General Information

Broker Name: Mixfinancing

Broker Type: Forex & CFDs

Country: UK

Operating since year: /

Regulation: /

Address: 22 Bishopsgate, London, England, EC2N 4BQ

Broker status: Active

Customer Service

Phone:

Email: [email protected]

Languages: English

Availability: 24/7

Trading

The Trading platforms: Web

Trading platform Time zone: /

Demo account: No

Mobile trading: No

Web-based trading: Yes

Bonuses: Yes

Other trading instruments: Yes

Account

Minimum deposit: $250

Maximal leverage: 1:50

Spread: Floating From 1 Pip

Scalping allowed: Yes

CONTENT

- General Information & First Impressions

- Fund and Account Security

- Account info at mixfinancing.com

- Mixfinancing’s Trading Platform

- Conclusion

Broker Review: Mixfinancing

General Information & First Impressions

Mixfinancing is a CFDs broker that operates primarily within Europe but also offers its services worldwide. It’s a broker from the UK, although the language on the website is German by default. Don’t be frightened if you don’t speak the language, though, as the translations available are fully functional and accurate. So you won’t miss anything important or read anything incorrect, even if you switch it over to English or even French.

Our Mixfinancing review will explore the broker’s service and what it brings to users. And since Mixfinancing is a CFD broker, that’s a neat place to start.

A lot of traders, especially those without experience of their own, are weary of CFD brokers. They hear that CFDs are scams and stick to that religiously without further exploration. And while it’s true that scammers like to pose as CFD brokers, discounting all CFD brokerages is foolish.

Contracts for difference pose a unique trading structure that guarantees versatility and an efficient price. It also has numerous other advantages, like greater liquidity and less chance of execution issues.

Realistically, CFDs are the better choice for all but the few top traders. The prices are lower, there are more assets, and you get more control. If you manage to dodge the scammers that use CFDs as a lure, you’re in for a great experience.

And we’ll discuss the broker’s security status soon in our Mixfinancing review. However, for now, we’d also like to mention that the initial user experience is very pleasant. The website runs well and is informative, making the broker easy to explore. On top of that, Mixfinancing divided the information well, making it simple to consume in smaller chunks. Altogether, it’s a great introduction for anyone and has definitely made us eager to learn more.

Fund and Account Security

Now it’s time to explore the security and trust conditions that Mixfinancing displays. As always, that’s the first thing we check, since a scam broker can cause massive amounts of harm. And as we said earlier in our mixfinancing.com review, CFD brokers are a bit more dangerous than regular ones.

A lot of people have already gotten tricked by dubious brokerages. Before regulators got involved, it was wild, and online trading was a cast of the die. And while the situation has gotten better with regulation, malicious companies can still slip by unnoticed.

The best way to counteract that is meticulously investigating each broker you decide to trade with. An issue with that is, however, that you can’t always do so in a straightforward manner. There are some rough guides you can find, but a lot of it comes down to learned patterns and intuition. And since most traders don’t change brokers often, that intuition usually isn’t highly developed.

That’s where this part of our Mixfinancing review comes in. Since we look at brokers all the time, we’ve gotten pretty good at sniffing out scammers. And we’re ready inform you of our opinion on the broker at hand.

As you could’ve likely told from the intro part, we’re quite eager about Mixfinancing. And that’s because we’re confident it’s a secure brokerage. In part, that’s because it has a history of treating customers well and operating with integrity. Additionally, it’s a UK brokerage, which means it needs to follow strict local regulatives to keep operating.

The two factors set the fact that it won’t harm customers in stone. Even if it had any desire to do so, which we don’t believe it does, it wouldn’t be able to without getting heavily fined.

Account Info at mixfinancing.com

Mixfinancing’s accounts play a significant role in ensuring the versatility of the broker’s service. That’s because, ublike most brokers, it actually has something for everyone.

Brokers commonly use their accounts to differentiate between luxury users and those on a strict budget. A lot of companies fail in their approach since they favor one side too heavily. Budget users don’t mind losing some features for an efficient service, while high-end traders want everything maxed out. The two groups conflict and usually aren’t satisfied with the same account.

That means you can’t please everyone with a single option. So a split seems like a logical solution, and if done correctly, it is. However, brokers are often either too shy with the high-end options or too stingy with the budget features. Either way, they end up back at square one, with their service only fitting one section of trader.

