Libertex Broker: Review of an exceptional crypto CFD trader

Introduction to Libertex review

Libertex is an online CFD and forex broker who is a part of multinational brand Forex Club Group. Founded in 1997, this European broker has since extended its reach in 27 countries, offering its 2.2 million clients worldwide services in currencies, commodities, stocks, indices, and cryptocurrencies.

The firm has also earned 30 international awards, with the latest including the Best Crypto-Currencies Broker and the Best Trading App in 2017 and 2018. Its platform features 213 assets available for trading.

When it comes to trading platforms, this broker offers its own proprietary platform, which is accessible through the web or mobile phones (iOS and Android).

Once traders have funded their live Libertex accounts, they can simply select an asset type, the amount of money to commit, and then speculate on a market’s movement.

Libertex Account Types

The Libertex keeps its account types to a minimum. The platform offers a Demo and two live accounts, i.e., the Libertex and Libertex Pro account. The process of switching from a Demo account to a live account and vice versa is easily done as well.

Clients may start trading with Libertex for as low as €10, and the process would only take 5-10 minutes.

Here’s a rundown of each account:

Demo Account

- Web-based and mobile trading available

- Terminal used is the same as where live trading takes place

- Virtual money worth €50,000 will be automatically credited

Libertex Account

- Leverage up to 1:600

- No spread charges

- Commission starts from 0.03%

- $100 minimum transaction amount for all tools

- Marker order execution available

- Mobile (iOS and Android) trading available

Libertex Pro Account

Clients of Libertex with Pro accounts can benefit from not being subjected to the new European leverage restrictions and a maximum leverage of 1:600, although traders must first meet at least two of the following requirements to be able to register for a Pro account.

- Traders must have done at least 10 transactions per quarter, of considerable size, over the last four quarters on the relevant market.

- They need to have a background in the financial industry. At least one year of experience in a job involving financial-related transactions or services.

- The size of the portfolio should be more than €500,000 (including cash savings and financial instruments.

Trading Products at Libertex

The Libertex platform caters to a wide range of trading assets, including currencies, metals, indices, stocks, ETFs, oil and gas, agriculture, as well as cryptocurrencies. All assets use a market execution method. Details of each asset are as follows:

Currencies

- Libertex has a total of 49 currency pairs available for trading, which includes 7 majors, 21 crosses, and 21 exotics.

- Commissions are included and vary, depending on the currency pair.

- Lowest commissions charged is -0.011% (EUR/USD), while the highest is -0.41% (USD/RUB).

- Maximum leverage is 600

Metals

- The platform allows trading in five metals, i.e., Gold, Silver, Platinum, Palladium, and Copper.

- Maximum leverage is 200

- Lowest commissions charged is -0.252% (Copper), while the highest is -0.004% (Spot Gold).

Indices

- Clients may perform trades on 18 stock indices across the US, Europe, and Asia with Libertex.

- Some of the well-known indices this broker cover include Dow Jones, DAX, and Nikkei 225.

- Maximum leverage is 500

- Lowest commissions charged is 0.0% (MEX BOLSA Index), while the highest is -0.015% (US Dollar Index Future).

Stocks

- Libertex has 50 stock CFDs available for trading, which include blue chips of the US market as well as popular stocks from Europe and Latin America.

- Leverage for all stocks is 5

- Lowest commissions charged on some stocks is 0.0%, while the highest is -0.02%.

ETFs

- There are 10 ETFs accessible for clients

- Maximum multiplier is 20

- Lowest commissions charged is -0.175%, while the highest is -0.075%.

Oil and Gas

- Traders are given access to 5 Oil/Gas instruments on the platform, i.e., Brent crude oil, WTI crude oil, Light Sweet crude oil, Natural Gas, and Heating Oil.

- Maximum leverage is 120

- Lowest commissions charged is -0.516% (Natural Gas), while the highest is -0.0042% (Heating Oil).

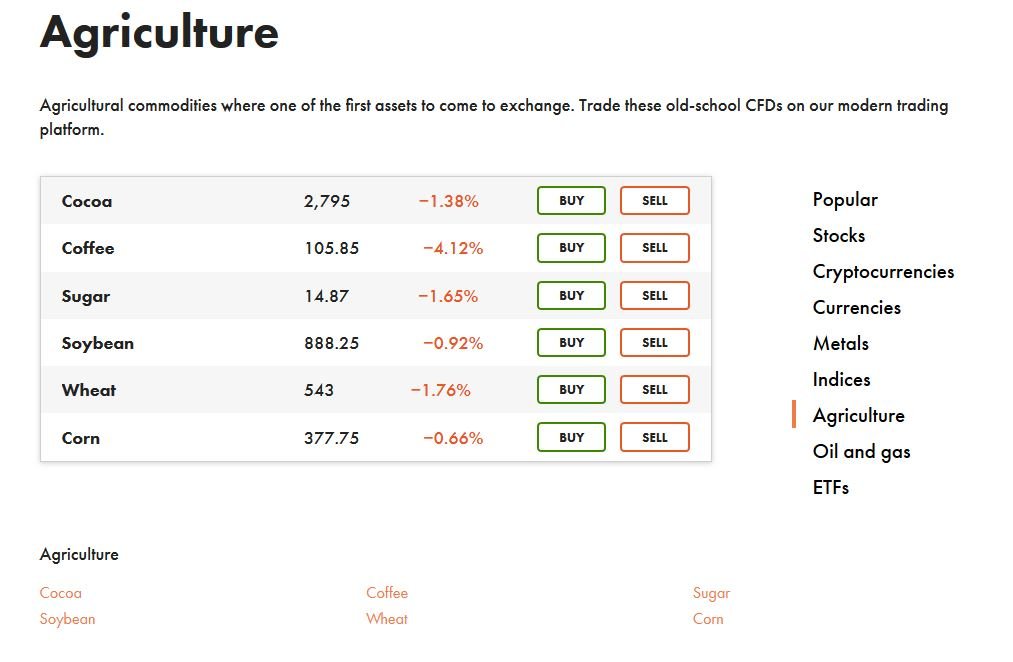

Agriculture

- There are 6 agricultural commodities that Libertex caters to, namely, Cocoa, Coffee, Corn, Soybean, Sugar, and Wheat.

- Leverage for agricultural commodities is 50

- Lowest commissions charged is -0.191% (Coffee), while the highest is -0.072% (Soybean).

Cryptocurrencies

- Libertex offers 40 crypto assets, including but not limited to Bitcoin, Ethereum, Dash, Litecoin, and Ripple.

- Brokerage fee for CFD trading in cryptocurrencies is cut by 50%.

- Leverage for all cryptocurrencies is 20

- Lowest commissions charged is -1.02% (Litecoin), while the highest is -0.1% (Bitcoin Gold).

Trading Conditions at Libertex

Below discusses some of the important conditions that traders need to consider if they intend to open an account with Libertex.

Commissions

- There are no spreads charges for trades with Libertex, only commissions.

- A commission is charged for each trade performed on the platform.

- Percentage charges included in Libertex’s assets are different as well.

Leverage

- All trades performed on the Libertex platform can be leveraged. Rather than having a fixed leverage number, this broker employs a multiplier which could vary depending on the asset being traded.

