FINMARKET Review: Broker that offers top-quality trading experience

General Information

Broker Name: FINMARKET

Broker Type: Forex

Country: Cyprus

Operating since year: 2015

Regulation: CySec

Address: 56 Griva Digeni Avenue, AnnaTower, First Floor, 2063, Limassol, Cyprus

Broker status: Active

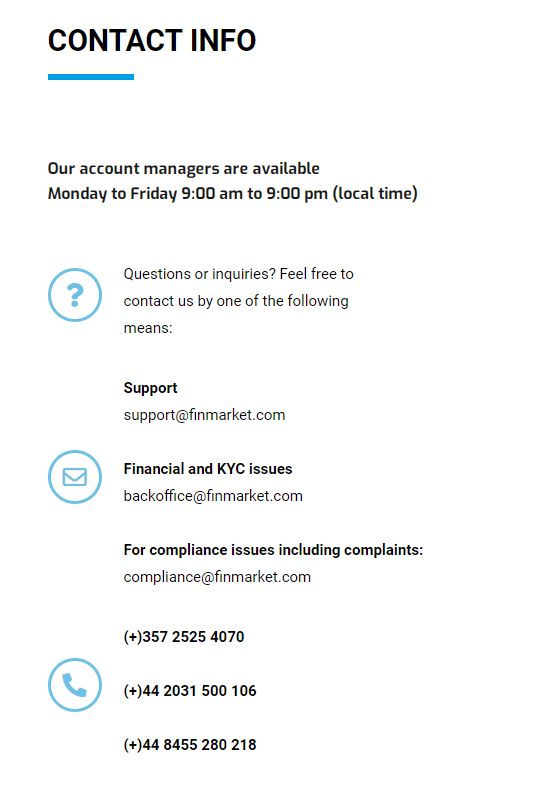

Customer Service

Phone: 357 2525 4070

Email: [email protected]

Languages: ENG, FR, IT, DE

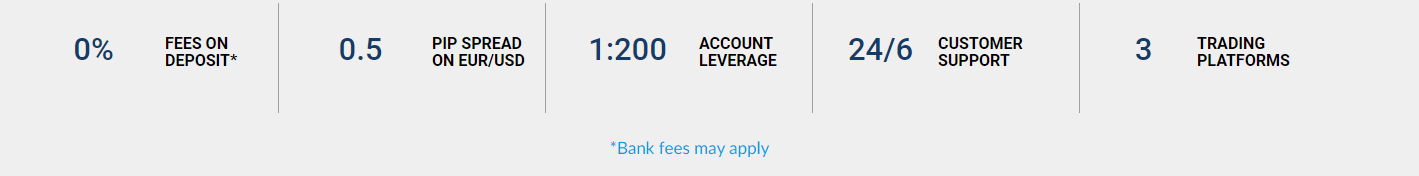

Availability: 24/6

Trading

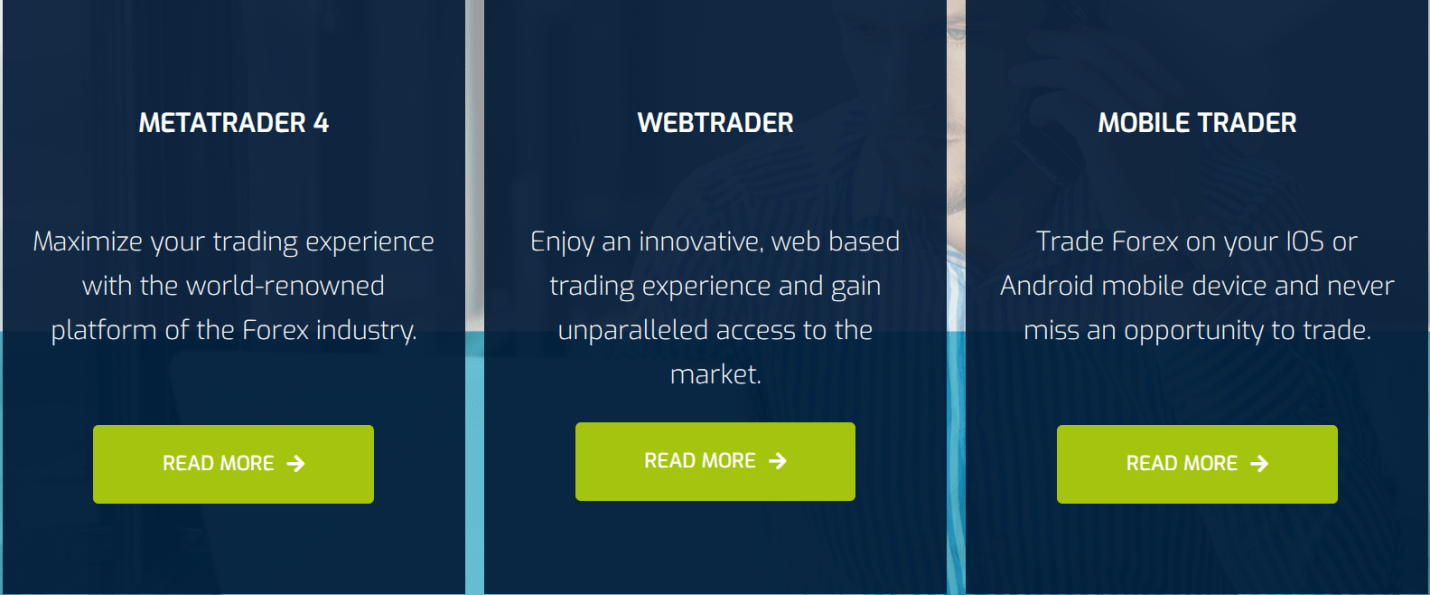

Trading platforms: MT4, WebTrader, MobileTrader

Trading platform Time zone: GMT+0

Demo account: No

Mobile trading: Yes

Web-based trading: Yes

Bonuses: Yes

Other trading instruments: Currency, CFDs, Stocks, Commodities, Cryptocurrency

Account

Minimum deposit ($): $250

Maximal leverage: 1:200

Spread: Variable

Scalping allowed: No

General Information

FINMARKET is an experienced broker offering Forex, CFD, and other services. The company was established in 2015 and is based in Cyprus. Its offices are located at 56 Griva Digeni Avenue, AnnaTower, First Floor, 2063, Limassol, Cyprus.

As soon as you find yourself on FINMARKET’s landing page, you will see that time hasn’t outdated them. Many older brokers are old-fashioned or have barely functional webpages. Web design has evolved rapidly, and typically brokers are unable to keep up. FINMARKET, however, is on top of the latest trends, providing a sleek, professional, and minimalist look.

