Forex day trading involves buying and selling currencies within one trading day, ensuring all positions are closed by the day’s end.

This approach leverages small market movements, offering traders multiple opportunities to profit within the same day.

Unlike traditional investment strategies that benefit from long-term price movements, forex day trading thrives on volatility and liquidity, demanding a unique set of skills and mindset from those who venture into this fast-paced trading style.

Requirements for Successful Forex Day Trading

Day trading demands a high level of time commitment, focus, and dedication. Traders must be quick in their decision-making and execution, often working under pressure as they simultaneously monitor multiple charts and indicators. The ability to make rapid decisions and execute trades swiftly is crucial. This requires a specific mindset characterised by discipline, patience, and resilience.

Unlike long-term investment strategies that rely on macroeconomic trends and company fundamentals, day trading is primarily driven by technical analysis. Traders use charts, historical data, and technical indicators to make informed decisions. The aim is to identify short-term trends and patterns that can be exploited for profit.

3 Key Factors to Consider For Successful Forex Day Trading

#1. Liquidity

Liquidity is a critical factor in day trading. It refers to the ease with which an asset can be bought or sold in the market without affecting its price. High liquidity is essential for day traders because it allows them to enter and exit positions quickly and efficiently.

The forex market is known for its high liquidity, making it an attractive choice for day traders. Currency pairs such as EUR/USD, GBP/USD, and USD/JPY are particularly popular due to their high trading volumes and tight spreads.

#2. Volatility

Volatility measures the rate at which the price of an asset increases or decreases for a given set of returns. In day trading, volatility is a double-edged sword.

On one hand, it creates opportunities for significant profits due to rapid price changes. On the other hand, it can lead to substantial losses if trades are not carefully managed. Day traders thrive in volatile markets, as price fluctuations provide numerous trading opportunities.

However, managing risk becomes even more critical in such environments.

#3. Trading Volume

Trading volume indicates the number of transactions executed for a particular asset within a specified period.

High trading volume is a positive indicator for day traders as it signifies strong interest and participation in the market. It helps traders identify potential entry and exit points and gauge the strength of a trend.

A currency pair with high trading volume is less likely to experience sudden price jumps due to large trades, making it easier for traders to execute their strategies.

Effective Forex Day Trading Strategies

#1. Trend Trading

Trend trading is a popular strategy among day traders. It involves analysing the direction of asset prices and making trades based on the identified trend. If the trend is upward, with higher highs, traders take long positions, buying the asset with the expectation of selling it at a higher price.

Conversely, if the trend is downward, with lower lows, traders take short positions, selling the asset with the anticipation of buying it back at a lower price.

Trend trading is not exclusive to day trading; it can be applied over various time frames. Positions can remain open as long as the trend continues, making them suitable for short-term and long-term traders. The key to successful trend trading is accurately identifying the trend direction and maintaining discipline to stay within the trend until it shows signs of reversal.

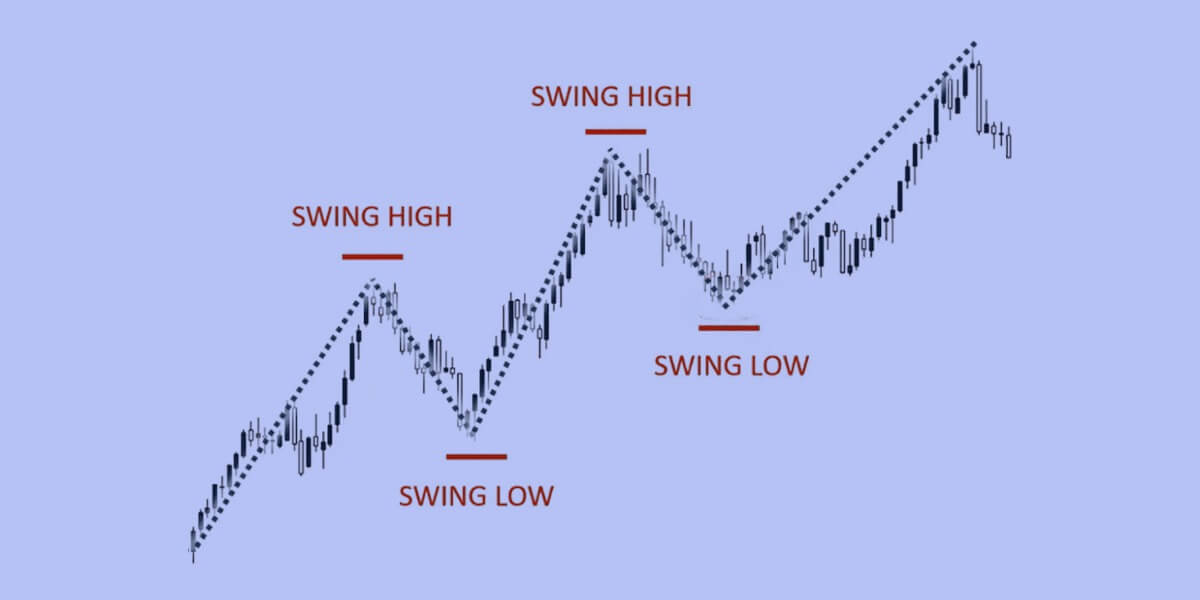

#2. Swing Trading

Swing trading takes advantage of short-term price patterns within a larger trend. This strategy aims to profit from upward and downward movements within the trend. Swing traders look for small reversals or “swings” in the market’s price movement. These reversals often occur at support and resistance levels, allowing traders to enter or exit positions.

