Spicy Broker on the horizon: Pepperstone Review

The purpose of this review is to break down the important features of Pepperstone and whether or not trading with them puts you at an advantage or the opposite.

Lets take a look at Pepperstone – introduction

Since being founded in 2010, Pepperstone Group has manifested itself to be a top-tier Australian brokerage firm. The Melbourne-based broker also has offices in the United States, United Kingdom, China, and Thailand.

According to their website, Pepperstone was built from the ground up by a team of experienced traders with a shared commitment to improve the world of online trading.

Frustrated by delayed executions, expensive prices and poor customer support, they have set out to provide traders around the world with superior technology, low-cost spreads and a genuine commitment to helping them master the trade.

Notably Pepperstone Group processes an average of $12.55 billion worth of trade every day and it is trusted by 73,000 traders around the world.

Pepperstone Review of Account Types

Pepperstone’s three main trader account plans contain mostly similar specs. According to Pepperstone, there are some things that all its clients look for in a trading account, namely:

- Minimum 0.01 lot trading size

- Maximum 100 lot trading size

- Available leverage up to 500:1

- AUD$200 minimum account opening balance

- Base currencies available: AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD

- Scalping allowed

- Expert advisors allowed

- Hedging allowed

- News trading available

- No dealing desk execution

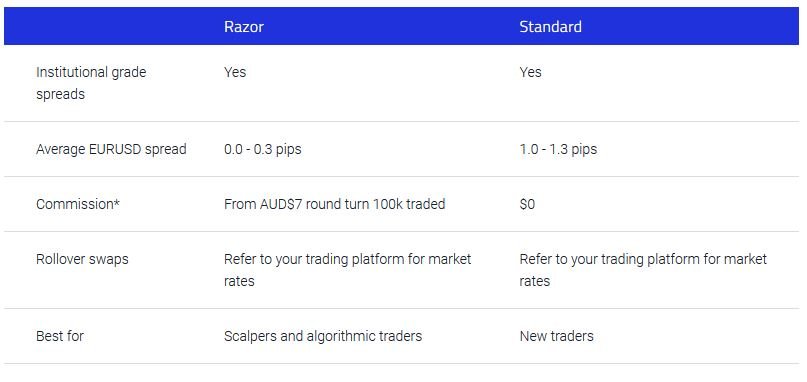

Despite most of the accounts’ features being similar, they do have their own distinctions. Pepperstone offers three account types; each goes by the names Razor, Standard, and Swap-Free.

Standard Account

- Institutional grade spreads

- 1.0 to 1.3 average EURUSD spread

- Rollover swaps

- Minimum account balance $0

The most basic account type that Pepperstone offers for traders. With a minimum account balance of $0 to keep trading, this account is ideal for beginner traders trying the ins and outs of the market; as well as identify the do’s and don’ts of trading with minimal monetary risks involved.

Swap-Free or Interest-free Account

- Institutional grade spreads

- 1.0 to 1.3 average EUR/USD spread

- Fixed admin fee

- Minimum account balance $200

This account is an interest-free trading account that allows users to take advantage of competitive low spreads without receiving or paying swaps.

Razor Account

- Institutional grade spreads (without markups)

- 0.0 to 0.3 average EUR/USD spread

- Rollover swaps

- Commission (from AUD$7 round turn 100k traded)

- Minimum account balance of $200

Although we would like to see more specifications when it comes to the accounts’ overview, these specs appear to be on the normal side of things. With Pepperstone, what you see is what you get. You get a range of account types catering to what you need for the right amount.

PepperstoneL Variety of Trading Products

Pepperstone covers a wide selection of asset classes and products. Trading with this broker allows clients to trade in over 150 currency, CFD, and futures markets across 62 currency pairs, 62 shares, 14 indices, 7 futures, 6 commodities, and 5 cryptocurrencies.

Forex

- Pepperstone spreads can reach as low as 0 pips on the EUR/USD, as liquidity can influence its spreads at any given time, since this broker accesses interbank markets for currencies and other spreads.

- Average spread on EUR/USD is 0.16 pips for Razor account holders and 1.16 pips on Standard accounts.

- Pepperstone also prioritizes low latency, quality execution, with flexible leverage up to 500:1 and reliable trading infrastructure.

Index CFDs

- Investors may execute trades on 14 major stock markets without the dealing desk and commissions.

- Pepperstone ensures that its index CFDs do not have hidden markups, no re-quotes, and low latency.

- Some of the available indices include Australian 200, Germany 30, Japan 225, UK 100, US 500, US Tech 100, US Wall Street 30, Hong Kong 50, China 50, and more.

Share CFDs

- Buy and sell CFDs of over 50 top-listed US companies.

- Pepperstone allows traders to long and short stock CFDs with leverage up to 10:1.

- Notable share CFDs that the platform offers include Apple Inc., Alphabet Inc., and Amazon.com Inc.

- Share CFD margin rate is at 10%.

Commodities

- Pepperstone have a minimum trade size from 10c per pip for all of its energy instruments as well as leverage of up to 500:1 and no commission.

- The average spread of oil, i.e. West Texas Intermediate crude oil and Brent crude oil are 0.5 pips and 0.7 pips respectively.

- Notably, minimum spread for precious metals can reach 0.5 pips.

- Some commodities available include sugar, gold, natural gas, and more.

Cryptocurrencies

- The platform offers five cryptocurrency derivative products, including Bitcoin, Bitcoin Cash, Ethereum, Dash, and Litecoin.

- Also leverage available is up to 5:1 across all Pepperstone platforms, with no commissions.

- Trading with cryptocurrency CFDs enable clients of Pepperstone to hedge on a single account.

Pepperstone Trading Conditions

Commissions

- Pepperstone employs mainly a commission-free model, but there a few commissions depending on trade and account types. The amount of the fees from the client’s side comes from the spread the platform offers.

Spreads

- The size of Pepperstone spreads is quite minimal, ranging between 1-1.7 pips based on pairings and markets. The highest spreads of the platform are on GBP/CHF (2.48), cotton (16.76), and UK100 outside market hours (1.88).

Pepperstone Trading Platforms

When it comes to platforms, Pepperstone have some of the widest-ranging trading platforms available. Pepperstone offers three major platforms, i.e., the MetaTrader 4 (MT4), MetaTader 5 (MT5), and the cTrader.

MetaTrader 4 (MT4)

- The MT4 platform features more than 85 pre-installed indicators, a user-friendly interface, and the ability to chart within various windows, while monitoring several markets. The MT4 also enables automated trading and order execution.

MetaTader 5 (MT5)

- The MT5, which is equipped with a built-in economic calendar, has 38 built-in indicators and can present up to 21 different time-frames across an interface. The platform also allows hedging of positions and better control over pending orders.

cTrader

- Designed by traders, cTrader features different presets, detachable charts, and a customizable interface. It also offers level II pricing and automated trading, while its detachable charts help ease management of orders.

Conclusion – Is Pepperstone good broker?

In the first place Pepperstone is a highly decorated firm, earning various awards due to its performance, and exerting great effort to integrate a huge selection of options for clients.

