fantastic broker company. Services are really pleasant and there are so many ways to earn money.

Did you find this review helpful? Yes No

Best platform

One of the best platforms I have ever used. The features are excellent and helpful.

Did you find this review helpful? Yes No

Good broker performance

Good overall performance. I am happy with my profit and satisfied with the services.

Did you find this review helpful? Yes No

The best broker

The best choice to trade forex with. Signals and services are all worthwhile.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker in forex trading. They are reliable and very professional.

Did you find this review helpful? Yes No

Great company

Good broker company. I was able to get my money on time.

Did you find this review helpful? Yes No

Profitable broker

Profitable broker to deal with. I gain good trading returns and great services as well with this broker company.

Did you find this review helpful? Yes No

Good service

Good overall service. I will surely keep them as my trading partner.

Did you find this review helpful? Yes No

Outstanding services

Outstanding trading services and fast withdrawals. I am very happy and satisfied with the trading results.

Did you find this review helpful? Yes No

Great broker services

Fast withdrawals and profitable to trade with. Great broker services

Did you find this review helpful? Yes No

Remarkable trading experience

I get a really remarkable trading experience from this broker. I gain a profit huge enough to help me and my family.

Did you find this review helpful? Yes No

More than excellent

More than excellent broker services. All transactions including withdrawals are smoothly processed.

Did you find this review helpful? Yes No

Amazing broker company

They are simply an amazing broker company. I get the tools and services that I need.

Did you find this review helpful? Yes No

More than excellent

More than excellent broker services. All transactions including withdrawals are smoothly processed.

Did you find this review helpful? Yes No

Excellent services

Excellent services. They are efficient forex brokers.

Did you find this review helpful? Yes No

Fast and easy withdrawals

A great option to trade with. Withdrawal is very fast and trading with them is profitable.

Did you find this review helpful? Yes No

Excellent broker

I started trading with really less knowledge so I seek help from a broker. I got this as my broker. I am glad to have them. They have helped me not only gain profit but also understand everything about forex trading. I am now confident to say that I can trade on my own.

Did you find this review helpful? Yes No

Efficient broker company

Highly recommended broker in terms of signals and services. All are proven efficient.

Did you find this review helpful? Yes No

Professional broker

I am dealing with very professional people. I love the people and I love the services.

Did you find this review helpful? Yes No

Good trading company

Good trading company. Signals are accurate and profitable.

Did you find this review helpful? Yes No

Easy and quick withdrawals

What I like about this broker aside from its profitable signals is that all transactions here are smoothly processed. That includes withdrawal which is very easy and quick.

Did you find this review helpful? Yes No

Great trading opportunities

They have given me so many great opportunities to earn money. I am glad to have traded with the right broker. I gain a good profit and received my withdrawals earlier than the expected date.

Did you find this review helpful? Yes No

Great broker

I have been with this broker for around 8 months, within this time I have built up a good relationship with my accounts manager and with my broker. They treat all concerns with high importance and I feel valued as a trader.

Did you find this review helpful? Yes No

Smooth withdrawals

Smooth deposit and withdrawal process. I did not encounter any issues in the past few months and I am looking forward to seeing consistency in good services.

Did you find this review helpful? Yes No

Honest broker

100% trusted and honest broker. They are very dedicated to helping me whether on small or big trades.

Did you find this review helpful? Yes No

Fast withdrawals

With this broker, withdrawal is fast and hassle-free. I never had any issues and I am happy with my profit.

Did you find this review helpful? Yes No

Happy with this broker

Very happy with all of the processes, all seems smooth here. I will further observe but for my first month, all is good.

Did you find this review helpful? Yes No

Reliable trading advise

Reliable trading advice. I can always rely on their signals.

Did you find this review helpful? Yes No

Great trading advise

Great trading advice. I gain huge profit thru the help of this broker.

Did you find this review helpful? Yes No

Awesome broker

Fast execution, reliable signals, and good services. I would definitely promote this broker.

Did you find this review helpful? Yes No

Great broker company

Great broker company. Withdrawal is always swift and hassle-free.

