Heikin Ashi Strategy – Why Is It Important for Traders?

What do you think about the Heikin Ashi technique?

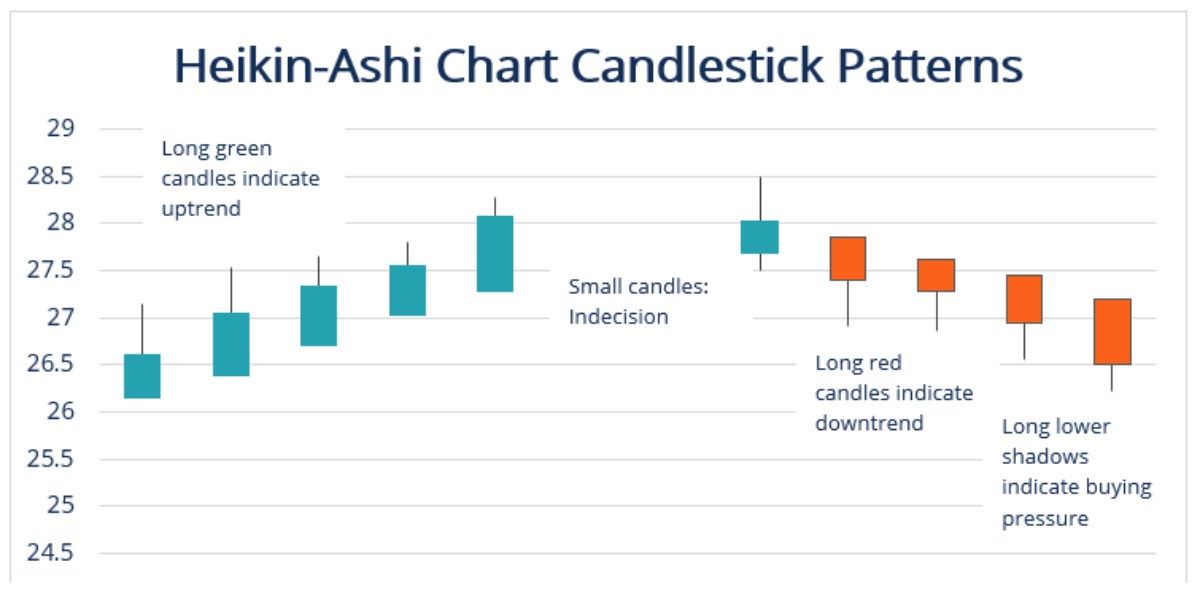

The above-mentioned technique averages price data in order to create a Japanese candlestick chart that removes market noise.

Interestingly, Munehisa Homma developed Heikin Ashi charts a long time ago, more precisely in the 1700s. We need to mention that Heikin Ashi charts share certain characteristics with standard candlestick charts; however, they differ based on the values utilized to create each candle.

Rather than utilizing the open, high, and close like typical candlestick charts, the above-mentioned technique utilizes an altered formula. Notably, the formula is based on two-period averages. This gives the chart a smoother appearance, making it easier to identify trends as well as reversals, but it also obscures gaps and certain price data.

What makes the Heikin Ashi technique so important?

Technical traders use the technique mentioned above in order to spot a given trend more easily.

As a reminder, reversal candlesticks utilizing the Heiken ashi strategy resemble traditional candlestick reversal patterns. You won’t find gaps on a Heikin Ashi chart.

Thanks to the above-mentioned technique, it is easier to spot trends, price patterns, as well as reversal points. In the case of Heikin Ashi charts, the situation is also quite interesting. In most cases, Heikin Ashi charts have more consecutive colored candles, helping traders to spot past price movement more easily.

We also need to mention one interesting fact when it comes to the Heikin Ashi strategy. It reduces false trading signals in sideways as well as choppy markets.

As stated earlier, the Heikin Ashi strategy uses a modified formula.

It is worth mentioning the Heikin Ashi strategy. It isn’t for everyone. As the above-mentioned technique uses price information from two periods, a trade setup takes longer to develop. This isn’t a big problem for swing traders as they aren’t in a hurry.

Nevertheless, the Heikin Ashi strategy may not be suitable for day traders.

What is swing trading?

Now, let’s take a look at swing trading.

It is a strategy that looks to profit from the oscillations that happen within wider market moves.

Traders who use this strategy will seek trading opportunities within a time frame that could be anything from several days to several weeks. Swing trading is distinct from day trading, as in the case of day trading, the goal is to make a profit within a day. Furthermore, swing trading isn’t a long-term play, as opposed to position trading, in which the trade can be left alone for a very long period of time.

What about day trading?

Without exaggeration, day trading is a popular trading strategy. As a reminder, the above-mentioned trading strategy involves opening and closing positions within the trading day.

It is a very popular trading strategy where traders buy and sell over a time frame of a single day’s trading. The goal is to make money from small price movements.

As a reminder, both day trading and scalping belong to short-term trading strategies.

However, in the case of day trading, as opposed to scalping, you are typically only taking one trade a day and closing it out when the day is over.

You need to be careful when it comes to various strategies, and day trading isn’t an exception. It isn’t suitable for all types of traders.

It is suitable for forex traders that aren’t in a hurry. To cut a long story short, it is suitable for traders who have enough time throughout the day in order to analyze, execute and monitor a trade.

Generally, day traders rely on technical analysis when executing their trades.

Monitoring short-term price action is utilized in order to spot optimal entry and exit positions.

Is it hard to become a successful forex day trader? Hopefully, it isn’t very difficult. For example, it is important to pay close attention to economic news.

Day trading and its role

As stated earlier, day trading isn’t for everyone.

The above-mentioned strategy involves making fast decisions, as well as executing a huge number of trades for a relatively small profit each time.

Is day trading popular among forex traders?

The forex market is a popular choice for traders who are interested in day trading. Unsurprisingly, the above-mentioned strategy is popular among traders as they can choose from numerous currency pairs. Let’s not forget about the high market liquidity as well.

There are several key factors to take into account before you start to day trade forex.

Let’s take a look at the factors that have the potential to influence the situation.

One of them is liquidity. It is worth mentioning that high liquidity is very important for day traders, as it is likely day traders will be executing numerous trades throughout the day.

We shouldn’t forget about the trading volume as well. As a reminder, a high trading volume shows that there’s a lot of interest. Moreover, it is useful for identifying entry and exit points.

Useful tips

Now, we can take a look at several useful tips for day traders.

First of all, you need to decide which product you would like to trade with. For instance, derivatives are quite popular for day trading, as there is no necessity to own the underlying asset you are trading.

Moreover, it is vital to create a day trading plan. Without exaggeration, it is crucial to outline exactly what you are trying to achieve. It isn’t a good idea to set unrealistic goals.

Remember, it isn’t an easy task to make money.

Furthermore, it is vital to consider exactly how you are going to create a methodology for entering and exiting the market.

You need to learn how to take care of day trading risk. So, it is important to create a risk management strategy. You need to be prepared for the worst-case scenario if you want to minimize the risk.

It is worth noting that a trader doesn’t always need to be right; nevertheless, a trader needs to admit when they are wrong and do something quickly. You need to make sure that you are making more money on winning trades than you are losing on trades that go wrong.