Traders could benefit from the firm’s broad range of account options and trading markets, which offer almost no commission. Through the platform, they can also apply more flexibility than what they usually exercise with other brokers.

While Pepperstone offers a limited number of trading products, it still provides clients with competitive pricing and a wide variety of trading platforms which are all under a trusted international brand. This broker is also ideal for currency-focused traders, regardless of experience level.

Do not deal

Bad people and worst services. Do not deal with them.

Did you find this review helpful? Yes No

Fake broker

Pretending to be a regulated and good broker. Everything here is fake.

Did you find this review helpful? Yes No

Bas customer service

Bad customer service. They are very difficult to contact and they do not reply on messages.

Did you find this review helpful? Yes No

Poor signals

Unreliable trading signals. Do not use their signals, no good at all.

Did you find this review helpful? Yes No

Stay away

Stay far away from this trading company. They are not good at all.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process. I have waited too long for a simple withdrawal.

Did you find this review helpful? Yes No

Fraud

Fraudulent activity. Avoid them by all means.

Did you find this review helpful? Yes No

Not recommended

Not a recommended broker for online trading. They ignore trading concerns.

Did you find this review helpful? Yes No

Poor services

Poor online trading services. Do not deal with this broker.

Did you find this review helpful? Yes No

Bastards

Has so many excuses when you ask for withdrawals. Avoid these bastards by all means.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst trading signals

Huge slippage and the worst trading signals I have ever used.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Do not deal

Signals are poor and so are the services. Do not deal with them.

Did you find this review helpful? Yes No

Difficult withdrawals

It is very difficult to withdraw . Do not trust them.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I am so frustrated with all the hassles I have gone thru.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Don't give any information to them

Do not give out any information to these people. They cold call me and ask for my banking details, their mere sales pitch is greatly questionable.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Poor broker service

It is not advisable to trade with this broker, signals are very poor, trading options are expensive and customer service are very rude.

Did you find this review helpful? Yes No

Worst broker

They are the worst broker I have ever dealt with. I deposited but is not able to get my money back.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Poor trading conditions

I will be switching to a different broker. Trading conditions aren’t all fair and good for me.

Did you find this review helpful? Yes No

Not legit

Not a legit trading broker. Do not invest money here.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process. I have waited too long for a simple withdrawal.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process. I have waited too long for a simple withdrawal.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process. I have waited too long for a simple withdrawal.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always go against the market movements.

Did you find this review helpful? Yes No

Poor trading platform

Poor trading platform. I always encounter system errors. Customer service aren’t even helping at all.

Did you find this review helpful? Yes No

Unreliable trading signals

Not ideal forex brokers. They are not trained to trade forex, signals are unreliable.

Did you find this review helpful? Yes No

Worst broker company

Worst broker company. They do not have a withdrawal process, only deposits.

Did you find this review helpful? Yes No

Stay away

Stay away from this broker company. Signals are not good enough.

Did you find this review helpful? Yes No

Unprofitable

Poor overall performance. Signals are weak and unprofitable. Customer service are helpful but overall, I am not satisfied because I never had any profit at all.

Did you find this review helpful? Yes No

Upset with this broker

I am upset with this broker’s services. I am expecting them to perform better than this.

Did you find this review helpful? Yes No

Worst experience

My situations become worst after dealing with this broker. They have stolen my money and made it seem like I lost in all of my trades.

Did you find this review helpful? Yes No

No withdrawals

No withdrawal process here, they will give you hard time. It is almost imposible to withdraw. I will never trade with them again.

Did you find this review helpful? Yes No

Annoying customer service

So annoying customer services. They can not even communicate well. Hard to comprehend concern. They’re very useless.

Did you find this review helpful? Yes No

Scammers

Stay away from this Scammers at all costs,they are are the biggest scam in the the forex market.

Did you find this review helpful? Yes No

Too good to be true

Keep yourself safe from scams. Their offer is too good to be true.

Did you find this review helpful? Yes No

Do not trade with them

I never imagine that I will have to undergo all these hassles. Do not trade with them.

Did you find this review helpful? Yes No

Don't give any information to them

Do not give out any information to these people. They cold call me and ask for my banking details, their mere sales pitch is greatly questionable.

Did you find this review helpful? Yes No

Fair but not good

They are one of the reputable forex broker but the actual trading results are not that satisfactory. Just fair but not so good.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawals. This is the only thing I do not like about them. That is why I quit trading with this broker.

Did you find this review helpful? Yes No

Stressful withdrawals

I had a stressful withdrawal process. Do not deal with them.

Did you find this review helpful? Yes No

Stressful withdrawals

I had a stressful withdrawal process. Do not deal with them.

Did you find this review helpful? Yes No

Bad people

Bad people. They sounded nice at the start but will eventually worsen once they were able to get your money.

Did you find this review helpful? Yes No

Expensive offers

Very expensive offers. I end up paying more than gaining profit.

Did you find this review helpful? Yes No

Scammers

Pity those who have been a victim of their scam like me. That is why I am leaving this review as a warning. Do not deal with them.

Did you find this review helpful? Yes No

Not a trusted broker

Chose a different broker and avoid trading with this one. They are not trustworthy.

Did you find this review helpful? Yes No

Rude and unprofessional

So rude and unprofessional. Funny how friendly these people are upon account activations and turned out to be monsters on withdrawal requests.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. Services are not ideal for gaining good profits.

Did you find this review helpful? Yes No

Cheaters

Cheaters. I see some profit on my trades however they charge too much. I end up getting nothing.

Did you find this review helpful? Yes No

Liars

Unwanted trading brokers. They are not skilled and they lie most of the time.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They are rude and very manipulating.

Did you find this review helpful? Yes No

Poor signals

I am quite hesitant to continue trading with them. I had some losses for the past few days.

Did you find this review helpful? Yes No

Scammers

Be very vigilant, and avoid this trading company. They are scammers and not legit trading brokers.

Did you find this review helpful? Yes No

Unregulated and dishonest

Stay away from this company. Unregulated and dishonest brokers.

Did you find this review helpful? Yes No

Worst trading signals

Huge slippage and the worst trading signals I have ever used.

Did you find this review helpful? Yes No

Hassled withdrawals

Avoid dealing with them. There are so much hassle on withdrawals.

Did you find this review helpful? Yes No

Do not deal

Do not deal with them. They are not going to approve withdrawal requests in any way.

Did you find this review helpful? Yes No

Unreliable brokers

Unhelpful and unreliable brokers. After the deposit they let me trade on my own.

Did you find this review helpful? Yes No

Stay away from this people

Stay away from these people. They are scam brokers and will just ripped off your wallet.

Did you find this review helpful? Yes No

Bad people

Bad behavior people. Stay away from them.

Did you find this review helpful? Yes No

Poor broker performance

Poor broker performance. It is just a waste of money and time to trade with them.

Did you find this review helpful? Yes No

Poor services

Very slow withdrawal process. Poor services.

Did you find this review helpful? Yes No

Bad brokers

They never refund money and don’t have fair judgement. I lost a few trades due to platform technical issues and yet they are not willing to help me.

