Brent crude futures climbed 25 cents, or 0.3%, to $93.79 a barrel at 1000 GMT. U.S. West Texas Intermediate (WTI) crude futures ascended 35 cents, or 0.4%, to $91.42 a barrel.

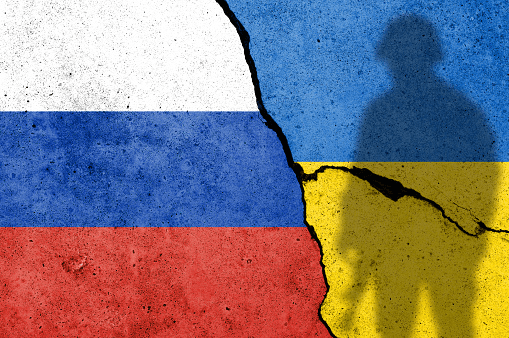

On Monday, French President Emmanuel Macron stated that U.S. President Joe Biden and Russian President Vladimir Putin agreed to a summit over Ukraine. Still, the Kremlin expressed there were no immediate plans for a meeting.

U.S. markets will be shut on Monday for the Presidents Day holiday.

OANDA analyst Jeffrey Halley said that a potential reduction in Ukraine tensions has seen sellers arise in oil in Asia.

European Commission President Ursula von der Leyen voiced Russia would be cut off from international financial markets and restricted access to significant exports needed to modernize its economy if it invaded Ukraine.

As the U.S. and U.K. have warned in recent days, if a Russian invasion takes place, Brent futures could spike above $100/bbl, even if an Iranian deal is reached, Commonwealth Bank analyst Vivek Dhar said in a note.

The nuclear deal is very close

Meantime, ministers of Arab oil-producing countries noted that OPEC+ should stick to its existing agreement to add 400,000 barrels per day (bpd) of oil output each month, refusing calls to pump more to ease pressure on prices.

Price gains have also been restricted by the chance of more than 1 million bpd of Iranian crude returning to the market.

Iranian foreign ministry spokesman Saeed Khatibzadeh expressed “significant progress” had been made in talks to restore Iran’s 2015 nuclear agreement on Monday following a senior European Union official who said on Friday that a deal was “very, very close.”

Analysts stated the market remained tight, and any addition of oil would help. Still, prices would stay volatile in the near term because Iranian crude is doubtful to return until later this year.