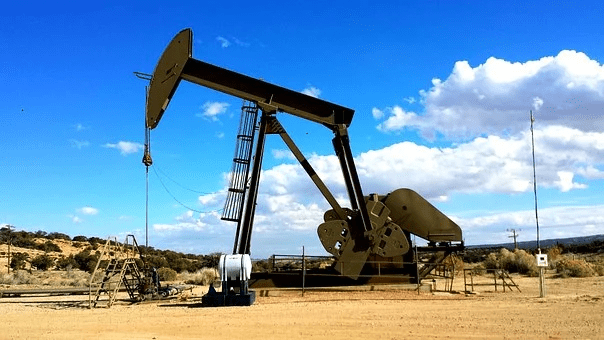

Oil prices gained on Wednesday, extending gains as OPEC+ members adhered to an agreed-upon output goal increase for February. The U.S. fuel stocks, however, grew owing to falling demand as COVID-19 cases increased. Brent oil futures closed the day at $80.80 a barrel, up 80 cents, or 1%. WTI oil futures in the United States finished at $77.85, up to 86 cents or 1.1%.

Fed’s Meeting Impacts the Market

The most recent U.S. Federal Reserve meeting revealed that the policymakers might have to hike rates faster than investors expected. After the release of minutes from this meeting, the market erased gains late in the day. Oil fell along with other risky assets such as equities. Crude stocks in the United States have experienced a 2.1 million barrels fall. This fall is partly due to the tax incentives for producers to reduce inventories before the year’s conclusion. On the other hand, gasoline supplies increased by more than 10 million barrels, while distillate stocks increased by 4.4 million barrels. According to analysts, due to the new version of the coronavirus, individuals dug down during the final week of 2021.

Is This a New Pandemic?

On Monday, the United States recorded about 1 million new coronavirus infections, the largest daily total of any country globally. It nearly doubled the previous high of a week ago. Overall product supply, a proxy for demand, has dropped considerably. In contrast, demand has been greater in the previous four weeks than two years ago, before the epidemic began.

Caroline Bain, Capital Economics’ chief commodities analyst, has stated, “Implied product demand plummeted, particularly for fuel, indicating that people were afraid of traveling following the fast spread of the Omicron version. These worries are likely to continue a few weeks longer.”

On Tuesday, OPEC+ producers, who comprise members of the Organization of Petroleum Exporting Countries and Russia and others, decided to increase production by 400,000 barrels per day in February, as they have done every month since August. According to Barclays analysts, OPEC+ will still struggle to meet that goal because countries such as Nigeria, Angola, and Libya are having trouble ramping up output. “Actual incremental supply is expected to be significantly less, similar to the demand effect from Omicron,” the bank noted, even as the group raises objectives.