Leverage on Libertex functions based on the trader’s categorization status, i.e., Retail or Professional client.

- Once Retail clients open a position, the margin requirements will be based upon the leverage, meaning the leverage establishes clients’ trade amount.

- Professional clients, on the other hand, can trade without leverage. They will be investing their own money, which will be kept on their account, while no margin will be taken.

Conclusion – Is Libertex good?

Based on the Libertex Review above can be said that: trading with Libertex offers a number of advantages. One of them is its regulation by the Cyprus Securities and Exchange Commission (CySEC), as this helps ensure client fund safety and segregation.

This broker also keeps a tight rein on its clients’ risk exposure. The risk exposure is limited to the amount of opened transactions, and not to the account balance. When it comes to its set commission schedule and multiplier, these two can either be beneficial or unfavorable, depending on the trader’s experience. The execution of trades on the platform could be more efficient, due to the multiplier and the absence of dealer spreads.

Scammers

Stay away from them. They are goons and scammers.

Did you find this review helpful? Yes No

Fraud

Fraudulent activity. Avoid them by all means.

Did you find this review helpful? Yes No

Poor trading advise

Poor trading advise. My reason of closing my trading account with them is their ineffective trading advise. It seems more like an opinion and not based on facts. It causes too much losses.

Did you find this review helpful? Yes No

Scam-broker

Keep yourself away from this scam-broker.

Did you find this review helpful? Yes No

Poor signals

One of the worst trading brokers I have traded with. Do not trust their signals.

Did you find this review helpful? Yes No

Stay away

Stay away from this trading broker. The services are not good at all.

Did you find this review helpful? Yes No

Scam tycoons

Better think twice and do not deal with this broker. They are one of the scam tycoons in the industry.

Did you find this review helpful? Yes No

Worst trading tools

Worst trading tools I have ever used. Has so much lags and glitches.

Did you find this review helpful? Yes No

Poor trading company

Poor trading company. Do not deal with them.

Did you find this review helpful? Yes No

Scam offers

Always remember to be mindful of the scammer’s strategy. Anything that is too good to be true is a scam. And so is their offer.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Do not believe

Do not believe their lies. They are just trying to fool people.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Poor broker

Poor broker performance. They are not good at all.

Did you find this review helpful? Yes No

Unresponsive

Unresponsive customer service. I have to deal with long queues over the phone too.

Did you find this review helpful? Yes No

Avoid them

Did not pay my profit. Avoid them by all means.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Not a trusted broker company

Not a trusted company to trade with. They conceal their identities and use fake names and phone numbers.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Do not deal with them

Poor trading services. Slow withdrawals and unresponsive customer service. Do not deal with this broker service.

Did you find this review helpful? Yes No

Unable to withdraw

I was not able to get my profit from this broker. They gave so many excuses.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Poor trading signals

Do not deal with them. Their signals aren’t helpful at all.

Did you find this review helpful? Yes No

Manipulate trades

Manipulates trades. I have lost so much money on this.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Stay away

Stay away from this trading broker. The services are not good at all.

Did you find this review helpful? Yes No

Stay away

Stay away from this trading broker. The services are not good at all.

Did you find this review helpful? Yes No

Stay away

Stay away from this trading broker. The services are not good at all.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

All losses

Do not deal with this broker, there ain’t really winning trades. They will always let the client lose as if they are earning from losses.

Did you find this review helpful? Yes No

Took all my money

Cruel people. They’ve left me with nothing but financial problems. They took all my money away.

Did you find this review helpful? Yes No

Bad broker

Bad customer service and brokers. All they care about is to get your hard-earned money.

Did you find this review helpful? Yes No

Too many technical problem

Too many technical problems to face. I won’t trade with them again.

Did you find this review helpful? Yes No

Bad withdrawal process

The withdrawal process is really very annoying. Aside from those tons of documents asked for, waiting takes longer time than usual.

Did you find this review helpful? Yes No

Upset with withdrawal process

I am upset with their withdrawal process. They keep on returning and asking me to replace my documents. It is really very difficult to request the withdrawal.

Did you find this review helpful? Yes No

Low quality tools

Got the lowest quality of trading tools and services. I do not recommend this broker.

Did you find this review helpful? Yes No

Worst trading software

Worst trading software. It has so many features that makes trading easy and more organized.

Did you find this review helpful? Yes No

Bad broker

Huge slippage and they keep on changing trading term. Manipulate everything to freeze money.

Did you find this review helpful? Yes No

Do not process withdrawals

It’s hard to trade with unprofessional brokers. They always give lame excuses not to pay profit.

Did you find this review helpful? Yes No

Unable to withdraw

I was not able to get my profit from this broker. They gave so many excuses.

Did you find this review helpful? Yes No

Poor services

Poor trading services. They do not care for thier clients.

Did you find this review helpful? Yes No

Not a trusted broker company

Not a trusted company to trade with. They conceal their identities and uses fake names and phone numbers.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawals. Services are fair not bad but not that good, just average. But when it comes to withdrawals, it’s the worst.

Did you find this review helpful? Yes No

Bad broker

Bad broker. They have start ignoring me after I have deposited money.

Did you find this review helpful? Yes No

Poor services

They will never pay profit. Poor services.

Did you find this review helpful? Yes No

Poor services

They will never pay profit. Poor services.

Did you find this review helpful? Yes No

Stay away

Stay away from these scammers. They will only do you harm.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. They have very thick accents and can not communicate well.

Did you find this review helpful? Yes No

Do not trade

Do not trade with them. I have tried trading with them some time in the past and really it causes me so much problem.

Did you find this review helpful? Yes No

Bad trading company

Bad trading company. Do not deal with this scammers.

Did you find this review helpful? Yes No

Do not join this broker

Do not join this broker service. I have so much regretted using their services. I have noticed that they only let me win for the first time to convince me to add more money but eventually, they let me lose all. I felt like they are fake brokers and the trading they have is not real.

Did you find this review helpful? Yes No

Services sucks

If I can only put zero as a rating, I would. I have traded with them in the past and none of their services is okay. Platform, broker signals, withdrawal, and customer service, they all suck!

Did you find this review helpful? Yes No

Do not deal

Do not deal with these scammers. They are very good in convincing people, do not to believe what they say.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. There are so many withdrawal issues.

Did you find this review helpful? Yes No

Do not trust

They have stolen money from people who do not trust them.

Did you find this review helpful? Yes No

Inaccurate signals

Not an ideal trading broker. The signals are inaccurate.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. They do not communicate well.

Did you find this review helpful? Yes No

Do not believe

Do not believe their lies. They are just trying to fool people.

Did you find this review helpful? Yes No

Do not deal with them

Do not deal with them. Save your money from these scammers.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow in terms of withdrawals and execution. Some latencies cause me so much trouble.

Did you find this review helpful? Yes No

Unreliable

Extremely unreliable company. They had so many suspicious practices.

Did you find this review helpful? Yes No

Do not approve withdrawals

They do not approve withdrawal requests. I feel like there is something wrong.

Did you find this review helpful? Yes No

Beware

Do not pay profit. Beware.

