Introduction to FxPro Review

NOTICE: Broker seems not to be active right now.

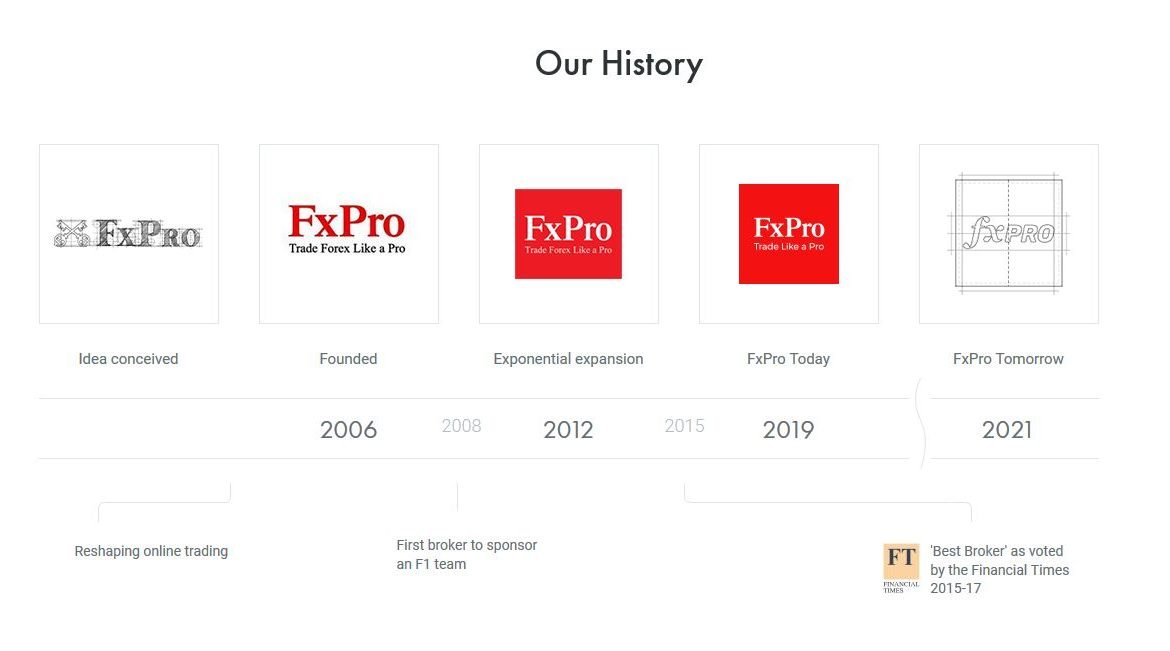

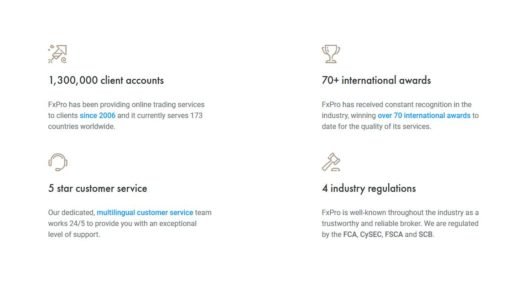

FxPro is a London-based global broker, specializing in the CFD and Spread Betting market. Since entering the trading business in 2006, it has performed over 250 million orders and was chosen as UK’s most trusted forex brand by Global Brands Magazine in 2017.

Today, FxPro is a highly-regulated broker in several jurisdictions, with offices around the world and €100 million of Tier 1 capital. The firm offers both true Electronic Communication Network (ECN) and access to a dealing desk.

Clients of FxPro may trade six asset classes through MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, while experiencing premium liquidity as well as quality trade execution with No Dealing Desk (NDD) operation.

Account Types

Investors have the option to open one of the three live trading accounts with FxPro, i.e., the FxPro MT4, FxPro MT5, and the FxPro cTrader account.

Each account type trades on the associated platform, and all have the following requirements and features available:

- Free Demo Account

- Access to Micro Accounts

- Access to VIP Services

- $500 Initial Deposit

- Swap/rollover charges are incurred when a trade is kept overnight.

- Tiered Liquidity, Volume-Weighted Average Price (VWAP) Execution

- NDD Intervention

- Mobile (iOS and Android) and Web-based Trading Available

- Leverage up to 1:500

The difference between the three accounts are:

FxPro MT4 Account

- Fixed Spread is also available

- EUR/USD Variable Spread is 1.2 for accounts on Market Execution and 1.55 for accounts with Instant Execution

- Spread mark-up on Forex & Metals

- No commission on Futures, Shares, Indices, and Cryptocurrencies

- Instant or Market Order Execution

- Stop-out from 20%-50%

- EA-supported Algorithmic Trading

- Accessible instruments include Forex, Spot Indices, Spot Energies, Spot Metals, Futures, and Shares

- 1 pip minimum stop/limit level

- Requotes may include on Instant Execution accounts and no requotes on Market Execution accounts

- Partial Fills of orders in times of limited liquidity in Market Execution accounts

- As well as 24/5 Minors and Exotic trading halted between 10 pm and 10 pm UK time

FxPro MT5 Account

- Only Variable Spread (Floating Rate Model) is available

- EUR/USD Variable Spread is 1.52 for accounts on Market Execution

- Spread mark-up on Forex & Metals

- No commission on Futures, Indices, and Cryptocurrencies

- Only Market Execution is offered where orders are performed at the VWAP

- Stop-out from 30%-50%

- EA-supported Algorithmic Trading

- Accessible instruments include Forex, Spot Indices, Spot Energies, Spot Metals, and Futures

- 1 pip minimum stop/limit level

- No requotes

- Partial fills of orders in times of limited liquidity

- 24/5 Minors and Exotic trading halted between 10 pm and 10 pm UK time

FxPro cTrader Account

This account based on the cTrader platform. Although cTrader is a relative newcomer to the world of trading platforms, it is becoming more and more popular among the traders.

- Only Variable Spread (Floating Rate Model) is available

- EUR/USD Variable Spread is 0.45 for accounts on Market Execution

- Trading costs in Forex and Metals is $45 per $1 million traded (upon opening and closing a position)

- No commission on Indices and Cryptocurrencies

- Only Market Execution is offered where orders are performed at the VWAP

- Stop-out from 30%-50%

- Algorithmic Trading is not EA-supported

- Accessible instruments include Forex, Spot Indices, Spot Energies, and Spot Metals

- No minimum stop/limit levels

- No requotes

- Partial fills of orders in times of limited liquidity

- 24/5 trading halted between 10 pm and 10 pm UK time

In addition to the three accounts, UK-based traders may sign up for FxPro’s Edge account, which enables trading in the form of Spread Betting and features the following benefits:

- Tax-free2

- No commission

- Tight Spreads

- Accessible instruments include Forex, Shares, Spot Indices, Spot Metals, and Spot Energies

- Limited Risk Account with no additional charge

Trading Products

FxPro allows CFD trading in more than 200 markets, including Forex, Shares, Spot Indices, Futures, Spot Metals, and Spot Energies.

Forex

- FxPro enables market participants to trade over 70 major, minor, and exotic currency pairs.

- Forex traders can also benefit from tight spreads and high-speed order execution.

- Some popular currencies available in the platform include CAD/CHF, EUR/USD, EUR/CHF, CAD/JPY, and EUR/JPY.

