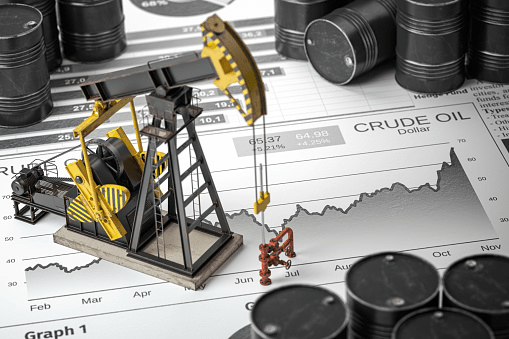

Brent crude futures increased $2.01, or 2.2%, to $94.37 a barrel by 0900 GMT, and U.S. West Texas Intermediate (WTI) crude futures increased $2, or 2.3%, to $88.61.

Both benchmarks skated 3% to two-week lows in the prior session, and Brent was on course for a weekly decline of almost 6%, while WTI was set for a drop of nearly 5% over the week.

OPEC+ will meet on Sept. 5 versus expected reductions in demand, though top producer SA says supply is tight.

OPEC+ this week revised market balances for this year. It now sees demand waning supply by 400,000 barrels per day (BPD) versus the 900,000 BPD prediction earlier. The producer group anticipates a market shortage of 300,000 BPD in its base case for 2023.

Russian Oil Exports In Question

The market is also examining a possible price cap on Russian oil exports.

G7 finance ministers should harden plans on Friday to set a price cap on Russian oil, striving to curb revenue for Moscow’s war in Ukraine but holding crude flowing to bypass price spikes.

Meantime, investors remain anxious regarding the influence of the latest coronavirus restrictions in China. The city of Chengdu on Thursday called for a lockdown that has pierced manufacturers such as Volvo.

Data revealed that Chinese factory activity in August leased for the first time in three months in the face of weakening demand, while power shortages and coronavirus outbreaks also disrupted production.