Oil price is approaching to close the week with a 6% gain, with both benchmarks steady above $60.00 per barrel.

The latest hike catalyst includes a positive global demand outlook for crude as two of the world’s biggest economies report impressive economic data.

China notched an 18.3% economic growth during the first quarter of 2021, beating analysts’ expectations.

The East Asian nation garnered a much-needed boost as coronavirus transmissions slumped during the past months.

At the time when a rise in cases was reported in some Chinese provinces, policymakers proactively adopted draconian measures to stop the spread.

These include careful contact tracing and restriction of mobility on the affected areas.

On the other hand, economists say recovery may come at a steadier rate in the remaining months of the year. No one is expecting any bullish records.

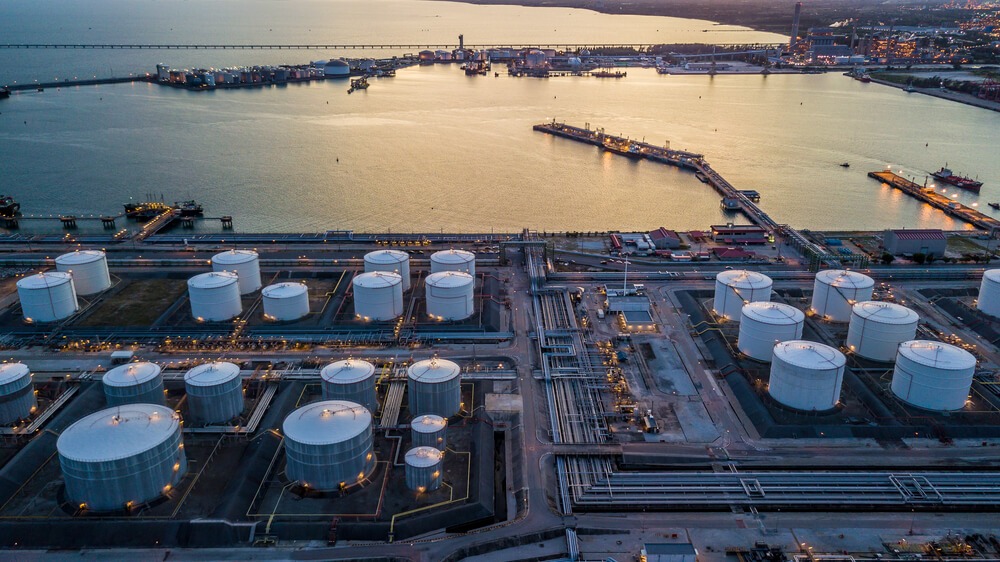

Nevertheless, the crude oil imports of the country are still likely to grow by 3.4% in 2021. The expectation is that the figure might go up to 11.2 million barrels per day.

This is under the expectation that economic growth will bring about stimulation in consumer activity.

Meanwhile, the United States followed the uptrend after reporting strong retail sales and business inventory for March and February, respectively.

The $1.9 trillion stimulus injection provided a safety net for citizens who were on the lifeline, literally and figuratively, due to the devastating pandemic.

The US weekly jobless claims are also at a record low. The indicator fell to its lowest settlement since March of 2020.

West Texas Intermediate’s Reaction with Positive Reports

The consequent positive news sent the West Texas Intermediate futures to add 0.4% and traded steadily at $63.74 per barrel.

The American benchmark has totally moved on from its painful fall below the $60.00 threshold last month.

With its counterpart on the uphill ride, the Brent crude futures also managed to bring in some gains during the same session.

The European benchmark added 0.5% to $67.24 cents per barrel, one of the highest notched in weeks.

The back-to-back support from global economic recovery and OPEC’s decision to keep supply curbs in place are all playing their respective roles.

In the past week, the oil association’s member states finally agreed to increase OPEC production and output as demand arose.

For the May and June period, the market will expect some additions in supply from the leading exporters of oil in the world.

Traders are crossing their fingers that demand will become more relatively stable by then.