Futures

- Traders may access 20 Futures, including 12 agricultural commodities, 3 energy futures, and indices.

- FxPro offers CFD trading on Futures from markets such as cocoa, Dow Jones 30, natural gas, and more.

Spot Indices

- FxPro covers 24 Spot Indices from across the US, Europe, and Asia.

- Some of the highly-traded indices catered by the platform include the NASDAQ 100 index, DAX 30, Nikkei 225, and more.

Shares & Stocks

- The platform offers the opportunity to trade CFDs on Shares of more than 150 global companies, and experience the advantage of fast order execution as well as dividend payments on long positions.

- Investment opportunities are available in Shares of some of the well-known companies, like Apple Inc., Coca Cola Company, and Amazon.com Inc.

Spot Metals

- Traders are given access to trade 7 Spot Metals in the FxPro platform.

- Spot Metals available for trading include gold, platinum, and silver.

- FxPro also makes sure that clients’ orders are carried out with the right and competitive prices.

Spot Energies

- Market participants on FxPro may invest in Spot Energies, including Brent oil, West Texas Intermediate (WTI) crude oil, and Natural Gas.

- Spot Energies are available on all of the firm’s platform, i.e., MT4, MT5, and cTrader.

Cryptocurrencies

- FxPro Cryptocurrencies offerings cover a number of market pairings with the USD, including Bitcoin, Bitcoin Cash, Litecoin, Ripple, and Ethereum.

- Maximum leverage allowed on these digital currencies is 1:2.

FxPro Trading Conditions

The following will discuss the trading conditions that potential clients could face once they’d registered with FxPro.

Execution Speed

- The average execution time on the FxPro platform is less than 11.06 ms.

- This broker also doesn’t often encounter slippage, although it happens from time to time.

Leverage

- While FxPro’s leverage level of up to 1:500 is considered relatively high, there are still other brokers whose leverage are up to 1:500 and higher.

- To minimize the risk involved with such leverage levels, FxPro employs a forex leverage model on the MT4 and MT5 platforms, which automatically adjusts to clients’ trading positions.

Spreads

- The company has a competitive spread structure, as well as a fixed spread offering.

Traders of FxPro can expect a substantial expansion of spreads on news reports that hold great market impact, such as non-farm payrolls, UK inflation data, and more.

FxPro Review Conclusion – Is FxPro good?

Despite a few differing opinions, most see FxPro to be a good fit for any kinds of traders, due to its selection of orders and account types, as well as its execution and pricing models, which offer instant execution and floating or fixed spreads.

The firm’s suite of platform offerings, which includes the MT4, MT5, and cTrader, also adds to the FxPro’s value proposition to clients.

Moreover, for those who values reputation and credibility, FxPro got those two qualities backed up by the fact that it has been authorized by some of the respected financial regulators in the industry, making this broker safe to trade with.

Poor company

Poor trading company. Avoid them.

Did you find this review helpful? Yes No

Scam tycoons

Better think twice and do not deal with this broker. They are one of the scam tycoons in the industry.

Did you find this review helpful? Yes No

Useless services

Useless trading services. I honestly felt like it was better to trade on my own than use their services. And by the way, I have lost so much money on this.

Did you find this review helpful? Yes No

Worst trading company

Worst trading company. They can not even give out good advice.

Did you find this review helpful? Yes No

Inaccurate signals

They are not good trading brokers. They have a few signals that are not accurate.

Did you find this review helpful? Yes No

Poor broker performance

Poor broker performance. It is just a waste of money and time to trade with them.

Did you find this review helpful? Yes No

Scammers

I was scammed by this broker. I am unable to withdraw.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They are rude and unhelpful.

Did you find this review helpful? Yes No

Worst trading services

They have the worst trading signals and services. do not trade here.

Did you find this review helpful? Yes No

Scammers

Hope authorities with be able to catch this bunch of scammers. Have took all my money in a snap.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Poor broker

Do not honor words. They change policies every time.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Thieves

Stay away from these thieves. They are not good at all.

Did you find this review helpful? Yes No

Bad broker

My withdrawal request has been denied several times. Bad broker.

Did you find this review helpful? Yes No

Not worth it

Not worth my money and time. I did not gain profit trading with this broker.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Have lose so much

Have lost so much from this broker. Do not even dare to try.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Unresponsive customer care

Calling customer service is very annoying. They are not available most of the time, I only hear an endless ring.

Did you find this review helpful? Yes No

Scammers

Do not provide any details to these people. They are scammers.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Unresponsive

Customer service is not responsive to client queries. I never got the help that I need.

Did you find this review helpful? Yes No

Unprofitable signals

Inaccurate and unprofitable signals. Do not use their services.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Poor broker performance

Poor broker performance. It is just a waste of money and time to trade with them.

Did you find this review helpful? Yes No

Poor broker performance

Poor broker performance. It is just a waste of money and time to trade with them.

Did you find this review helpful? Yes No

Poor broker performance

Poor broker performance. It is just a waste of money and time to trade with them.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. Services are not ideal for gaining good profits.

Did you find this review helpful? Yes No

Fake brokers

They are fake brokers. All information on their website aren’t real.

Did you find this review helpful? Yes No

Fake trading

Do not be hooked on their trading schemes. It is not real.

Did you find this review helpful? Yes No

Pricey trading instruments

Trading with them is too pricey. I am not going to deal with them again.

Did you find this review helpful? Yes No

Bad forex broker

This is a bad forex broker making so many delaying tactics for withdrawals. Signals aren’t that good and believe me, it is almost impossible to withdraw.

Did you find this review helpful? Yes No

Not trustworthy

They are not trustworthy. The worst they’ve done is that they place trades without my permission.

Did you find this review helpful? Yes No

Unpleasant

Unpleasant people. They seem so nice and professional at first but right after the deposit, they turned to be very rude and unprofessional.

Did you find this review helpful? Yes No

Bad broker

I encourage everyone to stay away from these people. They have ripped off my wallet and will surely do the same to all who will be victims of their schemes.

Did you find this review helpful? Yes No

Poor forex broker

It’s not good to trade with this broker. Aside form the limited trading options, it is very difficult to get an approval for withdrawal requests.

Did you find this review helpful? Yes No

Not a skilled broker

I do not recommend trading with this broker. they are not skilled.

Did you find this review helpful? Yes No

Scammers

Do not provide any details to these people. They are scammers.

Did you find this review helpful? Yes No

Dishonest brokers

Dishonest and rude brokers. Do not trade with them.

Did you find this review helpful? Yes No

Have lose so much

Have lost so much from this broker. Do not even dare to try.

Did you find this review helpful? Yes No

Bad brokers

Do not waste your time on this. They will only collect your deposits but will never give you anything in return.

Did you find this review helpful? Yes No

Worst trading tools

The worst trading tools I have ever used. I find the interface very confusing and I encounter so many trading problems.

Did you find this review helpful? Yes No

Do not trust

Do not trust them. Bad broker services.

Did you find this review helpful? Yes No

Do not trust

Do not trust them. Bad broker services.

Did you find this review helpful? Yes No

Unregulated broker

Unregulated trading broker. too late when I found out, I already lost so much money.

Did you find this review helpful? Yes No

Stay away

Stay away from them. They are scammers and will surely take all your money.

Did you find this review helpful? Yes No

Unreliable signals

Unreliable signals. It brings about consecutive losses. I have used the service for just a month and I am never satisfied.