Did you find this review helpful? Yes No

Poor forex broker

Will never trade with them again. I always face challenges with withdrawals and tools.

Did you find this review helpful? Yes No

Poor tools

Poor trading tools. I always have to face technical issues.

Did you find this review helpful? Yes No

No withdrawals

No withdrawal process here, they will give you hard time. It is almost impossible to withdraw. I will never trade with them again.

Did you find this review helpful? Yes No

Bad services

Bad services. Do not trade with them.

Did you find this review helpful? Yes No

Poor broker service

I opened a live account and lost all my money. After losing everything, it suddenly becomes difficult to contact the broker even their customer service.

Did you find this review helpful? Yes No

Do not trade with them

I never imagine that I will have to undergo all these hassles. Do not trade with them.

Did you find this review helpful? Yes No

Do not trade with them

I never imagine that I will have to undergo all these hassles. Do not trade with them.

Did you find this review helpful? Yes No

Not worth it

Irrelevant trading advice and inaccurate market analysis. Not worth it.

Did you find this review helpful? Yes No

Annoying customer service

So annoying customer service. They can not even communicate well. Hard to comprehend concern. They’re very useless.

Did you find this review helpful? Yes No

Poor trading platform

Poor trading platform. I always encounter system errors. Customer service aren’t even helping at all.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process. I have waited too long for a simple withdrawal.

Did you find this review helpful? Yes No

Worst signals

Worst trading signals I have ever used. It always goes against market movements.

Did you find this review helpful? Yes No

Fair but not good

They are one of the reputable forex brokers but the actual trading results are not that satisfactory. Just fair but not so good.

Did you find this review helpful? Yes No

Don't give any information to them

Do not give out any information to these people. They cold call me and ask for my banking details, their mere sales pitch is greatly questionable.

Did you find this review helpful? Yes No

Poor customer service

Very poor customer service. They don’t even care at all.

Did you find this review helpful? Yes No

Slow withdrawals

Slow customer service and also a very slow withdrawal process.

Did you find this review helpful? Yes No

Worst broker company

Worst broker company. They do not have a withdrawal process, only deposits.

Did you find this review helpful? Yes No

Do not deal

Do not deal with these trading brokers. Most of us who trade with them lose money.

Did you find this review helpful? Yes No

Inefficient broker service

I didn’t find this trading broker efficient. Services ain’t ideal for online trading.

Did you find this review helpful? Yes No

Bad broker

The product is misrepresented on their website. Does not really work well.

Did you find this review helpful? Yes No

Poor broker service

I opened a live account and lost all my money. After losing everything, it suddenly becomes difficult to contact the broker even their customer service.

Did you find this review helpful? Yes No

Frustrating withdrawals

I am very frustrated with this broker service due to withdrawals. I have traded with them and decided to withdraw. They said it has been processed but my money went missing. My withdrawal up to these days is under investigation.

Did you find this review helpful? Yes No

Do not deal with this broker

Do not deal with any of these brokers to trade forex. I have lost so much on this, I regret trading with them.

Did you find this review helpful? Yes No

Lose money here

I have lost so much money from the software that always lags. I had to quit, they never address my concern anyway.

Did you find this review helpful? Yes No

Do not deal

Signals are poor and so are the services. Do not deal with them.

Did you find this review helpful? Yes No

Too good to be true

Keep yourself safe from scams. Their offer is too good to be true.

Did you find this review helpful? Yes No

Poor services

Poor services. Stay away from them.

Did you find this review helpful? Yes No

Poor signals

I have lost huge money. I regret using their signals and services.

Did you find this review helpful? Yes No

Poor broker company

Poor broker company. They are unreliable and services are not good.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawals and poor customer service. Not a good broker company to deal with.

Did you find this review helpful? Yes No

Unreliable

Unreliable trading service. Just a waste of money and time.

Did you find this review helpful? Yes No

Worst trading tools

Worst trading tools I have ever used. Has so many lags and glitches.

Did you find this review helpful? Yes No

Slow withdrawal process

Very slow in processing withdrawals. I was asked for so many documents and I was asked to wait for a few weeks.

Did you find this review helpful? Yes No

Corrupt broker company

The most corrupt trading company. Do not trade with them.

Did you find this review helpful? Yes No

Worst broker

They are the worst broker I have ever dealt with. I deposited it but is not able to get my money back.

Did you find this review helpful? Yes No

Worst trading signals

Huge slippage and the worst trading signals I have ever used.

Did you find this review helpful? Yes No

Difficult withdrawals

It is very difficult to withdraw. Do not trust them.

Did you find this review helpful? Yes No

The worst forex trading platform

The worst trading platform for forex. If they really are as reliable and big a company as they claim, why can’t they improve their system to a better one? It is really annoying and messes up trades.

Did you find this review helpful? Yes No

Scammers

Do not deal with these scammers. They’ll surely take your money away.

Did you find this review helpful? Yes No

Poor forex broker

I thought they are good brokers but apparently, they are not. I had no choice but to quit trading with them.

Did you find this review helpful? Yes No

Do not process withdrawals

They do not process a withdrawal. I had a hard time requesting a withdrawal.

Did you find this review helpful? Yes No

Bad company

Bad trading company. They gave me hard time on withdrawals.

Did you find this review helpful? Yes No

Rude

They are insincere and sounded very rude over the phone. I regret investing money here.

Did you find this review helpful? Yes No

Not a good broker

Not a good trading broker to deal with. Withdrawal is very slow and signals are not that good.

Did you find this review helpful? Yes No

Stay away

Stay away from this broker company. Signals are not good enough.

Did you find this review helpful? Yes No

Scammers

Be very vigilant, avoid this trading company. They are scammers and not legit trading brokers.

Did you find this review helpful? Yes No

Difficult withdrawal process

I find it very difficult to request withdrawal. They intentionally give me hard time as if they do not want anyone to withdraw money.

Did you find this review helpful? Yes No

Unreliable

Unreliable trading advise. I have followed their trading advise but still lose money on their trading scheme.

Did you find this review helpful? Yes No

Troubled withdrawals

I was trouble with their withdrawal process. They keep on asking for so many things and I waited for so long.

Did you find this review helpful? Yes No

Bad broker

Trusting this broker was my biggest mistake. They have stolen all my money.

Did you find this review helpful? Yes No

Have lost huge money here

The trading result is far from what is projected. They showed me the trading possibilities which is what I am convinced to deposit more money. But after depositing the result is otherwise. I regret dealing with this broker, I have lost a lot.

Did you find this review helpful? Yes No

Good but not impressive

I was really expecting better from this broker as they promise too much. Nothing impressive but good anyway.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service and slow withdrawals. Not worth trading with.

Did you find this review helpful? Yes No

Worst

Don’t even deserve a single-star rating. The services are really bad.

Did you find this review helpful? Yes No

Worst trading software

Worst trading software. It has so many features that make trading easy and more organized.

Did you find this review helpful? Yes No

Worst services

Worst trading service. Do not transact with them.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I am so frustrated with all the hassles I have gone thru.