Navigation is easy and intuitive, as everything you need to know is never more than a few clicks away. The drop-down menus on top of the landing page hold general brokerage info while you can scroll to the bottom to find out more about the legal details. As everything is readily available, doing your research about the broker is an easy task.

However, most traders put convenience second, behind the overall trading experience. As such, most are willing to turn a blind eye to a slightly clunky service. So we’ll cover some of the best trading-related details about the broker.

NO EXTRA CHARGES

As traders are aware, the finance world is full of risk on its own. Even the most recognizable names in the trading world can be a few bad trades away from going bankrupt. As such, it’s vital to grab any advantage you can, or adversely, avoid any disadvantage. Added fees are exactly that, an inherent disadvantage you need to overcome. And no matter how small they are, they add up over time and can make a huge dent in your long-term profits.

STRONG REGULATION

Security has been a hot topic in the trading world for quite some time now. With the influx of new traders, scams have become more noticeable, as novices usually don’t do their research and get tricked. As such, it’s quite a significant benefit that FINMARKET is covered by one of the best regulators in the world, CySEC. Not only that, but the firm vouches to follow MFID-related European Regulatory Requirements.

EXTENDED CUSTOMER SUPPORT WORK-TIME

Everyone knows that if you have an issue, dealing with customer service can be an unpleasant process. Even if you get the best representative, the stress of things not going your way can simply get to you. Couple that with the fact that trading is already quite stressful by itself, and you’ve got a recipe for disaster. That’s why it’s great that FINMARKET added an extra day of support; something most firms don’t offer. Then you can deal with your issues while not worrying about your trades.

Trading, Funds and Security

We mentioned earlier in our FINMARKET review that security is one of the firm’s strong points. To reiterate, they are regulated by Cyprus’ financial authority, known as CySEC. It is one of the strictest watchdogs out there. On top of that, the company operates under EU laws, which present another layer of safety. Lastly, the firm offers separate user and company financial accounts, which means you’ll get your money back even in the case of FINMARKET going under.

Another great factor in trustworthiness is reputation. Brokers that keep a clean slate over an extended period are extremely hard to come by, and traders should value them highly as such. FINMARKET falls into that category, with a small number of complaints in over half a decade that the firm has been operating. All those factors combined result in a safety rating rivaled by few.

Finmarket Account types

The broker provides a good variety of account types, surpassing much of the competition. The starting Silver account will set you back the usual $250, and from there, you can progress through the ranks until you reach Elite Member status. Although it’s named differently, the last rank is equivalent to a VIP account you’d see at other brokers.

Many brokers, however, use their account typing as sort of a trap to get traders to invest more. They lock key features behind account types to make their customers put in more than they otherwise would for functions they realistically shouldn’t be paying for at all. Luckily, there’s no trace of that at FINMARKET, as the experience across accounts is quite leveled.

However, you might ask, what’s the point of even upgrading then? The answer is simple. While there aren’t any function restrictions, the overall trading experience does improve. For example, the variable spreads get tighter as you move up account types. That results in a delicate balance between rewarding loyalty and not asking for much.

Perhaps the best part about the accounts is that you can accidentally upgrade simply by using the service for an extended period. That means you don’t necessarily need to chase better account types, and can just ease into them. Of course, if you’re willing to spoil yourself a bit, going for one of the higher ranks straight away isn’t a bad idea. Here are some of the specifications of each account type:

SILVER

Minimum deposit $250

Allow Expert Advisors: Yes

Hedging & Scalping allowed: Yes

Commission discount up to: Standard

Forex Variable Spreads (EURUSD): 4.0

Indices Variable Spreads (DOW): 240

GOLD

Minimum deposit $5000

Allow Expert Advisors: Yes

Hedging & Scalping allowed: Yes

Commission discount up to: 15%

Forex Variable Spreads (EURUSD): 3.4

Indices Variable Spreads (DOW): 238

PLATINUM

Minimum deposit $20000

Allow Expert Advisors: Yes

Hedging & Scalping allowed: Yes

Commission discount up to: 65%

Forex Variable Spreads (EURUSD): 1.1

Indices Variable Spreads (DOW): 235

DIAMOND

Minimum deposit $50000

Allow Expert Advisors: Yes

Hedging & Scalping allowed: Yes

Commission discount up to: 75%

Forex Variable Spreads (EURUSD): 0.9

Indices Variable Spreads (DOW): 230

ELITE

Minimum deposit $250000

Allow Expert Advisors: Yes

Hedging & Scalping allowed: Yes

Commission discount up to: 85%

Forex Variable Spreads (EURUSD): 0.8

Indices Variable Spreads (DOW): 225

The Trading Conditions

All the trading conditions at FINMARKET are good enough to even easily compete with market leaders. With tight spreads and good leverage levels across all accounts, you wouldn’t be missing out no matter how much you decide to invest. Even better, you get to customize your experience quite a bit by choosing among the multiple account types and numerous assets. The fact that FINMARKET also uses one of the leading trading platforms only further strengthens the level of service.

Even when you move past the conditions that strictly relate to trading, it’s more of the same. The support team is quick and works longer than the industry norm. All the deposit and withdrawal methods are free and process quite quickly. There are many options for payment, so your preferred one will nearly certainly be there. When everything’s added up, the firm leaves little to be desired.

Trading Platform

FINMARKET uses one of, if not the most used platforms worldwide in MetaTrader4. The platform allows new traders to adapt quickly, with an easy to use UI that makes it easy for novices to comprehend what their display is showing them. However, that doesn’t mean higher level traders lose out either, as there’s a wealth of analytical tools to assist them in their predictions.

On top of that, users get two extra options in the web and mobile traders. The former lets you access your account and trade from any desktop device without the need to download anything. The latter does require a download but allows you to buy or sell wherever you are, as long as you’ve got your phone with you.

FINMARKET’s Products

FINMARKET has a great dose of variety as far as the assets it offers go. It has something for each of the major categories, ensuring that there’s something for everyone. Meanwhile, their webpage has a short description for each product class to help those that are unsure where to go. The major trading product categories at FINMARKET are:

- Currencies

- CFDs

- Commodities

- Digital currencies

- Stocks and indices

Customer Service

As we already stated earlier in our FINMARKET review, their customer support team is a step ahead of the others. Not only does the company provide an added day of support, but it also lets customers enjoy the help of financial advisors. Few competitors offer similar services, and some words of wisdom are always welcome, so we suggest you utilize the offer.

Phone number: (+)357 2525 4070

Email: [email protected]

Conclusion

The world of brokerages is quite competitive, and as online trading popularity rises, the competition only gets harsher. Many fail to either meet initial demands or adapt over time and as a result go under. As such, a broker that’s consistently evolved and stayed competitive for over five years, such as FINMARKET, is a sight to behold. The firm provides a top-quality trading experience right now and keeps constantly improving.

