2020 Fundiza Review– A Broker Worth the hard-earned coin?

Traders, fancy meeting you here! Welcome. We are glad that you have joined us today because we have read various sources to create a review for Fundiza for you! This review will give you an overview and allow you to decide if they are right for you. Let’s dive in.

The Basics – Fundiza

Although they are new to the market, Fundiza has already left its mark. They were established in 2019 and became registered at Victoria Park Road, Kingstown, St. Vincent & Grenadines, Kingstown P.O. Box 4457. The registration number is 25770BC2020.

Their transparency and effortless registration and licenses allowed them to form a solid connection and credibility with the broker initially.

They have their terms and conditions enclosed on the footer of their website. There, one can find all the vital information. According to their conditions, the company and traders have a decent number of obligations and duties, helping create mutual reliability and trustworthiness. This sort of relationship is not common as brokers often like to dump the responsibility on their users. But not Fundiza!

Fundiza provides all of its policy in the footer, including information about refunds, grievances, etc. This sort of openness helps foster a feeling of trust and respect from users. Quite often, brokers tend to leave out such important details, to hide previous incriminations. This leaves users with an uneasy feeling. However, Fundiza is quite the opposite. They are extremely transparent and unafraid to share their true colors. For this reason, we give them a thumbs up! But that is not the only positive element of Fundiza.

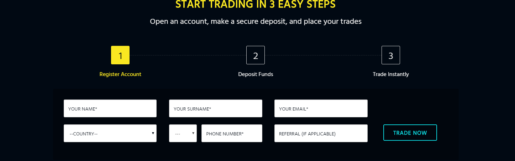

Registering with Fundiza

Although creating accounts with brokerages is usually quite straightforward, we would like to give you a short lesson so that we can give you our firsthand experience. Often, brokerages tend to make this process more complicated than it needs to be. Such an approach leaves users with a lot of confusion, uncertainty, and skepticism. Thus, to get a better idea of the brokerage, we like to go through the process ourselves to give you the best possible summary.

Step 1: Registering

The registration process with Fundiza is three steps. Yes, just three steps. The initial step consists of providing basic information required for trading. Such elements include your name, email, phone number, country, and any referrals. Although this information may seem simple, the last part is quite important!

From what we know, a referral box during registration essentially shows that bonuses are present while opening an account. This means that if you are a loyal customer and recommend another customer, you will receive a bonus. This is a massive benefit for the broker because this simple factor shows their appreciation for loyal clients. From what we can see, this is a serious advantage.

Another plus we were able to identify was that if you enter fake information, you are automatically redirected to the referral desk. This a serious plus because this shows how serious and well organized their customer service facilities are. If you make any mistakes or are uncertain of what you are doing, they will be by your side to help you through the process.

Stage 2: Deposit Funds

For this step, all you need to do is put in your payment information and deposit your money. You decide how much to deposit, and then you are given a tier of the accounts. So depending on the money you put in, you will be added to the level of trader starting from Rookie to VIP. We will discuss this thoroughly in the next section.

Stage 3: Trade

Now all you need to do is trade. The registration was pretty simple and fast. It’s important to consider how much information the trader takes from you initially. More information might seem more trustworthy because usually, brokerages don’t need that much information from the start.

The following countries can’t trade with Fundiza: USA, Iran, Syria, and North Korea. The list is short and precise, including the countries which generally have trading restrictions as it is. So, we are happy to see Fundiza include such a huge chunk of the world to their family.

Trading Platforms at Fundiza

Once you register at Fundiza, you will have to download the MT5 trader. Though it might seem to limit too many traders because the most popular platform is MT4, the MT5 provides a lot more flexibility. You can add the widgets of your choice and optimize them as you wish. The interface is all up to you – you want to have 12 charts? Go ahead and have them. Though we don’t recommend it, as it can get quite confusing.

Trading Conditions Offered by Fundiza

The following list includes are the conditions offered by Fundiza broker:

- Cross-Asset Trading – Fundiza offers a lot of assets on its platform, such as currencies, commodities, indexes, and so on.

- Clear fees – They tell you what the fees are from the start. They know exactly how unnerving it can be to find out that you have more fees to pay at the end. So, they make it crystal clear how much you need to pay. They are not trying to steal from you, and they want to make sure you know that.

- Flexible leverage – The maximum leverage offered by Fundiza is 1:400, which gives you a lot of flexibility to choose the leverage of your choice. This is very important as flexibility allows you to choose your profits and losses, though be careful. As the profits get bigger, conversely, the losses increase too.

- Secured Funds – Fundiza made sure to protect your funds and thus they got an affiliate payment service that provides a multi-level SSL encryption

- Instant Market Access – The market is available 24 hours and 5 days a week, making it accessible to everyone all over the world. It seems quite fitting for such an international brokerage.

- 24/5 customer service – Their customer service allows you to get in touch with them via chat, web, or phone – an option for any kind of trader, introvert or not.

The conditions offered by the brokerage are quite great, though not outstanding. The biggest plus is that they have very flexible leverage, allowing you to increase your profits by 400. But as we said, you need to be careful with the leverage. Make sure you know how to trade with it before you commit to the maximum.

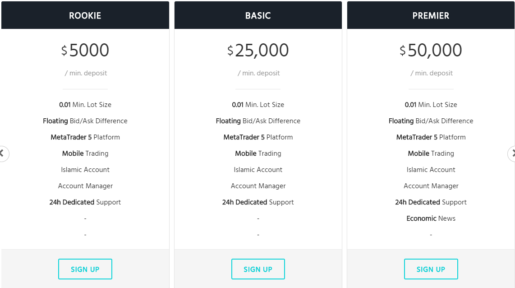

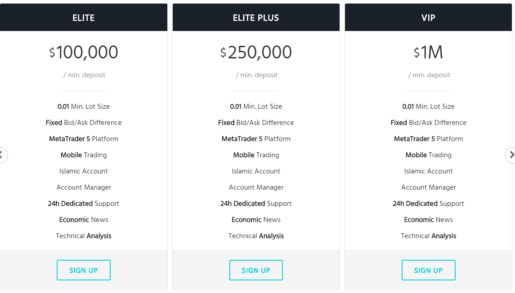

Account Types Available with Fundiza

You have an option to choose your account from a choice of 6 different accounts: Rookie, Basic, Premier, Elite, Elite+, and VIP. The biggest differences are the size of the deposits.

- Rookie – 5,000 USD

- Basic – 25,000 USD

- Premier – 50,000 USD

- Elite – 100,000 USD

- Elite Plus – 250,000 USD

- VIP – 1 million USD

All of the accounts offer: 0.01 min lot size, floating pip, MT5, mobile trading, Islamic accounts, account manager, and 24h dedicated support. The advanced trading, starting from the premier account, also receives economic news, fixed ask/bid difference, and technical analysis.

Fundiza Review Conclusion – is it Worth the Deposit?

We are very happy with the broker, so we do consider them to be worth the deposit. Though the money might seem like it’s a lot, in reality, you get more than you deposit. So depending on how much profit you want to make, you can deposit the respective amount.

We are confident that Fundiza is a trustworthy broker, and that you will be satisfied with the quality of trading. Leave a comment below with your experience with Fundiza so we can get your perspective on them as well. We hope you enjoyed our perspective and – good luck, trading!

Best brokers

It is probably one of the best brokers for trading Forex. They have low trading costs, support pleasant, fast and personalized and a wide range of products to exchange.