Did you find this review helpful? Yes No

Good profit

I am gaining really good profit out of currencies pairing here. Really get great deals and I am overall satisfied with the services.

Did you find this review helpful? Yes No

Great broker

Extremely good customer service and fast withdrawals. Good broker

Did you find this review helpful? Yes No

Worth it

The initial deposit is affordable, I started with their minimum account. After month-long trading, I am very happy with the result and it is worth it.

Did you find this review helpful? Yes No

Impressive brokers

Impressive trading services. I am always amazed with their profitable signals. No doubt, they are experienced brokers.

Did you find this review helpful? Yes No

The best broker services

Got the best online trading services. Withdrawal is fast and easy and signals are so profitable.

Did you find this review helpful? Yes No

Good platform

One of the best platforms I have ever used. The features are excellent and helpful.

Did you find this review helpful? Yes No

Commendable customer service

Fast and efficient customer service all the time.Highly commendable.

Did you find this review helpful? Yes No

Great broker

I have been with this broker for around 8 months, within this time I have built up a good relationship with my accounts manager and with my broker. They treat all concerns with high importance and I feel valued as a trader.

Did you find this review helpful? Yes No

Great broker

Friendly and helpful customer service. Great trading profit and fast withdrawals.

Did you find this review helpful? Yes No

Satisfied

Prompt customer service and quick withdrawals. Happy and satisfied.

Did you find this review helpful? Yes No

Good signals

Good signals and services. I am thankful for having such a good broker as them.

Did you find this review helpful? Yes No

Good customer service

Good customer service. They attend to my concerns promptly.

Did you find this review helpful? Yes No

Great profit

I am so much thankful to this broker service for giving me really great services and profit.

Did you find this review helpful? Yes No

Good broker company

Good broker company. No withdrawal issues.

Did you find this review helpful? Yes No

Excellent broker

Overall broker performance is excellent. I am happy with my profit.

Did you find this review helpful? Yes No

Great trading advise

Great trading instructions. I always get a good profit from their advice.

Did you find this review helpful? Yes No

Outstanding brokers

One of the brokers that I can confidently recommend. They have great services and outstanding employees.

Did you find this review helpful? Yes No

Decent broker

A decent broker. They are very professional in dealing with me and all transactions are smoothly done.

Did you find this review helpful? Yes No

The best forex company

The best company for online trading. I really had a blast.

Did you find this review helpful? Yes No

Smooth withdrawals

Awesome broker services. Withdrawal has never been this easy. I am able to withdraw profit smoothly, with no hassles and runarounds.

Did you find this review helpful? Yes No

Professional broker

Offers a wide range of affordable forex assets to trade with. Also, offer excellent services and very professional brokers.

Did you find this review helpful? Yes No

Great services

Great service and fast execution. Customer service is prompt and withdrawal is easy.

Did you find this review helpful? Yes No

Efficient services

Efficient services for online trading. Withdrawal is always processed smoothly and swiftly.

Did you find this review helpful? Yes No

Good trading broker

Good trading broker. They are easy to deal with and they promptly attend to all of my trading needs.

Did you find this review helpful? Yes No

Highly recommended

Highly recommended brokers, especially to newbies. They are really very effective trading partners.

Did you find this review helpful? Yes No

Wonderful signals

Wonderful trading signals. It gives me good profit. They are consistently great.

Did you find this review helpful? Yes No

Expert brokers

Good services for online trading. I am getting the proper signals that bring good profit.

Did you find this review helpful? Yes No

The best forex company

The best company for online trading. I really had a blast.

Did you find this review helpful? Yes No

Commendable broker company

I get consistently good services and I am happy with my profit. Highly commendable broker company.

Did you find this review helpful? Yes No

Competive trading conditions

They have proven expertise in forex trading. I have been using their services for a few months and I am always impressed with their overall performance.

Did you find this review helpful? Yes No

Great trading broker

Great trading broker. I have been dealing with them for quite some time but they consistently deliver good services.

Did you find this review helpful? Yes No

Good brokers

Really good at what they do. Never fail to bring good profit to my trading account.

Did you find this review helpful? Yes No

Reliable broker

Reliable and trouble-free broker company. I’ve got no problem dealing with them and no problem with the services as well.