Did you find this review helpful? Yes No

Poor broker company

Poor broker company. They are unreliable and services are not good.

Did you find this review helpful? Yes No

Complicated trading platform

This is my current broker but I am planning to switch. They have a very complicated platform and customer service is not even helping me understand the platform. I am having some trouble organizing my portfolio.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals, choose a different broker. Do not deal with this one.

Did you find this review helpful? Yes No

Not good brokers

Try other brokers and avoid this one. They are not good brokers.

Did you find this review helpful? Yes No

Fake brokers

It’s a trap! Nothing is real here.

Did you find this review helpful? Yes No

Scam-broker

Scam-broker. Beware, do not deal with them.

Did you find this review helpful? Yes No

Do not trade

Do not trade with this broker company. They are not legit and they do not allow withdrawals.

Did you find this review helpful? Yes No

Fraud

Fraud broker company. They are fake so do not deal with them.

Did you find this review helpful? Yes No

Bad people

Bad people. They keep my money and I can not even withdraw.

Did you find this review helpful? Yes No

Poor broker

Do not honor words. They change policies every time.

Did you find this review helpful? Yes No

Avoid them

The worst broker company I have ever seen. Avoid dealing with them.

Did you find this review helpful? Yes No

Poor services

Avoid trading with them. Poor broker services.

Did you find this review helpful? Yes No

Bad people

Bad people. They called me one day offering a really good deal and so I trusted them but they ran away with my money.

Did you find this review helpful? Yes No

Unregulated scammers

Unregulated and scammers. Please save yourself from being victimized by their scam schemes.

Did you find this review helpful? Yes No

Unreliable

Unreliable trading service. Just waste of money and time.

Did you find this review helpful? Yes No

Do not trade

Do not trade with this broker, they are scammers and they do not process withdrawals.

Did you find this review helpful? Yes No

Worst trading broker

They are one of the worst trading brokers I have ever dealt with. Services are really one of the worst.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service, they are not readily available to help, and are very arrogant people.

Did you find this review helpful? Yes No

Worst services

Extremely worst services. Not recommended.

Did you find this review helpful? Yes No

Poor services

Poor trading advice. I have lost so much money because of this.

Did you find this review helpful? Yes No

Bad broker

I encourage everyone to stay away from these people. They have ripped off my wallet and will surely do the same to all who will be victims of their schemes.

Did you find this review helpful? Yes No

Worst services

Worst broker services. Do not trade with them.

Did you find this review helpful? Yes No

Worst services

Do not be fooled by their false advertisements. They will tell all the good things about their services but nothing is true. Services are one of the worst.

Did you find this review helpful? Yes No

Dishonest brokers

Dishonest and rude brokers. Do not trade with them.

Did you find this review helpful? Yes No

Dishonest brokers

Dishonest and rude brokers. Do not trade with them.

Did you find this review helpful? Yes No

Bad brokers

I was asked for tons of documents, have complied, and yet still unable to get my profit. Bad brokers.

Did you find this review helpful? Yes No

Poor forex broker

It’s not good to trade with this broker. Aside from the limited trading options, it is very difficult to get approval for withdrawal requests.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. Services are not ideal for gaining good profits.

Did you find this review helpful? Yes No

Poor broker performance

Poor broker performance. It is just a waste of money and time to trade with them.

Did you find this review helpful? Yes No

Bad company

Bad trading company. not recommended.

Did you find this review helpful? Yes No

Bad brokers

Do not waste your time on this. They will only collect your deposits but will never give you anything in return.

Did you find this review helpful? Yes No

Have lose so much

Have lost so much from this broker. Do not even dare to try.

Did you find this review helpful? Yes No

Poor services

Poor trading services. Withdrawal is very slow and customer service are very unresponsive.

Did you find this review helpful? Yes No

Poor trading signals

Poor trading signals and services. I have waited for my withdrawal request to get approved but it was never approved.

Did you find this review helpful? Yes No

Fake trading

Do not be hooked on their trading schemes. It is not real.

Did you find this review helpful? Yes No

Arrogant

Arrogant. They sounded very unprofessional.

Did you find this review helpful? Yes No

Poor communication skills

Poor communication skills. These people lack comprehension and do not listen to concerns.

Did you find this review helpful? Yes No

Poor market analysis

Poor market analysis. I never find it worthy to trade using their signals.

Did you find this review helpful? Yes No

Worst services

Do not be fooled by their false advertisements. They will tell all the good things about their services but nothing is true. Services are one of the worst.

Did you find this review helpful? Yes No

Irresponsible and unprofessional

Irresponsible and unprofessional. They are supposed to help me succeed but their negligence made me fail.

Did you find this review helpful? Yes No

This broker has withdrawal issues

This broker has withdrawal issues. I have sent all the needed documents for withdrawal, and it got approved but I still don’t have my money. It’s been 2 weeks now since I got the approval to withdraw. I called and was advised to wait because according to them it has been processed.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawals. This is the only thing I do not like about them. That is why I quit trading with this broker.

Did you find this review helpful? Yes No

Thieves

Stay away from these thieves. They are not good at all.

Did you find this review helpful? Yes No

Scammers

Do not provide any details to these people. They are scammers.

Did you find this review helpful? Yes No

Stay away

Stay far away from these people. I have been scammed by them.

Did you find this review helpful? Yes No

Bad people

Bad people. Give me my money back.

Did you find this review helpful? Yes No

Not recommended

Not recommended. They are not responsive and are very inefficient.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. They seem to lack knowledge about trading.

Did you find this review helpful? Yes No

Worst services

The worst trading services I have ever seen. Do not invest money here.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. There are so many terms and requirements needed.

Did you find this review helpful? Yes No

Bad experience

Bad experience. Have lost so much money here.

Did you find this review helpful? Yes No

Terrible company

Terrible company. They are obviously just doing scams and their trading platform seems fake.

Did you find this review helpful? Yes No

Scammers

Do not provide any details to these people. They are scammers.

Did you find this review helpful? Yes No

Poor broker

Do not honor words. They change policies every time.

Did you find this review helpful? Yes No

Bad broker

My withdrawal request has been denied several times. Bad broker.

Did you find this review helpful? Yes No

Trading terms are not good at all

Very exaggerated descriptions of trading terms were in fact on actual trading the terms aren’t good at all like spreads and leverage.

Did you find this review helpful? Yes No

Thieves

Thieves. Do not trust them.

Did you find this review helpful? Yes No

Not worth it

Not worth my money and time. I did not gain profit from trading with this broker.

Did you find this review helpful? Yes No

Slow withdrawals

Worst trading company to deal with. Slow withdrawals.

Did you find this review helpful? Yes No

Rude customer service

Poor customer service. They sounded very rude all the time.

Did you find this review helpful? Yes No

Poor customer service

Annoying customer service. They seem to be clueless about their job.

Did you find this review helpful? Yes No

Not worth it

Irrelevant trading advise and inaccurate market analysis. Not worth it.

Did you find this review helpful? Yes No

Pricey trading instruments

Trading with them is too pricey. I am not going to deal with them again.

Did you find this review helpful? Yes No

Fraud

Fraud broker company. They are fake so do not deal with them.

Did you find this review helpful? Yes No

Poor communication skills

Poor communication skills. These people lack comprehension and do not listen to concerns.

Did you find this review helpful? Yes No

Expensive trading instruments

Too expensive trading assets. I have traded with several brokers and their prices are way too high compared to other brokers.