As we said earlier in our mixfinancing.com review, it has actually managed to balance the scales. The budget account offers a full trading experience but even has a glimpse into the high-end world. The cheapest account only requires a $250 deposit, and you get a personal account manager and trading alerts.

And the top-end is filled with exclusive features like risk-free trades. There’s also a 30% welcome bonus which, while it’s proportional to your deposit, brings more money to those that invest more. And there are other assistance and trading improvement features that make the experience more pleasant and effective.

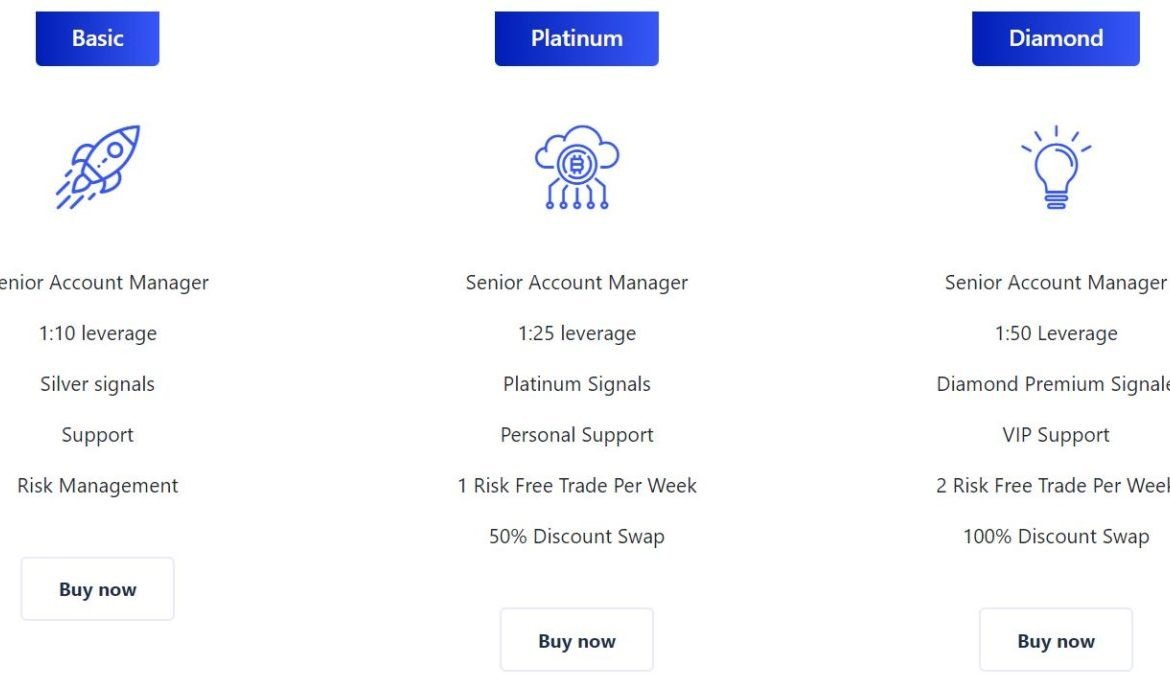

Here are some of the properties that the different accounts on mixfinancing.com offer:

Basic

- Senior Account Manager

- 1:10 leverage

- Silver signals

- Support

- Risk Management

Platinum

- Senior Account Manager

- 1:25 leverage

- Platinum Signals

- Personal Support

- 1 Risk Free Trade Per Week

- 50% Discount Swap

Diamond

- Senior Account Manager

- 1:50 Leverage

- Diamond Premium Signale

- VIP Support

- 2 Risk Free Trade Per Week

- 100% Discount Swap

Mixfinancing’s Trading Platform

The last thing we should cover in our Mixfinancing review is the broker’s platform. It uses a proprietary WebTrader that was developed specifically for browsers. And that may sound like a moot point since all WebTraders are for browsers, but that’s not what we mean.

A lot of brokers develop browser trading programs as an afterthought or a copy of their original service. In other words, most develop a mobile or downloadable platform, and then they port it to be compatible with browsers. That often makes them feel not fully fleshed out, with bugs or small hitches that degrade the user experience.