Did you find this review helpful? Yes No

Impressive services

I have been using this broker service for over a year and so far it’s been a good experience. I gain good profit and services are always impressive.

Did you find this review helpful? Yes No

Happy with this broker

I am happy with the services. Signals brings good profit nd withdrawal is smooth and fast.

Did you find this review helpful? Yes No

Fast withdrawals

Fast and hassle-free withdrawals. I have no complaints about the services, I get good profit.

Did you find this review helpful? Yes No

Awesome broker

Awesome broker for online trading. Aside from its accurate market analysis, they are also very good mentors. I have learned a lot from them as I earn money.

Did you find this review helpful? Yes No

Good broker

Always maintain a good connection with me. Trading results are good and I am happy with customer service.

Did you find this review helpful? Yes No

Trusted broker

My trusted trading broker. Signals are profitable.

Did you find this review helpful? Yes No

Great experience

Great trading experience. They have helped me learn effective trading.

Did you find this review helpful? Yes No

Decent broker

Decent trading broker. Their services are reliable.

Did you find this review helpful? Yes No

Excellent

Excellent broker services and signals. I gain good profit while learning the art of trading.

Did you find this review helpful? Yes No

Superb broker

Superb customer support and smart brokers. I am impressed with both signals and services, they outperform most of the brokers.

Did you find this review helpful? Yes No

Fast withdrawals

Fast and hassle-free withdrawals. I have no complaints about the services, I get good profit.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker for online trading. I will definitely recommend them.

Did you find this review helpful? Yes No

Easy withdrawals

All transactions are smooth and easy. That includes withdrawals, I always get my money earlier than expected.

Did you find this review helpful? Yes No

Good profit

They offer great trading opportunities. I am happy with the profit and prices are fair enough.

Did you find this review helpful? Yes No

Excellent signals

Excellent trading signals. They always come up with the best and most accurate market forecasts that serve as a trading guide.

Did you find this review helpful? Yes No

Good trading company

This is a very good trading company. They process withdrawals smoothly. Execution is fast, signals are always accurate and customer service is good.

Did you find this review helpful? Yes No

Good customer service

Good customer service. They always attend to all of my trading needs promptly and they process withdrawals swiftly.

Did you find this review helpful? Yes No

Good trading tools

Good trading tools and services. It had greatly helped me make money online.

Did you find this review helpful? Yes No

Satisfied with this broker service

I am truly satisfied with this broker service. They have provided excellent signals that are very profitable.

Did you find this review helpful? Yes No

Helpful customer service.

They have helped me for hours on the phone and have very professional support. It has been the best choice I ever had in forex.

Did you find this review helpful? Yes No

Good services

No execution delays and trading advice are very effective. Good customer service, too.

Did you find this review helpful? Yes No

Impressive broker service

Trustworthy and reliable broker. I’ve been trading with them for a year now and I am very impressed with the signals, customer support, platform, and withdrawals.

Did you find this review helpful? Yes No

Good trading advice

Good trading advice. I can depend on this broker service. They always provide sound trading advice.

Did you find this review helpful? Yes No

Trusted broker

I can fully trust their services. They are proven to be efficient brokers.

Did you find this review helpful? Yes No

Friendly customer service

Friendly customer service. They are always there to assist me o all of my trading needs.

Did you find this review helpful? Yes No

Amazing trading signals

Well-versed in the forex market. I am amazed by the trading signals I am getting from them. Very accurate and profitable.

Did you find this review helpful? Yes No

Recommended broker

If you are looking for a good forex broker, then I want to recommend this company to you. They have really good services and I am getting awesome profits from the signals.

Did you find this review helpful? Yes No

Favorable trading results

I am dealing with an amazing trading broker. Signals are always accurate and trading results are favorable.

Did you find this review helpful? Yes No

Easy withdrawals

Smooth and easy withdrawals. I’ve been dealing with them for a few months and had several withdrawals and all are fast.

Did you find this review helpful? Yes No

Fast withdrawals

Great trading signals and fast withdrawals. These are the things I like about this broker. I am keeping their services for sure.