Did you find this review helpful? Yes No

Unreliable signals

Not a good trading broker. Signals are very unreliable.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. As if they are not trained to assist people.

Did you find this review helpful? Yes No

Profit withheld

Profits withheld. They have freeze my money and won’t let me withdraw. They said it is due to their policy. I am having trouble requesting for withdrawal.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and slow customer service, too. Not recommended.

Did you find this review helpful? Yes No

Poor signals

I did not gain any profit at all. Stop trading with this broker.

Did you find this review helpful? Yes No

Worst trading software

Worst trading software. It has so many features that make trading easy and more organized.

Did you find this review helpful? Yes No

Bad trading company

Bad trading company to deal with. They have very slow withdrawals.

Did you find this review helpful? Yes No

Expensive

Affordable to open an account but on the actual trading need to add more money. Fees and charges are surprisingly expensive. Unbelievable pricing also.

Did you find this review helpful? Yes No

Poor services

Poor trading services. They do not care for their clients.

Did you find this review helpful? Yes No

Poor services

Poor trading services. They do not care for their clients.

Did you find this review helpful? Yes No

Technical issues

Worst trading tools I have ever used. There are so many technical issues.

Did you find this review helpful? Yes No

Bad broker

Huge slippage and they keep on changing trading terms. Manipulate everything to freeze money.

Did you find this review helpful? Yes No

All losses

Do not deal with this broker, there ain’t really winning trades. They will always let the client lose as if they are earning from losses.

Did you find this review helpful? Yes No

Stay away

Stay away from this trading broker. The services are not good at all.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. I will never recommend them.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawals. Services are fair, not bad but not that good, just average. But when it comes to withdrawals, it’s the worst.

Did you find this review helpful? Yes No

Not a trusted broker company

Not a trusted company to trade with. They conceal their identities and use fake names and phone numbers.

Did you find this review helpful? Yes No

Bad brokers

Bad brokers. They practice unsolicited calls and force me to deposit more money on my trading account.

Did you find this review helpful? Yes No

Difficult withdrawals

Difficult withdrawal process. There are so many required documents needed. it is almost impossible to withdraw money here.

Did you find this review helpful? Yes No

Bad broker

Bad customer service and brokers. All they care about is getting your hard-earned money.

Did you find this review helpful? Yes No

Unprofessional brokers

Not a good trading broker. They are very unprofessional, especially on withdrawals.

Did you find this review helpful? Yes No

Difficult withdrawal process

I find it very difficult to request a withdrawal. They intentionally give me hard time as if they do not want anyone to withdraw money.

Did you find this review helpful? Yes No

Liars

I was advised that they are institutions to help me recover funds but it was a complete lie. Nothings happens.

Did you find this review helpful? Yes No

Expensive

Affordable to open an account but on the actual trading need to add more money. Fees and charges are surprisingly expensive. Unbelievable pricing also.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. The intonation of the representatives over the phone is sarcastic and rude.

Did you find this review helpful? Yes No

I am not fully satisfied with this broker

Good broker but I am not fully satisfied. Aside from they only having 24/5 customer service, I cant contact their customer service on their scheduled available days and time.

Did you find this review helpful? Yes No

Poor signals

Poor trading signals. All trading advice are very ineffective.

Did you find this review helpful? Yes No

Poor broker

Poor broker performance. They are not good at all.

Did you find this review helpful? Yes No

Unable to withdraw

I was not able to get my profit from this broker. They gave so many excuses.

Did you find this review helpful? Yes No

Denied withdrawals

They did not approve my withdrawal request. I am very frustrated.

Did you find this review helpful? Yes No

Scam

Scam company. They took all my money.

Did you find this review helpful? Yes No

Not worth trading with

I have just wasted my money and time. Not worth trading with.

Did you find this review helpful? Yes No

Poor signals

I am not happy with the services. Signals are not recommended.

Did you find this review helpful? Yes No

Unprofessional

Not a good company to trade with. Very unprofessional.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They are rude and unhelpful.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I had several withdrawals with them and all are really very slow.

Did you find this review helpful? Yes No

Slow withdrawals

Very very slow customer service replies. They will start ignoring you after they have taken a deposit.

Did you find this review helpful? Yes No

Unable to withdraw

I was not able to get my profit from this broker. They gave so many excuses.

Did you find this review helpful? Yes No

Do not brelieve

Do not believe their lies. They are just trying to fool people.

Did you find this review helpful? Yes No

Unresponsive

Unresponsive customer service. I have to deal with a long queue over the phone too.

Did you find this review helpful? Yes No

Do not deal with this broer, I have lost a lot of money

Be careful in choosing the right forex broker partner, make sure not to deal with this broker service. I have lost a lot of money on this forex broker, services aren’t good at all.

Did you find this review helpful? Yes No

Stay away from them

An extremely worst trading experience I ever had. Stay away from them.

Did you find this review helpful? Yes No

So much losses

Not worth trading with. I had so many losses.

Did you find this review helpful? Yes No

Do not deal

Do not deal with this broker. They are unauthorized to operate and most of their clients lose money including me.

Did you find this review helpful? Yes No

Drastic price increase

They increase prices drastically. I am so frustrated with this broker.

Did you find this review helpful? Yes No

Ineffective broker

Ineffective trading signals and service. Not a good idea to trade with them.

Did you find this review helpful? Yes No

Not profitable

It is more of a game of chance. Market forecasts are not profitable.

Did you find this review helpful? Yes No

Too many technical problem

Too many technical problems to face. I won’t trade with them again.

Did you find this review helpful? Yes No

Inaccurate signals

Not an ideal trading broker. The signals are inaccurate.

Did you find this review helpful? Yes No

Unreliable

I can not fully rely on the trading tools and services. Not a good trading partner to deal with.

Did you find this review helpful? Yes No

Poor services

Poor services, withdrawal is very slow and customer service are very unresponsive. Could have been a good broker because signals are quite okay but the rest of the services really sucks.

Did you find this review helpful? Yes No

Unresponsive support

Unresponsive chat support. I will have to call them if I needed help, the problem is I spend a few hours waiting in queue to get a live representative.

Did you find this review helpful? Yes No

Rude and disrespectful

Rude and disrespectful customer support. I am very much annoyed with how they treat me over the phone.

Did you find this review helpful? Yes No

Worst customer service

Worst customer service. Out of all the brokers I have traded with, they have the worst customer service. Can’t even help me with any of my trading concerns.

Did you find this review helpful? Yes No

Good so far

There are so many negative remarks about them online, that I wasn’t able to check prior to joining but so far all is good. Been with them for 2 weeks now.

Did you find this review helpful? Yes No

Poor trading platform

Poor trading platform. I always encounter system errors. Customer service isn’t even helping at all.

Did you find this review helpful? Yes No

Poor services

Avoid trading with them. Poor broker services.

Did you find this review helpful? Yes No

No withdrawals

No withdrawal process here, they will give you hard time. It is almost impossible to withdraw. I will never trade with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

Very difficult to request withdrawals. Do not trade with them.

Did you find this review helpful? Yes No

Avoid them

Did not pay my profit. Avoid them by all means.

Did you find this review helpful? Yes No

Do not process withdrawals

It’s hard to trade with unprofessional brokers. They always give lame excuses not to pay a profit.