However, traders are aware that trying a service is worth more than words can say. As such, we suggest you try out FINMARKET, as you just might decide to make it your new trading home.

Excellent customer service

So far, excellent customer service and profitable signals. I am a happy and satisfied client.

Did you find this review helpful? Yes No

Good broker

Based on my trading results, I can feel that these are good brokers. I can see their efforts and dedication to help me attain successful trades.

Did you find this review helpful? Yes No

Good services

Good service for forex trading. No problem with any of the services, all good.

Did you find this review helpful? Yes No

Fast withdrawals

Fast withdrawals. I never encounter any hassle in the withdrawal process.

Did you find this review helpful? Yes No

Warm customer service

Both brokers and customer service are warm and helpful. The signals are good but the terms are fair enough.

Did you find this review helpful? Yes No

Low trading cost

Has one of the lowest trading costs I have seen in the market, which I am not surprised. They offer competitive leverage and tight spreads, too.

Did you find this review helpful? Yes No

Extremely good broker

Extremely helpful customer service and great trading signals. I am so much happy with my profit and satisfied with their tools and services.

Did you find this review helpful? Yes No

Fantastic broker

Fantastic broker company. Services are really pleasant and there are so many ways to earn money.

Did you find this review helpful? Yes No

Good broker

Based on my trading results, I can feel that these are good brokers. I can see their efforts and dedication to help me attain successful trades.

Did you find this review helpful? Yes No

Excellent broker

Excellent trading services and fast withdrawals. I highly recommend this broker company to everyone.

Did you find this review helpful? Yes No

Easy withdrawals

Easy to withdraw money, no hassles and easy requirements for verification.

Did you find this review helpful? Yes No

Excellent brokers

Excellent broker performance. I always get desirable trading results. They always go beyond what is expected.

Did you find this review helpful? Yes No

Productive trading experience

I had a really fun and productive experience trading with this broker. Signals are all worth it and withdrawal is really smooth.

Did you find this review helpful? Yes No

Happy with services

I am pleased and happy with the services. Gaining good profit per month is fair enough.

Did you find this review helpful? Yes No

Smart trading tools

Smart trading platforms and tools for day trading. I have traded with several companies in the past but this one got the best tools.

Did you find this review helpful? Yes No

Good broker

Always maintain a good connection with me. Trading results are good and I am happy with customer service.

Did you find this review helpful? Yes No

Almost real-time withdrawals

Services are amazing and trading terms are fair. The best part, withdrawal is almost real-time. Good job.

Did you find this review helpful? Yes No

Good broker services

Pleased with this broker’s service. They have good trading materials and highly skilled brokers. Signals are accurate and profitable.

Did you find this review helpful? Yes No

Competitive broker

Competitive broker services and signals. I am glad to had picked the perfect broker to help me on all my trading needs.

Did you find this review helpful? Yes No

Satisfied with the services

Good customer service and smooth withdrawals. I am happy and satisfied with the services.

Did you find this review helpful? Yes No

Smooth payouts

No doubt, they process a payout. I just got mine. I was able to process it smoothly and it has been created in my bank account earlier.

Did you find this review helpful? Yes No

Profitable forecast

Awesome market forecast. They have accurate and profitable signals.

Did you find this review helpful? Yes No

Swift withdrawals

No long waits on withdrawals. I also get prompt answers from customer service

Did you find this review helpful? Yes No

Amazing profit

Great trading signals. I am surprised with the amazing profit I get every time.

Did you find this review helpful? Yes No

Impressive services

I have been using this broker service for over a year and so far it’s been a good experience. I gain good profit and services are always impressive.

Did you find this review helpful? Yes No

Good trading experience

I had a good broker experience. They explain all things clearly and process my withdrawals smoothly.

Did you find this review helpful? Yes No

Affordable trading

I can trade at a lower cost. They have affordable initial deposits and a lot of not so expensive trading assets. Signals are reliable, too.

Did you find this review helpful? Yes No

Good trading broker

Fast and hassle-free withdrawals. I have no complaints about the services, I get good profit for the past few months. A bit expensive to open an account and start trading but it’s worth my money and time.

Did you find this review helpful? Yes No

Impressive brokers

Impressive trading news. They are pretty much updated on the current market news and what’s best is that they have really strong analysis.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Professional broker

I felt like I found the best broker company to trade with. People are very professional and services are all very efficient.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Good broker

They have given me so many opportunities to earn good income. I am happy to deal with its happy people everyday as well.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker signals all the time. I am using their signals for more than a year and so They never fail to impress me.

Did you find this review helpful? Yes No

Outstanding broker

Outstanding broker services. They outperform most of the big broker company.

Did you find this review helpful? Yes No

Good broker

They have been a very good broker to me. They’ve helped me manage losses and taught me on thing I still don’t know.

Did you find this review helpful? Yes No

Great performance

Wonderful performance! Trades are simple to execute and frequently quite rewarding. Well done, brokers!

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Good broker

I have been using this broker service for a while now and so far so good. They’ve a wide range of trading assets, tight spreads, and fast withdrawals, too.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Worth my time

Worth my money and time. I am able to file for chargeback and successfully got my money back.

Did you find this review helpful? Yes No

The best broker

The best choice to trade forex with. Signals and services are all worthwhile.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

The best broker

The best broker among the ones I have traded with. Really amaze me with my monthly profit. People here al also very nice and friendly.

Did you find this review helpful? Yes No

Skilled brokers

I can always rely on signals and trading advice. They are skilled brokers and show expertise in forex trading.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

The best forex company

The best company for online trading. I really had a blast.

Did you find this review helpful? Yes No

The best forex company

The best company for online trading. I really had a blast.

Did you find this review helpful? Yes No

The best forex company

The best company for online trading. I really had a blast.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Warm and accomodating

These are the team of very professional guys from brokers, technical support to their customer service. They are very nice, warm and accommodating. And the skills they have in forex is exemplary.

Did you find this review helpful? Yes No

Sounded market analysis

Sound market analysis and great trading tools. I am so far happy and satisfied with my trading results.

Did you find this review helpful? Yes No

Reliable trading signals

Reliable trading signals and good services. I am sure that they are one of the best, been trading with them for almost a year now.

Did you find this review helpful? Yes No

Excellent signals

Worth my money and time, they are so dedicated in providing excellent signals.

Did you find this review helpful? Yes No

Good signals

I gain good profit from the signals. They always come up with accurate market analysis.

Did you find this review helpful? Yes No

Amazing signals

The signals and services are both amazing. I love trading with them.