Did you find this review helpful? Yes No

Avoid this broker

Avoid joining this broker by all means. They will keep on collecting money but will never let you withdraw anything. Poor and unworthy services.

Did you find this review helpful? Yes No

Unable to withdraw

I will not trade with this broker anymore. I was not able to withdraw anything.

Did you find this review helpful? Yes No

Unprofitable

Not a good broker for forex trading. Although services are quite okay, I am not happy with my trading profit.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. It is my first time withdrawing, hope the next transaction is smooth and fast.

Did you find this review helpful? Yes No

All losses

Do not deal with this broker, there ain’t really winning trades. They will always let the client lose as if they are earning from losses.

Did you find this review helpful? Yes No

Worst

Good at the start. But is getting worst later on.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service and poor trading signals. I can not recommend this broker, they are not good enough.

Did you find this review helpful? Yes No

Inaccurate signals

Not a good broker for online trading. Signals are inaccurate.

Did you find this review helpful? Yes No

Not worth it

Not worth my money and time. I did not gain profit from trading with this broker.

Did you find this review helpful? Yes No

Not a skilled broker

I do not recommend trading with this broker. they are not skilled.

Did you find this review helpful? Yes No

Bad broker

I encourage everyone to stay away from these people. They have ripped off my wallet and will surely do the same to all who will be victims of their schemes.

Did you find this review helpful? Yes No

Bad trading company

Bad trading company. They did not approve my withdrawal request for no good reason.

Did you find this review helpful? Yes No

Unregulated broker

Unregulated trading broker. too late when I found out, I had already lost so much money.

Did you find this review helpful? Yes No

Slow withdrawals

I do not recommend trading with this broker. Withdrawal is slow and signals are not profitable.

Did you find this review helpful? Yes No

Scammers

Big-time scammers. They call to ask for more money.

Did you find this review helpful? Yes No

Unethical

They are very unethical. Do not respond to messages and even ignore phone calls. Not a good trading broker.

Did you find this review helpful? Yes No

Poor broker

Not profitable to trade with. Poor broker performance.

Did you find this review helpful? Yes No

Poor services

The trading signals usually go against market movements. I am never impressed with services, withdrawal is always delayed.

Did you find this review helpful? Yes No

Ridiculous offers

Ridiculous offers. They will let you deposit a small amount but won’t let you trade. You will end up adding more in order to start trading.

Did you find this review helpful? Yes No

Unreliable signals

I am not going to recommend this broker service. The signals are unreliable.

Did you find this review helpful? Yes No

Dishonest brokers

Dishonest and rude brokers. Do not trade with them.

Did you find this review helpful? Yes No

Not satisfied

I am not satisfied with the services. I am not getting a decent profit.

Did you find this review helpful? Yes No

Stay away

They ran away with my money. Stay away from them.

Did you find this review helpful? Yes No

Dishonest brokers

Dishonest and rude brokers. Do not trade with them.

Did you find this review helpful? Yes No

Do not pay profit

They do not pay a profit. I experience so much trouble getting my withdrawal request approved.

Did you find this review helpful? Yes No

Rude customer service

Disrespectful customer service. I called to ask for help but they have been very rude.

Did you find this review helpful? Yes No

Bad broker

Bad trading broker. All they want from me is to deposit more money.

Did you find this review helpful? Yes No

Do not deal

Very unresponsive on concerns. Do not deal with these guys.

Did you find this review helpful? Yes No

Incompetent brokers

Incompetent trading brokers. They are a big company but they perform worst than I have ever expected.

Did you find this review helpful? Yes No

Do not trust

Do not trust these people. They are scammers and we’ve got no idea of their office address.

Did you find this review helpful? Yes No

Dishonest brokers

Dishonest and rude brokers. Do not trade with them.

Did you find this review helpful? Yes No

Scammers

Unregulated and notorious scammers. Avoid these people.

Did you find this review helpful? Yes No

Poor trading platform

Poor trading platform. There are so many technical problems.

Did you find this review helpful? Yes No

Bad brokers

Bad brokers. They practice unsolicited calls and force me to deposit more money on my trading account.

Did you find this review helpful? Yes No

Slow withdrawals

I am not happy with the services because of slow withdrawals. They ask for so many documents needed and there is a very long wait.

Did you find this review helpful? Yes No

Bad brokers

Bad brokers. They practice unsolicited calls and force me to deposit more money on my trading account.

Did you find this review helpful? Yes No

Not a good broker

I am unhappy with my trading results. They are not a good broker to deal with.

Did you find this review helpful? Yes No

Bad people

Bad people. They sounded nice at the start but will eventually worsen once they were able to get your money.

Did you find this review helpful? Yes No

Huge slippage

I felt like there is a cheat on their charts. Slippage is also getting bigger as I go on.

Did you find this review helpful? Yes No

Worst trading company

Worst trading company. They do not treat customers well.

Did you find this review helpful? Yes No

Bad broker

Customer service and broker have bad behavior. They are very unprofessional and difficult to deal with.

Did you find this review helpful? Yes No

Inefficient services

Poor broker company. Services are inefficient.

Did you find this review helpful? Yes No

Inaccurate signals

They are not good trading brokers. They have a few signals that are not accurate.

Did you find this review helpful? Yes No

Slow withdrawals

I am not trading with this broker again. The withdrawal is really very slow.

Did you find this review helpful? Yes No

Incompetent brokers

The worst services I have ever used. People are very incompetent from brokers down to customer service.

Did you find this review helpful? Yes No

Bad people

Bad people. Do not trade with them.

Did you find this review helpful? Yes No

Unresponsive

Very unresponsive. They ignore me most of the time, causing me greater losses.

Did you find this review helpful? Yes No

Bad experience

I had a bad experience with this company as they keep me waiting too long for my withdrawal. I have complied with all requirements but still, I am having a hard time getting my profit.

Did you find this review helpful? Yes No

Poor broker services

Poor broker services. I am not happy with the services I get from this broker.

Did you find this review helpful? Yes No

Bad broker

Bad trading broker. All they want from me is to deposit more money.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawals. Services are fair, not bad but not that good, just average. But when it comes to withdrawals, it’s the worst.

Did you find this review helpful? Yes No

Do not trust

Do not trust them. Bad broker services.

Did you find this review helpful? Yes No

Worst trading company

Worst trading company I have ever dealt with. They did not assist me causing too much losses.

Did you find this review helpful? Yes No

No withdrawals

Will never process withdrawals. Do not deal with this company.

Did you find this review helpful? Yes No

Bad brokers

Bad brokers. They practice unsolicited calls and force me to deposit more money on my trading account.

Did you find this review helpful? Yes No

Poor services

I cannot depend on them as my trading broker. Services are not good at all.

Did you find this review helpful? Yes No

Bad brokers

Bad brokers. They practice unsolicited calls and force me to deposit more money on my trading account.

Did you find this review helpful? Yes No

Expensive trading instruments

Poor trading instruments. They are not profitable and all are very expensive.

Did you find this review helpful? Yes No

Bad brokers

Bad brokers. They practice unsolicited calls and force me to deposit more money on my trading account.

Did you find this review helpful? Yes No

Bad broker

Customer service and the broker has bad behavior. They are very unprofessional and difficult to deal with.

Did you find this review helpful? Yes No

Poor trading platform

Poor trading platform. I always encounter lags and glitches. Not a good one to use for trading.