Did you find this review helpful? Yes No

Excellent services

Excellent customer service. They have shown me friendliness and enthusiasm.

Did you find this review helpful? Yes No

Accurate signals

Faster execution than the rest of the brokers I have dealt with. Signals are accurate and they address all concerns promptly.

Did you find this review helpful? Yes No

Excellent services

Excellent services, good trading terms, and profitable signals. I don’t have any complaints, I am indeed thankful to this broker for helping me gain profit.

Did you find this review helpful? Yes No

Good trading experience

I experience good trading services from this company. Also, I was able to withdraw profit swiftly.

Did you find this review helpful? Yes No

Good broker

Overall, this is a good broker. Witdrawals is always smooth and fast.

Did you find this review helpful? Yes No

Good services

Enthusiastic customer service. They always turn concerns into positive experiences.

Did you find this review helpful? Yes No

Smooth withdrawals

Smooth withdrawals and good customer service. Highly recommended trading brokers.

Did you find this review helpful? Yes No

Good platform

They have a cool trading platform and tools. It is easier to trade forex with their software that is effective.

Did you find this review helpful? Yes No

Accurate signals

Faster execution than the rest of the brokers I have dealt with. Signals are accurate and they address all concerns promptly.

Did you find this review helpful? Yes No

Good broker overall

Overall broker performance is good. They attend to all of my queries promptly. Provides sound trading signals and useful trading tools.

Did you find this review helpful? Yes No

Good trading company

I can consider this as one of the best forex brokers. Services are very reliable and signals are profitable.

Did you find this review helpful? Yes No

Smooth withdrawals

With this broker, withdrawal is always smooth and signals are good. Been using their services for a few months now.

Did you find this review helpful? Yes No

Amazing brokers

Their customer service is truly amazing. They are helpful and attentive most of the time.

Did you find this review helpful? Yes No

Good services

Good spreads even on a volatile market. The signals are good as well as the services.

Did you find this review helpful? Yes No

Great forex broker

They have helped me understand how forex trading works. At first, I started trading with zero knowledge. They have patiently taught me everything and best of all they have helped me gain profit.

Did you find this review helpful? Yes No

Highly recommended

Not only offers great trading opportunities but also offers free trading education. I highly recommend this broker.

Did you find this review helpful? Yes No

Smooth withdrawals

I began to succeed in forex trading when I started using their services. Profitable signals and easy to withdraw profits, no hassle.

Did you find this review helpful? Yes No

Good broker

Fair trading terms and conditions. Good broker services as well. Been trading for a couple of months and had several withdrawals. So far, all is good.

Did you find this review helpful? Yes No

Best trading broker

One of the best trading company I have ever dealt with. I need not to worry about my trades, I just listen to their advise and wait for my profit.

Did you find this review helpful? Yes No

Helpful and patient

They have helped me grow my investment and understand the trends. They have skilled and patient brokers.

Did you find this review helpful? Yes No

Consistently good services

Services and signals are consistently good. I have been trading with this broker for a few months and the profits are progressing.

Did you find this review helpful? Yes No

Good brokers

Based on my trading results, I can say that these are good brokers. I can see their efforts and dedication to help me attain successful trades. I gain profit and was able to withdraw swiftly.

Did you find this review helpful? Yes No

Enthusiastic brokers

Enthusiastic brokers and customer service. They always work with fun. Easy to deal with and best of all, they never ail to deliver good result.

Did you find this review helpful? Yes No

Best trading company

This is one of the best trading company. They laid down so many good offers and the services are great.

Did you find this review helpful? Yes No

Good profit

I tried trading with them and gained good profit after a month. I have no regrets spending my time and money with this broker, it is worth it, indeed!

Did you find this review helpful? Yes No

Competitive services

They support me all the way and help me gain good profit. They offer competitive services and profitable deals. Highly commendable broker services.

Did you find this review helpful? Yes No

Good broker company

I am extremely happy about my trading results. I gain good profit and get good services from this broker company.

Did you find this review helpful? Yes No

Good profit

I am getting good profit on a monthly basis which is a good start. Been trading for over a month and I will surely keep the services. They seem good based on my first month results.

Did you find this review helpful? Yes No

Good profit

Happy to trade with them. I gain good profit.

Did you find this review helpful? Yes No

Good brokers

Based on my trading results, I can say that these are good brokers. I can see their efforts and dedication to help me attain successful trades. I gain profit and was able to withdraw swiftly.

Did you find this review helpful? Yes No

Excellent trading advise

Excellent trading advice from the brokers. I simply follow instructions and wait for my profit.

Did you find this review helpful? Yes No

Excellent broker performance

Excellent broker performance. I am happy and satisfied with the services.

Did you find this review helpful? Yes No

Skilled brokers

Simple and easy to use the platform, trustworthy and skilled brokers, useful and practical strategies. I have been using their services for 6 months and will stay for sure.

Did you find this review helpful? Yes No

Good broker company

Good customer service and withdrawal is fast. A good broker to trade with. They are skilled trading coach and has good trading education to help me.

Did you find this review helpful? Yes No

Good forex company

Good and trusted company for forex brokerage. They are experienced and skilled in the forex market. I gain profit from my trades, too.

Did you find this review helpful? Yes No

Reliable broker signals

Reliable source of trading signals and advise. I am happy and satisfied with my profit.

Did you find this review helpful? Yes No

Good trading broker

So far deposits and withdrawals were done smoothly. And the customer service is superb, too.

Did you find this review helpful? Yes No

Excellent broker

Excellent in all services. I have no regret choosing this broker, they are really very good.

Did you find this review helpful? Yes No

Excellent broker

Overall broker performance is excellent. I am happy with my profit.

Did you find this review helpful? Yes No

Good broker

Not just a good broker but the best forex broker in the industry. They’ve got fair trading terms and efficient trading services.

Did you find this review helpful? Yes No

Excellent trading advise

Excellent trading advise from the brokers. I simply follow instructions and wait for my profit.

Did you find this review helpful? Yes No

Good broker

Fast executions and withdrawals. Very effective trading advise. Good broker for online trading.

Did you find this review helpful? Yes No

Competitive

A competitive forex broker. Signals are always excellent and customer service are always helpful.

Did you find this review helpful? Yes No

Great signals

Good signals. Always accurate and profitable.

Did you find this review helpful? Yes No

Good broker

If you are wondering if this is a good broker to deal with. I can vouch for it. I have been trading with them for a year and services are guaranteed excellent.

Did you find this review helpful? Yes No

Excellent broker

Excellent forex brokers. I am impressed not only with their services but also with their support team. They are both competitive and knowledgeable.

Did you find this review helpful? Yes No

Great services

Great services for online trading. Signals are reliable and broker signals are reliable.

Did you find this review helpful? Yes No

Amazing broker

Smooth withdrawals, great selection of trading assets, affordable pricing and great services. I’ve got no complaints at all for the past six months. They’re truly amazing.

Did you find this review helpful? Yes No

Smooth transaction

The services are better than what I have expected. Faster than usual withdrawal process and all transactions are smooth.

Did you find this review helpful? Yes No

Good broker

Smooth transactions including withdrawals. Good customer service, too.

Did you find this review helpful? Yes No

Exceptional services

Services from this broker are simply exceptional. Their customer service are always attentive and signals are profitable.

Did you find this review helpful? Yes No

Great broker company

Great broker company. For me, they are one of the leading brands for forex brokerage.