Did you find this review helpful? Yes No

Fully satisfied

Fully satisfied. This broker service provided me with the best services, the best signals, and the easiest withdrawal process.

Did you find this review helpful? Yes No

The best broker services

Got the best online trading services. Withdrawal is fast and easy and signals are so profitable.

Did you find this review helpful? Yes No

Professional broker

Professional and friendly brokers and customer service. They are easy to deal with and are experienced in the forex market.

Did you find this review helpful? Yes No

Good brokers

I have traded with this broker for about a few months and based on my observation, they’re good.

Did you find this review helpful? Yes No

Interesting services

Interesting trading services and tools.I’m also satisfied with the trading conditions provided here.

Did you find this review helpful? Yes No

Sound analysis

Skilled brokers. They seem so experience in trading CFD’s. Always accurate and anticipates market movements. Sound analysis.

Did you find this review helpful? Yes No

Highly recommended

Highly recommended forex trading broker. The services are always good and I get good profit as well.

Did you find this review helpful? Yes No

Good broker

Fast execution,fast withdrawals and good customer service. I have been using their services for quite some time and so far everything works well.

Did you find this review helpful? Yes No

Professional broker

People are nice and are very professional. They do not take advantage of their traders but intead are very dedicated to help traders like me succeed.

Did you find this review helpful? Yes No

Good broker

I have been using this broker service for a while now and so far so good. They’ve wide range of trading assets, tight spreads and fast withdrawals, too.

Did you find this review helpful? Yes No

Good profit

They offer great trading opportunity. I am happy with the profit and prices are fair enough.

Did you find this review helpful? Yes No

Outstanding broker service

Outstanding broker service. I never had any issues with withdrawals, deposits not even with customer service.

Did you find this review helpful? Yes No

Happy with profit

This broker offers me very valuable and highly profitable trading options. I love the services and I am happy with my profit.

Did you find this review helpful? Yes No

Happy with profit

This broker offers me very valuable and highly profitable trading options. I love the services and I am happy with my profit.

Did you find this review helpful? Yes No

Profitable trading

All of their services are reliable and effective. I love trading with them, very profitable.

Did you find this review helpful? Yes No

Helpful customer service

Helpful customer service. I always get the support I need promptly.

Did you find this review helpful? Yes No

Amazing broker

This is one of the best trading company. The services are really good and people are amazing.

Did you find this review helpful? Yes No

Smooth withdrawals

Easier and faster withdrawals. I have used several brokers in the past but among them this broker has the smoothest withdrawal process.

Did you find this review helpful? Yes No

Very good services

Very good services. Friendly and willing to help customer service with great brokers providing profitable signals. All good.

Did you find this review helpful? Yes No

The best trading advise

They’ve got the best trading advice. Accurate and profitable all the time.

Did you find this review helpful? Yes No

Happy with this broker

No problem with withdrawals, tools or even services. I am happy since day 1.

Did you find this review helpful? Yes No

Excellent broker

This broker has so much to offer. Services are all excellent and signals are profitable.

Did you find this review helpful? Yes No

Excellent broker and mentor

I have joined this broker service with zero forex trading experience. I get to read a few articles about trading but did not really understand. I am glad I came into the right broker, they not only helped me gain profit but also, have taught me everything from basic to the most advanced lessons of forex trading.

Did you find this review helpful? Yes No

Good services

Services are good as always. I got several withdrawals which smoothly process. I get decent profit and I deal with professional people.

Did you find this review helpful? Yes No

Happy to recommend

I am overall satisfied with the broker’s services. Happy to recommend it.

Did you find this review helpful? Yes No

Good experience

I had a really good experience with this broker. The signals are good and so are the services. I am happy and satisfied.

Did you find this review helpful? Yes No

Professional broker

I felt like I found the best broker company to trade with. People are very professional and services are all very efficient.

Did you find this review helpful? Yes No

Good broker

Good trading broker. Signals are always timely and profitable.

Did you find this review helpful? Yes No

Good broker

Thumbs up. Services and signals are good.

Did you find this review helpful? Yes No

Efficient services

Extremely recommended services. Profitable and efficient.

Did you find this review helpful? Yes No

Good services

They attend to all of my trading needs promptly. Very efficient in all services and signals are worthwhile.

Did you find this review helpful? Yes No

The best broker

No doubt, this is the best broker for forex trading. Profit is consistent. And they never fail on their market forecast.

Did you find this review helpful? Yes No

Professional broker

Services are always awesome and people are very professional. I started trading with zero knowledge but they have patiently helped me succeed.

Did you find this review helpful? Yes No

Reliable signals

If you are looking for a good trading broker to deal with, can recommend this broker company. Signals are so much reliable.

Did you find this review helpful? Yes No

Happy with profit

Decent broker to start off. Signals are consistently reliable. I am happy with my profit.

Did you find this review helpful? Yes No

Good company

Good trading company. Their profit is always paid on time.

Did you find this review helpful? Yes No

Happy with profit

Decent broker to start off. Signals are consistently reliable. I am happy with my profit.

Did you find this review helpful? Yes No

Interesting services

Interesting trading services and tools. I’m also satisfied with the trading conditions provided here.

Did you find this review helpful? Yes No

Excellent services

The services are all excellent throughout. Have been trading with them for almost six months and I am very happy and satisfied.

Did you find this review helpful? Yes No

Highly recommended

Excellent customer service, fast withdrawals, and profitable signals. Highly recommend a forex broker.

Did you find this review helpful? Yes No

Professional broker

People are nice and very professional. They do not take advantage of their traders but instead are very dedicated to helping traders like me succeed.

Did you find this review helpful? Yes No

Professional broker

People are nice and very professional. They do not take advantage of their traders but instead are very dedicated to helping traders like me succeed.

Did you find this review helpful? Yes No

Profitable signals

Consistently profitable signals. I am fully satisfied with all of their services and will surely recommend them.

Did you find this review helpful? Yes No

Sound analysis

Skilled brokers. They seem so experienced in trading CFD’s. Always accurate and anticipates market movements. Sound analysis.

Did you find this review helpful? Yes No

Warm and accommodating

These are a team of very professional guys from brokers, and technical support their customer service. They are very nice, warm, and accommodating. And the skills they have in forex are exemplary.

Did you find this review helpful? Yes No

The best forex company

The best company for online trading. I really had a blast.

Did you find this review helpful? Yes No

Impressive signals

A good broker company to deal with. Impressive signals and great services.

Did you find this review helpful? Yes No

Good profit

They offer great trading opportunities. I am happy with the profit and prices are fair enough.