Did you find this review helpful? Yes No

Amazing broker company

It is really my pleasure to do business with this company. The services are amazingly good. I get good profit and services.

Did you find this review helpful? Yes No

Great trading services

Good trading services and wonderful trading offers. I gain real good profit and have no problem with all of their services.

Did you find this review helpful? Yes No

Worth it

Worth the effort and time. I get good returns from my trades.

Did you find this review helpful? Yes No

Good services

Good services overall. I never encounter problems with tools and services.

Did you find this review helpful? Yes No

Productive

Productive dealing with. I gain good money that has helped me and my family.

Did you find this review helpful? Yes No

On time withdrawals

My withdrawals are always on time. Good job!

Did you find this review helpful? Yes No

Happy and satisfied

Services are consistently good. It’s been a year since I’ve joined them but services just keep getting better. Happy and satisfied.

Did you find this review helpful? Yes No

Good customer service

Good customer service, they’ve been very nice and amicable in all dealings.

Did you find this review helpful? Yes No

Accurate signals

State of the art trading facilities. The signals are always accurate as well.

Did you find this review helpful? Yes No

Excellent services

Excellent services. They are efficient forex brokers.

Did you find this review helpful? Yes No

Good results

Everything here is smooth and easy. People are kind to me. I am so far, getting good results.

Did you find this review helpful? Yes No

Highly recommended

Excellent customer service and good trading offers. Highly recommended.

Did you find this review helpful? Yes No

Happy with profit

The best decision I have ever made is to trade with this broker. I am very happy with my profit.

Did you find this review helpful? Yes No

Satisfied

There are so many options to earn money and I am really earning well. Have used the services since last month and so far I am satisfied.

Did you find this review helpful? Yes No

Good broker

Extremely good customer service and fast withdrawals.Good broker

Did you find this review helpful? Yes No

Good brokers

Very good signals. Based on my trading results, I can say that they are good brokers.

Did you find this review helpful? Yes No

Great company

Great trading company to deal with. They are very professional all the time.

Did you find this review helpful? Yes No

Good broker

I’ve got a very professional and friendly account manager. He guides me efficiently in order to become successful in trading.

Did you find this review helpful? Yes No

Excellent broker

Excellent trading tools and services. No complaints, I am happy with my profit.

Did you find this review helpful? Yes No

Smooth transactions

Withdrawals are always taken care of in a timely manner. Smooth transactions.

Did you find this review helpful? Yes No

Excellent signals

Excellent trading signals and sound trading advice. I will surely keep their services.

Did you find this review helpful? Yes No

Fully satisfied with services

No regrets about joining this broker. They’ve been very effective and I am fully satisfied with the services.

Did you find this review helpful? Yes No

Good broker

I have been using this broker service for a while now and so far so good. They have a wide range of trading assets, tight spreads, and fast withdrawals, too.

Did you find this review helpful? Yes No

Good broker

It is currently my second month trading with this broker and so far I get good profit. Services and tools are fine.

Did you find this review helpful? Yes No

Excellent trading company

Excellent trading company. I never had any regrets about joining, I get good profit.

Did you find this review helpful? Yes No

Dedicated brokers

Very dedicated to helping me with all of my trading needs. Smooth withdrawals and good customer service are the highlights of this company’s services.

Did you find this review helpful? Yes No

Good broker

Honest and very reliable brokers for online trading. Signals are all worthwhile and withdrawal is always fast.

Did you find this review helpful? Yes No

Great company

Great company! Have traded with them for a while now and I am fully satisfied.

Did you find this review helpful? Yes No

Highly recommended

Helpful and knowledgeable brokers and customer service. Highly recommended trading company.

Did you find this review helpful? Yes No

Good customer service

Helpful and professional brokers and customer service. They help me all the time.

Did you find this review helpful? Yes No

Good trading company

Good company to deal with. They have been a good trading partner to me.

Did you find this review helpful? Yes No

Good broker company

I really had a positive experience with this broker company. highly recommended.

Did you find this review helpful? Yes No

Good broker

My experience with this broker has been good so far. Customer service is great and signals are very profitable.

