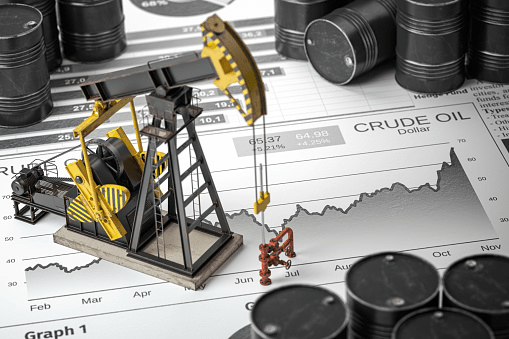

Due to passing on Wednesday, Brent crude futures for October were under $2.78 at $96.53 a barrel following Tuesday’s $5.78 decline. The more active November contract was under $1.37, or 1.4%, at $96.47 a barrel.

U.S. West Texas Intermediate (WTI) crude futures were under $1.31, or 1.43%, at $90.33 a barrel by 1303 GMT, after gliding $5.37 in the prior session on recession fears.

Both contracts dropped by higher than 3% in earlier trade

Eurozone inflation leaped to a record high further. It will soon hit double-digit territory, indicating a string of large interest rate hikes even as a bitter recession seems inevitable.

Inflation in the 19 countries conveying the euro currency revved to 9.1% in August from 8.9% a month earlier. Meantime, U.K. bonds resumed a quick sell-off on a scale not seen after the 1990s because of the country’s bleak economic outlook.

China’s factory activity expanded declines in August as new coronavirus infections, the worst heatwaves in decades, and an embattled parcel sector weighed on production, indicating the economy will work to sustain momentum.

Parts of China’s southern city of Guangzhou set coronavirus curbs on Wednesday, entering the tech hub of Shenzhen in fighting flare-ups and fuelling uncertainty over commerce and daily life in two of the region’s most economically dynamic cities.

A report by the Joint Technical Committee of the Organization of the Petroleum Exporting Countries (OPEC) and partners named OPEC+ measured the bearish signals.

In it, the JTC expressed its base case scenario was an oil abundance this year of 900,000 barrels per day (BPD), up 100,000 BPD from its prediction a month earlier.