Did you find this review helpful? Yes No

Poor software

Poor trading software. There are so many technical problems along the way.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I had several withdrawals with them and all are really very slow.

Did you find this review helpful? Yes No

Technical problem

I always encounter technical problems with this broker service. I reported the problem so many times but they are left unresolved.

Did you find this review helpful? Yes No

Inconsiderate broker

Shows no concern. I have lost so much money but they still insisted on asking for more deposits as if they wanted me to lose more and more.

Did you find this review helpful? Yes No

Bad services

Do not use the services. Not good at all.

Did you find this review helpful? Yes No

Worst offers

Worst trading offers. Losing has a greater chance than getting a winning trade.

Did you find this review helpful? Yes No

Incompetent

They are very incompetent and unreliable. It is not a good idea to trade with them.

Did you find this review helpful? Yes No

Do not trade

Do not trade with this broker company. It is so much difficult to ask for a withdrawal.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. They do not respond to messages right away.

Did you find this review helpful? Yes No

Stealing money

I honestly think that they are just stealing money from me. I will be closing my account real soon.

Did you find this review helpful? Yes No

Delayed withdrawals

Delayed withdrawals. I will never trade with them again.

Did you find this review helpful? Yes No

Do not deal

Do not deal with this broker company. They are very inefficient and signals are really worst.

Did you find this review helpful? Yes No

Bad broker

Avoid this broker by all means. This broker does not pay profit and will turn very unresponsive after depositing your hard-earned money.

Did you find this review helpful? Yes No

Manipulated charts

Manipulated charts. I notice irregularities on their trading platform.

Did you find this review helpful? Yes No

Poor services

Poor services. Do not trade with them, it is only a waste of time.

Did you find this review helpful? Yes No

Not a good broker

I do not recommend trading with this broker. Services are not good at all.

Did you find this review helpful? Yes No

Poor trading company

Poor trading company. I did not gain anything from this broker.

Did you find this review helpful? Yes No

Slow withdrawals

The slow process of withdrawals with so many annoying documents to submit.

Did you find this review helpful? Yes No

Do not pay profit

They do not pay a profit. I experience so much trouble getting my withdrawal request approved.

Did you find this review helpful? Yes No

Extremely worst company

Extremely worst services for online trading. I will never trade with this company again.

Did you find this review helpful? Yes No

Poor trading signals

Poor trading signals. I have lost so much money on this broker service. They are also very unresponsive after the deposit stage.

Did you find this review helpful? Yes No

Not a good broker

Not a good broker to deal with, people are rude and unhelpful. Also, services are not good.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawal process. I will never trade with this broker again. They gave me so much headache during the withdrawal process.

Did you find this review helpful? Yes No

Crappy customer service

Crappy customer service. Seldom answers chat and email. It sounded very dull.

Did you find this review helpful? Yes No

Unprofessional

Very unprofessional brokers. They do not meet schedule callbacks and did not meet commitments.

Did you find this review helpful? Yes No

Slow customer service

Slow customer service. I even lose so many times because of late responses.

Did you find this review helpful? Yes No

Worst customer service

Worst customer service I have dealt with. As if they do not know what to do and have very poor communication skills.

Did you find this review helpful? Yes No

Freezing trading platform

The trading platform always freezes and they were not able to fix it. It happens most of the time and greatly affects trades so I quit trading with them.

Did you find this review helpful? Yes No

Unprofessional

No response to messages sent on their website. It is even hard to call their customer service. They never get back to me on missing withdrawals, very unprofessional.

Did you find this review helpful? Yes No

Avoid this broker

Avoid this broker by all means. They are just after your cold cash deposits. They will never really help you get good trades.

Did you find this review helpful? Yes No

Slow withdrawals

Performance is never impressive nor good. I am not recommending them. Poor signals and slow withdrawals and most of the services are not good.

Did you find this review helpful? Yes No

Worst forex services

I have so many regrets about the choice I made-trading within this broker. They have the worst services ever.

Did you find this review helpful? Yes No

Withdrawal issues

I will discontinue trading with this broker due to withdrawal issues. I had so much trouble requesting to withdraw my profit.

Did you find this review helpful? Yes No

Rude customer service

Rude customer service. Aside from ignoring my messages, they even don’t answer phone calls.

Did you find this review helpful? Yes No

Bad brokers

Bad trading broker. They always call-forcing deposits.

Did you find this review helpful? Yes No

Difficult withdrawals

I have provided all the documents they have asked me to provide but still, a withdrawal request is not granted. I am really having difficulty trying to withdraw my profit.

Did you find this review helpful? Yes No

Poor services

Their services are not good at all. Do not trade with them.

Did you find this review helpful? Yes No

Beware

Beware. They are unregulated.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. They can not even answer a simple question.

Did you find this review helpful? Yes No

Stay away

Stay away from these people. They are rude, intimidating, and inefficient.

Did you find this review helpful? Yes No

Frustrating experience

Frustrating experience. I deposited my money hoping to get good returns as promised but right now I am unable to withdraw anything.

Did you find this review helpful? Yes No

Bad trading brokers

I never had the support that I needed in trading. They are always unavailable to help.

Did you find this review helpful? Yes No

Gambling

Pain to see, I am simply gambling and nothing is really sure.

Did you find this review helpful? Yes No

Bad people

Bad people. They have processed my deposit smoothly, why can’t they do the same for my withdrawals?

Did you find this review helpful? Yes No

Poor trading experience

Poor trading experience. I did not get a good profit. ‘ve had a few dollars in a month and felt like I am just wasting my time.

Did you find this review helpful? Yes No

Not a good broker

I am unhappy with my trading results and dissatisfied with their services. Not a good broker to deal with.

Did you find this review helpful? Yes No

Poor services

Poor services. I will not trade with them again

Did you find this review helpful? Yes No

Poor signals

Worst trading signals. They not even accurate.

Did you find this review helpful? Yes No

Frustrating services

Do not trade with the. They ain’t good at providing trading advice and services are frustrating.

Did you find this review helpful? Yes No

Unhappy with this broker

Unhappy with this broker service. I get profit but not that much. Worst, I had a hard time withdrawing my profit.

Did you find this review helpful? Yes No

Slow withdrawals

Unjust withdrawal process. It is taking them few weeks to process and the documents are very difficult to provide.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawals. Services are fair, not bad but not that good, just average. But when it comes to withdrawals, it’s the worst.

Did you find this review helpful? Yes No

Unreliable signals

Good customer service but very unreliable trading signals. Avoid these trading brokers.

Did you find this review helpful? Yes No

Bad trading platform

Bad trading platform. I notice some errors causing me to lose money on my trading account. As if they intended it to get my money.

Did you find this review helpful? Yes No

Worst platform

Worst trading platform. So many technical errors and is very difficult to use and understand.

Did you find this review helpful? Yes No

Confusing platform

The trading platform is very confusing. Pattern indicators are very difficult to understand.

Did you find this review helpful? Yes No

Poor trading company

Not a wise choice to trade with them. Charges are too much and profit is very minimal.

Did you find this review helpful? Yes No

Super slow withdrawals

Super slow withdrawal process. It will take you several weeks of follow-ups before getting your money credited to your bank account.

Did you find this review helpful? Yes No

Poor trading platform

Outdated trading platform. I encountered unreasonable technical problems on their trading platform.

