Review of all decent set of products and tools: is FBS Broker worth a try?

Introduction to FBS Review

FBS Inc. entered the trading industry in 2009, and has since broadened its reach in over 190 countries, with a customer base of 13 million traders. This broker is well-decorated, earning a number of international awards and recognitions throughout its years in the industry.

FBS conducts seminars and special events to provide its clients, both novice and expert traders, with the necessary learning tools, advanced trading technologies, and latest methods on the

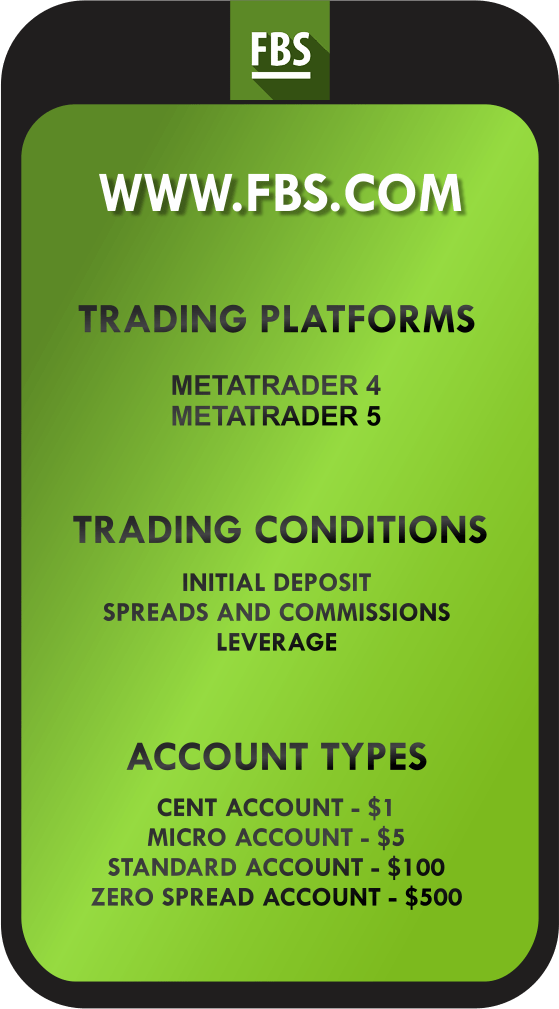

financial market. As regards platforms, FBS has a suite of MeTrader platforms available, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

This broker also understands that every client is different and the same can be said when it comes to their needs. That is why, FBS offers swap-free account or Islamic account to meet the different demands of traders, particularly the requirements of Muslim traders.

FBS Account Types

One key reason why investors opt for FBS is because of its low barrier, as it only requires a minimum deposit of $1.

FBS’ accounts cater to all types of traders. From market participants seeking minimal risks to those who prefer to trade in huge volume, FBS offers five account types, each having their own conditions and advantages.

Clients on the platform can also become VIP members and receive exclusive benefits once they funded their accounts for $10,000 and traded 50 lots.

There are two account types suitable for small traders, the Cent and Micro account, which share the following the conditions and benefits:

- No commission

- Maximum of 200 open positions and pending orders

- Straight-Through Processing (STP) execution rate starting at 0.3 sec

While distinguishing requirements include:

Cent Account

- Initial deposit $1

- Floating spread from 1 pip

- Maximum leverage up to 1:1000

- Order volume from 0,01 to 1,000 cent lots (with 0,01 step)

Micro Account

- Initial deposit $5

- Fixed spread from 3 pips

- Maximum leverage up to 1:3000

- Order volume from 0,01 to 500 lots (with 0,01 step)

On the other hand, FBS’ Standard account fits experienced market players making their way up the trading ladder.

Standard Account

- Initial deposit $100

- Floating spread from 0.5 pips

- No commission

- Maximum leverage up to 1:3000

- Maximum of 200 open positions and pending orders

- Order volume from 0,01 to 500 lots (with 0,01 step)

- STP execution rate starting at 0.3 sec

The Zero Spread account enables investors to trade immediately without spread charges.

Zero Spread Account

- Initial deposit $500

- Fixed spread from 0 pips

- Commission from $20 per lot

- Maximum leverage up to 1:3000

- Maximum of 200 open positions and pending orders

- Order volume from 0,01 to 500 lots (with 0,01 step)

- STP execution rate starting at 0.3 sec

Lastly, the Electronic Communications Network (ECN) account is designed for expert and long-term traders, as well as those who are interested in experiencing the capabilities of ECN technology.

ECN Account

- Initial deposit $1,000

- Floating spread from -1 pip

- Commission from $6

- Maximum leverage up to 1:500

- No limits for open positions and pending orders

- Order volume from 0,01 to 500 lots (with 0,01 step)

- Full ECN execution

Trading with leverage means there are risks involved. FBS has a negative balance protection in place to prevent clients’ accounts from losing what they have invested. Still, it’s better to set stops to secure positions, as these can offer some assurance from likely huge losses.

