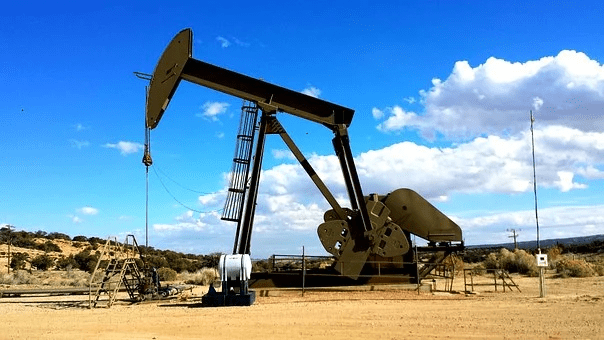

Brent oil futures edged up 0.15% to $86.19 by 10:47 PM ET (3:47 AM GMT) and WTI futures leaped 0.34% to $83.58. Both Brent and WTI futures built on their gains from the prior week.

Some investors expect reducing concerns that omicron could dent demand and tighter output, pushing the black liquid to multiyear highs.

Fujitomi Securities Co Ltd. analyst Toshitaka Tazawa told Reuters that the bullish sentiment persists as the OPEC+ does not provide enough supply to meet strong global demand.

He added that if investment funds raise allocation weight for crude, prices could get their highs of 2014.

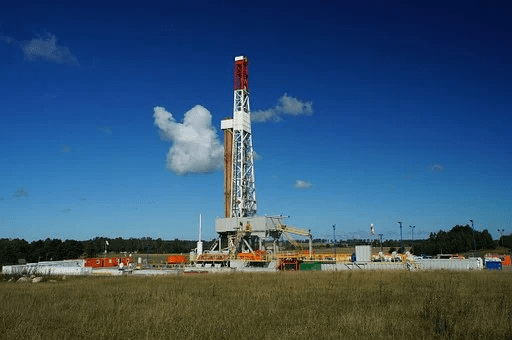

OPEC+ Adding Supply

OPEC+ chose to add oil supply for February at its last meeting on January 4, 2022. Nevertheless, many investors are cautious that smaller producers cannot complete the agreed output. At the same time, other producers are careful regarding pumping too much oil over worries that coronavirus outbreaks might affect demand.

Meanwhile, persisting tensions between U.S. and OPEC+ member Russia over Ukraine also lent support to oil. Russia has pressed 100,000 troops on Ukraine’s border, and any armed conflict could impact Russia’s oil output.

As stated by Reuters, to prepare for this potential conflict, the U.S. held talks on contingency plans for providing natural gas to Europe with several international energy companies.

In the Asia Pacific, supply is also a problem. China intends to release oil reserves about the Lunar New Year holidays from the U.S-led coordinated release plan.