Did you find this review helpful? Yes No

Scammers

Stay away from these Scammers at all costs, they are the biggest scam in the forex market.

Did you find this review helpful? Yes No

No withdrawals

No withdrawal process here, they will give you hard time. It is almost impossible to withdraw. I will never trade with them again.

Did you find this review helpful? Yes No

Did not approve withdrawals

I have traded with these guys and never get any money back. They did not approve my withdrawal request.

Did you find this review helpful? Yes No

Bad people

Bad people. They sounded nice at the start but will eventually worsen once they were able to get your money.

Did you find this review helpful? Yes No

Harassing brokers

I felt harassed by this broker. I have activated an account to see how it goes, after a few weeks I felt like this ain’t for e and so I discontinued. But they keep on calling me, I get several calls daily forcing me to add more money. It is really very annoying.

Did you find this review helpful? Yes No

Do not invest here

Do not invest money here. You will never get them back.

Did you find this review helpful? Yes No

Get more losses

I get more losing trades than winning. I guess there must be something wrong with the signals.

Did you find this review helpful? Yes No

Unreliable

Extremely unreliable company. They had so many suspicious practices.

Did you find this review helpful? Yes No

Not a good broker

Not a good broker service. Signals are not profitable and withdrawal is really slow.

Did you find this review helpful? Yes No

Worst customer service

They have the worst customer service. They can not resolve trading concerns and can not even communicate well.

Did you find this review helpful? Yes No

Lose money

I regret trading with this broker. The offer seems so good but I was wrong. I have lost huge money on this.

Did you find this review helpful? Yes No

Do not trade with them

I never imagine that I will have to undergo all these hassles. Do not trade with them.

Did you find this review helpful? Yes No

Worst experience

Worst experience. I have lost a fortune overnight.

Did you find this review helpful? Yes No

Not a good broker

Not an ideal forex broker. Signals are poor and withdrawals are always slow.

Did you find this review helpful? Yes No

Do not trade with them

I never imagine that I will have to undergo all these hassles. Do not trade with them.

Did you find this review helpful? Yes No

Poor trading signals

Very slow withdrawals and very poor trading signals. I am not dealing with this broker ever again.

Did you find this review helpful? Yes No

Lengthy withdrawal process

Lengthy withdrawal process. Has the most tedious verification process among the ones I have tried.

Did you find this review helpful? Yes No

Worst services

I did not get any profit trading with them. Services are really the worst.

Did you find this review helpful? Yes No

Troubled withdrawals

I am facing so much trouble requesting a withdrawal. Will never trade with them again.

Did you find this review helpful? Yes No

Don't deal with them

They freeze my money and accused me of violations I never made. Don’t deal with them.

Did you find this review helpful? Yes No

Worst trading company

Worst trading company. They do not treat customers well.

Did you find this review helpful? Yes No

Do not trade with them

I never imagine that I will have to undergo all these hassles. Do not trade with them.

Did you find this review helpful? Yes No

Worst services

Worst services. I am not going to trade with this broker ever again.

Did you find this review helpful? Yes No

Withdrawal issues

I always encounter withdrawal issues. Pissed off with the runarounds, too.

Did you find this review helpful? Yes No

Do nor deal

Worst trading services I have ever tried. DO not deal with them.

Did you find this review helpful? Yes No

Poor services

Poor services. trade with other brokers, not with them.

Did you find this review helpful? Yes No

Stay away

Stay away from this broker. They do chart manipulation, which I notice a bit different from my research.

Did you find this review helpful? Yes No

Unable to withdraw

Good at the start but is becoming really worst eventually. I am unable to withdraw.

Did you find this review helpful? Yes No

Unregulated broker

Unregulated trading broker. too late when I found out, I had already lost so much money.

Did you find this review helpful? Yes No

Fraudsters

Thieves and fraudsters. Do not trust these people.

Did you find this review helpful? Yes No

Bad brokers

Inaccurate trading signals caused me to lose more money. Bad brokers.

Did you find this review helpful? Yes No

Poor forex broker

Do not be fooled by their status in the industry, they are a big forex company but services are really the worst. I have tried them for a month and got nothing but losses.

Did you find this review helpful? Yes No

Withdrawal Successfully

This broker company took advantage of me by taking away my life savings after locking me out of my account for no reason all efforts to get my money back from them has been abortive i couldn’t have done it on my own without the consultation of support At onestandardfinance dot org ; i can boldly recommend this consultant to whosoever has been cheated by this binary company.

Did you find this review helpful? Yes No

Not worth it

Not worth my money and time. I am not dealing with this broker company ever again.

Did you find this review helpful? Yes No

Stay away

Stay far away from this trading company. They are not good at all.

Did you find this review helpful? Yes No

Beware with bonuses

Beware of this broker. They offer such great services but all is a trap. It is their way to freeze withdrawals.

Did you find this review helpful? Yes No

Do not deal

Once you deposit, you will never get your money back. Do not deal with them.

Did you find this review helpful? Yes No

Poor services

Poor services. Not a good idea to trade with them.

Did you find this review helpful? Yes No

Worst experience

Worst experience. I have lost a fortune overnight.

Did you find this review helpful? Yes No

Poor trading signals

I go crazy with the signals. I get consecutive losses and I wonder why. I had to stop trading with them before losses worsen.

Did you find this review helpful? Yes No

Bad brokers

They never attend to my trading needs. After depositing my hard-earned money, they turned so very difficult to contact.

Did you find this review helpful? Yes No

Beware with bonuses

Beware of this broker. They offer such great services but all is a trap. It is their way to freeze withdrawals.

Did you find this review helpful? Yes No

Huge fees

There are so many trading fees and charges. Computing all, it’s almost break even. Profit ain’t that great but fees are.

Did you find this review helpful? Yes No

Stressful withdrawals

I had a stressful withdrawal process. Do not deal with them.

Did you find this review helpful? Yes No

Poor company

I have deposited money on this but they vanished after getting my money. Poor trading company.

Did you find this review helpful? Yes No

Unregulated

Unregulated and fake. Do not trust them.

Did you find this review helpful? Yes No

Poor signals

I will never trade with this broker again. Signals are not accurate, not even profitable.

Did you find this review helpful? Yes No

Unreliable trading advise

Unreliable trading advice. I notice the advice most of the time goes against the market movement.

Did you find this review helpful? Yes No

Poor signals

I will never trade with this broker again. Signals are not accurate, not even profitable.

Did you find this review helpful? Yes No

Poor trading signals

Poor trading signals. I did not gain good profit from their signals.

Did you find this review helpful? Yes No

Poor signals

I will never trade with this broker again. Signals are not accurate, not even profitable.

Did you find this review helpful? Yes No

Poor forex broker

Do not be fooled by their status in the industry, they are a big forex company but services are really the worst. I have tried them for a month and got nothing but losses.

Did you find this review helpful? Yes No

Worst trading signals

Worst signals and customer service I have dealt with. Not a good broker company to trade with.

