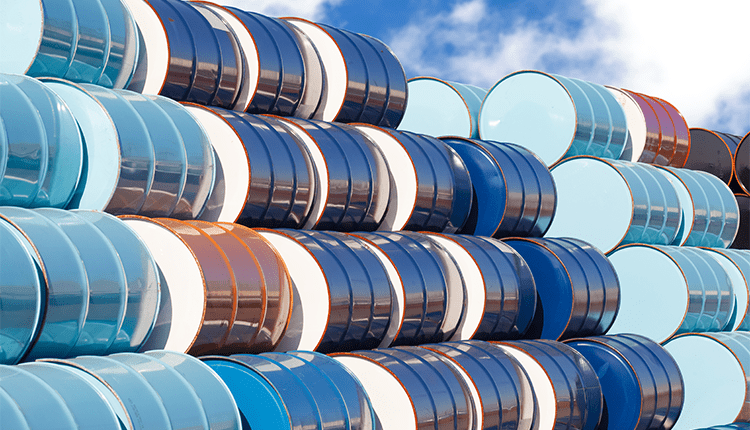

The U.S. oil prices dropped on Tuesday. It weighed down by doubt over whether U.S.-China trade talks are improving. Also, higher Saudi Arabian crude production supported concerns about oversupply.

U.S. West Texas Intermediate (WTI) crude fell 18 cents, or 0.3%, at $56.68 a barrel. The contract decreased by 0.7% in the recent session.

Brent crude futures settled down 14 cents, or 0.2%, at $62.04 a barrel, after falling 0.5% on Monday.

Worries about the effect on oil demand from the fallout of the U.S.-China trade war, it weighed on global economic progress. It returned after uncertainties cast on the possibility of a “phase one” agreement.

United States President said talks with China were moving good, but the U.S. would only agree if it were for the good of Washington. Also, he said there is false news about U.S. eagerness to lift tariffs.

OANDA senior market strategist said oil prices are grappling at the start of the week as trade concerns hinder some of the momenta in October. Besides, the “phase one” deal might give a boost to energy demand.

Caution governed in other markets ahead of a speech by Trump to the Economic Club of New York in case there is any new word on a deal.

OPEC production target of Saudi Arabia kept its oil markets low. It increased its oil output in October to 10.3 million barrels per day.

The OPEC+ will likely extend a deal to limit crude supply. Contrarily, it’s unlikely to deepen their cuts, according to Oman’s energy minister.

OPEC+ will meet in early December. The organization cut production by 1.2 million bpd since January under an agreement until March 2020.

Oil Prices Rebound; Uncertainty on Trade Progress Remains

Oil prices rebounded on Tuesday in Asia after falling in the previous session amid uncertainty over Sino-U.S. trade progress.

WTI Crude Oil Futures gained 0.3% to $57.08. International Brent Oil Futures also rose 0.4% to $62.41.

Hopes of a possible trade deal faded since U.S. President said he did not agree to roll back the U.S. tariffs sought by China.

U.S. President is going to speak at the Economic Club of New York today. Also, some are expecting that he will give clarity on when the “phase one” deal might be signed.

Elsewhere, U.S. data presented that crude inventories at Cushing dropped about 1.2 million barrels in the week of Nov. 8. Cushing is the delivery point for WTI, traders said, citing market intelligence company Genscape.

Cushing inventories grew for five weeks in a row through Nov. 1, according to government data.

Furthermore, demand growth may keep up next after a year of rushed expectations amidst the U.S.-China trade war. The data is according to Fitch Solutions Macro Research analysts in a new report.

Fitch Solutions said their data show that 2019 will mark the lowest point of oil demand growth over the next five years.

Moreover, Fitch Solutions’ report demand to grow by around 0.5% this year, increasing to 0.8% in 2020, the report said. Contrarily, it added that trade and political risks remain incredibly elevated.