Did you find this review helpful? Yes No

Good income

Two-thumbs up for this broker company. I gained a really good income for my family.

Did you find this review helpful? Yes No

Great customer service

Great customer service. They are always there for me and really helped me in all of my trading needs.

Did you find this review helpful? Yes No

Good customer service

Prompt and helpful customer service. Have provided the assistance I need in order to succeed in trading.

Did you find this review helpful? Yes No

Amazing platform

Amazing forex trading platform. It made trading so much easier for me. There are so many good features.

Did you find this review helpful? Yes No

Good to deal with

Good to deal with. They never give me any problem on withdrawals or whatsoever. I have a skilled mentor as well.

Did you find this review helpful? Yes No

Reliable broker signals

Reliable source of trading signals and advise. I am happy and satisfied with my profit.

Did you find this review helpful? Yes No

Smooth withdrawals

Easier and faster withdrawals. I never had any problem withdrawing my money.

Did you find this review helpful? Yes No

Excellent customer service

Excellent customer service. I am impressed on the way they assist me.

Did you find this review helpful? Yes No

Good forex broker

I had no problem at all with this broker. The signals and services are really good. Easy deposit and withdrawals.

Did you find this review helpful? Yes No

Good customer support

Good customer support. I always get the help I needed in trading. Signals and services are both great.

Did you find this review helpful? Yes No

Great broker services

Great and responsive brokers and customer service. I just started trading with them last month and so far all services seem good.

Did you find this review helpful? Yes No

Excellent broker

I joined this broker company last month and as early as 2 weeks I see potential. I must admit they are one of the best among any other brokers in the industry.

Did you find this review helpful? Yes No

Reliable broker

Reliable and great services. I had so many great options to earn money and I have a good return on my investment.

Did you find this review helpful? Yes No

Satisfied with the services

They offer a wide array of trading assets and great services. I am satisfied with all of their services and happy with my trading profit.

Did you find this review helpful? Yes No

Good broker

What I observe from a few months of trading with this broker is that all services are good. Withdrawal is fast and signals are spot on.

Did you find this review helpful? Yes No

On time withdrawals

Withdrawal is always on time. Services are one of the best. I am happy with all of my trading results so far.

Did you find this review helpful? Yes No

Consistently good

Good from day 1. I love their consistency on all services.

Did you find this review helpful? Yes No

Skilled brokers

All the trading instructions are clear and effective. Brokers are skilled and experience enough to get me winning trades.

Did you find this review helpful? Yes No

Reliable broker

Reliable and great services. I had so many great options to earn money and I have a good return on my investment.

Did you find this review helpful? Yes No

Good forex broker

I had no problem at all with this broker. The signals and services are really good. Easy deposit and withdrawals.

Did you find this review helpful? Yes No

Great brokerage services

Great brokerage services. Withdrawal has never been so easy. I am able to withdraw profits smoothly, without the hassle and without detours.

Did you find this review helpful? Yes No

Great source of income

I never write reviews but they deserve to. I was looking for an additional source of income when they were introduced to me. I can say that earning opportunities here are great, I even quit my full time job cause I really earn well.

Did you find this review helpful? Yes No

Highly recommended

Signals are accurate and profitable. Highly recommended.

Did you find this review helpful? Yes No

Profitable trading signals

Free trading signals that are truly profitable. I am consistently gaining good profits out of their trading signals.

Did you find this review helpful? Yes No

Great and trusted

A great and trusted company for forex brokerage. They are experienced and skilled in the forex market.

Did you find this review helpful? Yes No

Great trading advise

Great trading advice. I am always getting good profit from the broker’s advice.

Did you find this review helpful? Yes No

Good broker

Good broker. I am gaining decent profit so far.

Did you find this review helpful? Yes No

Helpful customer service

Helpful customer service. They attend to trading needs promptly.

Did you find this review helpful? Yes No

Easy withdrawals

Easy to withdraw money, no hassle.

Did you find this review helpful? Yes No

Accurate market analysis

Accurate and sound market analysis. Signals give out at least 8 to 10 percent profit. Services are good and people are very professional.

Did you find this review helpful? Yes No

Good broker

Good trading broker. They perform very well.

Did you find this review helpful? Yes No

Fully satisfied

Fully satisfied. This broker service provided me with the best services, the best signals, and the easiest withdrawal process.

Did you find this review helpful? Yes No

Great signals

Great signals and good trading platform. Have been using their services for a few months and it is really one of the best brokers.

Did you find this review helpful? Yes No

Impressive services

Impressive services with good signals. The moment I started trading I have zero knowledge and zero trading experience. Glad I trade with the right broker, they’ve helped me succeed.

Did you find this review helpful? Yes No

Good services

Good trading company. I never had any problem dealing with them. Services are all good.

Did you find this review helpful? Yes No

Happy with the services

I have been using this broker for a long time and I am satisfied. No plans for switching. I am more than happy with the services.

Did you find this review helpful? Yes No

Reliable Broker

Reliable and excellent services. I had so many options interesting to earn money and I have a good return on my investment.

Did you find this review helpful? Yes No

Professional broker

They are enthusiastic and very friendly. Assist me gain good profit and are very professional.

Did you find this review helpful? Yes No

Good customer service

Good customer service. I never encounter problems on any of their desks. They are very professional and skilled.

Did you find this review helpful? Yes No

Amazing trading platform

Amazing trading platform and trading signals. I become a decent profit on my first month. I expect to have more this month, the services are really great.

Did you find this review helpful? Yes No

Good forex broker

I had no problem at all with this broker. The signals and services are really good. Easy deposit and withdrawals.

Did you find this review helpful? Yes No

Satisfied with services

Have been using this broker service for a few months now and so far I am satisfied with the services, signals, and even with the people I am dealing with.

Did you find this review helpful? Yes No

Competitive broker

Competitive broker services and signals. I am glad to have picked the perfect broker to help me on all my trading needs.

Did you find this review helpful? Yes No

Excellent services

I can rate the services as excellent. Withdrawals are always fast and easy. Customer service is also very efficient.

Did you find this review helpful? Yes No

Helpful customer service

Helpful customer service. They attend to trading needs promptly.

Did you find this review helpful? Yes No

Great trading opportunites

There are so many great opportunities to make money. They have guided me toward profitable trading.

Did you find this review helpful? Yes No

Wonderful forex broker

The most wonderful broker to trade forex. They’re proven excellent in the market forecast. I get good profit trading with them and I am happy with the services.

Did you find this review helpful? Yes No

Great trading opportunities

There are so many great opportunities to make money. They have guided me toward profitable trading.

Did you find this review helpful? Yes No

Good broker company

A very good broker company. They are very responsible and are truly dedicated in helping me place great trades.

Did you find this review helpful? Yes No

Good broker

This is the place for investments. There are so many great opportunities. Both services and results are good.

Did you find this review helpful? Yes No

Happy and satisfied with this broker

I am on the right track with my trading career. It is all because of this brokers dedication and perseverance to help me suceed. I am happy and satisfied with this broker service.

Did you find this review helpful? Yes No

Great and trusted

Great and trusted company for forex brokerage. They are experience and skilled in the forex market.

Did you find this review helpful? Yes No

Profitable to Trade

Friendly and nice broker to deal with. Profitable to trade with, also. Two thumbs up for this broker service.