Did you find this review helpful? Yes No

Slow customer service

SLow customer service and poor signals. Not recommended and will never trade with them again.

Did you find this review helpful? Yes No

Poor trading services

Poor trading services. I do not recommend this broker service, they are not good enough.

Did you find this review helpful? Yes No

Lose money

I lose money on their trading scheme. I am so sure what went wrong. I followed instructions from them.

Did you find this review helpful? Yes No

Slow customer service

The worst services I have ever used in online trading. The signals are not reliable and they have slow customer service.

Did you find this review helpful? Yes No

Lose my money in an instant

I had the worst nightmare with this broker company. Have lose all my money in an instant.

Did you find this review helpful? Yes No

Rude customer service

Rude customer service. Aside from ignoring my messages, they even don’t answer phone calls.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. They are very rude and sounded uninterested.

Did you find this review helpful? Yes No

Avoid them

Worst signals I have ever used. it is always against market movements. Avoid dealing with them.

Did you find this review helpful? Yes No

Poor trading advice

Unreliable trading advice. Not sure where they base it from as if all are just wild guesses.

Did you find this review helpful? Yes No

Run away from them

I feel like they are not doing something good and they are just after my deposits. Run away from them.

Did you find this review helpful? Yes No

Ineffective brokers

Do not trade with this broker. They are not effective brokers for online trading.

Did you find this review helpful? Yes No

Stay away

Stay away from people like them. They will promise too much but all is not real.

Did you find this review helpful? Yes No

Bad brokers

They seem to be a good forex broker because they offer really good trading terms but have the worst services really. I was not able to get even a single cent.

Did you find this review helpful? Yes No

Unable to withdraw

I am unable to withdraw profit. Do not deal with them.

Did you find this review helpful? Yes No

Rude brokers

Do not trade with this broker company. They are very unresponsive and rude.

Did you find this review helpful? Yes No

Unreliable signals

Do not trade with this broker company. Signals are unreliable.

Did you find this review helpful? Yes No

Worst services

Services are consistently worst. The signals are not profitable.

Did you find this review helpful? Yes No

Irresponsible broker

Irresponsible brokers and customer service. Their negligence has caused me too many losses.

Did you find this review helpful? Yes No

Poor trading signals

Very slow withdrawals and very poor trading signals. I am not dealing with this broker ever again.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and unresponsive customer service. Who would want to keep such services?

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They seem very rude and harassing over the phone.

Did you find this review helpful? Yes No

Poor broker service

I have been living a miserable life because of this broker service. They have taken so much money from me. I have lost a fortune.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process. Unreliable services, they do not attend to trader needs promptly. And they delay the withdrawal process.

Did you find this review helpful? Yes No

All losses

Do not deal with this broker, there ain’t really winning trades. They will always let the client lose as if they are earning from losses.

Did you find this review helpful? Yes No

Poor services

They are a really big company as they claim but services are not worth it. I did not get any profit trading with this broker.

Did you find this review helpful? Yes No

Poor services

Very slow withdrawal process and poor customer service.

Did you find this review helpful? Yes No

Poor broker

Poor broker and customer services. I never see potential in trading with them. Try someone else.

Did you find this review helpful? Yes No

Poor services

Everything about this broker is poor. Services are not good at all, with slow withdrawals, poor signals, and bad customer service.

Did you find this review helpful? Yes No

Worst broker

This broker is the worst I have ever used. They trade against at every opportunity. Do not deal with them, better try someone else.

Did you find this review helpful? Yes No

Unreliable

Unreliable and unresponsive broker services. I am not trading with this broker again.

Did you find this review helpful? Yes No

Not a good broker

They are not a good broker for forex trading. Signals are not accurate most of the time. And customer service is not helpful.

Did you find this review helpful? Yes No

Worst forex broker

Do not fall for this company. They do not allow withdrawals. One of the worst and most difficult to deal with.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I have several withdrawals with this broker, though only the first transaction is slow it happens to all of my withdrawals and so I decided to close my trading account instead.

Did you find this review helpful? Yes No

Poor signals

Against the market movement trading signals. I do not recommend trading with them.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process, I always get those annoying runarounds on my withdrawals.

Did you find this review helpful? Yes No

Waste of time

I felt like I have just wasted my time on this non-sense trading. I did not get anything trading with this broker.

Did you find this review helpful? Yes No

Bad trading partner

Bad trading partner. They are most of the time unavailable whenever I needed help.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and poor customer service. I am not trading with them again.

Did you find this review helpful? Yes No

Do not invest

Worst services. Do not invest money here.

Did you find this review helpful? Yes No

Poor company

Didn’t get the help I needed, resulting in many losses. Poor broker company.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and poor customer service. Not a recommended broker.

Did you find this review helpful? Yes No

Warning! scammers

Stay away from them. I am a victim of their scam. I am writing these reviews to warn and help everyone to be safe from these notorious scammers.

Did you find this review helpful? Yes No

Do not deal

Do not deal with them. I have never heard someone wins here. All have lost money.

Did you find this review helpful? Yes No

Bad signals

Bad on signals. I can not get a good profit from this.

Did you find this review helpful? Yes No

Slow withdrawals

Slow and difficult withdrawal process. Not a good broker for online trading.

Did you find this review helpful? Yes No

Do not deal

Do not deal with this broker service, they are one of the worst. I have experienced too many issues with withdrawals.

Did you find this review helpful? Yes No

Slow process

Very slow withdrawal process. Been tired of waiting.

Did you find this review helpful? Yes No

Worst customer service

Worst customer services. They are rude and unhelpful.

Did you find this review helpful? Yes No

Slow withdrawals

Frustrating withdrawal process. I always end up waiting.

Did you find this review helpful? Yes No

Hassled withdrawals

Hassled with their withdrawal process. I always get the runaround.

Did you find this review helpful? Yes No

Poor forex broker

Slow withdrawals, poor services, and unprofitable signals. I will never trade with them again.

Did you find this review helpful? Yes No

Annoying customer service

So annoying customer services. They cannot even communicate well. Hard to comprehend concern. They’re very useless.

Did you find this review helpful? Yes No

Poor signals

Good customer service but poor signals. I get good replies but can not get a decent profit from this broker.

Did you find this review helpful? Yes No

Poor trading services

Poor trading services. It is not a good idea to trade with this broker.

Did you find this review helpful? Yes No

Poor broker service

Poor customer support and broker services. Unresponsive and very unhelpful. I can not depend on their services.

Did you find this review helpful? Yes No

Slow withdrawals

I wonder why they always say withdrawals take 3 to 5 business days. Because of the actual process, it took them few weeks to process.

Did you find this review helpful? Yes No

Rude

Rude customer service. Could have been a good broker if people are nice.

Did you find this review helpful? Yes No

Lost all my money

I am now depressed because of this broker. They have shown me potential earnings and convince me to invest that much which I did but I lost everything. I even sold some properties for this.

Did you find this review helpful? Yes No

Does not allow withdrawals

This broker does not allow withdrawal, they won’t admit it of course but I notice it because they are making the withdrawal process very complicated that I cant almost withdraw.

