The market is apprehensive ahead of the release of the US economic data later on Thursday.

On the other hand, gold seems unperturbed by the jitters after recording a conservative hike for the day.

In commodity charts on Thursday morning trading in Asia, futures contract added 0.14% to $1,738.80 per ounce.

The metal remains above the $1,700.00 threshold which is seen as a psychological support level by spectators.

On the other hand, it failed to ascend beyond this level for weeks. It is still lacking the right indicators to buoy prices back to a record high.

Currently, the bullion is still far-off from reaching the highest price recorded in its trading history notched in August last year.

At $2,050.00 per ounce, the yellow metal managed to capitalize on the massive uncertainty that surrounded the market during that time.

Now that global reflation is more certain than ever, it will be difficult for the commodity major to revisit that beautiful time of history again.

The recent rise in gold futures is brought by the weakness in the greenback, with the US Dollar index now back at the 91-point level.

This has been one of the weakest performances of DXY in months after resting at 94-level in the past week.

The fall in the USD index is positive for the bullion. The two safe havens move inversely proportional to each other lately.

Analysts consider the possibility of a heightened appetite for safe-haven assets in the coming months due to the rising number of cases in some nations.

Japan’s central bank is keeping movements calculated amid recorded cases in western Osaka, organic with the Federal Reserve’s steady stance.

London Copper is Falling Down

The ongoing uncertainty will dictate the dominant market sentiment in the short term, affecting not only the precious metal but also its counterparts.

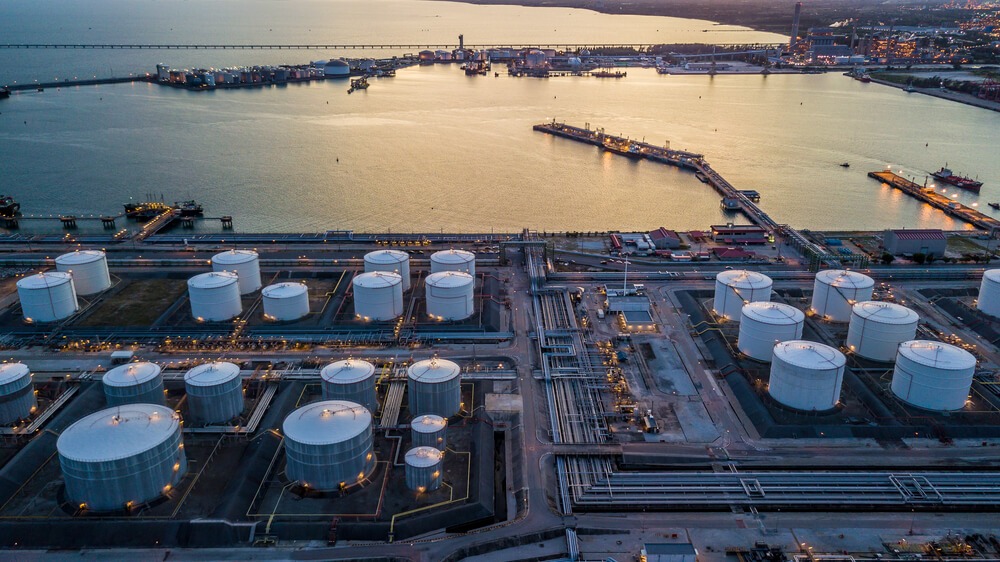

In an update from London, copper suffers from the fears of rising stockpiles amid easing international demand.

Three-month futures contract in the London Metal Exchange declined by 0.1% to $9,064.00 per tonne.

In the latest update from LME-connected warehouses, inventories ballooned to their highest in five months at 172,000 tonnes.

Nevertheless, a further dip is mitigated by the weak greenback which made purchasing more affordable for other currency holders.

The USD remains affected by the Federal Reserve’s dovish monetary policy and falling government debt yields.

Meanwhile, Shanghai Futures Exchange seemed unbothered of what is happening miles away. The May copper price rose by a robust 1.5% to $10,279.13 a tonne.