Did you find this review helpful? Yes No

Stay away from this broker

Stay away from this broker service. They will start to be difficult to contact and you will start losing more money on a later part.

Did you find this review helpful? Yes No

Avoid this broker

Avoid this broker at all costs. They won’t let you make any withdrawals.

Did you find this review helpful? Yes No

Faulty platform

I am happy with customer service,they are indeed very helpful. I just can’t stand faulty trading platform,it always has errors most of the time.

Did you find this review helpful? Yes No

Do not deal with this broker

Do not deal with this broker service. They will never allow anyone to withdraw profit.

Did you find this review helpful? Yes No

Very expensive transaction charges

Very expensive transaction charges. They have really good ads for their company but on the actual trading, you will be surprised by the numerous transaction charges that you will have to pay.

Did you find this review helpful? Yes No

Delayed execution and not so accurate signals

Very expensive initial deposit, I thought the services, system, and products are okay since it is a bit pricey, but hell no. Signals are not so accurate and there is a great delay in execution.

Did you find this review helpful? Yes No

Bad brokers

Bad brokers. They practice unsolicited calls and force me to deposit more money on my trading account.

Did you find this review helpful? Yes No

Poor customer support

Poor customer support. They are not able to help with any of my concerns.

Did you find this review helpful? Yes No

Rude

They are insincere and sounded very rude over the phone. I regret investing in money here.

Did you find this review helpful? Yes No

Poor offers

The offers are not good at all. They are mainly gambling and everything is a game of chance.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. This has always been my problem that is why I have closed my trading account with them.

Did you find this review helpful? Yes No

Poor services

Has great delays on execution, causing me to lose the chances to make money. Poor services.

Did you find this review helpful? Yes No

Poor signals

I am not going to trade with them again. The signals bring more losses than winning trades.

Did you find this review helpful? Yes No

Inaccurate signals

I do not recommend trading with this broker company. Signals are inaccurate and unprofitable.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. They are always not available to assist.

Did you find this review helpful? Yes No

Slow responses

Slow responses from customer service. Not a good one to deal with.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. They always ignore all my trading concerns.

Did you find this review helpful? Yes No

Bad trading partner

Bad trading partner. They are most of the time unavailable whenever I needed help.

Did you find this review helpful? Yes No

Trouble with withdrawal process

I am having trouble with their withdrawal process. I did start so strong with this broker but I am so upset that upon withdrawal, all will turn out worst.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process. I am furious that after providing all the documents, waiting is never-ending.

Did you find this review helpful? Yes No

Great broker

It’s a good forex broker and they provide nice trading conditions. I like their website and customer support is useful and professional.

Did you find this review helpful? Yes No

Do not deal

Stay safe from losses. Do not even engage in any trading offers from this company.

Did you find this review helpful? Yes No

Poor software

Poor trading software. There are so many technical problems along the way.

Did you find this review helpful? Yes No

Do not invest here

Do not invest your money here, the services are not worth it.

Did you find this review helpful? Yes No

Poor services

Poor trading services. They are always unavailable to assist clients.

Did you find this review helpful? Yes No

Unreliable broker

Do not rely on their signals and services. They are not skilled brokers.

Did you find this review helpful? Yes No

Lost huge money

I have lost huge money overnight. I regret joining this broker company.

Did you find this review helpful? Yes No

Poor support

Support isn’t always available to assist me in my trading needs. I even encounter losses due to their negligence. Not a recommended broker to deal with.

Did you find this review helpful? Yes No

Poor services

I cannot depend on them as my trading broker. Services are not good at all.

Did you find this review helpful? Yes No

Withdrawals don't work

Withdrawals don’t work here. They will always give out excuses to block it.

Did you find this review helpful? Yes No

Promise too much

They promise too much. On the actual trading, they do not perform well.

Did you find this review helpful? Yes No

totally satisfied

I’m totally satisfied with Fxpro because it has all the necessary conditions for a successful trade. Convenient deposit/withdrawal service, good support and website.

Did you find this review helpful? Yes No

Frustrating withdrawal process

I am so frustrated with their very slow withdrawal process. There are so many needed documents.

Did you find this review helpful? Yes No

Poor trading options

Most of the trading options are not good. They aren’t profitable.

Did you find this review helpful? Yes No

Slow withdrawals

I am so frustrated with their services. Customer service and the withdrawal process are both slow.

Did you find this review helpful? Yes No

Delayed withdrawals

Delayed withdrawals. I will never trade with them again.

Did you find this review helpful? Yes No

Unreliable broker

I can not rely on this broker service. They are not good enough.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawal process. I am not getting my money on time.

Did you find this review helpful? Yes No

Poor trading company

Poor trading company. Do not deal with them.

Did you find this review helpful? Yes No

Horrible support

Horrible trading support. They are very rude and as if they never care about their customers.

Did you find this review helpful? Yes No

Fake trading results

Fake results. I compare my trading results with my friend using a different broker and it is really far different.

Did you find this review helpful? Yes No

Poor trading tools

Tools are always under maintenance. Even their website is not working properly.

Did you find this review helpful? Yes No

Slow withdrawals

Very very slow withdrawal process. Do not deal with this broker.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I had several withdrawals with them and all are really very slow.

Did you find this review helpful? Yes No

Bad broker

Rude customer service and arrogant brokers. I always felt humiliated every after the call I had with them.

Did you find this review helpful? Yes No

Denied withdrawals

Although I have submitted all the supporting documents needed, the withdrawal request has been denied.

Did you find this review helpful? Yes No

Problem with withdrawals

I did not receive my withdrawal from this broker. I am until today, having a hard time contacting them.

Did you find this review helpful? Yes No

Inconsiderate broker

Shows no concern. I have lost so much money but they still insisted on asking for more deposits as if they wanted me to lose more and more.

Did you find this review helpful? Yes No

Poor website

Poor website and tools. I get a problem all the time.

Did you find this review helpful? Yes No

Useless signals

Useless broker services. I can not rely on the signals, I’d rather trade alone.

Did you find this review helpful? Yes No

Pretty good forex provider with a good range of services and reliable withdrawals.

Did you find this review helpful? Yes No

Worst withdrawal process

My withdrawals here gone missing. I have just started trading with them and have requested my first withdrawal, however, it took them weeks to process. It even went missing.

Did you find this review helpful? Yes No

Bad broker

Very good on small trades but these changes upon depositing a bigger amount. I feel like they are just merely collecting cash and what they have is not really genuine trading.

Did you find this review helpful? Yes No

Poor trading profit

I am talking base on my own point of view. This ain’t a good broker for me because profit is not good. Although services are, we came here for the money.

Did you find this review helpful? Yes No

Poor forex broker

I did not get profit from their forex trading. I have deposited but no return or whatsoever. I lost all my money.

Did you find this review helpful? Yes No

Poor trading signals

I have traded with this broker last year and have regretted doing so. Signals are not profitable and the services are very very poor.

Did you find this review helpful? Yes No

Worst platform

Worst trading platform. It has so many technical problems, very difficult to use, and is outdated.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and worst platform. I encounter so many technical problems and also I got problems with services.

Did you find this review helpful? Yes No

Cheaters

They have the smoothest way of cheating people. I did observe, they cheat true slippage and pricing. I compared it with my friend’s account from different brokers and mine is way too high.

Did you find this review helpful? Yes No

One of the most well-known brokerage companies, I work with them for several years and never had any issues with the withdrawals, execution, server connection or other technical problems. Trustworthy and recommended broker!