Mixfinancing’s approach has some major advantages, and the first is, obviously, the removal of those issues. The second is that traders that prefer trading via computers can remain much more mobile and trade with any device. Unlike with other brokers, you’ll actually get a fully-functional experience without losing any power.

Of course, we also need to mention that the platform is much better optimized than competitors. That means it’s much less likely to ruin your trading flow because of your device. Additionally, it means even older or less powerful computers can trade without feeling technologically outdated.

The platform itself has all the functions you’re used to and more. There is a solid suite of analytical measurements and features you can use to improve your trading experience. For example, visual indicators can help you locate trends and find breakout points. The platform supports multiple, so they’re a potent visual aid for your trading process.

There are tons of additional options you can explore, such as take wins and stop losses. They all formulate a coherent service with the goal of making the trading process easier and more lucrative for traders.

Mixfinancing Review: Conclusion

Mixfinancing is an impressive company that offers a uniquely powerful and pleasant service. Few brokers shape their service around what users actually find important to the degree of Mixfinancing. It looks and handles well and is actually a potent trading tool on top of that.

There’s no other way to conclude our Mixfinancing review than with a glowing recommendation. The next time you’re searching for a broker, be sure to take it into consideration.

Accurate signals

Faster execution than the rest of the brokers I have dealt with. Signals are accurate and they address all concerns promptly.

Did you find this review helpful? Yes No

Good trading broker

I am happy to see progression in my trades. It is one of the best brokers I have dealt with. Signals are always good and services are, too.

Did you find this review helpful? Yes No

Fast withdrawals

Fast withdrawals. I got my money earlier than expected. I never encounter any problem with any of my transactions.

Did you find this review helpful? Yes No

Good broker

Good to trade with this broker. I am consistently gaining great profit.

Did you find this review helpful? Yes No

Amazing broker

I am truly amazed with their services. I can withdraw easily and I gain good profit, too.

Did you find this review helpful? Yes No

Good brokers

Based on my trading results, I can say that these are good brokers. I can see their efforts and dedication to help me attain successful trades. I gain profit and was able to withdraw swiftly.

Did you find this review helpful? Yes No

Good broker

Good broker. I am gaining decent profit so far.

Did you find this review helpful? Yes No

Good source of income

I am fully satisfied with what I get from this broker. It is a good source of income.

Did you find this review helpful? Yes No

Skilled broker

Admirable trading brokers. They are skilled and dedicated to conduct market research all the time.

Did you find this review helpful? Yes No

Good customer service

Commendable customer service. I wouldn’t have to wait long in the phone queue, they are prompt. Even in emails and chats, they are responsive.

Did you find this review helpful? Yes No

Good forex company

My trusted forex company. SIgnals are good as well as the services.

Did you find this review helpful? Yes No

Happy with my profit

Easy deposit and withdrawal process. No much hassles and no fancy documents to provide. I am happy with my profit so far.

Did you find this review helpful? Yes No

Good broker

Good trading company. I’ve got no regrets dealing with this broker, I was able to gain good profit from my trades.

Did you find this review helpful? Yes No

Excellent signals

Worth my money and time, they are so dedicated in providing excellent signals.

Did you find this review helpful? Yes No

Good broker

Fast withdrawal process. Good trading signals and services as well.

Did you find this review helpful? Yes No

Good support

One of the best broker in the industry. The support really gives greater attention to their traders and make sure not to miss anything. One of the best broker, good support and an outstanding platform to recommend.

Did you find this review helpful? Yes No

Satisfied

I am fully satisfied with what I get from this broker. It is a good source of income.

Did you find this review helpful? Yes No

Good profit

This has been my broker for a year and all year round I got really good profit. There is no problem on withdrawals as well.

Did you find this review helpful? Yes No

Amazing services

Amazing services and good profit are my reasons for keeping this broker service. I have never experienced withdrawal delays.

Did you find this review helpful? Yes No

Good services

Good services overall. The trading software is updated with so many helpful and good features. Brokers and customer service are also good in providing services.

Did you find this review helpful? Yes No

Amazing broker.

Excellent trading company. The signals and services are both amazing.

Did you find this review helpful? Yes No

Good customer service

Good customer service. They are helpful and skilled. I am getting the support I need promptly.

Did you find this review helpful? Yes No

Amazing software

Amazing trading software. It has so many opportunities to make money. Easy to use s well.