Trading Products

FBS provides access to 4 major trading products, i.e., Forex, Precious Metals, Stocks, Cryptocurrencies. Excluding ECN account, the Account types mentioned above support trading instruments, including 35 currency pairs, 4 precious metals, 3 CFDs, and 4 cryptocurrencies.

Forex

- Clients of FBS may trade major and exotic currency pairs such as USD/JPY, EUR/TRY, AUD/CAD, and others.

- Lot size is 100,000

- Swap-free option is not offered on exotic currencies

- Average spread of 0.8 pip and 1 pip for exotic currency pairs

Precious Metals

- Available metals include gold, silver, palladium and platinum

- Lot size is 100

- Maximum leverage is up to 1:333

- Average spread from 5 pips

CFD

- All account types, except for ECN, may access derivatives on Brent crude oil, West Texas Intermediate (WTI) crude oil, and DAX30

- Average spread of 2 pips

- Lot size starts at 10

- Commission of $15 for Cent account and $25 commission for Micro, Standard, and Zero Spread accounts

Stocks

- Standard account holders can trade more 30 stocks on the FBS platform

- Commission of $3 for Cent, Standard, and Zero Spread account

- Maximum leverage available up to 1:10

- Lot size is 10

- Average spread of 3 pips

Cryptocurrencies

- FBS allows CFD trading in cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Dash

- Maximum leverage up to 1:3

- Lot size starts at 1

- Average spread from 300 pips

- Commission of $15 for Cent and Standard accounts

Trading Conditions

As far as trading conditions are concerned, FBS’ seems quite reasonable.

Initial Deposit

- As mentioned earlier, FBS’ $1 minimum deposit is one major reason why investors chose to trade with this broker, as this a low initial amount. Some online brokers will require at least $100 as a minimum to be able to trade with them.

Spreads and Commissions

- Out of all FBS’ five account types, traders may find the spreads on the ECN account to be the most ideal, as they start from negative 1 pip and the commission is $6 per lot. The average spreads offered by other brokers are usually 0.6 pips.

Leverage

- This broker’s maximum leverage of 1:3000 is considered to be among the highest in the industry, which is excellent, particularly for traders with a small budget, since it enables them to trade with higher amounts.

However, it’s important to be wary when trading with high leverage levels, as there are risks associated when trading with leverage, and the higher the leverage becomes, the bigger the risk.

Conclusion – Is FBS good?

Having garnered millions of traders, it is safe to say that FBS got a number of things right – its offering of fee and commission structures, selection of platforms, as well as its ability to deliver reliable services to clients.

While FBS does not have most of the trading instruments that other online brokers offer, the platform still has a decent set of products available for traders – this is the core negative point of FBS review.

With multiple account types to choose from, excellent spreads, a maximum leverage of up to 1:3000, and STP processing, FBS provides investors with a steady trading environment.

This broker also stayed with the officially qualified trading platforms. FBS is available on both the MT4 and MT5, which include desktop, web-based, and mobile trading.

Scammers

I was scammed by this broker. I am unable to withdraw.

Did you find this review helpful? Yes No

Unsatisfied

I am not satisfied with the trading services and I am unhappy with the trading results. During the time when I am still trading with them, I always encounter problems with the platform, too.

Did you find this review helpful? Yes No

Stay away

Stay away from them. They will ripped off your bank account.

Did you find this review helpful? Yes No

Bad services

Bad trading services. They do not process withdrawals and ignore you after the deposit stage.

Did you find this review helpful? Yes No

Unreliable signals

Not a good trading broker. Signals are very unreliable.

Did you find this review helpful? Yes No

Bad broker company

I am not getting a proper reply from my missing withdrawals. Bad broker company

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. There are so many terms and requirements needed.

Did you find this review helpful? Yes No

Poor trading advise

It is not a good choice for a broker. I have traded with them and have lose so much money. Poor trading advise.

Did you find this review helpful? Yes No

Liars and cheaters

Liars and cheaters. Do not fall on their tricks, it is just a way to rubbed your money.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Bad broker

They hand up on me on topics of withdrawals but are very prompt on deposits. Bad broker.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Poor broker

Poor broker performance. Not recommended.

Did you find this review helpful? Yes No

Poor trading tools

Poor trading tools. I had encounter so many technical problems.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They are not acomodating and prefers to ignore trading concerns.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Warning! scammers

Stay away from them. I am a victim of their scam. I am writing this review to warn and help everyone to be safe from these notorious scammers.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Blocks withdrawals

This broker service has a shady trading policy that will block you from doing withdrawals. Be careful, do not trade with them.

Did you find this review helpful? Yes No

Bad people

Bad people, they stole money from inoscent.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Annoying unsolicited phone calls

I have opened an account with them with just a minimum deposit to try trading and see how it goes. But much to my regrets because after opening an account I’ve got phone calls almost every minute of the day pushing me to deposit more. So annoying!

Did you find this review helpful? Yes No

Frustrating withdrawals

There are so many issues on their withdrawal process. Very frustrating.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Unreliable signals

Not a good trading broker. Signals are very unreliable.

Did you find this review helpful? Yes No

Unreliable signals

Not a good trading broker. Signals are very unreliable.