Did you find this review helpful? Yes No

Unprofitable

Unprofitable. I have used their services and I am not impressed with the signals, they can not give me a decent profit.

Did you find this review helpful? Yes No

Poor services

Poor broker services. There is a great delay in processing withdrawals and they are also very unresponsive on messages.

Did you find this review helpful? Yes No

Poor trading services

The results on the demo account are far different from the actual trading results. Services here are very unreliable.

Did you find this review helpful? Yes No

Worst forex platform

The worst trading platform I have ever used to trade forex. I encounter so many technical problems that affect my trades. I lost in several trades because of the technical problems.

Did you find this review helpful? Yes No

Great signals

I have obtained really helpful and good trading strategies from the brokers. Signals are good and I get a good profit.

Did you find this review helpful? Yes No

Poor trading signals

Good customer service, they’ve been very helpful however I have to close my trading account due to poor trading signals. I am not happy with the trading results. I get more losses.

Did you find this review helpful? Yes No

Poor trading platform

A very confusing trading platform for forex traders. I am always having trouble understanding its features and always encounter technical problems.

Did you find this review helpful? Yes No

Worst trading company

It is the worst company I have ever seen. They always mess up on trading instructions and withdrawal is very difficult and slow.

Did you find this review helpful? Yes No

fxpo review

In FxPro I found a lot of advantages – a good platform, as well as an android application. Good analysis and tight spreads on the major pairs. Recommend this broker for everyone.

Did you find this review helpful? Yes No

Inconvenient platform

Inconvenient trading with. The platform is very confusing and there are so many technical problems.

Did you find this review helpful? Yes No

Bad brokers

I got ripped off by this broker. Candlesticks and analysis will never do any justice. Do not be deceived by these people, what they have is not real trading but it is merely programmed software to steal people from people.

Did you find this review helpful? Yes No

Poor broker service

Poor customer support and broker services. Unresponsive and very unhelpful. I can not depend on their services.

Did you find this review helpful? Yes No

Slow customer service response

Slow response from customer service. They are not available when you need them for help.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. Aside from they aren’t helping at all, they sounded so rude and sarcastic all the time.

Did you find this review helpful? Yes No

Poor services and platform

Poor broker platform and services. I am not getting the right support that I needed to succeed and their platform is really worthless.

Did you find this review helpful? Yes No

Poor services

They do not deserve any star at all. You can not depend on the signals, the same with their services.

Did you find this review helpful? Yes No

Rude customer service

They have multi-lingual support that I guess is also knowledgeable. The problem is, they are very rude and sounding unhelpful.

Did you find this review helpful? Yes No

fxpro review

As well as any broker, Fxpro has advantages and disadvantages. But in general, I think they are one of the best and most reliable brokers in the market. FxPro provides quite flexible conditions, the wide range of instruments and quite tight spread. Withdrawals are fast enough.

Did you find this review helpful? Yes No

Inefficient broker

Inefficient broker service. I never had anything good to say about this broker. They are one of the worst brokers in the forex market.

Did you find this review helpful? Yes No

Poor customer service

Customer service is unavailable most of the time. I always face challenges trying to get hold of one over the phone.

Did you find this review helpful? Yes No

Worst services

Worst services I have ever encounter in the forex trading industry. I can’t imagine it is that worst.

Did you find this review helpful? Yes No

Problems on withdrawals

I had so many problems with their withdrawal process. They keep on rejecting my request to withdraw profit. It’s just so annoying to face the runarounds.

Did you find this review helpful? Yes No

Extremely rude

Frustrated with customer service. They are very nice at first but are extremely rude later on. Do not deal with this broker service.

Did you find this review helpful? Yes No

Long withdrawal process

I love their fast execution and great customer service. But I am so disappointed with a very long withdrawal process.

Did you find this review helpful? Yes No

Not good at all

Do not trade with this broker. I end up wasting my money and time with this broker. Not good at all.

Did you find this review helpful? Yes No

Difficult to contact

Good services except that customer support are not available all the time. It is really very difficult to get hold of one.

Did you find this review helpful? Yes No

Unreliable brokers

I am not confident in trading with this broker. Poor signals and unreliable service.

Did you find this review helpful? Yes No

Slow withdrawals

The only issue I have with this broker is their withdrawal process. It is very slow and has so many requirements.

Did you find this review helpful? Yes No

Poor customer service

Not a good broker service, customer support is always unavailable.

Did you find this review helpful? Yes No

Can't withdraw

This broker does not allow withdrawal, they won’t admit it of course but I notice it because they are making the withdrawal process very complicated that I cant almost withdraw.

Did you find this review helpful? Yes No

Poor broker service

Not a good broker to trade with. Trading advice are not helpful at all. Aside from poor signals, services are also poor.

Did you find this review helpful? Yes No

Do not trade with them

This broker is not that good to deal with. I have traded with them and lost a lot of money. Do not trade with them.

Did you find this review helpful? Yes No

Slow withdrawals

Horrible broker company. They have so many excuses not to give your money. Super slow withdrawals.

Did you find this review helpful? Yes No

Inefficient forex broker

Not an efficient forex broker to trade with. Poor trading signals I may say. The moment I started trading with them until for about 2 months, I got so many losses due to poor broker signals.

Did you find this review helpful? Yes No

Long withdrawal process

Very long withdrawal process, I waited for a few weeks and it is so annoying they keep on asking me to replace documents. Do not deal with this broker service.

Did you find this review helpful? Yes No

Poor trading brokers

Trading instruments are very few just the usual. Fewer chances to get good trades. Weak market analysis and poor broker signals.

Did you find this review helpful? Yes No

Long withdrawal process

I have started a live account with these brokers a few days ago and I am satisfied with the signals. I am just wondering why is it taking too long for them to process withdrawals.

Did you find this review helpful? Yes No

Unresponsive on withdrawals

Not a good broker. Unresponsive and great delays in withdrawals. Customer service also has great delays in responding to emails, chats and even on the phone.

Did you find this review helpful? Yes No

Lost all my money

I am now depressed because of this broker. They have shown me potential earnings and convince me to invest that much which I did but I lost everything. I even sold some properties for this.

Did you find this review helpful? Yes No

Poor forex broker

At the start, all seems perfect but I am shattered to see the next morning that all my funds were gone. Be cautious, do not deal with them.

Did you find this review helpful? Yes No

Expensive to trade with

They will tell you affordable initial deposits but actual trading here is really very expensive. They will tell you affordable initial deposits but actual trading here is really very expensive.

Did you find this review helpful? Yes No

Worst choice of broker

This is the worst choice of the broker I have ever made. They have the longest wait time for withdrawals.

Did you find this review helpful? Yes No

Unprofessional

Very unprofessional. They will bombard you with unsolicited calls.

Did you find this review helpful? Yes No

Manipulative and rude

Don’t trust this broker. They are manipulative and rude.

Did you find this review helpful? Yes No

Poor overall performance

This is a regulated broker service however overall performance is poor. So many losing trades due to inaccurate broker signals and market analysis.

Did you find this review helpful? Yes No

Expensive

Surprised with so many transaction charges and trading costs. Expensive broker services.

Did you find this review helpful? Yes No

Super slow withdrawals

Super slow withdrawal process. It will take you several weeks of follow-ups before getting your money credited to your bank account.

Did you find this review helpful? Yes No

Huge slippage

For over a month of trading with them, I have noticed huge slippage. I stop trading right away.