Unlike trend trading, swing trading typically involves holding positions for several days to weeks, depending on the market conditions and the trend’s strength. This strategy requires patience and the ability to recognise potential reversal points.

Successful swing traders use a combination of technical analysis tools, such as moving averages, oscillators, and candlestick patterns, to make informed decisions.

#3. Scalping

Scalping is a short-term strategy that aims to make small, frequent profits by capitalising on minor price movements. Scalpers execute many trades within a day, holding positions for a short duration, often just a few minutes. The goal is to achieve a high win rate with small profit margins on each trade. Scalping requires a strict exit strategy to avoid losses that could counteract the small gains from successful trades.

Due to the fast-paced nature of scalping, traders must have a solid understanding of the market and be able to react quickly to price changes. Scalping is best suited for highly liquid markets with frequent and significant price movements. This strategy is demanding and requires constant market monitoring, making it suitable for experienced traders with the necessary skills and resources.

#4. Mean Reversion

Mean reversion is based on the theory that prices eventually return to their historical average. This strategy involves identifying assets that have deviated significantly from their historical mean and taking positions that profit from the return to the normal trajectory. Traders use technical analysis tools to identify these deviations and make informed decisions on when to enter or exit trades.

Mean reversion applies to various time frames, making it suitable for day trading and longer-term strategies. However, it requires a thorough understanding of historical price data and recognising when an asset will likely revert to its mean. This strategy works well in stable markets where prices fluctuate around a long-term average.

#5. Money Flows

The money flow strategy uses volume and price data to determine whether an asset is oversold or overbought. It involves analysing money flow into and out of an asset to generate trading signals. A reading of 80 or higher indicates an asset is overbought, signalling a potential sell opportunity. Conversely, a reading of 20 or lower suggests that an asset is oversold, presenting a potential buy opportunity.

Money flow analysis helps traders identify potential reversal points and decide when to enter or exit trades. This strategy requires a good understanding of volume and price dynamics and the ability to interpret various technical indicators. Successful traders use a combination of money flow analysis and other technical tools to increase the accuracy of their trading signals.

Starting Guide for Forex Day Trading

#1. Choosing How to Day Trade

The first step in starting forex day trading is deciding which product to trade with. Forex derivatives, such as contracts for difference (CFDs) and futures, are popular choices because they allow faster opening and closing of positions. These instruments give traders leverage, enabling them to control larger positions with less capital. However, leverage also increases the risk, making it essential to have a solid risk management strategy.

#2. Creating a Day Trading Plan

A well-defined day trading plan is crucial for success. This plan should outline your trading goals and set realistic targets. Decide whether you will rely on fundamental analysis, which revolves around macroeconomic data, company reports, and breaking news, or technical analysis, which focuses on chart patterns, historical data, and technical indicators. Your plan should also include criteria for entering and exiting trades and guidelines for managing risk.

Managing Day Trading Risk

Risk management is a critical aspect of day trading. A well-defined risk management strategy helps minimise potential losses and protect your trading capital. Use tools such as stop-loss orders and limits to manage risk effectively. Stop-loss orders automatically close a trade when the price reaches a predetermined level, limiting potential losses. Limits set the maximum amount you are willing to risk on a single trade.

Successful traders cut losing trades quickly and let profitable trades run. They target a risk-to-reward ratio of at least 1:2, meaning they aim to make twice as much profit as the amount they are willing to risk. This approach helps ensure that even if a few trades result in losses, the overall profitability of the trading strategy remains positive.

Opening and Monitoring Your First Position

When opening your first position, place long and short trades within a single trading day. Keep updated with market events and breaking news that can impact currency prices. Continuous market monitoring is essential to make timely decisions and execute trades effectively.

Close all your trades to avoid overnight market risks at the end of each trading day. Maintain a trading diary to record successful and unsuccessful trades, noting the reasons for each outcome. This diary is a valuable learning tool, helping you identify patterns and improve your trading strategies over time.

Conclusion

Forex day trading is a dynamic and challenging endeavour that offers significant profit potential for those who master it. By understanding the key factors that influence the forex market, adopting effective trading strategies, and implementing a robust risk management plan, traders can confidently navigate the complexities of day trading.