Did you find this review helpful? Yes No

Worst trading software

Worst trading software. It has so many features that make trading easy and more organized.

Did you find this review helpful? Yes No

Scam

Sad truth. I am a victim of their scam so I advise everyone to stay away from them.

Did you find this review helpful? Yes No

Stay away

Stay away from these scammers. They will only do you harm.

Did you find this review helpful? Yes No

Do not trade with this broker

Do not trade with this broker. They are not cooperative and will give you hard time on withdrawals.

Did you find this review helpful? Yes No

Stay away from them

I lose a fortune because of these bad people. Stay away from them.

Did you find this review helpful? Yes No

Consecutive losses

They treat me real nice but there is one thing that’s bothering me, I get consecutive losses. I guess it is more practical to just stop this. Maybe trading is not for me or they are not a good trading partner.

Did you find this review helpful? Yes No

Unreliable brokers

Unhelpful and unreliable brokers. After the deposit they let me trade on my own.

Did you find this review helpful? Yes No

Huge fees

I am surprised by so many trading fees and charges. I paid more than the profit I get. Just a waste of time.

Did you find this review helpful? Yes No

Worst broker

Horrible forex broker. They’ve got the worst withdrawal process and the worst customer service I have ever dealt with.

Did you find this review helpful? Yes No

Unreliable broker

Do not rely on their signals and services. They are not skilled brokers.

Did you find this review helpful? Yes No

Poor services

Poor trading services. They do not care for their clients.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawals. They are friendly but they do not address withdrawal issues.

Did you find this review helpful? Yes No

Bad broker company

Bad broker company. Do not deal with them.

Did you find this review helpful? Yes No

Poor services

Poor trading services. They do not care for their clients.

Did you find this review helpful? Yes No

Poor trading services

Poor trading services. Not an ideal broker for online trading.

Did you find this review helpful? Yes No

Worst broker

The worst trading company I have dealt with. They do not pay profit and are very arrogant over the phone.

Did you find this review helpful? Yes No

Unreliable signals

Do not trade with this broker company. Signals are unreliable.

Did you find this review helpful? Yes No

Not good

I never had a good experience and I’ve got no reason to recommend and keep this broker service. Not good at all.

Did you find this review helpful? Yes No

Worst trading company

Worst trading company. They do not treat customers well.

Did you find this review helpful? Yes No

Poor services

They are just after our hard-earned money. Poor services.

Did you find this review helpful? Yes No

Poor services

Poor trading services. They do not care for their clients.

Did you find this review helpful? Yes No

Stay away

Stay away from the offers. These are just trapped to get your money.

Did you find this review helpful? Yes No

Expensive instruments

Very expensive trading instruments. I invested too much and yet I do not get good returns.

Did you find this review helpful? Yes No

Poor customer service

Very poor customer service. They don’t even care at all.

Did you find this review helpful? Yes No

Avoid them

Illegitimate broker company. Avoid them.

Did you find this review helpful? Yes No

Poor customer service

Very poor customer service. They don’t even care at all.

Did you find this review helpful? Yes No

Stay away

Stay away from them. They are not legit trading brokers.

Did you find this review helpful? Yes No

Worst withdrawal process

Poor customer service and the worst withdrawal process I have ever observed.

Did you find this review helpful? Yes No

Scam company

One of the leading scam companies. Stay away from them.

Did you find this review helpful? Yes No

Don't deal with them

They freeze my money and accused me of violations I never made. Don’t deal with them.

Did you find this review helpful? Yes No

Do not deal with them

Do not deal with this broker, they do not pay profit not process refunds. They will surely give you hard time just freezing your trading account.

Did you find this review helpful? Yes No

Unreliable services

Unreliable trading services. I do not gain profit from their signals.

Did you find this review helpful? Yes No

Poor signals

One of the worst trading brokers I have traded with. Do not trust their signals.

Did you find this review helpful? Yes No

Unreliable trading brokers

Do not trade with this broker. they are not reliable trading partners.

Did you find this review helpful? Yes No

Rude customer service

Extremely rude customer service. Very upset with how they’ve treated me over the phone.

Did you find this review helpful? Yes No

Unreliable service

Stay away from this trading company. Signals are very unreliable.

Did you find this review helpful? Yes No

Frustrating withdrawals

Withdrawals take so much time. I am very frustrated with the process.

Did you find this review helpful? Yes No

Worst broker company

Worst company and poor customer support. I am so annoyed with this broker company. Signals are unreliable and support is very unresponsive.

Did you find this review helpful? Yes No

Unreliable signals

I had a really bad experience with this broker service. Signals are unreliable.

Did you find this review helpful? Yes No

Unreliable trading brokers

Do not trade with this broker. they are not reliable trading partners.

Did you find this review helpful? Yes No

Fair but not good

They are one of the reputable forex brokers but the actual trading results are not that satisfactory. Just fair but not so good.

Did you find this review helpful? Yes No

Poor services

They will never pay a profit. Poor services.

Did you find this review helpful? Yes No

Scam

Do not invest money in scams such as this. Report them to the authorities when they call instead.

Did you find this review helpful? Yes No

Ruthless thieves

They are ruthless thieves. Avoid dealing with these people.

Did you find this review helpful? Yes No

Poor customer service

Very poor customer service. They don’t even care at all.

Did you find this review helpful? Yes No

Limited options

Very limited trading options and so for withdrawal. Services are somewhat okay but not good.

Did you find this review helpful? Yes No

Poor customer service

Very poor customer service. They don’t even care at all.

Did you find this review helpful? Yes No

Rude

They are very difficult to deal with. People are very rude and don’t seem to care.

Did you find this review helpful? Yes No

Poor customer service

Very poor customer service. They don’t even care at all.

Did you find this review helpful? Yes No

Slow customer service

Very slow customer service. I even lose before they attend to my trading concerns and needs.

Did you find this review helpful? Yes No

Lose money on this

I have lost so much money on this. It is more of gambling. I will never deal with them again.

Did you find this review helpful? Yes No

Do not invest here

Do not invest your money here, the services are not worth it.

Did you find this review helpful? Yes No

Slow withdrawal process

Very slow in processing withdrawals. I asked for so many documents and I was asked to wait for a few weeks.

Did you find this review helpful? Yes No

Cannot withdraw money

I am so frustrated with their withdrawal policy. It is always changing, I cannot withdraw money.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I had trouble getting my profit. I will never trade with them again.

Did you find this review helpful? Yes No

Consecutive losses

I felt like tools are manipulated and programmed to let everyone lose. I get consecutive losses and I really can’t believe it.

Did you find this review helpful? Yes No

Not profitable

Not profitable trading with. I feel like I have just wasted my time on this.

Did you find this review helpful? Yes No

Do not approve withdrawals

Avoid dealing with them. They freeze money and do not approve withdrawal requests.

Did you find this review helpful? Yes No

Bad broker

Slow withdrawals and poor customer service. Not trading with them again.

Did you find this review helpful? Yes No

Poor trading advice

Unreliable trading advice. Not sure where they base it from as if all are just wild guesses.

Did you find this review helpful? Yes No

Worst trading experience

The worst experience I had in my entire life. I have lost a fortune and is now facing lawsuits and financial problem.