Did you find this review helpful? Yes No

Good broker

I have been using this broker service for a while now and so far so good. They’ve got a wide range of trading assets, tight spreads, and fast withdrawals, too.

Did you find this review helpful? Yes No

Trusted broker

My trusted trading broker. Very honest and dedicated.

Did you find this review helpful? Yes No

Good profit

Competitive trading conditions and broker signals. I gain good profit consistently.

Did you find this review helpful? Yes No

Reliable trading signals

Reliable trading signals and good services. I am sure that they are one of the best, been trading with them for almost a year now.

Did you find this review helpful? Yes No

Excellent signals

Excellent signals. I am happy to withdraw a good profit monthly.

Did you find this review helpful? Yes No

Smooth withdrawals

Smooth deposit and withdrawal process. I did not encounter any issues in the past few months and I am looking forward to seeing consistency in good services.

Did you find this review helpful? Yes No

Great brokers

Signals are very reliable and accurate. Great forex brokers.

Did you find this review helpful? Yes No

Wonderful forex company

Wonderful forex broker company with great customer support. I have been with them for some time now and I never encountered any problem so far.

Did you find this review helpful? Yes No

Great trading broker

What I really like about this broker service aside from being profitable is that I can easily trade on multiple markets on my account. I can access several markets easily. Great trading tools, indeed.

Did you find this review helpful? Yes No

My trusted broker

This by far is my trusted company for forex trading. Everything is clear and well explained prior to trading. They never fail to update me with statuses and market possibilities.

Did you find this review helpful? Yes No

Good profit

I love the way they assist me. They’ve been very patient. I came in with zero trading knowledge but they were able to manage my account effectively. I am gaining real good profit.

Did you find this review helpful? Yes No

Good broker

They have given me so many opportunities to earn a good income. I am happy to deal with its happy people every day as well.

Did you find this review helpful? Yes No

Good broker

Fast execution, fast withdrawals, and good customer service. I have been using their services for quite some time and so far everything works well.

Did you find this review helpful? Yes No

Swift withdrawals

I am overall happy and satisfied with this broker’s service. I get to withdraw profit swiftly.

Did you find this review helpful? Yes No

Good broker

Good to deal with. They never give me any problem with withdrawals whatsoever.

Did you find this review helpful? Yes No

Smooth withdrawals

Withdrawals are always smooth and easy. Tools are simple and easy to use.

Did you find this review helpful? Yes No

Good profit

Happy to have them as my trading broker. I withdraw decent profit on a monthly basis.

Did you find this review helpful? Yes No

Superb broker

Superb customer support and smart brokers. I am impressed with both signals and services, they outperform most of the brokers.

Did you find this review helpful? Yes No

Efficient services

Efficient service. Signals are so much profitable and customer service are reliable.

Did you find this review helpful? Yes No

Spot on signals

Spot on trading signals. I just need to follow their trading advice and I am gaining good profit.

Did you find this review helpful? Yes No

Smooth withdrawals

With this broker, withdrawal is always smooth and signals are good. Been using their services for a few months now.

Did you find this review helpful? Yes No

The best broker

The best choice to trade forex with. Signals and services are all worthwhile.

Did you find this review helpful? Yes No

Professional broker

I felt like I found the best broker company to trade with. People are very professional and services are all very efficient.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker signals all the time. I am using their signals for more than a year and so They never fail to impress me.

Did you find this review helpful? Yes No

Outstanding brokers

Outstanding forex trading terms. Tight spreads, great bonuses, and fast withdrawals.

Did you find this review helpful? Yes No

Reliable signals and services

Reliable trading signals and services. I am very satisfied with my profit and with all of their services so far.

Did you find this review helpful? Yes No

Fast withdrawals

Fast and hassle-free withdrawals. I have no complaints about the services, I get good profit.

Did you find this review helpful? Yes No

Best broker

One of the best broker companies to deal with. Signals and services are efficient.

Did you find this review helpful? Yes No

Amiable customer service

Amiable customer service. They are very friendly and they attend to my concerns promptly.

Did you find this review helpful? Yes No

Smart trading tools

Smart trading platforms and tools for day trading. I have traded with several companies in the past but this one got the best tools.

Did you find this review helpful? Yes No

Professional broker

This deserves more than a 5-star rating. They’ve been very professional in dealing with me and never fail to give profitable signals.

Did you find this review helpful? Yes No

Excellent signals

Worth my money and time, they are so dedicated to providing excellent signals.

Did you find this review helpful? Yes No

Happy to recommend

I am overall satisfied with the broker’s services. Happy to recommend it.

Did you find this review helpful? Yes No

Profitable trading

All of their services are reliable and effective. I love trading with them, very profitable.

Did you find this review helpful? Yes No

Good support

Profitable signals. I am always getting good profit from this broker.

Did you find this review helpful? Yes No

Good customer ssrvice

Good customer service. They are very helpful and professional. I am getting the support I need promptly.

Did you find this review helpful? Yes No

Recommending this broker to all

Fast withdrawals. It is almost real-time and it is also hassle-free.

Did you find this review helpful? Yes No

Great trading mentors

They are more than a trading broker. Aside from getting good profit from their good signals, they are also providing me with great trading education.

Did you find this review helpful? Yes No

Professional forex brokers

I am glad to leave a review for this broker service. They are very professional and skilled in forex trading.

Did you find this review helpful? Yes No

Outstanding platform and excellent support

This broker has an outstanding platform and excellent support. The platform is easy to use and support had been very cheerful in helping me with my trade concerns.

Did you find this review helpful? Yes No

Sound trading advise

Sound trading advise. I can fully rely on all signals, brokers are knowledgeable.

Did you find this review helpful? Yes No

Commendable brokers

Commendable brokers and customer service. They are very professional and helpful all the time.

Did you find this review helpful? Yes No

Excellent brokers

Excellent is not enough to describe their services. I am impressed with their support, their broker signals as well as their platform.

Did you find this review helpful? Yes No

Outstanding broker

Oustanding broker services. They outperform most of the big broker companies.

Did you find this review helpful? Yes No

Highly recommended

Highly recommended forex trading broker. The services are always good and I get good profit as well.

Did you find this review helpful? Yes No

Interesting services

Interesting trading services and tools. I’m also satisfied with the trading conditions provided here.

Did you find this review helpful? Yes No

Good broker

Not just a good broker but the best forex broker in the industry. They’ve got fair trading terms and efficient trading services.

Did you find this review helpful? Yes No

Profitable trading

All of their services are reliable and effective. I love trading with them, very profitable.

Did you find this review helpful? Yes No

Great trading experience

I had a great trading experience with this broker. I was able to withdraw a profit of approximately 15 percent monthly. I never had any problem with any of their transactions.