Did you find this review helpful? Yes No

Professional brokers

I am satisfied with their services.Professional and skilled brokers

Did you find this review helpful? Yes No

Good services

Good services overall. I never encounter problems with tools and services.

Did you find this review helpful? Yes No

Great signals

Signals are good and withdrawal is quick. I enjoy the service and I love the profit that I’m getting from the signals.

Did you find this review helpful? Yes No

Competitive brokers

There are so many good things about this forex broker company. Aside from having good signals, brokers are competitive.

Did you find this review helpful? Yes No

Skilled broker

I am thankful to this broker for being so patient with me. They have always shown compassion and genuinely helped me grow my investment.

Did you find this review helpful? Yes No

Honest and transparent

This is the only broker I am confident trusting my money with. They are very transparent and honest in all transactions.

Did you find this review helpful? Yes No

Competitive services

They support me all the way and help me gain good profit. They offer competitive services and profitable deals. Highly commendable broker services.

Did you find this review helpful? Yes No

Happy with my profit

Easy deposit and withdrawal process. No much hassles and no fancy documents to provide. I am happy with my profit so far.

Did you find this review helpful? Yes No

Good profit

I have joined this broker a couple of months ago and I had a great trading experience. I gain good profit and got no problem with withdrawals or on any transactions. trading services.

Did you find this review helpful? Yes No

Skilled brokers

This has been my broker for quite some time and so far all services are good. They are skilled and I love trading with them.

Did you find this review helpful? Yes No

Great signals

Signals are good and withdrawal is quick. I enjoy the service and I love the profit that I’m getting from the signals.

Did you find this review helpful? Yes No

Transparent brokers

I can fully trust this broker. They are honest and transparent.

Did you find this review helpful? Yes No

Fast withdrawals

Fast and hassle-free withdrawals. I have no complaints about the services, I get good profit.

Did you find this review helpful? Yes No

Consistently great

I am working with this broker since last year and for more than a year, they’ve been consistently great. Have helped me gain really good profit.

Did you find this review helpful? Yes No

Outstanding broker

Outstanding broker signals and good trading software. They’ve made trading easier and more productive for me.

Did you find this review helpful? Yes No

Satisfied with the services

I see good results from all of my trades. I am by far very satisfied with all of their services.

Did you find this review helpful? Yes No

Swift withdrawals

What I like the most about this forex broker is that they process withdrawals swiftly. I never encountered any problem on all of my withdrawals.

Did you find this review helpful? Yes No

Good brokers

They are good brokers. They let me see their company and regulation prior to trading. Also, they explain all the things I need to know including risk. Very transparent.

Did you find this review helpful? Yes No

Prompt brokers

I am happy with this broker. They are always prompt in all concerns. Withdrawals are on time as well.

Did you find this review helpful? Yes No

Good signals

Valuable forex signals, I am really glad I traded with this broker. Highly recommended forex services.

Did you find this review helpful? Yes No

Good profit

I get good trading assistance and good profit. I never had any problem dealing with this broker so far.

Did you find this review helpful? Yes No

Good services

I would always choose this broker company. Services are more than good.

Did you find this review helpful? Yes No

Good profit

They have given me so many great opportunities to earn money. I am glad to have traded with the right broker. I gained good profit and received my withdrawals earlier than expected date.

Did you find this review helpful? Yes No

Great signals

Signals are good and withdrawal is quick. I enjoy the service and I love the profit that I’m getting from the signals.

Did you find this review helpful? Yes No

I am satisfied.

Friendly customer service and fast withdrawals. I am satisfied.

Did you find this review helpful? Yes No

Helpful and attentive customer service

Helpful and attentive customer service. They are also keen on details and always think out of the box.

Did you find this review helpful? Yes No

Reliable and great services.

Reliable and great services. I had many great opportunities to earn money, and I have a good return on my investment.

Did you find this review helpful? Yes No

The signals are very good.

I had a great trading experience trading with this broker. The signals are very good.

Did you find this review helpful? Yes No

Prompt customer service, always ready to assist whenever I have concerns.

Prompt customer service, always ready to assist whenever I have concerns. Broker signals are always timely and accurate. I made profits, and the withdrawal process was smooth.

Did you find this review helpful? Yes No