Did you find this review helpful? Yes No

Hard time on withdrawals

I suggest not to deal with this broker. It is their practice to give you hard time on withdrawals.

Did you find this review helpful? Yes No

Worst experience

Worst experience I ever had. Have lost so much money. I really regret trading with this broker.

Did you find this review helpful? Yes No

Inaccurate movements

I am trading currencies with this broker and notice some shady movements. I understand I am working in a very volatile niche however the ups and downs of the currencies on their platform seem inaccurate.

Did you find this review helpful? Yes No

Slow customer service

Very slow customer service and delayed withdrawal process.

Did you find this review helpful? Yes No

Do not trade

Not a good company to deal with. Do not trade with them.

Did you find this review helpful? Yes No

Poor signals

I will never trade with this broker again. Signals are not accurate, not even profitable.

Did you find this review helpful? Yes No

Worst services

Worst trading services. I did not even get any profit, just a waste of time.

Did you find this review helpful? Yes No

Not a good broker

Tired of the runarounds on my missing withdrawals. Not a good broker.

Did you find this review helpful? Yes No

Poor trading services

Poor trading services. Not an ideal broker for online trading.

Did you find this review helpful? Yes No

Inaccurate signals

Do not fully trust their signals. Some are not accurate.

Did you find this review helpful? Yes No

Not a good broker

They are not a good broker for forex trading. Signals are not accurate most of the time. And customer service is not helpful.

Did you find this review helpful? Yes No

Beware with this broker

Beware with this broker, they will start to be very difficult upon withdrawal request. Do not believe their sweet words, it’s all a trap.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service, they are very difficult to contact. I am also having a hard time understanding them, they can not speak English properly.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. Services are not ideal for gaining good profits.

Did you find this review helpful? Yes No

Worst platform

Worst trading software I have ever used. I always encounter platform glitches and lags.

Did you find this review helpful? Yes No

Inefficient brokers

Inefficient broker for online trading. Find other brokers, avoid them.

Did you find this review helpful? Yes No

Confusing trading software

Very confusing trading software. I am having a hard time understanding its features and uses. Maybe trading is not really meant for me.

Did you find this review helpful? Yes No

Worst broker service

They’re probably the worst forex broker. Will ask you to add more money but will also let you lose all of them.

Did you find this review helpful? Yes No

Very annoying

“They have a way to catch a person open an account. Once you sign up, they will start bothering you with so many phone calls asking for deposits. Very annoying.”

Did you find this review helpful? Yes No

Unhappy with the services

Unhappy with my trading results. I am losing more money on their broker signals.

Did you find this review helpful? Yes No

Poor trading signals

Poor trading signals. I have lost so much money on this broker service. They are also very unresponsive after the deposit stage.

Did you find this review helpful? Yes No

Bad experience

Not really good experience with this broker. I had good days but most are bad days and all in I lost huge money.

Did you find this review helpful? Yes No

Do not trust

Never trust this broker service. They start to be so difficult to contact when I started requesting a withdrawal.

Did you find this review helpful? Yes No

Poor trading software

Poor trading software. I will have to face too many technical problems.

Did you find this review helpful? Yes No

Slow customer service

Slow customer service. Their late response had caused me so many trading losses.

Did you find this review helpful? Yes No

Poor customer service

Unhappy with their customer service. I always have to wait in the queue and end up getting no resolution.

Did you find this review helpful? Yes No

Trouble withdrawals

I am having trouble with my withdrawals. They are giving me hard time, I can not get approval.

Did you find this review helpful? Yes No

Difficult withdrawal process

The withdrawal request has always been rejected. They told me so many things that I need to do as if it is impossible to withdraw.

Did you find this review helpful? Yes No

Stay away

Stay away from them while you can. They have caused me so many miseries.

Did you find this review helpful? Yes No

Do not invest here

This company stole our money, I and my friends decided to trade with them and we all lose. Do not invest money here.

Did you find this review helpful? Yes No

Lose money

I was not able to get my money back. I have lost but they did not process the withdrawal of my remaining funds.

Did you find this review helpful? Yes No

Poor trading tools

Tools are always under maintenance. Even their website is not working properly.

Did you find this review helpful? Yes No

Unresponsive

They are very unresponsive. Always unavailable at times I need them the most.

Did you find this review helpful? Yes No

Huge losses

I have closed my trading account to stop losses. I noticed several losses and I quit before it’s gonna be too late for me.

Did you find this review helpful? Yes No

Worst trading broker

In the worst trading atmosphere, withdrawal is very slow and signals are unreliable.

Did you find this review helpful? Yes No

Difficult to withdraw

Difficult to secure approval from this broker, they always give me a runaround. I am good with other services but not with their withdrawal process.

Did you find this review helpful? Yes No

Worst broker ever

Worst trading signals. They not even accurate.

Did you find this review helpful? Yes No

Frustrated with withdrawals

Could have been a good broker if withdrawal is easy. I am frustrated with their withdrawal process.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawal process. Been tired of waiting.

Did you find this review helpful? Yes No

Expensive trading assets

Initial deposit seems affordable but the actual trading pricing is very expensive. It is way higher than those previous brokers I have tried.

Did you find this review helpful? Yes No

Poor services

Poor services. They never attend to trading needs and are very arrogant. They always sound like all they need is for me to give them my money.

Did you find this review helpful? Yes No

Worst software

The worst trading software I have ever used. It has so many technical problems and system errors.

Did you find this review helpful? Yes No

Fair but not good

They are one of the reputable forex brokers but the actual trading results are not that satisfactory. Just fair but not so good.

Did you find this review helpful? Yes No

Worst broker

Worst trading partner I have ever dealt with. Unprofessional and unresponsive.

Did you find this review helpful? Yes No

Rude and unhelpful

Rude and unhelpful staff from customer service, technical team to the brokers. They sounded very arrogant and are not providing the help I needed.

Did you find this review helpful? Yes No

Unreliable

I traded with this and lost everything. Unreliable and dishonest broker.

Did you find this review helpful? Yes No

Unreliable brokers

I am not confident in trading with this broker. Poor signals and unreliable service.

Did you find this review helpful? Yes No

Slow customer service

Customer service and withdrawals are both slow. The of the services are okay but overall performance is below average.

Did you find this review helpful? Yes No

Worst broker

Do not trade with this broker, they do not pay out a profit. Worst I have ever dealt with.

Did you find this review helpful? Yes No

Poor broker service

Bad mannered customer support. They are very sarcastic and demanding over the phone.

Did you find this review helpful? Yes No

Fair but not good

The services are fair but not good. They are friendly but the trading result is not that impressive.

Did you find this review helpful? Yes No

Hassle withdrawal process

Almost impossible to request withdrawals. They will ask you to provide so many documents for account verification and will decline the papers and ask for replacements. There is so much hassle in their withdrawal process.

Did you find this review helpful? Yes No

So many charges to pay

There are so many trading instruments you can choose to trade but trading with them is a bit expensive. There are so many charges to pay.

Did you find this review helpful? Yes No

Not a good broker

It is not a good idea to trade with this broker. Poor broker signals and withdrawal is almost not possible.

