Saudi Aramco IPO prospectus isn’t due out for several days yet. But OPEC’s annual tome, the World Oil Outlook, fell Tuesday — and it reads like an essential introduction.

The oil exporters’ club stays optimistic about long-term prospects for its preferred fuel and its fortunes. Total liquids supply from the group includes crude oil, natural gas liquids, and others. These are expected to drop by 2.2 million barrels a day until 2023, to just 32.7 million barrels a day. Since Qatar left OPEC this year, the comparisons with the previous estimates are hard to tell.

UAE, Dubai’s current output is equivalent to this year’s projection for OPEC’s production in 2023, which is 3.9 million barrels. That was below than expected this time last year. Also, this increases a trend in OPEC’s assessments for its supply in recent years.

These numbers mask a deeper problem. Notably, OPEC hasn’t broken out its predictions for output into its element parts this year, as it did last year. Instead of separate lines for NGLs, crude oil, and other liquids, they will get a total OPEC liquids number. Still, using the previous year’s numbers and assuming all of Qatar’s growth will approach in the form of non-crude oil. Also, this is the latest projections indicate OPEC’s higher-value crude oil output falling by another 2 million barrel a day by 2024.

Crude oil output from U.S. shale is expecting to increase above 10 million barrels a day in 2021. OPEC’s report was less than half than three years ago.

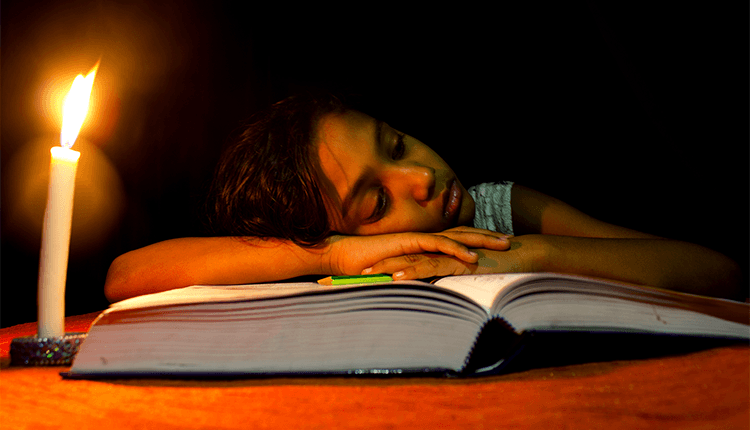

Moreover, shares in Saudi Arabian Oil Co tilted more like medium-term bonds than equity. As the timetable for Aramco’s IPO speeds up, its state-owner announced one incentive after another, designed around one big marketing point. An investor’s dividend is safe through the early 2020s, come what may.

Saudi Aramco on OPEC’s Projections

Saudi Aramco’s valuation is anywhere close to the reportedly adjusted extent of around $1.6 trillion to $1.8 trillion. It requires an oil price expectation of at least $70 a barrel and a dividend crop not much higher than 5%. Also, that assumes crude oil output averaging 11 million barrels a day.

OPEC’s latest medium-term projections turned positive after a rose-tinged hue to those assumptions. If OPEC’s market share set to decrease from 35% today to 31% by 2024, then the problem of supply cuts will fall heaviest on its de facto leader. Also, every half-million-barrel-a-day change in output shifts Aramco’s yearly cash flow by about $5 billion. Every $5 move in the oil price adjusts it by $8.5 billion, lower than $70 a barrel.

Qatar produced about 1.9 million barrels a day in 2018, and OPEC anticipates that to reach nearly 2.1 million a day by 2024. Adding the last number to OPEC’s projected total supply in 2023 results in a Pro-forma value to 34.8 million barrels a day. This is about 3.8 million barrels a day lower than the projection given in the previous year’s World Oil Outlook before Qatar left OPEC.

The recently announced change in royalty rates means the impact reduced when oil is above $70 a barrel and especially above $100.