Did you find this review helpful? Yes No

Great trading advise

Great trading advice. I am always getting good profit from the broker’s advice.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker and customer service. I am fully satisfied with the services and highly recommend them.

Did you find this review helpful? Yes No

Good results

Everything here is smooth and easy. People are kind to me. I am so far, getting good results.

Did you find this review helpful? Yes No

Good profit

Happy to have them as my trading broker. I withdraw decent profit on a monthly basis.

Did you find this review helpful? Yes No

Best broker

One of the best broker companies to deal with. Signals and services are efficient.

Did you find this review helpful? Yes No

Good company

Good trading company. Signals are always accurate and services are truly amazing.

Did you find this review helpful? Yes No

Good broker company

Good broker company. There are so many good trading instruments to choose from.

Did you find this review helpful? Yes No

Good broker

Good trading broker. No gray areas all are explained very clearly.

Did you find this review helpful? Yes No

Happy with my profit

Easy deposit and withdrawal process. No much hassles and no fancy documents to provide. I am happy with my profit so far.

Did you find this review helpful? Yes No

Excellent customer service

Excellent customer service. They have been really very nice to me since day 1.

Did you find this review helpful? Yes No

Smart trading tools

Smart trading platforms and tools for daytrading. I have traded with several companies in the past but this one got the best tools.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Good broker

Excellent trading terms and great services. I am overall satisfied with the broker services.

Did you find this review helpful? Yes No

My favorate broker

They have been my favorate broker.Signals are good and withdrawal is fast.

Did you find this review helpful? Yes No

Good signals

Good signals and services. I am fully satisfied.

Did you find this review helpful? Yes No

Satisfied with services

Have been using this broker service for few months now and so far I am satisfied with services, signals and even with the people I am dealing with.

Did you find this review helpful? Yes No

Great broker

The broker is truly what it says it is. The promotions, services and signals are great. I am gaining good income and I’m satisfied with everything.

Did you find this review helpful? Yes No

Good customer service

Prompt and helpful customer service. Have provided the assistance I need in order to succeed in trading.

Did you find this review helpful? Yes No

Highly recommended

Helpful customer service and profitable signals. Highly recommended broker for online trading.

Did you find this review helpful? Yes No

Good profit

Glad to trade with them. They are very professional and I get good profit.

Did you find this review helpful? Yes No

Smooth withdrawals

So far deposits and withdrawals were done smoothly. And the customer service is superb.

Did you find this review helpful? Yes No

Highly recommended

They have made trading easy and more productive for me. Highly recommended trading services.

Did you find this review helpful? Yes No

The best broker

Nothing but the best. Signals are always accurate. I guess they are really dedicated in doing market research in order to come up with sound trading advice.

Did you find this review helpful? Yes No

Satisfied with this broker

Signals give good profit and services are great. I observe consistency for the past six months and I am very satisfied.

Did you find this review helpful? Yes No

Gain huge profit

I have gained really huge profit from this broker. Signals are great and withdrawal is smooth and quick.

Did you find this review helpful? Yes No

The best forex company

The best company for online trading. I really had a blast.

Did you find this review helpful? Yes No

Spot on signals

Spot on broker signals. They are highly skilled and always come up with accurate technical and fundamental analysis.

Did you find this review helpful? Yes No

Professional brokers

Professional brokers and customer service. They are educated and treated me nicely all the time.

Did you find this review helpful? Yes No

Ideal trading company

Ideal trading company. The signals are spot on and withdrawals are always on time.

Did you find this review helpful? Yes No

Prompt customer service

Prompt customer service. I am happy with the overall broker performance.

Did you find this review helpful? Yes No

Good broker

I had fun trading with this broker. I get good trading returns and I am dealing with good people.

Did you find this review helpful? Yes No

Satisfied with services

I gain good profit here and I am satisfied with the services.

Did you find this review helpful? Yes No

Good trading conditions

I am happy with the trading conditions. Tight spreads, good leverage, and fast execution. Signals are reliable and services are dependable.

Did you find this review helpful? Yes No

Excellent broker

I joined this broker company last month and as early as 2 weeks I see potential. I must admit they are one of the best among any other brokers in the industry.

Did you find this review helpful? Yes No

Great brokers

I am happy with my dedicated account manager. he really is very good in helping me manage my account. Satisfied as well with broker signals, with almost a hundred percent accuracy.

Did you find this review helpful? Yes No

Good broker company

Good broker company. No withdrawal issues.

Did you find this review helpful? Yes No

Excellent broker

I joined this broker company last month and as early as 2 weeks I see potential. I must admit they are one of the best among any other brokers in the industry.

Did you find this review helpful? Yes No

The best broker

The best broker service for forex trading. They have so many good things, highly recommended.

Did you find this review helpful? Yes No

Profitable options

I was offered equally profitable trading options. I am happy with my profit so far.

Did you find this review helpful? Yes No

Respected broker

Respected and trustworthy broker company. I have been with them for a few months and have decided to keep the services.

Did you find this review helpful? Yes No

Good broker

Signals and services are very effective. Good trading broker to deal with.

Did you find this review helpful? Yes No

Perfect forex broker

Perfect broker for online trading. They have so many good things to offer.

Did you find this review helpful? Yes No

Good broker service

No doubt, this is a good broker service. All transactions here are very transparent and smooth including withdrawals. I am happy to recommend this broker service.

Did you find this review helpful? Yes No

Great customer service

The best customer service, they are willing to help me anytime. Very resourceful and efficient.

Did you find this review helpful? Yes No

Great trading mentors

They are more than a trading broker. Aside from getting good profit from their good signals, they are also providing me with great trading education.

Did you find this review helpful? Yes No

Smart trading tools

Smart trading platforms and tools for day trading. I have traded with several companies in the past but this one got the best tools.

Did you find this review helpful? Yes No

Great trading mentors

They are more than a trading broker. Aside from getting good profit from their good signals, they are also providing me with great trading education.

Did you find this review helpful? Yes No

Good signals

Good signals and services. I am fully satisfied.

Did you find this review helpful? Yes No

Good trading software

No technical issues. Good trading software for online trading. Good support also.

Did you find this review helpful? Yes No

Great trading tolls and signals

What I can say about this broker service is that they have so many helpful tools and great trading signals to help you succeed in trading. I got great profit trading with them.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

My favorite broker

They have been my favorite broker. Signals are good and withdrawal is fast.

Did you find this review helpful? Yes No

Helpful customer service

Helpful customer service. They attend to trading needs promptly.

Did you find this review helpful? Yes No

Excellent services

I can rate the services excellent. Withdrawals are always fast and easy. Customer service is also very efficient.

Did you find this review helpful? Yes No

Satisfied with services

Have been using this broker service for a few months now and so far I am satisfied with the services, signals and even with the people, I am dealing with.

Did you find this review helpful? Yes No

The best broker

The best choice to trade forex with. Signals and services are all worthwhile.

Did you find this review helpful? Yes No

Superb broker

Superb broker services. I got no idea about forex when I started but they’ve been a good trading partner to me, really.

Did you find this review helpful? Yes No

Great broker

Great broker services. I will keep this broker and will surely recommend them.

Did you find this review helpful? Yes No

Great trading options

There are so many trading options. All are very affordable and profitable. I am amazed with the services and the profit I am getting.

Did you find this review helpful? Yes No

Highly recommended

I have been using this broker for a few months now and I have to admit I was very surprised with the profit I get from them. Highly commendable broker service.