Did you find this review helpful? Yes No

Disappointing customer service

I am extremely disappointed with their customer service, really rude and lazy. Will always promise to call you back but will never just hang up the phone without resolving the concern.

Did you find this review helpful? Yes No

Very expensive

With this broker, trading is very expensive. I have tried their services in the past they told me a low initial deposit which I thought is enough to trade but no. When I started trading they ask me to add up because the minimum deposit ain’t enough to trade.

Did you find this review helpful? Yes No

Poor customer service

Very poor customer service. They don’t even care at all.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawal process. From filing and waiting for approval, until the crediting stage took them so much time.

Did you find this review helpful? Yes No

Worst customer service

Worst customer service. They are not even skilled to assist customers.

Did you find this review helpful? Yes No

Inefficient customer service

Inefficient customer service. They are always not available to assist and when they are, they can’t even resolve trading concerns.

Did you find this review helpful? Yes No

Poor trading services

Poor trading tools and services. I will never trade with this broker company ever again.

Did you find this review helpful? Yes No

Frustrating withdrawals

Frustrating withdrawal process. I was asked to provide them with so many documents. I did, but they keep on rejecting my withdrawal request.

Did you find this review helpful? Yes No

Bad services

Bad trading services. They do not attend to trading concerns promptly.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawal process. I have to wait for almost a month.

Did you find this review helpful? Yes No

Inaccurate signals

Inaccurate trading signals. Always against market movements.

Did you find this review helpful? Yes No

Upsetting experience

I am very much upset with the experience I had with this broker service. They have promised me so many things that didn’t really happen.

Did you find this review helpful? Yes No

Worst signals

They’ve got the worst trading signals and services. I will never recommend this trading company to anyone.

Did you find this review helpful? Yes No

Unprofitable

Good customer service however I am not gaining any profit from their signals. That is why I have to change my broker.

Did you find this review helpful? Yes No

Bad trading experience

I am so much upset with my trading experience. I have to gain minimal profit at first and they told me that adding more money will help me make more profit. But after doing so, I started losing money.

Did you find this review helpful? Yes No

Worst signals

I incur so many losses when I traded with this broker back then. Well, they’ve got good customer service but signals are really worst.

Did you find this review helpful? Yes No

Slow withdrawals

Very difficult and slow withdrawal process. Poor services and really the worst customer service I have a deal with.

Did you find this review helpful? Yes No

Poor trading signals

I am very frustrated with this trading broker. The signals are poor and the analysis is not even accurate.

Did you find this review helpful? Yes No

Do not trade with them

They did not pay my profit. Do not trade with them.

Did you find this review helpful? Yes No

Slow customer service

Very slow customer service. They tend to ignore messages too.

Did you find this review helpful? Yes No

Unreliable signals

The signals are unreliable. I am not earning from this broker service.

Did you find this review helpful? Yes No

Lost money

I regret trading with this broker. The offer seems so good but I was wrong. I have lost huge money on this.

Did you find this review helpful? Yes No

Bad broker company

The worst part of trading with them aside from the losses is that I am unable to get any money left on my account. I do not recommend trading with this broker.

Did you find this review helpful? Yes No

Did not pay me profit

Thy haven’t paid my profit yet. They are not responding on my messages either.

Did you find this review helpful? Yes No

Limited options

Very limited trading options and so for withdrawal. Services are somewhat okay but not good.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process and poor customer service. Avoid dealing with this broker, not good at all.

Did you find this review helpful? Yes No

Poor services

Poor trading services with so many technical issues. I do not recommend this trading broker, not good enough.

Did you find this review helpful? Yes No

Poor trading signals

I will never recommend this forex broker. Withdrawal is really very difficult and signals are not worth it.

Did you find this review helpful? Yes No

Frustrating experience

I am so frustrated with this broker. I keep on requesting withdrawals and they always reject my request. I am hopeless as if I will never get my money back.

Did you find this review helpful? Yes No

Hard time on withdrawals

I suggest not to deal with this broker. It is their practice to give you hard time on withdrawals.

Did you find this review helpful? Yes No

Poor services

Poor services. I lose huge money here.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They can not help and yet sound very rude.

Did you find this review helpful? Yes No

Difficult to withdraw

Do not deal with this broker. It is very difficult to ask for a withdrawal. They always give me hard time.

Did you find this review helpful? Yes No

Annoying customer service

Annoying customer service. I have opened an account with this broker and as a new trader, all I see on the tolls are new to me. But instead of helping me, customer service even made things more complicated than they use to be.

Did you find this review helpful? Yes No

Not a good broker

This is not a good broker, my story will tell you why. I traded with this broker and have succeeding losses. Also, their market analysis is not 100% accurate not even 50%.

Did you find this review helpful? Yes No

Poor trading tools

Tools for online trading from this broker are really the worst. I always encounter technical problems and up until I closed my account, all the issues are left unresolved.

Did you find this review helpful? Yes No

Do not deal

I deposited money here but never get anything in return. Do not deal with them.

Did you find this review helpful? Yes No

Bad broker

They will turn to be very difficult to contact when you start to request withdrawals. I regret dealing with them, I am unable to get my money back.

Did you find this review helpful? Yes No

Slow withdrawal process

Very slow in processing withdrawals. I asked for so many documents and I was asked to wait for a few weeks.

Did you find this review helpful? Yes No

Bad broker

Bad broker services. Do not trust them in any way.

Did you find this review helpful? Yes No

Slow withdrawals

Slow customer service and slow withdrawals. I will never trade with them again.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I had trouble getting my profit. I will never trade with them again.

Did you find this review helpful? Yes No

Waste of time

Services are just okay but I am not happy with what I get here. I feel like it is just a waste of time.

Did you find this review helpful? Yes No

Annoying technical problem

Good customer service but really terrible trading software. I never had any problem with other services except their annoying technical problems on all of their trading tools.

Did you find this review helpful? Yes No

Poor forex broker

Delayed order execution and slow withdrawals. Good platform but the overall trading result is poor.

Did you find this review helpful? Yes No

Delayed withdrawals

One of the worst forex broker company. Employee’s behavior are really frustrating. Withdrawal is very difficult and has great delays.

Did you find this review helpful? Yes No

Poor trading signals

I can not fully rely on this broker’s signals. The signals are sometimes against the market movements.

Did you find this review helpful? Yes No

Bad broker

I do not really have to explain everything why you shouldn’t be dealing with this broker. You can read so many bad comments online about them. I wish I get to read those prior to joining this broker, it could have saved me from huge losses.

Did you find this review helpful? Yes No

Poor terms and services

Poor trading terms and services. They will keep on changing the terms as if it is a way to freeze accounts and block withdrawals.

Did you find this review helpful? Yes No

Bad broker

Do not believe in their $100 initial deposit it is just a trap to have you activate an account. After account activation, they will show you how to trade and how the $100 is not enough to place a trade. Then they will start forcing for more money.

Did you find this review helpful? Yes No

Unresponsive customer service

I am frustrated with their customer service. I am new to all of these and I needed help but they are very unresponsive. I can not rely on their services.

Did you find this review helpful? Yes No

Bad broker

I am a victim of their trading schemes. They ask me for money claiming to give me good returns but unfortunately, I have lost all those money instead.