Did you find this review helpful? Yes No

Happy to recommend

Highly skilled and experienced trading brokers. I am happy to recommend it.

Did you find this review helpful? Yes No

Fast withdrawals

Easy and fast withdrawals. Great customer service also.

Did you find this review helpful? Yes No

Good broker company

Good broker company. Signals and services are both efficient. I get effective trading advice from the brokers, too.

Did you find this review helpful? Yes No

Amazing broker

I am very satisfied with my profit and with the services. Truly an amazing broker to deal with.

Did you find this review helpful? Yes No

Great trading opportunities

I am impressed with the great trading opportunities given to me by this broker. I have tried a few and they’re really very profitable.

Did you find this review helpful? Yes No

Happy and satisfied

Services are consistemtly good. It’s a been a year since I’ve joined them but services are just keeps getting better. Happy and satisfied.

Did you find this review helpful? Yes No

Consistent profit

Profitable broker. I am getting profit monthly. I get different amounts because that is how trading works, not fix. Sometimes low, sometimes high profits but I consistently get and that’s what matters to me.

Did you find this review helpful? Yes No

Professional

Fun to deal with customer service. Ther are very good and professional.

Did you find this review helpful? Yes No

Excellent trading advice

Excellent trading advice. I simply followed their instructions and I am trading progressively.

Did you find this review helpful? Yes No

Great services

A genuine forex broker. They deliver really great services and trading results. Response time is quick and withdrawal is on time.

Did you find this review helpful? Yes No

Consistently profitable

One of the best brokers for forex. They are transparent and friendly. Consistently profitable.

Did you find this review helpful? Yes No

Happy with profit

Excellent customer service and good withdrawals. Happy with profit.

Did you find this review helpful? Yes No

Amazing services

Low spreads and good trading conditions. Services are amazing and the people I dealt with are very professional.

Did you find this review helpful? Yes No

Great broker services

Their support of this broker is good and commendable, I mean they are helpful in guiding my trading experienced and that is the reason why I feel excited about trading with them. Excellent Customer Service, I should say.

Did you find this review helpful? Yes No

Happy with this broker

Happy with this broker. I will stay with them, they provide the best broker services.

Did you find this review helpful? Yes No

Reliable signals

Very reliable signals. They are also very professional in dealing with their clients. I have been trading with finance brokerage for quite some time but all services are awesome, never had any issues.

Did you find this review helpful? Yes No

Smooth transactions

Smooth transactions and efficient services. I would definitely recommend this broker service. I always trade with ease and confidence because of their outstanding services.

Did you find this review helpful? Yes No

Amazing forex broker

Quick and easy withdrawals and profitable signals. These are the main reason I am keeping their services. Amazing forex broker.

Did you find this review helpful? Yes No

Good broker

Way better than any other broker I know and have dealt with. Profitable signals and services are very efficient.

Did you find this review helpful? Yes No

Trustworthy and skilled

Overall, the broker is trustworthy and skilled. I have traded with several brokers in the past but this one is the best among the ones I have tried.

Did you find this review helpful? Yes No

Good trading software

State-of-the-art trading features. I am truly lucky to have these trading tools, they’ve helped me gain a good income.

Did you find this review helpful? Yes No

The best trading broker

I can see good results even at the start. I am trading with them for few months and I am satisfied with the services so far.

Did you find this review helpful? Yes No

Good profit

Worth my time and money. It is okay to spend a few dollars on this, the return is very good.

Did you find this review helpful? Yes No

Good trading software

No technical issues. Good trading software for online trading. Good support also.

Did you find this review helpful? Yes No

Outstanding broker

Outstanding broker for forex trading. Withdrawals are hassle-free all the time. Broker signals are accurate and customer service is accomodating and helpful.

Did you find this review helpful? Yes No

Excellent signals

Excellent in terms of signals and service. Great broker to trade with.

Did you find this review helpful? Yes No

The best trading broker

One of the best trading brokers in the forex industry. I love trading with them and love their efficient services.

Did you find this review helpful? Yes No

Reliable trading company

Reliable trading company to trade with. I am happy with all of the services.