Did you find this review helpful? Yes No

Best customer service

Great trading services. Fast withdrawal and the best customer service.

Did you find this review helpful? Yes No

Good broker

Excellent trading terms and great services. I am overall satisfied with the broker’s services.

Did you find this review helpful? Yes No

Good broker

Good trading broker to deal with. Signals are so much reliable and withdrawal is always fast.

Did you find this review helpful? Yes No

Good profit

Worth my money and time. I get a decent profit and was able to withdraw it swiftly.

Did you find this review helpful? Yes No

Satisfied with services

Glad to trade with them, I get amazing profit.

Did you find this review helpful? Yes No

Competitive

Very competitive forex broker. Signals are always excellent and customer service are always helpful.

Did you find this review helpful? Yes No

Best choice of broker

The best choice of broker I ever had. Signals are profitable and services are awesome.

Did you find this review helpful? Yes No

Great broker

Such a big help to my forex trading career. I a gaining good profit because of their reliable signals and great trading tools.

Did you find this review helpful? Yes No

Good trading company

Good trading company. Services are one of the best that I have ever used.

Did you find this review helpful? Yes No

Good customer service

They deliver good customer service. They reply to messages promptly.

Did you find this review helpful? Yes No

Satisfied with services

Have been using this broker service for a few months now and so far I am satisfied with services, signals and even with the people I am dealing with.

Did you find this review helpful? Yes No

Great trading advise

Amazing trading signals. I always gain profit from all of their tradings advice.

Did you find this review helpful? Yes No

Professional trading company

Professional trading company. They paid my withdrawals on time and attend to my trading concerns promptly.

Did you find this review helpful? Yes No

Good broker

They are good at what they do. They never settle for less but maximize their potential earnings.

Did you find this review helpful? Yes No

Best customer service

The best customer service, they are willing to help me anytime. Very resourceful and efficient.

Did you find this review helpful? Yes No

Satisfactory

Satisfactory broker services and signals. Highly recommended brokers for online trading.

Did you find this review helpful? Yes No

Accommodating customer service

Very accommodating customer service. Every time I send a message about any concerns, they immediately call me and address my needs.

Did you find this review helpful? Yes No

Good platform

Excellent platform and trading tools. They made everything easier for me.

Did you find this review helpful? Yes No

Excellent brokers

Good customer service and excellent brokers. I am gaining around 10-15 percent profit monthly and I am truly satisfied.

Did you find this review helpful? Yes No

Great forex brokers

Super fast and easy withdrawal process. Profitable signals and happy people assist me all the time.

Did you find this review helpful? Yes No

Warm and accommodating

The people are warm and accommodating. I am currently trading with them and I am truly satisfied with their trading services.

Did you find this review helpful? Yes No

Satisfied with my profit

I am so surprised at how this broker works hard and persevere to attain excellent trading results. I am happy and satisfied with my profit.

Did you find this review helpful? Yes No

Great broker

I found all that I am looking for in a broker in this broker service. Profitable signals, good platform, great services, and fast withdrawals. They all have it.

Did you find this review helpful? Yes No

Awesome broker

Awesome customer service and broker signals. I never had any problem dealing with them for the past 6 months.

Did you find this review helpful? Yes No

Wise choice

This is really a wise choice. Signals are profitable and withdrawal is easy.

Did you find this review helpful? Yes No

Good broker

What I observe from a few months of trading with this broker is that all services are good. Withdrawal is fast and signals are spot on.

Did you find this review helpful? Yes No

Reliable

Great source of market analysis and signals. Very reliable.

Did you find this review helpful? Yes No

Fast withdrawals

Withdrawals are always ultra fast. A good trading experience overall.

Did you find this review helpful? Yes No

Happy with profit

Excellent customer service and good withdrawals. Happy with profit.

Did you find this review helpful? Yes No

Highly recommended

Sincere in helping me gain good profit. They go the extra mile to get good trading results.

Did you find this review helpful? Yes No

Satisfied with my profit

I am so surprised at how this broker works hard and persevere to attain excellent trading results. I am happy and satisfied with my profit.

Did you find this review helpful? Yes No

Professional brokers

Regulated and professional broker service. One of the best who gives accurate and profitable signals.

Did you find this review helpful? Yes No

Good broker

This has been my broker for quite some time and so far all services are great. They are very professional and I love trading with them.

Did you find this review helpful? Yes No

Commendable brokers

Commendable brokers and customer service. I am glad they are my brokers.

Did you find this review helpful? Yes No

Perfect trading tools

Perfect trading tools and signals. I have no regrets about choosing them.

Did you find this review helpful? Yes No

Consistently great

I am working with this broker since last year and for more than a year, they’ve been consistently great. Have helped me gain really good profit.

Did you find this review helpful? Yes No

Good trading company

Good trading company. They are very professional in all transactions and attend to all trading needs promptly.

Did you find this review helpful? Yes No

Good signals

Good in providing trading signals and advise. I really enjoy trading with this broker, they are very nice and I get good profit.

Did you find this review helpful? Yes No

Smooth withdrawals

Easier and faster withdrawals. I have used several brokers in the past but among them, this broker has the smoothest withdrawal process.

Did you find this review helpful? Yes No

Great trading services

Good trading services and wonderful trading offers. I gain real good profit and have no problem with all of their services.

Did you find this review helpful? Yes No

Good broker

Good trading broker. Signals are always timely and profitable.

Did you find this review helpful? Yes No

Consistently good

Good from day 1. I love their consistency on all services.

Did you find this review helpful? Yes No

Smooth withdrawals

Smooth withdrawal process, profitable signals, and great services. I am keeping them to be my forex broker.

Did you find this review helpful? Yes No

Fast withdrawals

Low spread and fast execution. Fast withdrawal and no problem with winner tools and any of the services.

Did you find this review helpful? Yes No

Good trading services

Good trading services. I am truly satisfied with my trading result and pleased with their trading services.

Did you find this review helpful? Yes No

Fast withdrawals

Fast and hassle-free withdrawals. I have no complaints about the services, I get good profit.

Did you find this review helpful? Yes No

Smooth withdrawals

Easier and faster withdrawals. I have used several brokers in the past but among them, this broker has the smoothest withdrawal process.

Did you find this review helpful? Yes No

Great trading experience

My overall trading experience with this broker is great. I get good profit and I have no problem with the services so far.

Did you find this review helpful? Yes No

Great make money opportunities

Great opportunity to make money. Affordable initial deposit with really great returns.

Did you find this review helpful? Yes No

Highly recommended

Highly recommended broker for forex trading. I can always depend on the service and I can fully rely on the signals.

Did you find this review helpful? Yes No

Satisfied with this broker

Signals give good profit and services are great. I observe consistency for the past six months and I am very satisfied.

Did you find this review helpful? Yes No

Swift withdrawals

Swiftly process deposits. No hassle, the methods used to deposit are the same method used for withdrawals.

Did you find this review helpful? Yes No

Friendly

They are respectful and very friendly. I have no problem dealing with their customer services and even with the brokers.

Did you find this review helpful? Yes No

Best place to trade

Best place to trade forex. Instruments and signals are profitable. Withdrawals and customer service are both quick.

Did you find this review helpful? Yes No

Profitable signals

The best broker for forex trading among the brokers I have traded with. They have very reliable and profitable signals.