Did you find this review helpful? Yes No

Poor broker services

For month-long trading with this broker, I have several observations. First, withdrawals are really very difficult and slow. Second, customer service is slow, unresponsive, and rude. Lastly, signals are not profitable.

Did you find this review helpful? Yes No

Poor broker services

I got so many problems dealing with this broker. I faced so many technical issues and slow withdrawals.

Did you find this review helpful? Yes No

Poor signals

Inefficient customer service. There is a great delay in all transactions. Poor signals.

Did you find this review helpful? Yes No

Poor forex broker

Not the type of the broker to keep. Signals are most of the time inaccurate. They do not have strong market analysis.

Did you find this review helpful? Yes No

Hassled withdrawals

I get the worst trading experience with this broker service. I filed for withdrawal requests for the first time and they gave me a hard time. I started well until the withdrawal request, services suddenly become bad.

Did you find this review helpful? Yes No

Troubled withdrawals

I have used this broker in the past and have immediately closed my trading account because I had trouble requesting for withdrawal.

Did you find this review helpful? Yes No

Frustrated with this broker

I am deeply frustrated with this broker service. Upon deposit, they projected so many things offering help for me to earn extra income. They told me to do this and do that which I did. But nothing happens, no wins, no profit, all losses, and worst, they do not let me withdraw what’s left on my trading account.

Did you find this review helpful? Yes No

Not a good broker

It’s a no for this forex broker. The services are very unreliable. I have traded for a month but I can not trust them enough and so I close my account immediately.

Did you find this review helpful? Yes No

Poor withdrawal process

I have used the service for a few weeks. What I do not like about this broker is that they keep on reversing withdrawals requests with no clear explanation. Withdrawal has always been an issue here.

Did you find this review helpful? Yes No

Unreliable forex broker

I can not rely on their service for forex trading. Signals are not really accurate and there is a bit delay in the execution. This broker can not match the fast pace environment of forex trading.

Did you find this review helpful? Yes No

Poor forex broker

I have traded with this broker and have lost huge money in an instant. I am a bit surprised to have lost that much. I suppose they are a good broker but results say otherwise.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I keep on waiting on all withdrawals I have requested. This made me close my account instead.

Did you find this review helpful? Yes No

Do not trade with this

Be careful in choosing your broker for forex trading. If you ever came across this broker, do not trade with them. They’ve given me a hard time requesting withdrawals.

Did you find this review helpful? Yes No

Bad broker

Do not be deceived by their strong marketing and sales promoting their forex trading. I was once a victim of this broker. I have lost all of my money on my trading account.

Did you find this review helpful? Yes No

Poor broker services

I have stopped trading with them last month because of slow withdrawals and poor signals. I never gain anything ut got so many losses instead.

Did you find this review helpful? Yes No

Bad broker

Bad broker and poor customer service. They are very assertive and alert on deposits but don’t give a damn to help in any withdrawal and trading concerns.

Did you find this review helpful? Yes No

Difficult withdrawals

Better think twice before opening an account with this broker. I had a hard time requesting the withdrawal.

Did you find this review helpful? Yes No

trade

Get yourself enlightened under the latest and upgraded platform of Mr.Thomas John

he’s highly recommended to everyone out there in search of a good and legit Account Manager.He has improved my financial status with his tremendous strategies of trade with a minimum capital of $500. Thank you Sir.

Reach him via

Whatsapp: +19317923604.Here is his [email protected]

Did you find this review helpful? Yes No

Poor trading instruments

This broker offers so many trading instruments on their trading platform however most of them aren’t really working well. I am not happy trading with them, I feel like it is just a waste of time.

Did you find this review helpful? Yes No

Beware of this broker

Beware of this broker service, they do not pay off the profit. Find a different broker and avoid dealing with this instead.

Did you find this review helpful? Yes No

Poor trading performance

Poor trading performance overall. I have lost so much money on their trading signals.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service I have ever encountered. Aside from they are very unresponsive, they have the worst behavior I have ever encountered.

Did you find this review helpful? Yes No

Difficult to withdraw

There’s a lot of trading instruments to choose from and I am also very pleased with the services. The problem I faced is that very tedious withdrawal verification.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. It is a bit annoying experience I had from this broker. I end up closing my account, withdrawals are always slow.

Did you find this review helpful? Yes No

Rude and manipulating

All are just fair. The only thing I hate really is their aggressive marketing styles. They sounded so rude and very manipulating.

Did you find this review helpful? Yes No

Technical issues

There’s so much technical problem and they are not known to assist.poor forex brokers, I may say. I always have to call them every time and worst they are so difficult to contact.

Did you find this review helpful? Yes No

Worst broker

Extreme volatility and worst signals I have ever had in forex trading. Worst brokers.

Did you find this review helpful? Yes No

Poor signals

Do not deal with this broker service. Signals are very poor.

Did you find this review helpful? Yes No

Frustrating brokers

I am so frustrated with this broker service. Withdrawals are really very slow and customer service response as well.

Did you find this review helpful? Yes No

Waste of time

This broker will just be wasting your money and time. At first, I gain little profit and they’ve made my deposit for more in order to gain huge profit which I did. But surprisingly after I redeposit huge enough, I got all losing trades and my money was gone.

Did you find this review helpful? Yes No

Do not deal with them

This forex broker is more of trained thieves stealing money from people. I have lost so much money on thier schemes. Beware, do not deal with them.

Did you find this review helpful? Yes No

Difficult to withdraw

Do not deal with this broker. Depositing is as easy as 123 but withdrawals are almost impossible. They will become unresponsive once you start requesting withdrawals.

Did you find this review helpful? Yes No

Poor services

Unresponsive customer service. The response on chats and emails are also delayed. Poor services.

Did you find this review helpful? Yes No

Frustrating broker service

Frustrating broker services. Nothing is good. Withdrawal is very slow and customer service isn’t helpful.

Did you find this review helpful? Yes No

Poor broker performance

Poor broker performance. From signals to services and even withdrawals, all are worst.

Did you find this review helpful? Yes No

Unprofitable

Customer service is always happy to assist but I am not satisfied with the trading result. I did not get any profit at all.

Did you find this review helpful? Yes No

Crappy customer service

Crappy customer service. Seldom answers chat and email. It sounded very dull. I am not trading with them again.

Did you find this review helpful? Yes No

Slow withdrawals

I am a bit disappointed with their withdrawal process, aside from lots of documents needed, I am waiting so long for the money. It’s been a week I still don’t have it.

Did you find this review helpful? Yes No

Limited payment channels

There are so many easy ways to deposit, I wonder why it is difficult to withdraw and payment channels are very limited.

Did you find this review helpful? Yes No

Poor services

The trading platform is always down and customer service is always unavailable. Poor services.

Did you find this review helpful? Yes No

Poor broker performance

I am dissatisfied with the overall performance. I am not getting good profit and worst they do not allow withdrawals.

Did you find this review helpful? Yes No

Poor services

Services are of poor quality. Rude customer service and slow withdrawal process.

Did you find this review helpful? Yes No

Poor trading platform

I am using this broker service for only a month now and I want to stop and switch. Platforms lag almost on every transaction and I cant easily call their customer service. It is very frustrating.