Did you find this review helpful? Yes No

Good company

Great trading company. Signals are always spot on and services are good.

Did you find this review helpful? Yes No

Profitable

Excellent customer service. Good signals and indeed profitable trading with.

Did you find this review helpful? Yes No

Exceptional services

Exceptional broker services. I am impressed with broker signals and even services.

Did you find this review helpful? Yes No

Professional broker

Swift withdrawals and great support. I enjoy trading with this broker company, very professional.

Did you find this review helpful? Yes No

On time withdrawals

I always get my withdrawal on time and sometimes even earlier. Thumbs up for this broker service.

Did you find this review helpful? Yes No

Great trading services

Good trading partner. The signals are profitable and services are great.

Did you find this review helpful? Yes No

Great company

Profitable signals and instruments. Great broker company.

Did you find this review helpful? Yes No

Good customer service

I admire their customer service. They are always available to help, very professional, and knowledgeable.

Did you find this review helpful? Yes No

Good trading broker

Friendly customer service and good trading tools. I am so happy to have them as my forex broker.

Did you find this review helpful? Yes No

Good profit

I am gaining really good profit out of currencies pairing here. Really get great deals and I am overall satisfied with the services.

Did you find this review helpful? Yes No

Happy with this broker

Happy with my trading broker. I am getting 10 to 15 percent profit monthly. I am also able to withdraw my profit smoothly.

Did you find this review helpful? Yes No

great experience

One of the best! I love this broker. I have a great experience with them

Did you find this review helpful? Yes No

Delayed withdrawals

Delayed withdrawals. I am so much frustrated waiting for my money.

Did you find this review helpful? Yes No

Good broker

Glad to have traded with a good broker. They aren’t just skilled but also they show compassion to their clients.

Did you find this review helpful? Yes No

Sound analysis

Skilled brokers. They seem so experience in trading CFD’s. Always accurate and anticipates market movements. Sound analysis.

Did you find this review helpful? Yes No

Great trading software

State-of-the-art trading software with so many useful features. It also has great trading opportunities that really give off the good profit.

Did you find this review helpful? Yes No

Good broker company

Trading is made easier for me because of this broker company. They have helped me with all of my trading needs.

Did you find this review helpful? Yes No

Wonderful forex platform

Wonderful forex platform. It has so many opportunities to earn money. User-friendly software that has so many great features.

Did you find this review helpful? Yes No

Good services

My broker for almost a year and so far I am happy with all of their services.

Did you find this review helpful? Yes No

Very good broker

Very good trading experience. I am so much thankful to this broker service for helping me gain a good profit.

Did you find this review helpful? Yes No

Good trading advice

Outstanding broker signals. I am consistently getting really good trading advice from this forex broker. Among the brokers I have traded with, I can consider this as one of the best.

Did you find this review helpful? Yes No

Great services

I have traded with this for a year now and I never had any problem with all terms. Great services.

Did you find this review helpful? Yes No

Good signals

Happy to recommend this broker. Signals are good.

Did you find this review helpful? Yes No

Great broker

A broker company with a great set of trading tools and professional people to help traders gain more profit. I never regret choosing them to be my forex broker.

Did you find this review helpful? Yes No

Excellent forex broker

Excellent brokers for forex trading. They are the best I have ever traded with. I’ve traded with several brokers in the past but with this broker I have the most profit.

Did you find this review helpful? Yes No

Effective signals

Good forex broker. Highly recommended. All transactions are fast and easy. Signals are very effective.

Did you find this review helpful? Yes No

Definitely recommended

I have been using the service for over a year and I am fully satisfied with the services. This has been recommended to me by an experienced trader and I will definitely recommend this to others also.

Did you find this review helpful? Yes No

Great customer service

I had fun dealing with their customer service, they are very friendly and approachable.

Did you find this review helpful? Yes No

Highly recommended

I have been using their services for 7 months. Very efficient tools and services for forex trading. Highly recommended.

Did you find this review helpful? Yes No

Friendly and helpful customer service

Customer service is really helpful and friendly. They always assist me to the best they can whenever I call them.