Did you find this review helpful? Yes No

Exceeded my expectations

They have exceeded my expectations. Have been very nice to me for the past 6 months. I am glad I have chosen them to be my forex broker.

Did you find this review helpful? Yes No

Accurate signals

Leaving this note to let everyone know that this is a good broker company. Withdrawals are smooth and fast. Signals are so much accurate and profitable.

Did you find this review helpful? Yes No

Outstanding brokers

Outstanding forex trading terms. Tight spreads, great bonuses, and fast withdrawals.

Did you find this review helpful? Yes No

Fast withdrawals

It only takes a day or two to get your money. Really very fast withdrawals. I am happy with the services and satisfied with the results.

Did you find this review helpful? Yes No

The best customer service

The best customer service. Always think out of the box and are very resourceful.

Did you find this review helpful? Yes No

Worthwhile signals

This broker company is fairly new in the forex industry but really shows good performance. Signals are worthwhile.

Did you find this review helpful? Yes No

Efficient trading services

Efficient trading services. I gain good profit and I am satisfied with the services.

Did you find this review helpful? Yes No

Good broker

I decided to risk and fortunately, it worked for me. I think in all trading there is a risk but getting a good result would all depend on whom you are trading with. This is a good broker to trade with.

Did you find this review helpful? Yes No

Good broker

I have traded with this broker for about a few months and based on my observation, they’re good.

Did you find this review helpful? Yes No

Great trading broker

What I really like about this broker service aside from being profitable is that I can easily trade on multiple markets on my account. I can access several markets easily. Great trading tools, indeed.

Did you find this review helpful? Yes No

Good to deal with

Good to deal with. Customer service treats me well and is always available to assist me in all of my trading concerns.

Did you find this review helpful? Yes No

On time withdrawals

Withdrawal is always on time. Services are one of the best. I am happy with all of my trading results so far.

Did you find this review helpful? Yes No

Reliable trading services

Seriously reliable trading services and tools. I am so impressed with all of my trading results.

Did you find this review helpful? Yes No

Effective trading advise

I trade with confidence because of this broker company. I am getting really effective trading advice.

Did you find this review helpful? Yes No

Good and decent broker

I am speaking about this broker using my personal experience as a basis of my opinion. They are good and decent brokers.

Did you find this review helpful? Yes No

Positive experience

Positive experience. I was able to withdraw swiftly and I get good money from the trades.

Did you find this review helpful? Yes No

Fast withdrawals

Fast withdrawals. Good broker for online trading.

Did you find this review helpful? Yes No

Accurate market forecast

I can merely rely on their daily analysis provided to me. The very accurate market forecast and signals are profitable.

Did you find this review helpful? Yes No

The best forex broker

Good to have one of the best forex trading brokers in the industry. I gain good profit and I am satisfied with the services.

Did you find this review helpful? Yes No

Reliable signals

Signals are always reliable. They have been very efficient for the past few months.

Did you find this review helpful? Yes No

Good signals

Good signals and services. I am fully satisfied.

Did you find this review helpful? Yes No

Satisfied trader

The satisfied trader here. Withdrawal is always fast and signals are all the time profitable.

Did you find this review helpful? Yes No

Great brokers

Great things I got in life all started here. I am happy that they are my broker.

Did you find this review helpful? Yes No

Quick support

Quick support, great spreads, never had a problem with withdrawals or whatsoever.

Did you find this review helpful? Yes No

Excellent services

Excellent services and spot-on trading signals. The best broker I have ever dealt with.

Did you find this review helpful? Yes No

Amazing broker company

They are simply an amazing broker company. I get the tools and services that I need.

Did you find this review helpful? Yes No

Amazing broker

Truly an amazing forex broker. Signals are worthwhile and services are always good.

Did you find this review helpful? Yes No

Highly recommended

Helpful customer service and profitable signals. Highly recommended broker for online trading.

Did you find this review helpful? Yes No

Good broker

Friendly customer service and very professional brokers. I am happy to deal with them, results are always good.

Did you find this review helpful? Yes No

Good broker

They offer really good trading services. I can confidently recommend this broker to all.

Did you find this review helpful? Yes No

Trusted broker

One of my trusted brokers. They are very transparent in all transactions.

Did you find this review helpful? Yes No

Great trading brokers

I have so many reasons to keep this broker service. Aside from fast withdrawals and good customer service, they also have very profitable signals.

Did you find this review helpful? Yes No

Fully satisfied

I never had any problem with the services so far. I have been trading with this broker for the past six months and I am fully satisfied.

Did you find this review helpful? Yes No

Good broker company

They really perform well in online trading. I get huge profit and good services as always.

Did you find this review helpful? Yes No

Good customer service

Good customer service. They are always responsive and promptly attend to my trading needs.

Did you find this review helpful? Yes No

Good customer support

Customer support is very responsible and friendly. They always respond to all of my queries promptly.

Did you find this review helpful? Yes No

Great trading software

Updated trading software. It made my trading career easier and more successful. It has so many useful features.

Did you find this review helpful? Yes No

Professional brokers

Very professional people. I never have to worry about my trades because they are responsible and skilled, too.

Did you find this review helpful? Yes No

Excellent broker

Tight spread, fast execution, and amazing results. I also get great support from customer service.

Did you find this review helpful? Yes No

Best broker company

Best broker company I have never ever met. they are very dedicated to providing profitable signals.

Did you find this review helpful? Yes No

Trusted broker

A broker band I can truly trust. The signals are always amazing.

Did you find this review helpful? Yes No

Good broker

Good trading broker. They have been very patient with me. Came in with zero forex knowledge but I still earn money thru their help.

Did you find this review helpful? Yes No

Fantastic trading software

Fantastic trading tools. They have the most advanced trading software that has so many great features.

Did you find this review helpful? Yes No

I am keeping the services

I’m very satisfied with platforms, customer service, pricing, signals, and everything. Been with them for a long time and I’m keeping the services.

Did you find this review helpful? Yes No

Reliable broker

Reliable broker service. I have no regrets choosing them to be my trading broker. They have been very honest and professional.

Did you find this review helpful? Yes No

Profitable signals

I never had any problem trading with them for the past six months. They’ve been consistently good and signals are consistently profitable.

Did you find this review helpful? Yes No

Good services

Good services and very professional people. I am happy with my profit so far.

Did you find this review helpful? Yes No

Great broker

This broker has a really good chart and excellent signals. I am fully satisfied with all of their services and I am happy with my profit.

Did you find this review helpful? Yes No

Amazing profit

The best trading service I have ever used. I get amazing profits on a monthly basis.

Did you find this review helpful? Yes No

Accurate market forecast

I can merely rely on their daily analysis provided to me. The very accurate market forecasts and signals are profitable.

Did you find this review helpful? Yes No

Wonderful platform

Wonderful trading software. Very easy to use and has so many great trading assets to choose from.

Did you find this review helpful? Yes No

Excellent signals

Excellent signals. I have traded with several broke in the past but this one got the best signals.

Did you find this review helpful? Yes No

Amazing services

Amazing services and good profit are my reason for keeping this broker service. I have never traded to brokers as good as this before.

Did you find this review helpful? Yes No

Absolutely recommended

I absolutely recommend this service to all traders. I am consistently getting good profit and the perfect services that I deserve. Good people and are highly skilled.

Did you find this review helpful? Yes No

Skilled brokers

Simple and easy to use the platform, trustworthy and skilled brokers, useful and practical strategies. I have been using their services for 6 months and will stay for sure.

