The central bank is widely predicted to hike the fed-funds rate by half a percentage point to 4.25-4.50%. The conclusion will become public at 2 p.m. E.T. (1800 GMT). Jerome Powell will lead the press conference.

Data on Tuesday revealed that U.S. consumer prices rose at their most unhurried pace in nearly a year in November, flaring an early rally on Wall Street, with the S&P 500 bouncing as much as 2.8% to a three-month high.

The benchmark index, nevertheless, closed sharply off its high on worries over the central bank remaining fierce.

BCA Research stated in a note that this CPI release eventually cements the case for a downshifts in the pace of Fed rate hikes on Wednesday.

Although it increases the odds of a halt in H1, labor market dynamics stay too hot to call for rate cuts in the near term.

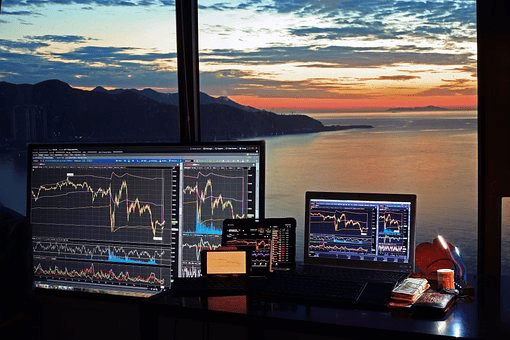

Dow Futures Low

Strategists at Morgan Stanley (NYSE: M.S.) predict the central bank to raise rates by 25 basis points at its February conference but see no additional increases in March, leaving the peak fed-funds rate at 4.625%.

In opposition, money market participants anticipate two more 25 basis-point hikes next year, upholding the terminal rate at 4.82% by May 2023.

At 6:06 a.m. ET, Dow e-minis were lower by 1 point, S&P 500 e-minis were lower by 1.25 points or 0.03%, and Nasdaq 100 e-minis were lower by 10.75 points or 0.09%.

Among stocks, Tesla (NASDAQ: TSLA) Inc dropped 1% in premarket trading behind a Goldman Sachs (NYSE: G.S.) analyst cut the price target for the electric vehicle maker’s stock.