Did you find this review helpful? Yes No

Incompetent customer service

Incompetent customer service. Every time I call to ask for help they do not know what to do.

Did you find this review helpful? Yes No

Unprofitable

I am not satisfied with the overall performance of this broker service. Not profitable.

Did you find this review helpful? Yes No

Worst broker

Do not trade with this broker, they do not pay out the profit. Worst I have ever dealt with.

Did you find this review helpful? Yes No

Poor trading services

Poor trading services. Withdrawals are very slow and customer service is not attentive to customer needs.

Did you find this review helpful? Yes No

Poor broker services

I am not trading with them again. Services suck.

Did you find this review helpful? Yes No

Impatient customer service

This is not a good broker service, withdrawals are very slow and customer service is very impatient.

Did you find this review helpful? Yes No

Terrible

Terrible brokers. Poor signals, I have lost huge money in just a few weeks.

Did you find this review helpful? Yes No

Trouble with withdrawal

I am in trouble requesting for withdrawal. I’m gonna be closing my account and will never trade with this again.

Did you find this review helpful? Yes No

Slow withdrawals

Great customer service, they are very helpful. I am just annoyed with their withdrawal process. It is very slow.

Did you find this review helpful? Yes No

Unhappy with the services

Unhappy with the services I am getting. Withdrawal is slow and difficult. I am closing my account.

Did you find this review helpful? Yes No

Disappointing performance

Disappointing broker performance. I never get good profit out of trading with them.

Did you find this review helpful? Yes No

Long withdrawals

There are so many things to fulfill prior withdrawal. It is also a long process.

Did you find this review helpful? Yes No

Do not deal

Do not deal with this broker service. Signals are very poor.

Did you find this review helpful? Yes No

Constant price change

I am an experienced trader and they can’t fool me with pricing. Prices here change constantly as if something is really wrong.

Did you find this review helpful? Yes No

Slow withdrawals

I am not happy with their withdrawal process. It brings so much stress and is very slow.

Did you find this review helpful? Yes No

Slow withdrawals

They have set the expectation that withdrawal is 3-5 business days. It is the 11th day now but the money isn’t still credited on my bank account and worst they can not give me a concrete answer as to when it will be credit and why is it delayed.

Did you find this review helpful? Yes No

Bad brokers

They helped me open accounts with initial deposit however after account opening I was asked to add more to start trading which I can’t for I do not have anything to add on. They charge me for non-activity and now not letting me withdraw my money.

Did you find this review helpful? Yes No

Huge transaction fees

Huge transaction charges as if profit will only be used to pay them off.

Did you find this review helpful? Yes No

Complicated trading platform

Vey complicated trading platform. I have been learning it but I find it so difficult to understand.

Did you find this review helpful? Yes No

Terrible company

Terrible company for forex trading. Find some other broker and do not deal with this, not good services at all.

Did you find this review helpful? Yes No

Worst

Do not deal with them. Worst forex brokers.

Did you find this review helpful? Yes No

Avoid this broker

Avoid dealing with this forex broker, they will give you a hard time during withdrawal requests.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawals. I won’t recommend this and will never trade with them again.

Did you find this review helpful? Yes No

Annoying

The brokers are so aggressive in asking for more money and it really sounded so annoying.

Did you find this review helpful? Yes No

Bad brokers

Bad broker service, poor signals, and slow withdrawals.

Did you find this review helpful? Yes No

Aggressive marketing styles

Services are good. The only thing I hate really is their aggressive marketing styles.

Did you find this review helpful? Yes No

So much technical problems

I had so many technical problems with thier platform. And it greatly affects my trades.

Did you find this review helpful? Yes No

Difficult withdrawal process

I have used the service in the past. They have the most difficult withdrawal process.

Did you find this review helpful? Yes No

Poor broker performance

Slow customer service and poor broker signals. I have traded only for a month due to poor broker performance.

Did you find this review helpful? Yes No

Unreliable signals

Unreliable broker signals. I have traded with them for a couple of months but I got more loses than winning trades.

Did you find this review helpful? Yes No

Slow withdrawal

Good trading terms specially leverage. The only thing I am concern about is the slow withdrawal process.

Did you find this review helpful? Yes No

Two thumbs up

Superfast withdrawal process,hassle-free and smooth transactions. Two thumbs up for this broker service.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They are not available most of the time and their behavior is very bad.

Did you find this review helpful? Yes No

Professional and skilled

I have dealt with so many brokers but this one is the worst. They ate very unprofessionally and signals are really poor.

Did you find this review helpful? Yes No

Misleading

This broker service always misleads people. I will tell you a different initial deposit but later on, I will ask more if you wish to start trading after account activation.

Did you find this review helpful? Yes No

Withdrawal is very difficult

This is a good broker except for that withdrawal is really very difficult, services are all okay.

Did you find this review helpful? Yes No

Poor trading conditions

Poor trading conditions. They only publish good ones but on the actual trading, they will change terms from time to time.

Did you find this review helpful? Yes No

Slow withdrawal and not profitable

I have so many regrets for choosing this broker service, withdrawal is very slow and signals are not profitable.

Did you find this review helpful? Yes No

Not good at all

I was very disappointed with this broker service. They are not good at all.

Did you find this review helpful? Yes No

Seems fake and take money away

This broker used a variety of lies to promote their services but on the actual trading, nothing is true. They are just one of the forex brokers who seems to be fake and will just take money away.

Did you find this review helpful? Yes No

A bit rude and unhelpful

Signals are fine, trading terms are also good for me. However, I can not tolerate the behaviors of brokers and customer service. They are a bit rude and unhelpful.

Did you find this review helpful? Yes No

I lost all my money in an instant

All who traded with this broker has a story to say and I guess mine is the worst. They ask to deposit more and I am convinced because they showed good result onset. However, all the money I have invested is gone in an instant.

Did you find this review helpful? Yes No

No words of honor

This broker service has no words of honor. I would tell you things from the start but will change it afterward.

Did you find this review helpful? Yes No

I keep on getting losing trades

They have great customer service, people are nice and helpful. The only problem I have though is that I keep on getting losing trades, signals from the broker are very poor that is why I change broker.

Did you find this review helpful? Yes No

Delayed responses from customer service

Customer service replies come in great delays. They are very slow in emails and chats. Every time I tried calling them, I always wait in a queue.

Did you find this review helpful? Yes No

Useless broker service

I have used this broker service sometime last year and I can say that the services are very useless. You can not rely on the broker signals and worst can’t even rely on thier customer service who are very difficult to contact.

Did you find this review helpful? Yes No

Difficult withdrawal process

It is very difficult to secure withdrawal approval. They would ask for documents over and over again.

Did you find this review helpful? Yes No

Disrespectful and sarcastic

These people especially the ones in customer service are really very bad. They are very sarcastic and disrespectful.

Did you find this review helpful? Yes No

Complicated platform

Good broker signals but the platform really sucks. Very complicated and confusing.

Did you find this review helpful? Yes No

Unreliable broker signals

Signals are very unreliable,this broker doesn’t even have a good market analysis.

Did you find this review helpful? Yes (1) No