Did you find this review helpful? Yes No

Great broker

I’d like to thank Tom, my account manager who has always been very nice to me. I have used this broker services for more than a year and I am truly satisfied with everything about them.

Did you find this review helpful? Yes No

Professional broker

Very professional trading broker. No hassle transactions including withdrawals.

Did you find this review helpful? Yes No

Absolutely recommended

Absolutely recommended! Very profitable signals. Withdrawal is smooth, almost real-time and customer service is prompt.

Did you find this review helpful? Yes No

Very good broker signals

Very good broker signals. They have very dedicated brokers doing market analysis.

Did you find this review helpful? Yes No

Fully satisfied

Good trading platform and trading services. I am happy I chose the right broker this time. I am fully satisfied with the services.

Did you find this review helpful? Yes No

Good profit

Signals here are so much profitable. I am gaining really good profit trading with them. Their excellent customer service is an added bonus.

Did you find this review helpful? Yes No

Fast withdrawals

Friendly customer service, commendable attitude. The withdrawal process is really fast and easy.

Did you find this review helpful? Yes No

Highly recommended

Reliable brokers and customer service. I am confident trading with this broker, they’re one of the best.

Did you find this review helpful? Yes No

Satisfied

Overall satisfied with this broker service. Signals are very profitable and customer service is friendly.

Did you find this review helpful? Yes No

Good broker

This broker defines excellence. Services are dependable and signals are reliable. They never fail to come up with good results.

Did you find this review helpful? Yes No

Good trading results

Skilled broker and customer service. They do most of the legwork for me.

Did you find this review helpful? Yes No

Great trading advise

Great trading advice. They never fail to give sound trading advice. Highly recommended brokers.

Did you find this review helpful? Yes No

Great signals

Great broker signals, always accurate and profitable. I am gaining a good profit out of their signals.

Did you find this review helpful? Yes No

Good broker

I am happy and satisfied with the services. Lucky enough to have such a good broker like them.

Did you find this review helpful? Yes No

Good broker

Good trading platform. Easy to use and up to date. Profitable signals and good customer service.

Did you find this review helpful? Yes No

Consistent profit

Profitable broker. I am getting profit monthly. I get different amounts because that is how trading works, not fix. Sometimes low, sometimes high profits but I consistently get and that’s what matters to me.

Did you find this review helpful? Yes No

Good trading results

I am happy with the services so far. I get good trading results.

Did you find this review helpful? Yes No

Excellent services

Excellent trading services. I never had any regret trading with this broker, all services are great.

Did you find this review helpful? Yes No

Excellent partner

Excellent trading partner. I was able to learn really good strategies from the brokers.

Did you find this review helpful? Yes No

Good company

A good one. They have been so very responsible and dedicated I helping me make money online.

Did you find this review helpful? Yes No

Excellent services

Excellent trading services. The signals are amazing.

Did you find this review helpful? Yes No

Highly recommended

Extraordinary forex broker company with people that has exemplary online trading skills. Highly recommended.

Did you find this review helpful? Yes No

Thumbs up

They are providing a really great service. I gain good profit in just a matter of few months. Thumbs up for this broker company.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker. I am pleased with all of their services.

Did you find this review helpful? Yes No

Wonderful company

Wonderful forex trading company. Signals are reliable and profitable.

Did you find this review helpful? Yes No

Professional brokers

Very objective on all projections. Keen on details and they are so professional.

Did you find this review helpful? Yes No

Good profit

Happy and blessed to have them as my forex adviser. I am on the right track and I get good profit.

Did you find this review helpful? Yes No

Good trading tools

I get really great trading options from this broker. My tools and the signals are very good.

Did you find this review helpful? Yes No

Good broker company

Trading terms and conditions are okay. I am fully satisfied with the services and happy with my profit as well.

Did you find this review helpful? Yes No

Good profit

I can withdraw my profit anytime without any hassle. All of the services are always very efficient and the profit is really good.

Did you find this review helpful? Yes No

Good broker. Been using their signals for a while now and so far it is profitable.

Did you find this review helpful? Yes No

Amazing signals

Signals are truly amazing. I get good trading profit.

Did you find this review helpful? Yes No

Good income

I am privileged enough to have all these opportunities to make money. I get a good income.

Did you find this review helpful? Yes No

Great signals

Great signals and goos trading platform. Have been using their services for a few months and it is really one of the best brokers.

Did you find this review helpful? Yes No

Outstanding trading services

Outstanding trading service. They are so reliable, I can confidently depend on their services.

Did you find this review helpful? Yes No

Effective trading advice

Effective trading advice. Sure to recommend.

Did you find this review helpful? Yes No

Good profit

Reluctant to trade at first due to fear of losing. I am really glad that I picked the right broker. I gain real good profit from their signals.

Did you find this review helpful? Yes No

Great trading facilities

Great trading facilities and trusted brokers. They never fail to give me good profit. I was able to double my initial deposit in just a few months.

Did you find this review helpful? Yes No

Fast withdrawals

Fast withdrawals and any other transactions are smoothly done. I never had any problem for the fast few months of trading with them.

Did you find this review helpful? Yes No

Good broker

For about six months I had a good observation. Will surely keep the services.

Did you find this review helpful? Yes No

Fair pricing

Fair pricing and good services. I am happy with the profit I am getting from this broker service.

Did you find this review helpful? Yes No

Good broker

Experience is great with them. I am currently trading for a few months now and all is proven good. Signals, services, and withdrawals are fine.

Did you find this review helpful? Yes No

Great broker service

Good broker for forex trading. Always ready to help support and strong broker signals.

Did you find this review helpful? Yes No

Effective trading strategies

A non-conventional broker service. Updated in latest trends in the financial market. They always come up with unique and effective trading strategies.

Did you find this review helpful? Yes No

Quick withdrawals

Quick withdrawal and excellent services. I have been trading with them for a year and got no complaints. Awesome brokers.

Did you find this review helpful? Yes No

Happy with the services

Profit is the most important thing for me. These broker brings so much profit and so I am happy with their services.

Did you find this review helpful? Yes No

Highly recommended

Affordable to trade with and are very reliable. Highly recommended.

Did you find this review helpful? Yes No

Great customer support

The great customer support they are available 24/7 and are very prompt in answering emails, chats, and even phone calls.

Did you find this review helpful? Yes No

Expert brokers

One of the best brokers I have traded with. Expert in market analysis and provides accurate signals. I am happy with their services.

Did you find this review helpful? Yes No

Great broker

I have been with this broker for around 18 months, within this time I have built up a good relationship with my accounts manager and with my broker. They treat all concerns with high importance and I feel valued as a trader.

Did you find this review helpful? Yes No

Good profit

I have no regrets about joining this trading company. I have gained a good profit from my trades.

Did you find this review helpful? Yes No

Quick withdrawals

Quick and easy withdrawal process. I never have any issues with their services.

Did you find this review helpful? Yes No

Satisfied

Prompt customer service and quick withdrawals. Happy and satisfied.

Did you find this review helpful? Yes No

Sounded market analysis

Sound market analysis and great trading tools. I am so far happy and satisfied with my trading results.

Did you find this review helpful? Yes No

Good support

Good customer support. They assist me in the best possible ways all the time.

Did you find this review helpful? Yes No

Simply good

My issue was resolved immediately by their customer service, no hassles getting through them. They are responsive even on chats and emails. Also, my withdrawals were swiftly processed. Simply good.

