The resource-rich Southeast Asian nation restricted coal exports for January, set limitations on palm oil shipments by demanding mandatory domestic market obligations, and stroked the idea of an export tax on nickel pig iron, all within the opening weeks of 2022.

Authorities quoted tight domestic coal stocks and high local edible oil prices as the major factors behind the announced moves. Moreover, Indonesia has indicated before that it is ready to disrupt raw commodity exports; it will aid the development of its domestic processing and refining sectors.

We can see this maneuver in the nickel and stainless steel markets after 2014; it helped transform Indonesia from a bit-part supplier into a dominant global producer of both commodities by 2020 thanks to surges of investments by mainly Chinese companies in the past five years.

Indonesian President Joko Widodo wants to replicate the feat elsewhere. The country may cut raw commodity exports overall. This way it will draw further investments in downstream industries. Moreover, it will increase employment and earning power in Southeast Asia’s largest and most populous economy.

As stated by the U.S. Geological Survey, Indonesia is the fifth-biggest producer of bauxite; accounting for about 7% of the global output of the mineral that is the direct source of aluminum in the world.

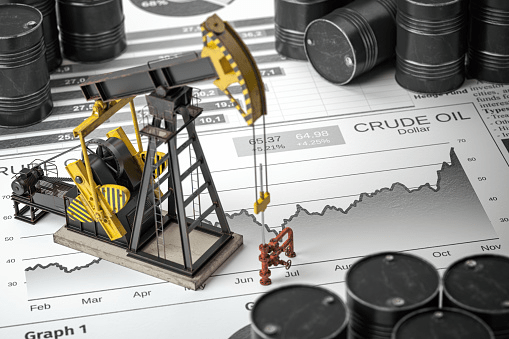

Dependence on Commodities

Nevertheless, that hard-line rhetoric is often sabotaged. This is because Indonesia is highly conditional on the revenues from raw commodity sales. It amounts to approximately $3 billion a month each from coal and palm oil alone.

As the top supplier of thermal coal, palm oil, and nickel, Indonesia’s moves sent prices of each of those commodities flying and raised worries among importers of fuel, food, and manufacturing materials about possible supply disruptions.