Did you find this review helpful? Yes No

Worst trading company

Worst trading company. Not a good broker, to deal with. Do not trade with them.

Did you find this review helpful? Yes No

Unreliable brokers

Very unreliable and truly a mess. They have let me lose all my money. Customer service, as well as brokers, are useless.

Did you find this review helpful? Yes No

Slow customer service

Except for one thing, I’ve noticed that they are very attentive and aggressive during deposits and redeposits but it takes so much time to wait for their responses whenever there is a technical issue that needs to be resolved.

Did you find this review helpful? Yes No

Poor trading conditions

Poor trading conditions. They only publish good ones but on the actual trading, they will change terms from time to time.

Did you find this review helpful? Yes No

Can't withdraw my money

This broker service won’t let me withdraw what’s left on my account. I got so many losses and so I decided to quit and just withdraw my remaining money but they freeze it.

Did you find this review helpful? Yes No

Skeptic about this broker service

I initially got good on the first two trades so I am enticed to deposit more money. Guess what happy, on the succeeding trades I lost all. I am quite skeptical about their legitimacy.

Did you find this review helpful? Yes No

Not a good broker

They are not skilled in forex trading. I have trusted their signals but have lost instead.

Did you find this review helpful? Yes No

Poor signals

I will never trade with this broker again. Signals are not accurate, not even profitable.

Did you find this review helpful? Yes No

Rude brokers

They are very rude. That is my observation during the time that I am trading with them. Have even force me to put more money.

Did you find this review helpful? Yes No

Worst broker

The worst trading broker I have ever encounter. I have lost so much money here, do not use their signals.

Did you find this review helpful? Yes No

Poor signals

I am not impressed with the broker’s performance. Signals are poor and I did not good profit.

Did you find this review helpful? Yes No

Annoying customer service

Annoying customer service. They always transfer me over to nowhere. I never get the resolution I needed even if I called.

Did you find this review helpful? Yes No

Poor services

Poor trading advice. I followed everything they told me but still lost so much money.

Did you find this review helpful? Yes No

Unhappy with services

I am not happy with the services. I did not get the right support I needed to succeed in trading.

Did you find this review helpful? Yes No

Poor broker company

Never gain anything from this trading company. Not a good broker to trade with.

Did you find this review helpful? Yes No

Not recommended

Not just bad but the worst customer service I have ever encounter. I do not recommend them.

Did you find this review helpful? Yes No

Poor trading services

Poor trading services. I am not going to recommend this company to anyone.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawal process. I really had a hard time getting approval on my withdrawal request.

Did you find this review helpful? Yes No

Do not trade

Do not trade with them. I started smoothly until I began to request for withdrawal, they started to be different and had given me hard time.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawal process. I was asked to submit so many documents and every time I made a follow-up, ask to wait for more.

Did you find this review helpful? Yes No

Slow customer service

Very slow customer service. I ask help today they attended the next day. Very ridiculous.

Did you find this review helpful? Yes No

Poor services

Poor services. I was asked to put more money but I do not see any proceeds.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process. Very frustrating experience.

Did you find this review helpful? Yes No

Difficult withdrawals

Withdrawal is very difficult. Have been requesting the withdrawal but got rejected several times.

Did you find this review helpful? Yes No

Bad services

Bad services. I am not happy and not satisfied with the services.

Did you find this review helpful? Yes No

Bad broker company

They have cheated me by increasing their price and slippage. Bad broker company.

Did you find this review helpful? Yes No

Unreliable services

I’d rather trade on my own. The services are very unreliable.

Did you find this review helpful? Yes No

Stay away

Stay away from them before it’s too late. I was a victim of their scam.

Did you find this review helpful? Yes No

Unreliable trading advice

Unreliable trading advice. I notice the advice most of the time go against the market movement.

Did you find this review helpful? Yes No

Worst broker

The worst trading broker I have ever dealt with. Aside from signals aren’t that much profitable, instruments are very very expensive.

Did you find this review helpful? Yes No

Slow withdrawals

This broker does not work well. I notice so many issues with services. Withdrawal is also very slow.

Did you find this review helpful? Yes No

Unreliable

Unreliable broker services. I can not fully trust the signals, it causes me more losses than winning trades.

Did you find this review helpful? Yes No

Not recommended

I’m dealing with an indifferent broker and rude customer service. Not recommended.

Did you find this review helpful? Yes No

Ineffective brokers

Do not trade with this broker. They are not effective brokers for online trading.

Did you find this review helpful? Yes No

Unreliable trading tools

Unreliable trading tools. I always had technical problems.

Did you find this review helpful? Yes No

Poor trading company

Poor customer service and trading tools. I won’t be trading with them again.

Did you find this review helpful? Yes No

Avoid this broker

Avoid dealing with this broker by all means. They do not let withdrawals.

Did you find this review helpful? Yes No

Poor trading tools

Frustrated with trading tools. I always encounter technical problems and glitches.

Did you find this review helpful? Yes No

Delayed execution

There is a great delay in execution causing so many losses. I did not continue trading with them due to this problem.

Did you find this review helpful? Yes No

Rude trading brokers

Rude trading brokers. They sounded very harassing, have forced me for more deposits, and never listen to concerns.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals process and really very annoying requirements to provide.

Did you find this review helpful? Yes No

Lost all money

They are good at tricks. They’ve lured me to deposit all my money but I lost all, unfortunately.

Did you find this review helpful? Yes No

Do not trade with them

Do not trade with this broker, they aren’t good brokers and signals are not effective, too.

Did you find this review helpful? Yes No

Scammers

They would normally present a good image while scamming people out of thousands. Glad I lose just minimal and not that much.

Did you find this review helpful? Yes No

Worst signals

Worst in terms of withdrawals and signals but have friendly customer service.

Did you find this review helpful? Yes No

Slow customer service

The worst services I have ever used in online trading. The signals are not reliable and they have slow customer service.

Did you find this review helpful? Yes No

Unreliable services

They are one of the worst brokers I have ever dealt with. I can not even rely on services.

Did you find this review helpful? Yes No

Poor broker company

These people are not fine for their job. Always miss out on important details and most of the time ignore my messages. I am very unhappy with their support and broker team.

Did you find this review helpful? Yes No

Terrible broker

Terrible broker. There are so many brokers out there who are much better than this. Do not deal with them.

Did you find this review helpful? Yes No

Bad broker

I am not trading with this broker again. I feel frustrated when right after losses they will ask for another deposit instead of explaining what went wrong.

Did you find this review helpful? Yes No

Difficult to withdraw

I had a hard time requesting withdrawals. I am new to their services and are trying to request my first withdrawals but they block it.

Did you find this review helpful? Yes No

Poor trading broker

Trading CFD’s is not good with this broker. They lack experience in the forex market, they give out so weak market analysis.

Did you find this review helpful? Yes No

Difficult withdrawal process

I am frustrated with their withdrawal process, it is very slow and it is also very difficult to request for approval.