Did you find this review helpful? Yes No

Brilliant broker company

Brilliant broker company. I am happy with both profit and services.

Did you find this review helpful? Yes No

Trusted trading company

A trading company I can fully trust. Signals are accurate and withdrawals are always swift.

Did you find this review helpful? Yes No

Decent broker

Decent forex broker to deal with. Signals are so much reliable and withdrawal is fast and easy.

Did you find this review helpful? Yes No

Good signals

Signals are always accurate and services are great. I would definitely recommend this broker to all.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Good profit

Fun to trade with. I gain real good profit from their deals.

Did you find this review helpful? Yes No

Excellent customer service

Excellent customer service. They are just a call away and are really very responsive to messages.

Did you find this review helpful? Yes No

Reliable services

I can count on this broker service. Signals are truly reliable.

Did you find this review helpful? Yes No

Extraordinary

Extraordinary forex trading broker. Never fail to give me a good profit.

Did you find this review helpful? Yes No

Reliable services

Reliable trading services. Signals and services are all worth it.

Did you find this review helpful? Yes No

Spot on signals

Excellent trading services. Prompt customer service and spot-on signals.

Did you find this review helpful? Yes No

Excellent customer service

Excellent customer service. They have been really very nice to me since day 1.

Did you find this review helpful? Yes No

Awesome broker company

Awesome broker company. I am happy with the signals and so am I with the services.

Did you find this review helpful? Yes No

Great trading options

There are so many trading options. All are very affordable and profitable. I am amazed by the services and the profit I am getting.

Did you find this review helpful? Yes No

Worth it

Worth my money and time. They are worth trading with. Very profitable signals.

Did you find this review helpful? Yes No

Good service

Services have been good for the past few months. So far I am happy and satisfied.

Did you find this review helpful? Yes No

Professional broker

I felt like I found the best broker company to trade with. People are very professional and the services are all very efficient.

Did you find this review helpful? Yes No

On time withdrawals

I always get my withdrawal on time and sometimes even earlier. Thumbs up for this broker service.

Did you find this review helpful? Yes No

Excellent

Happy to rate them excellent. Customer service and brokers are very attentive and efficient.

Did you find this review helpful? Yes No

Skilled broker

Highly skilled brokers. They seem well-versed in the forex market.

Did you find this review helpful? Yes No

Accurate signals

State of the art trading facilities. The signals are always accurate as well.

Did you find this review helpful? Yes No

Good broker

Fast and easy to withdraw money. Signals are accurate and services are consistently good.

Did you find this review helpful? Yes No

Good broker

Smooth transactions including withdrawals. They are easy to deal with and are very professional in all commitments.

Did you find this review helpful? Yes No

Excellent signals

Excellent trading signals. I am gaining a good profit here.

Did you find this review helpful? Yes No

Friendly customer service

Helpful and friendly customer service. They are always there to help me.

Did you find this review helpful? Yes No

Amazing broker

I am very satisfied with my profit and with the services. Truly an amazing broker to deal with.

Did you find this review helpful? Yes No

Highly recommended

Helpful and knowledgeable brokers and customer service. Highly recommended trading company.

Did you find this review helpful? Yes No

Wonderful trading company

Wonderful trading company. They have very professional brokers and customer service. The tools are awesome and efficient.

Did you find this review helpful? Yes No

Accurate signals

Always come up with thorough market research and accurate signals. Highly recommended.

Did you find this review helpful? Yes No

Decent profit

I gain a decent profit and experience good services. Highly recommended brokers.

Did you find this review helpful? Yes No

Good broker

I felt like they are capable of giving me more profit. It shows on their first-month performance.

Did you find this review helpful? Yes No

Profitable

I got a really profitable experience with this broker. I will definitely keep the services.

Did you find this review helpful? Yes No

Good forex broker

I am willing to recommend this broker to everyone. They are a good forex broker.

Did you find this review helpful? Yes No

Convenient withdrawals

Convenient withdrawal process and good customer service. I enjoy dealing with this company, they are one of the best.

Did you find this review helpful? Yes No

The best broker

The best forex trading broker among the one I have tried. Been trading for more than a decade and I have used so many brokers. I decided to stay with them because they really give me good services and profit.

Did you find this review helpful? Yes No

Affordable pricing

Deposits and trading lot prices are really affordable. Anyone can trade with them, they are open to accepting non-experience trader like me. They help me earn and learn forex.

Did you find this review helpful? Yes No

Great brokers

I find this broker service great. I can rate them even higher than 5 stars. They are good providers of market analysis.

Did you find this review helpful? Yes No

Good trading advice

I trade with ease because I have this as my forex broker. They are very good at providing effective forex trading signals and advice.

Did you find this review helpful? Yes No

Impressive services

Impressed with the services, withdrawals are always on time or earlier. I never have a problem with customer service also, they’re very nice.

Did you find this review helpful? Yes No

Great trading broker

Absolutely great trading broker. I gain passive income and I am very satisfied with services.

Did you find this review helpful? Yes No

Profitable trading signals

I am happy to leave good comments about this broker’s services. They have been very good to me, very dedicated to providing me with good trading advice that are truly profitable.

Did you find this review helpful? Yes No

Good broker

Efficient broker services and good signals. I’ve got no regret dealing with this broker, they’re very good.

Did you find this review helpful? Yes No

Good profit

Great trading services for all traders. Signals are really good and profitable. I get a good profit.

Did you find this review helpful? Yes No

Fast withdrawals

Process withdrawals fastest and smoothest. I have used several brokers in the past but I prefer keeping this one, services are really good.

Did you find this review helpful? Yes No

Awesome

Awesome trading partners. They render great services and provide good trading signals.

Did you find this review helpful? Yes No

Great services

Good trading services. Signals are always profitable and services are good all the time.

Did you find this review helpful? Yes No

Excellent broker

Excellent forex broker. I am so much impressed with the services and satisfied with my profit.

Did you find this review helpful? Yes No

My favorite broker

One of my favorite broker for forex trading. They are highly skilled and are very professional in all dealings.

Did you find this review helpful? Yes No

Smooth withdrawals

Process withdrawals in an instant, no hassles no hard processes.Easy to deal with, smooth transactions.

Did you find this review helpful? Yes No

Excellent trading partner

Excellent trading partner. I always count on them for advice and I never fail to get effective ones. Thanks to my broker and account manager who are patiently helping me all the time.

Did you find this review helpful? Yes No

Great brokers

The smooth transaction that includes withdrawals and refunds. They understand and listens to traders, unlike other brokers I have tried who are manipulative.

Did you find this review helpful? Yes No

Fast withdrawals

It only takes a day or two to get your money. Really very fast withdrawals. I am happy with the services and satisfied with the results.

Did you find this review helpful? Yes No

Excellent services

Excellent services. Been using their services for a few months now and I am truly satisfied.

Did you find this review helpful? Yes No

Great trading facilities

Great trading facilities and trusted brokers. They never fail to give me a good profit. I was able to double my initial deposit in just a few months.

Did you find this review helpful? Yes No

Excellent

Excellent in terms of trading signals with a fast and easy withdrawal process. I never had any issues trading with them.

Did you find this review helpful? Yes No

Good profit

I really enjoy the services. I have traded with them with just the minimum amount and in just a span of a few months, I gain real good profit.

Did you find this review helpful? Yes No

Good forex broker