Did you find this review helpful? Yes No

Highly recommended

They have made trading easy and more productive for me. Highly recommended trading services.

Did you find this review helpful? Yes No

Good broker

Thumbs up for this broker company. Very supportive customer service and broker, great trading tools, and fast withdrawals.

Did you find this review helpful? Yes No

Good profit

I get good profit and services are consistently good. Thumbs up for this forex broker.

Did you find this review helpful? Yes No

Happy and satisfied

Great broker services and excellent trading signals. I am happy and satisfied.

Did you find this review helpful? Yes No

Impressive services

I am impressed with the great services and happy people I am dealing with daily. I am happy with my profit as well.

Did you find this review helpful? Yes No

The best broker services

Get the best online trading services. Withdrawal is fast and easy and signals are so profitable.

Did you find this review helpful? Yes No

Professional broker

People are nice and are very professional. They do not take advantage of their traders but instead are very dedicated to helping traders like me succeed.

Did you find this review helpful? Yes No

Impressive broker services

One of the best brokers to trade forex. signals are profitable and services are reliable.

Did you find this review helpful? Yes No

Trusted broker

I can fully trust their services. They are proven to be efficient brokers.

Did you find this review helpful? Yes No

Professional broker

People are nice and are very professional. They do not take advantage of their traders but instead are very dedicated to helping traders like me succeed.

Did you find this review helpful? Yes No

Worth my money and time

I am keeping this broker service because I get good profit. Worth my money and time.

Did you find this review helpful? Yes No

Good services

Tools and services are good. I am so far happy with my profit.

Did you find this review helpful? Yes No

Worth keeping

Excellent spreads offered minimal slippage and good trading profit. I will surely keep them as my forex broker.

Did you find this review helpful? Yes No

Highly recommended

The opportunities I had from this broker have greatly helped me gain good profit. Highly recommended.

Did you find this review helpful? Yes No

Reliable broker

Lucky to have them as my trading broker. They’ve been very reliable.

Did you find this review helpful? Yes No

Worth keeping

Excellent spreads offered minimal slippage and good trading profit. I will surely keep them as my forex broker.

Did you find this review helpful? Yes No

Professional broker

People are nice and are very professional. They do not take advantage of their traders but instead are very dedicated to helping traders like me succeed.

Did you find this review helpful? Yes No

Great service

Great broker service. They are always available when I need them.

Did you find this review helpful? Yes No

Great broker

Happy to recommend this broker company. They are very professional and deliver good results.

Did you find this review helpful? Yes No

Great performance

They have proven expertise in forex trading. I have been using their services for a few months and I am always impressed with their overall performance.

Did you find this review helpful? Yes No

Good services

They have been very attentive to all my trading needs. I get good profit and good services.

Did you find this review helpful? Yes No

Great performance

They have proven expertise in forex trading. I have been using their services for a few months and I am always impressed with their overall performance.

Did you find this review helpful? Yes No

Good profit

Very helpful and prompt in all trading concerns. Signals bring good profit and services are dependable.

Did you find this review helpful? Yes No

Profitable signals

This broker deserves more than 5 stars ratings. Signals are accurate and are always very profitable. It is also pretty easy to withdraw money, with no delays and no hassles.

Did you find this review helpful? Yes No

Highly recommended broker

I am just new to this broker company but as early as the first month I can see the good result and it progresses as I trade along. I can say I can confidently recommend them.

Did you find this review helpful? Yes No

Good services

Good broker services for online trading. Signals are always reliable.

Did you find this review helpful? Yes No

Great broker

Awesome trading tools and professional brokers. They made trading more productive and easier.

Did you find this review helpful? Yes No

Good trading broker

Good trading broker. They are easy to deal with and they promptly attend to all of my trading needs.

Did you find this review helpful? Yes No

Good broker

Signals and services are very effective. Good trading broker to deal with.

Did you find this review helpful? Yes No

No hassle withdrawals

Fast and easy withdrawals process. No hassle and people are easy to deal with.

Did you find this review helpful? Yes No

Good broker

Good broker. Customer services are friendly and the broker deals with me professionally all the time.

Did you find this review helpful? Yes No

Pleased with the services

I am totally pleased with all of their services including withdrawals and signals. Happy that I have finally found a great broker for trading.

Did you find this review helpful? Yes No

Good profit

Amazing services and good profit are my reason for keeping this broker service. I have never traded to brokers as good as this before.

Did you find this review helpful? Yes No

Excellent trading broker

Excellent execution! Never seen a re-quote. Hardworking and efficient customer service and brokers.

Did you find this review helpful? Yes No

Profitable broker

I would like to commend their customer service for being so professionals and helpful. Also, their profitable signals had to help me grow my investment.

Did you find this review helpful? Yes No

No hassle withdrawals

Fast and easy withdrawals process. No hassle and people are easy to deal with.

Did you find this review helpful? Yes No

Highly recommended

The outstanding platform and the trading services are perfect. Highly recommended forex broker.

Did you find this review helpful? Yes No

Happy with profit

This broker offers me very valuable and highly profitable trading options. I love the services and I am happy with my profit.

Did you find this review helpful? Yes No

Great broker

Exemplary broker performance. They excel in all of their trading services.

Did you find this review helpful? Yes No

Amazing brokers

Very good service, high leverage, and low spreads. I am truly amazed all the time.

Did you find this review helpful? Yes No

Great performance

They have proven expertise in forex trading. I have been using their services for a few months and I am always impressed with their overall performance.

Did you find this review helpful? Yes No

Good offers

The offers are really very good. I am getting good returns from all of the offers I have tried.

Did you find this review helpful? Yes No

Great performance

They have proven expertise in forex trading. I have been using their services for a few months and I am always impressed with their overall performance.

Did you find this review helpful? Yes No

Good trading brokers

I am happy with this broker. They are indeed good trading brokers to deal with.

Did you find this review helpful? Yes No

Great performance

They have proven expertise in forex trading. I have been using their services for a few months and I am always impressed with their overall performance.

Did you find this review helpful? Yes No

Good profit

Reluctant to try forex trading at first because I thought I will lose money on this but this broker has proven me wrong. I gain good profit with any of their offers.

Did you find this review helpful? Yes No

Decent trading brokers

Decent trading broker. I get good support and better tools.

Did you find this review helpful? Yes No

Great trading opportunity

I never write reviews but they deserve to. I was looking for an additional source of income when they were introduced to me. I can say that earning opportunities here are great, I even quit my full-time job cause I really earn well.

Did you find this review helpful? Yes No

Proven and tested good

They are proven and tested to be good brokers. I have gained good profit and I am happy with the services so far.