Did you find this review helpful? Yes No

Poor signals

Poor broker signals. As if they do not have strong market analysis.

Did you find this review helpful? Yes No

Seldom replies on messages

They seldom reply to emails and chats. I always need to wait in the queue every time I need help from customer service.

Did you find this review helpful? Yes No

Unhelpful

Unhelpful customer service. I got unresolve withdrawal issues which they just ignored.

Did you find this review helpful? Yes No

Slow withdrawals

Super slow withdrawal process, very annoying. I gain profit however I am unable to withdraw them.

Did you find this review helpful? Yes No

Poor customer service

I am not satisfied with the services of this broker, withdrawal is very slow and poor customer service.

Did you find this review helpful? Yes No

Arrogant

Harrasing and rude brokers. They are firm and sounded so arrogant.

Did you find this review helpful? Yes No

Harassing

Harassing brokers, they sounded so rude and uneducated.

Did you find this review helpful? Yes No

Not a good broker

Not a good broker service, customer support is always unavailable.

Did you find this review helpful? Yes No

Useless broker service

Useless broker service. My instincts are better than their trading signals.

Did you find this review helpful? Yes No

Unsatisfied with broker performance

Unsatisfied with this broker performance. I got winning trades but doing the math, more losses than profits.

Did you find this review helpful? Yes No

Delayed withdrawals

Their performance is average, not bad but never impressive. What I don’t like about them is the great delays in the withdrawal process.

Did you find this review helpful? Yes No

Unethical and misleading

Very unethical and misleading. They are giving information that is not really accurate and will suddenly change during the actual trading.

Did you find this review helpful? Yes No

Slow withdrawals

I immediately closed my trading account with them upon experiencing thier slow and hassled withdrawal the first time I made a request.

Did you find this review helpful? Yes No

Useless services

Useless services. I have them as my forex broker for a few months and as if it is much better to trade alone.

Did you find this review helpful? Yes No

Technical issues

I had trouble using their trading app. There are so many technical issues left unresolved. I just ended closing my trading account because of this.

Did you find this review helpful? Yes No

Not satisfied with the services

I am not overall satisfied with the services, they have very slow withdrawals and poor broker signals.

Did you find this review helpful? Yes No

Good only at the start

I have traded with this broker, the result is good in the first few weeks but it becomes worst as days go on. I have noticed greater lose and they keep on asking for me to add more funds.

Did you find this review helpful? Yes No

Poor broker performance

I have traded with this broker for over a month. The overall performance is poor.

Did you find this review helpful? Yes No

Not satisfied with their services.

I am not satisfied with their services. They are not prompt in answering messages and phone calls.

Did you find this review helpful? Yes No

Useless broker signals

It’s not worth my money and time, useless broker signals.

Did you find this review helpful? Yes No

Customer support not available all the time

Good services except that customer support are not available all the time.

Did you find this review helpful? Yes No

Not a good forex broker

Not a good broker for forex. Trading signals and instructions are irrelevant.

Did you find this review helpful? Yes No

Do not deal with this broker

Do not deal with this broker. I have traded with them and lost all my money.

Did you find this review helpful? Yes No

Beware, do not trade with this

This company I am sure of has only one goal that is to make more deposits. As if there is no forex trading at all but only taking of deposits. Beware, do not trade with this.

Did you find this review helpful? Yes No

Stolen my money

They have stolen my money. I traded and have lost, all I want is to refund remaining balance but they freeze and own it.

Did you find this review helpful? Yes No

Slow withdrawals

Good broker signals, the problem is they have a lot of requirements for withdrawals and the process is very slow.

Did you find this review helpful? Yes No

Do not use this trading platform

Do not use this trading platform. Price keeps on changing and signals are very unreliable.

Did you find this review helpful? Yes No

Bad forex broker

This company is a total disaster. They have messed up my trading account and I never did get any profit for 6 months of trading with them.

Did you find this review helpful? Yes No

Won't let you withdraw

I was convinced by this broker. I’ll tell you what, do not be fooled by them, they will only let you deposit but won’t let you withdraw.

Did you find this review helpful? Yes No

Worst broker

I traded with them for a month. During this short span of time, I saw the worst. Slow withdrawals, weak signals, and rude customer service.

Did you find this review helpful? Yes No

There are so much hidden charges

There are so much hidden charges. Customer service is patient and helpful though but you will be paying all transactions.

Did you find this review helpful? Yes No

Annoying

Annoying marketing style. They keep on calling and forcing me to deposit more money on my trading account.

Did you find this review helpful? Yes No

Hard to request for withdrawal

I have traded with this broker for more than a month but I quit because of some issues about withdrawal. I notice that they are just doing the run around asking for so many documents because they really don’t really approve withdrawal requests easily.

Did you find this review helpful? Yes No

Worst forex broker

The worst you can get for a forex broker. Their signals are really poor and withdrawal is very slow. Their customer service can’t even communicate well.

Did you find this review helpful? Yes No

Fraudulent business opportunity

What they have is just a fraudulent business opportunity. It will convince you to invest and will not allow you to withdraw until you lose all your money.

Did you find this review helpful? Yes No

All they want is my money

Absolutely disgusting. Every time they call, I can feel that all they want is for me to add more money but weren’t even listening to my concerns.

Did you find this review helpful? Yes No

Bad brokers

Bad broker services. Do not deal with them.

Did you find this review helpful? Yes No

Expensive trading instruments

I was convinced to trade with this broker some time last year and I am very disappointed with the pricing on actual trading. The trading instruments are very expensive.

Did you find this review helpful? Yes No

So much technical problems

I’ve got so many problems with their platform. It has so many system errors and lags most of the time.

Did you find this review helpful? Yes No

Poor broker performance

Poor broker performance. Overall performance from platform to broker signals is not good at all. Just a waste of time.

Did you find this review helpful? Yes No

Poor communication skills

The brokers and customer service employees are not capable of communicating clearly. Every time they give instruction they mix things up and it’s very confusing I can not follow what’s being said.

Did you find this review helpful? Yes No

Fake trading

I think what this broker has is fake trading basing it from what I have experienced. After getting winning trades, they do not want to grant my withdrawal request but ask me to invest it instead. After doing so, the next thing I know is that I lost everything.

Did you find this review helpful? Yes No

Brokers are not good enough

I have lost real huge money with this broker. They are not good enough.

Did you find this review helpful? Yes No

Slow withdrawals

This could have been a good broker if not for their slow withdrawal process. It would take them over a week to process the withdrawal and it’s really very annoying.

Did you find this review helpful? Yes No

Expensive trading

Initial deposit is very expensive as well as a trading lots, My $500 initial deposit can’t do so much.

Did you find this review helpful? Yes No

Not happy with customer service

I am not happy with how the customer service assist me, just to get you off the phone they will provide the wrong resolution.

Did you find this review helpful? Yes No

Slow chat support

Slow chat support. I have spent so many hours with chat support just because of simple concern. Chat intervals are long because there is a great delay in the replies.

Did you find this review helpful? Yes No

Trading signals are not profitable

Trading conditions are generally okay, good leverage and tight spreads. The only reason I closed my account is that I am not happy with my profit. It seems that they need improvement in their trading signals.

Did you find this review helpful? Yes No

Rude customer service

They have the worst customer service among brokers, very rude and unwelcoming.

Did you find this review helpful? Yes No