Did you find this review helpful? Yes No

Good services

Good services I may say. I have traded with this broker for quite some time and I am satisfied with the services.

Did you find this review helpful? Yes No

Easy and quick withdrawals

What I like about this broker aside from its profitable signals is that all transactions here smoothly process. That includes withdrawal which is very easy and quick.

Did you find this review helpful? Yes No

Consistently good

Happy to trade with them. They are consistently good.

Did you find this review helpful? Yes No

Accurate analysis

Profitable trading signals. Their analysis is always accurate.

Did you find this review helpful? Yes No

Good broker

Friendly and enthusiastic customer service. I am okay with the terms and happy with the services.

Did you find this review helpful? Yes No

Happy to recommend

Fair pricing and good trading returns. Happy to recommend this broker service.

Did you find this review helpful? Yes No

Great broker

I have been with this broker for around 8 months, within this time I have built up a good relationship with my accounts manager and with my broker. They treat me all concerns with high importance and I feel valued as a trader.

Did you find this review helpful? Yes No

Great broker

I felt lucky to have them as my trading broker. The signals are spot on and profitable.

Did you find this review helpful? Yes No

Outstanding services

Outstanding trading services. Glad to have them as my trading broker.

Did you find this review helpful? Yes No

Professional brokers

Very professional brokers and customer service. I am happy to deal with them.

Did you find this review helpful? Yes No

Good company

Good company, They process all of my withdrawals on time with no hassle at all.

Did you find this review helpful? Yes No

Efficient broker company

Highly recommended broker in terms of signals and services. All are proven efficient.

Did you find this review helpful? Yes No

Great broker to deal with

Been using this broker service for quite some time and so far I am amazed at the services. A great one to deal with.

Did you find this review helpful? Yes No

Good services

Good offers and services since day 1. They have consistently given me the right support that I needed.

Did you find this review helpful? Yes No

Good broker

Good broker to deal with. They are very professional and have treated all of my concerns with high importance.

Did you find this review helpful? Yes No

Good profit

I am trading with this broker for a few months now and I am very happy with the services. I get a good profit that I can easily withdraw anytime.

Did you find this review helpful? Yes No

Skilled broker

The brokers are skilled in forex trading. They are competitive and are very friendly, too.

Did you find this review helpful? Yes No

Helpful customer service

Helpful customer service. They attend to trading needs promptly.

Did you find this review helpful? Yes No

Good broker

Good customer service and great trading signals from the brokers.

Did you find this review helpful? Yes No

Good broker

Good broker. Happy and satisfied with the services.

Did you find this review helpful? Yes No

Great services

Great services for online trading. The brokers are highly skilled and signals are very reliable.

Did you find this review helpful? Yes No

Great customer service

Great customer service and highly skilled forex brokers. I will surely keep the service and recommend them to other traders I know.

Did you find this review helpful? Yes No

Great services

Great services. Happy and satisfied!

Did you find this review helpful? Yes No

Honest brokers

Trustworthy and honest brokers. They do not hide anything and explain things clearly, too.

Did you find this review helpful? Yes No

Amazing broker

Really a very good broker and the platform is truly amazing. I am fully satisfied.

Did you find this review helpful? Yes No

Great brokers

Signals are very reliable and accurate. Great forex brokers.

Did you find this review helpful? Yes No

Good profit

I was lucky enough to have them as my trading broker. I gain a good profit.

Did you find this review helpful? Yes No

Great experience

Great trading experience. Happy to recommend it.

Did you find this review helpful? Yes No

Happy to recommend

Affordable trading instruments and very effective trading advice. I am happy to recommend this broker company.

Did you find this review helpful? Yes No

One of the best

So many good opportunities to make money here. Services are one of the best in the industry.

Did you find this review helpful? Yes No

Low prices for an excellent trading experience. Started using the broker recently and it’s been great

Did you find this review helpful? Yes No

Flawless

I’ve been trading with them for a few months and it’s the first time I haven’t had any problems with a broker. Really impressed.

Did you find this review helpful? Yes No

Amazing Broker

Amazing experience with them, misplaced a trade and they gladly refunded me since it was my first mistake.

Did you find this review helpful? Yes No