Did you find this review helpful? Yes No

Good profit

They have so many good opportunities to earn money. They are very dedicated to helping me grow my investment.

Did you find this review helpful? Yes No

Transparent broker

Very professional brokers and friendly customer service. I enjoy dealing with people and am happy with my profit.

Did you find this review helpful? Yes No

Good profit

These are well-rounded forex trading brokers. I had fun trading with them and best of all, I get a good profit.

Did you find this review helpful? Yes No

Very professional

I am delighted with this broker’s services. They’ve been very professional and easy to deal with.

Did you find this review helpful? Yes No

My super broker

They are my super broker. I gain real good money trading with them.

Did you find this review helpful? Yes No

Satisfied

I have been trading with them and so far I am fully satisfied.

Did you find this review helpful? Yes No

Fast withdrawals

Fast and smooth withdrawals. I never had any trouble dealing with them, they’re easy to deal with.

Did you find this review helpful? Yes No

The best broker

Thankful to its profitable signals, I am gaining good profit. Services are all good, no complaints. I am truly satisfied.

Did you find this review helpful? Yes No

Best trading company

The best trading company I have ever dealt with. Withdrawal is fast and easy.

Did you find this review helpful? Yes No

Perfect trading environment

Perfect trading environment. Signals are profitable, withdrawal is fast and they had good customer service.

Did you find this review helpful? Yes No

Great trading options

I have so many options to trade. All instruments are worthwhile.

Did you find this review helpful? Yes No

Love the services

I stayed updated with market news because they are very dedicated to doing research and come up with something new. Had so many great opportunities of earning. I love the services.

Did you find this review helpful? Yes No

Superb broker

Superb forex trading broker. All the trading tools are working smartly. I am impressed with the signals and with their customer service.

Did you find this review helpful? Yes No

Perfect broker

Perfect broker to trade forex with. Signals are profitable.

Did you find this review helpful? Yes No

Outstanding broker

Outstanding trading services and signals. I gain a good income and the people are very nice.

Did you find this review helpful? Yes No

Perfect forex broker

Perfect forex broker. Signals, withdrawals, and services are incomparable great.

Did you find this review helpful? Yes No

Professional and helpful

I would like to commend their customer service for being so professionals and helpful. Also, their profitable signals that had to help me grow my investment.

Did you find this review helpful? Yes No

Good performance

Good overall performance. I prefer to trade with this broker.

Did you find this review helpful? Yes No

Worth my money and time

I am keeping this broker service because I get good profit. Worth my money and time.

Did you find this review helpful? Yes No

Helpful broker

Trading isn’t easy and simple but this broker made it easy for me. They do most of the legwork and always come up with great results.

Did you find this review helpful? Yes No

Warm and accommodating

The people are warm and accommodating. I am currently trading with them and I am truly satisfied with their trading services.

Did you find this review helpful? Yes No

Excellent trading advise

Excellent trading advice. They do not just give good signals but also great trading education and risk management advice.

Did you find this review helpful? Yes No

Great trading instruments

They offer a wide selection of trading instruments to choose from. The assets are affordable and profitable.

Did you find this review helpful? Yes No

Profitable signals

I got awesome profits from this broker and still getting some more. Good and profitable signals.

Did you find this review helpful? Yes No

Excellent

Excellent in all ways. I get good profit.

Did you find this review helpful? Yes No

Reliable signals

Reliable trading signals and tools. I do not regret choosing them to be my online broker.

Did you find this review helpful? Yes No

Commit to excellence

Commit to excellence. They always go beyond expectations. Performs very well and has provided great trading results.

Did you find this review helpful? Yes No

Worth it

Worth my money and time. I am currently trading with this broker and I am very satisfied with my trading profit.

Did you find this review helpful? Yes No

Impressive broker

Impressive broker signals. I am surprised to see the trading results. They are such a great broker, highly recommended.

Did you find this review helpful? Yes No

Sound market analysis

I am getting good profit here. On a monthly basis, I almost get half of my invested amount. They are very dedicated to doing good market analysis and provides accurate trading signals.

Did you find this review helpful? Yes No

Good broker service

I can rate the signals and services, excellent. I get good profit and that clearly explains good ratings.

Did you find this review helpful? Yes No

Good profit

A bit expensive to trade with but all worth it. I am continuously gaining good profit.

Did you find this review helpful? Yes No

Warm and accommodating

The people are warm and accommodating. I am currently trading with them and I am truly satisfied with their trading services.

Did you find this review helpful? Yes No

Sound market analysis

They really went above and beyond in helping me earn profit in trading. They have sound market analysis and signals are accurate.

Did you find this review helpful? Yes No

Quick and easy withdrawals

They’ve been very good to me. Services are all good and withdrawals are always quick and easy.

Did you find this review helpful? Yes No

Good broker

Always maintain a good connection with me. Trading results are good and I am happy with customer service.

Did you find this review helpful? Yes No

Good trading services

Good services. They attend to all trading concerns promptly and effectively.

Did you find this review helpful? Yes No

Good services

Good trading services. I have been using this broker services for quite some time and so far they’ve been an amazing broker partner to me.

Did you find this review helpful? Yes No

Great broker

Has so many great opportunities to trade with. Services are also awesome. I have no problem trading with them for the past few months.

Did you find this review helpful? Yes No

Good broker

Good customer service and excellent broker advise. I am satisfied and happy with this broker service overall.

Did you find this review helpful? Yes No

Good trading opportunities

I was offered so many good opportunities. I took advantage of a few and really worked well for me.

Did you find this review helpful? Yes No

Amazing broker

I honestly don’t buy time to leave reviews such as this but these brokers deserve one. They are simply amazing. Would surely recommend them.

Did you find this review helpful? Yes No

Good earning opportunity

They offer really good earning opportunities. Every single offer I tried gets me good profit.

Did you find this review helpful? Yes No

Good trading services

Offers great trading instruments to trade, very affordable and profitable. Services are also very good.

Did you find this review helpful? Yes No

Excellent trading services

Excellent trading services. I gain a good profit and they’ve been very nice to me.

Did you find this review helpful? Yes No

Happy with this broker

Very happy with all of the processes, all seems smooth here. I will further observe but for my first month, all good.

Did you find this review helpful? Yes No

Great services

I am earning good in the comfort of my own home. I love the offers and the services.

Did you find this review helpful? Yes No

No hassle withdrawals

Fast and easy withdrawals. The moment I requested to withdraw money, they approve it and process it right away. No-hassle withdrawals.

Did you find this review helpful? Yes No

Easy withdrawal, this is what I want! Thank you

Did you find this review helpful? Yes No

Good services

Good services. Highly recommended trading broker.