Did you find this review helpful? Yes No

Bad forex broker

I was hooked to open an account because of their good trading terms. They are one of the few brokers who allow hedging and scalping so I thought it is a wise choice to trade with them. I never expect that the problem lies in the withdrawal process. They ask for so many documents, reject what’s being submitted, and ask for a replacement. I even waited too long for the money to hit my bank.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I keep on calling for follow-ups but can not do anything but wait.

Did you find this review helpful? Yes No

Huge profit

I was bothered by the huge charges that pop up. As if 70 percent of my profit is consumed on charges.

Did you find this review helpful? Yes No

Not recommended

I will never recommend this broker to anyone. Signals aren’t that good. I gain around 2 percent profit on a monthly and I think it isn’t enough to compensate my time.

Did you find this review helpful? Yes No

Unhelpful and rude

They sounded so rude and unhelpful over the phone. I am asking help for withdrawal and yet they aren’t willing to help.

Did you find this review helpful? Yes No

Worst forex broker

Worst forex trading broker I have dealt with. They are very unreliable and people sound rude.

Did you find this review helpful? Yes No

Trouble with withdrawals

I had trouble requesting withdrawals. They always gave me reasons that I think are not even relevant, just to reject my withdrawal request.

Did you find this review helpful? Yes No

Poor trading services

Poor trading services. Signals are not reliable and customer service is very unhelpful. I will never recommend this broker to anyone.

Did you find this review helpful? Yes No

Stay away from them

Stay away from this broker. They will do all possible ways to cheat and freeze your hard-earned money with lame excuses.

Did you find this review helpful? Yes No

Poor trading brokers

Not a skilled broker to trade forex with. I’ve got so many questions left unanswered. I’ve got huge losses too.

Did you find this review helpful? Yes No

Poor broker services

It is plain and simple to see that I am just wasting my time. I never gain anything but have several losses instead. No good.

Did you find this review helpful? Yes No

Annoying withdrawals

Money withdrawal is very annoying. They’ve let you have all the hassles as if they do not allow withdrawals at all.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process. This and only this is the ultimate problem I have about this forex broker. They always give me a headache whenever I try to withdraw.

Did you find this review helpful? Yes No

Inconsiderate brokers

Inconsiderate and cheaters. I have lost my money due to their platform issues and so I filed a refund but they refuse to process a refund saying it is considered a loss. They could have considered the fact that I will not lose much if not because of their platform issues, very inconsiderate.

Did you find this review helpful? Yes No

Unhappy with trading results

I am unhappy with my trading results and dissatisfied with their services. Not a good broker to deal with.

Did you find this review helpful? Yes No

Worst trading signals

Worst trading signals. I don’t recall gaining any profit from this broker. The trading advice always go against the market movement. I have used their services for about a month and quit.

Did you find this review helpful? Yes No

Huge fees

I was surprised with so many trading fees and charges. I never thought I will to pay such huge fees.

Did you find this review helpful? Yes No

Slow withdrawals

I have noticed that it is taking them a longer time to process withdrawals compared to other brokers I have traded with.

Did you find this review helpful? Yes No

Avoid this broker

I have traded with this broker in the past and here is what happen to me. They’ve lured me to add more money by letting me see some profit on small trades. The moment I added more money to trade bigger, I started getting problems until I lost all my funds.

Did you find this review helpful? Yes No

Poor trading services

Completely a waste of money and time. I have traded with them and got nothing but losses, didn’t even recall getting a good service.

Did you find this review helpful? Yes No

Poor trading advice

Good customer service but very unreliable broker signals. I am not gaining anything from their trading advice. In fact, I notice losses are becoming bigger.

Did you find this review helpful? Yes No

Delayed withdrawals

I have dealt with them in the past and I do not recommend their services. One of the worst and withdrawals are so much delayed.

Did you find this review helpful? Yes No

Bad customer services

Bad customer service. Aside from the delayed withdrawals, customer service staff are very annoying.

Did you find this review helpful? Yes No

Poor services

Poor trading services. Signals are worst and withdrawals are very weak. I have lost so much.

Did you find this review helpful? Yes No

Poor trading results

They are offering a demo account for test. I have traded using their demo account which is great and so I pursued to open a live account. But eventually, I am so disappointed on their actual trading results.

Did you find this review helpful? Yes No

Poor broker service

Do not be deceived by the false advertisements from this broker. They are not good at all. Terms are poor as well as the services.

Did you find this review helpful? Yes No

Slow withdrawals

Signals are good but withdrawal is slow and difficult. I encounter so much trouble and it took them a long time to process it.

Did you find this review helpful? Yes No

Slow withdrawals

This could have been a good broker because signals are profitable if their withdrawal is also fast. Very annoying to undergo all the runaround of their slow withdrawal process.

Did you find this review helpful? Yes No

Bad customer service

Bad customer care. Very unprofessional and rude, I will never trade with them again.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and poor customer service. I have used their services for only a month, I am not satisfied so I immediately closed my account.

Did you find this review helpful? Yes No

Poor broker service

Not an efficient broker for forex trading, signals are weak and unprofitable. I closed my trading account with them and will never trade with them again.

Did you find this review helpful? Yes No

Poor trading signals

Trading terms are okay but signals are not. The broker can’t give effective advice. I am not happy with the trading results.

Did you find this review helpful? Yes No

Bad forex brokers

Not a good broker, poor signals and poor services. Rude and unprofessional brokers. Stay away from them.

Did you find this review helpful? Yes No

Bad brokers

Do not invest your money with this broker service. They will do all the possible ways to block withdrawals.

Did you find this review helpful? Yes No

Poor broker service

Poor broker services. Withdrawal is always very slow. Bad customer service that are very unhelpful.

Did you find this review helpful? Yes No

Slow withdrawals

The services aren’t good enough. I am so disappointed.Withdwrawal is very slow and signals are very poor.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals, I always have to wait a long time for my withdrawals. Customer services are also unresponsive.

Did you find this review helpful? Yes No

Difficult withdrawals

Do not deal with this broker. It is almost impossible to get your money. Difficult withdrawals.

Did you find this review helpful? Yes No

Difficult to withdraw money

This broker just ignores you when you want to withdraw your money. If you call them they just promise a payout in 24 hours. But nothing happens. This process is repeated over 4 months.. and they just ignored me.

Did you find this review helpful? Yes No

Unhelpful customer service

Disappointing and unhelpful customer service. Do not use their services, I won’t recommend this broker.

Did you find this review helpful? Yes No

Technical problems

There are so many technical problems on the platform and even on their website. No one’s able to fix it I guess, have called so many times but still the same.

Did you find this review helpful? Yes No

Poor trading signals

Worst broker performance. Signals are poor and services are inefficient. Do not deal with this broker.

Did you find this review helpful? Yes No

Slow customer service

The customer service response is very slow. I am also having trouble calling them, can’t get through their customer service line.

Did you find this review helpful? Yes No

Worst service

Worst service I ever had in my entire years in forex trading. Poor broker signals.

Did you find this review helpful? Yes No

Fake trading

It seems to me that all they have is just fake trading. Nothing is real. I only got one winning trade and that is the first trade but the rest are all losses. Unbelievable.

Did you find this review helpful? Yes No

Bad customer service

Their customer service is not all the time available to assist clients in their trading concerns. Bad customer service.

Did you find this review helpful? Yes No

Worst customer service

The worst customer service I have ever dealt with. They are harassing and rude.

Did you find this review helpful? Yes No

Not recommended

Not recommended broker for forex trading. Delayed execution and poor trading signals.

Did you find this review helpful? Yes No

Huge transaction fees

This broker will surprise you with so many transaction charges. I end up getting almost nothing because I had to pay huge transaction fees.

Did you find this review helpful? Yes No

Delayed withdrawals

Delayed withdrawals. It took them a few weeks to process my withdrawal.

Did you find this review helpful? Yes No

Force for more deposits

I am not comfortable dealing with this broker service. They always force me for more deposits.

Did you find this review helpful? Yes No

Worst

The worst broker I have ever dealt with. Do not trade with them.

Did you find this review helpful? Yes No

Inaccurate signals

This ain’t a good broker for forex trading. Signals are not accurate enough to make money.

Did you find this review helpful? Yes No

Poor broker signals

Not an ideal broker for forex trading. Signals aren’t good enough.

Did you find this review helpful? Yes No

Slow withdrawals

Not a good broker to deal with. Slow withdrawal, it took them weeks to process.

Did you find this review helpful? Yes No

Poor services

Poor trading signals and poor services.This broker is not advisable to trade with.

Did you find this review helpful? Yes No

Poor signals

Not a good forex broker. Signals are very poor.

Did you find this review helpful? Yes No

Poor services

Slow withdrawals and poor customer service. I have used their services for only a month, I am not satisfied so I immediately closed my account.

Did you find this review helpful? Yes No

Poor signals

Signals are always against market movements. As if they gain profit on losing trades instead of winning they let me lose all my money.

Did you find this review helpful? Yes No

Incompetent

Incompetent broker service. Signals are poor and unprofitable.

Did you find this review helpful? Yes No

Fake trading

I have a strong feeling that their trading isn’t true. Movements are fake base on my research and comparison with other broker’s charts.

Did you find this review helpful? Yes No

Bad brokers

Not an effective forex trading broker. They will make you lose money instead of gain. I understand there is a risk of loss in trading but excessive losses mean one thing-bad broker.

Did you find this review helpful? Yes No

Rude customer service

Rude and sarcastic customer support. They sounded very irritating and are very unhelpful.

Did you find this review helpful? Yes No

Expensive

They set $200 as an initial deposit which is very affordable as it seems however on the actual trading, per lot and instruments are very expensive. I will not recommend this broker.

Did you find this review helpful? Yes No

Drastic price change

Drastic price changes. I wonder if this is how it really works in forex trading.

Did you find this review helpful? Yes No

Disappointed with this broker

I am so much disappointed with this broker service. They promise to much but do not deliver good results.

Did you find this review helpful? Yes No

Hard to request withdrawal

I have dealt with this broker service in the past, they gave me a hard time requesting for withdrawal. They even ask me to add more money to be able to withdraw.

Did you find this review helpful? Yes No

Not happy with this broker

I am not happy with this broker’s services. Slow withdrawals and signals are not accurate.

Did you find this review helpful? Yes No

Not an ideal broker

Not an ideal broker for forex. Slow withdrawals. Poor services.

Did you find this review helpful? Yes No

Do not chose their services

Not an ideal broker for forex trading, do not choose their services.

Did you find this review helpful? Yes No

Difficult to withdraw

Signals are good but withdrawal is slow and difficult.

Did you find this review helpful? Yes No

Worst customer service

This broker company had the worst customer service. They are not available most of the time and they are very unhelpful.

Did you find this review helpful? Yes No

Worst withdrawal process

They have the worst trading terms. They will not explain all terms, new terms will arise as you trade along and especially if you will try to withdraw.

Did you find this review helpful? Yes No

Difficult to withdraw

I have submitted all the required documents but still did not get my money. It is so difficult to withdraw.

Did you find this review helpful? Yes No

Difficult to withdraw

It is very difficult to trade with this broker service, they keep on rejecting documents and there are so many documents to provide.

Did you find this review helpful? Yes No

Poor broker signals

Poor broker signals, I have lost several times. Nice customer service though.

Did you find this review helpful? Yes No

A lot of hidden charges

Terrible forex broker. There’s a lot of hidden charges. I get minimal profit but will have to pay so much. So as if I did not gain anything.

Did you find this review helpful? Yes No

Long wait on withdrawals

The withdrawal process is very bad. You will have to wait a long time to get your money.

Did you find this review helpful? Yes No

Withdrawal is impossible

This is one of the worst I have ever dealt with. They will not let you get your money, withdrawal is impossible.

Did you find this review helpful? Yes No

Greedy

Do not invest your money with this broker service. They are really very greedy in asking for more. I lost all my money as if something wrong is going on.

Did you find this review helpful? Yes No

Very aggressive

They have experienced and skilled brokers but I am a bit disappointed because they are very aggressive in asking for more money.

Did you find this review helpful? Yes No

Stay away from this broker

Stay away from this broker service. They will just take your money and you won’t be able to take it back.

Did you find this review helpful? Yes No

Do not allow withdrawals

Impossible to withdraw. Do not use thier services, they do not allow withdrawals.

Did you find this review helpful? Yes No

Frustrating withdrawal process

Frustrating withdrawal process. Aside from it is very slow there’s so much to provide. People here are warm and accommodating though.

Did you find this review helpful? Yes No

Overall performance is not good

Worst trading platform and very expensive trading instruments. People are nice but overall performance is not good.

Did you find this review helpful? Yes No

Dishonest brokers

Dishonest broker. Won’t really even bother to explain to you what happens will just surprise you with losses.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawal process, they keep on asking a lot of documents. Trading terms and signals though are very good.

Did you find this review helpful? Yes No

They do not allow withdrawal of initial deposit

They do not allow me to withdraw my initial deposit. I was able to withdrawal minimal profits only but not the initial deposit.

Did you find this review helpful? Yes No

Complicated and confusing platform

I am currently trading with this broker and I am struggling with their platform. I find it very complicated and confusing.

Did you find this review helpful? Yes No

So many hidden charges

Great trading terms, good leverage, and hedging is even allowed. But be careful with their terms, they took so many charges. I was surprised upon requesting for withdrawal that there is so much deduction.

Did you find this review helpful? Yes No

Delayed withdrawals

There is a great delay in their withdrawal process. I have requested it and the approval itself is very difficult to secure. And crediting takes a longer time than normal.

Did you find this review helpful? Yes No

Don't trust your money with this broker

Don’t trust this broker with your money. I have traded with them for a month and their signals will just let you lose your money.

Did you find this review helpful? Yes No

Disgusting customer service

Disgusting customer service. They are very rude and unhelpful.

Did you find this review helpful? Yes No

Long wait time for withdrawals

I would like to leave a short review of transactions. This broker had the longest wait time for withdrawal, I ever had.

Did you find this review helpful? Yes No