Did you find this review helpful? Yes No

Good services

Services had been consistently good for the past few months. Happy to recommend it.

Did you find this review helpful? Yes No

Speedy withdrawal process

They always speed up the withdrawal process. I am amazed to see that money is even credited earlier than expected.

Did you find this review helpful? Yes No

Great trading assets

Offers a great selection of affordable and profitable trading assets. I have traded with a few commodities and I really get good profit. I am planning to trade currencies soon.

Did you find this review helpful? Yes No

Great broker

Great broker. I am happy and satisfied with the services.

Did you find this review helpful? Yes No

The best broker

The best and the most reliable broker service I have ever used. I am happy and satisfied.

Did you find this review helpful? Yes No

Affordable trading instruments

Affordable trading instruments. I do not have to spend too much to place trades.

Did you find this review helpful? Yes No

Proven effective trading advice

This broker is the best to deal with. Signals are reliable and profitable. I am gaining really good profit out of their trading signals and all trading advice is proven effective.

Did you find this review helpful? Yes No

Good broker

They have been a very good broker to me. They are always available in times I needed someone to coach me in my trading needs.

Did you find this review helpful? Yes No

Fast withdrawals

Services are good. Fast withdrawal for the first transaction. I hope it will be the same on the second and the rest.

Did you find this review helpful? Yes No

Satisfied

They have the fastest withdrawal process and excellent signals. I am satisfied with my profit.

Did you find this review helpful? Yes No

Good experience

Always a good experience for the past year of trading with them. I am keeping this broker service and will surely recommend it.

Did you find this review helpful? Yes No

Great brokers

Great broker for forex trading. Withdrawal is always fast and easy. Signals are also always very productive.

Did you find this review helpful? Yes No

Fast withdrawals

Pleased with the services. Fast and easy withdrawals, responsive customer service, and skilled broker.

Did you find this review helpful? Yes No

Good trading chart

Very good trading charts with filters. Easy to use and is up to date.

Did you find this review helpful? Yes No

Great customer service

I had fun dealing with their customer service, they are very friendly and approachable.

Did you find this review helpful? Yes No

Fast withdrawals

This has been my long time forex broker. I love the services especially the fast withdrawals.

Did you find this review helpful? Yes No

Highly recommended,good brokers

Highly recommended forex brokers, I appreciate their genuine concern and help in making my trades successful.

Did you find this review helpful? Yes No

Highly recommended brokers

Highly recommended broker services. They have accurate signals, fast execution, quick withdrawals, and great customer service.

Did you find this review helpful? Yes No

Great performance

They have proven experties in forex trading. I have been using their services for a few months and I am always impressed with their overall performance.

Did you find this review helpful? Yes No

Good signals

Good trading signals. Accurate and profitable all the time.

Did you find this review helpful? Yes No

Good services

Overall the broker is trustworthy and reliable. Services are always good.

Did you find this review helpful? Yes No

Trusted broker

Trusted broker for forex trading. They are honest and explains everything about trading clearly. I am always aware and updated on my trades.

Did you find this review helpful? Yes No

Good trading deals

Offers really good trading deals. I have been trading currency currencies and the results are favorable.

Did you find this review helpful? Yes No

One of the best

One of the best brokers I have dealt with in the forex market. I got a 10-11 percent profit on my first month and I really see potential to make money here.

Did you find this review helpful? Yes No

Excellent trading offers

Excellent trading offers. I gain a really good return on investment. I expected them to be good but I receive better services than expected.

Did you find this review helpful? Yes No

Good market forecast

I owe my trading success to this broker’s hard works. I always get a real good market forecast.

Did you find this review helpful? Yes No

Good trading company

Good trading company. They are very professional in whatever transaction I have with them.

Did you find this review helpful? Yes No

Excellent signals

Excellent trading signals. I enjoy the profit I am getting from this broker.

Did you find this review helpful? Yes No

Good broker service

I will surely keep this trading broker. Services are good.

Did you find this review helpful? Yes No

Good trading advise

I get really good trading advice from the brokers. I am profitable on my trades because of them.

Did you find this review helpful? Yes No

Good signals

The best place t trade forex. The signals are good and the services are amazing.

Did you find this review helpful? Yes No

Good trading broker

These for me are good trading brokers. Signals are worthwhile and services are always efficient.

Did you find this review helpful? Yes No

Efficient broker

Efficient trading broker. They process withdrawals real fast.

Did you find this review helpful? Yes No

Great trading opportunity

I never write reviews but they deserve to. I was looking for an additional source of income when they were introduced to me. I can say that earning opportunities here are great, I even quit my full-time job cause I really earn well.

Did you find this review helpful? Yes No

Easy to deal with

Easy to deal with trading brokers. They process withdrawals swiftly.

Did you find this review helpful? Yes No

Profitable signals

Consistently profitable signals. I am fully satisfied with all of their services and will surely recommend them.

Did you find this review helpful? Yes No

Expert brokers

Expert brokers. I find this trading company good and the services are efficient.

Did you find this review helpful? Yes No

Good broker

I was able to withdraw profit swiftly. I also get prompt replies from customer service.

Did you find this review helpful? Yes No

Good offers

They have so many interesting offers and I really get the proper support I needed in order to succeed. Glad to have them as my trading broker.

Did you find this review helpful? Yes No

Good offers

The offers are really very good. I am getting good returns from all of the offers I have tried.

Did you find this review helpful? Yes No

Happy with profit

This broker offers me very valuable and highly profitable trading options. I love the services and I am happy with my profit.

Did you find this review helpful? Yes No

Great broker

Great spreads. Always a phone call or just a message away, anytime.

Did you find this review helpful? Yes No

Trusted broker

I only trust this company for forex brokerage. I have proven their expertise and tested their honesty.

Did you find this review helpful? Yes No

Easy withdrawals

Easy withdrawal of funds and prompt customer services. I am overall satisfied with this forex broker services.

Did you find this review helpful? Yes No

Huge profit

I had a great trading experience with this company. I am earning huge profits on a monthly basis.

Did you find this review helpful? Yes No

Great trading options

I have so many options to trade. All instruments are worthwhile.

Did you find this review helpful? Yes No

Impressive services

Impressive broker services. Two thumbs up for them.

Did you find this review helpful? Yes No

Good broker

They’ve been very good to me all the time. Signals are very profitable.

Did you find this review helpful? Yes No

Incredible brokers

Incredible trading company. They have so much to offer.

Did you find this review helpful? Yes No

Excellent broker

Excellent trading services. I am so impressed with this broker’s performance. Aside from gaining good profit, they also serve as a very good trading mentor to me. They have taught me everything I need to know about trading.

Did you find this review helpful? Yes No