Did you find this review helpful? Yes No

Unreliable signals

Not a good trading broker. Signals are very unreliable.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request for even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Poor trading conditions

Not so good trading terms.Very poor leverage and a lot of policies upon withdrawal.

Did you find this review helpful? Yes No

Bad broker

They have lured me to deposit more in the hope of getting more profit. But I have lost more instead.

Did you find this review helpful? Yes No

Stay away

Stay away from this broker. They do chart manipulation, I notice is a bit different from my research.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I am so frustrated with all the hassles I have gone thru.

Did you find this review helpful? Yes No

Worst brokers

This is the worst broker I have tried. I never expect such failure from them. They have set high bars but unfortunately, their signals are poor and unprofitable.

Did you find this review helpful? Yes No

Do not trust this broker

Do not trust this broker service. They have lured me to deposit more than ran away with my money.

Did you find this review helpful? Yes No

Seriously worst

Seriously worst. Do not transact with anyone of them. They are not regulated and they froze money for no reason.

Did you find this review helpful? Yes No

Poor signals

Poor signals from the brokers. I can’t recall getting atleast a decent profit.

Did you find this review helpful? Yes No

Poor trading services

I have no reason in keeping the services. Can not even recommend them. Although customer services are okay, the signals and the trading tools are really one of the worst I ever used.

Did you find this review helpful? Yes No

Do not invest

Do not invest money here. You will never get any returns.

Did you find this review helpful? Yes No

Bad people

Bad people, they stole money from inoscent.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals all the time. Worst customer service.

Did you find this review helpful? Yes No

Warning! scammers

Stay away from them. I am a victim of their scam. I am writing this review to warn and help everyone to be safe from these notorious scammers.

Did you find this review helpful? Yes No

Poor brokers

They seem good at the start but they really are not. Do not deal with them, I have lost so much on this.

Did you find this review helpful? Yes No

Annoying withdrawal process

I am so annoyed with this broker. My first 2 withdrawals are really worst. Very slow and difficult.

Did you find this review helpful? Yes No

Worst trading company

They are the worst trading company I have ever used. Not recommended.

Did you find this review helpful? Yes No

Worst trading company

They are the worst trading company I have ever used. Not recommended.

Did you find this review helpful? Yes No

Worst withdrawal process

Poor customer service and the worst withdrawal process I have ever observed.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. Took them almost a month even with simple withdrawals.

Did you find this review helpful? Yes No

Unable to withdraw

I am unable to withdraw money here. Have traded gain a few profit but they won’t let withdrawals. As if profit is for my eyes only.

Did you find this review helpful? Yes No

Not worth trading with

I have just wasted my money and time. Not worth trading with.

Did you find this review helpful? Yes No

Hard to contact customer service

Almost impossible to get hold of customer service. I can’t even get one whenever I need their help. I am planning to just close my account and move to other brokers.

Did you find this review helpful? Yes No

Poor forex brokers

They are just after deposits and won’t let you withdraw money. I should know, I have traded with them and become a victim of their schemes.

Did you find this review helpful? Yes No

Lose money here

I have lose so much money on this. I feel like they earn from deposits and not really from winning trades.

Did you find this review helpful? Yes No

Poor trading broker

Irrelevant trading advice. Can not even get a single winning trade.

Did you find this review helpful? Yes No

Not a good broker

Hi! Testing them for over a week now and as early as 1 week, it’s really a no. Not a good broker.

Did you find this review helpful? Yes No

Slow withdrawals

I have traded with this broker in the past and based on my observations, they have really very slow withdrawal process.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process. I have waited too long for a simple withdrawal.

Did you find this review helpful? Yes No

Can't withdraw money

Frustrating experience. I can not withdraw my money.

Did you find this review helpful? Yes No

Bad broker

They hand up on me on topics of withdrawals but are very prompt on deposits. Bad broker.

Did you find this review helpful? Yes No

Poor broker company

Poor broker company. They do not pay profit and withdrawal is very slow.

Did you find this review helpful? Yes No

Worst

Don’t even deserve a single-star rating. The services are really bad.

Did you find this review helpful? Yes No

Stupid customer service

Stupid customer service. They can not comprehend and has poor communication skills.

Did you find this review helpful? Yes No

Scam company

Scam company. Everything here is virtual and profit can not be withdrawn.

Did you find this review helpful? Yes No

Unprofessional

Not a good company to trade with. Very unprofessional.

Did you find this review helpful? Yes No

Bad services

Bad services. Do not use this broker service.

Did you find this review helpful? Yes No

Poor signals

I have a few observations from a month-long of trading with this broker. Signals are poor and withdrawal is slow.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawal process, I got so much hassle, I was asked to provide too many documents.

Did you find this review helpful? Yes No

Poor signals

Poor trading advice. I followed their instructions but get so many losses.

Did you find this review helpful? Yes No

Worst customer service

Worst customer service. Always unavailable to assist.

Did you find this review helpful? Yes No

Poor signals

Poor signals from the brokers. I can’t recall getting at least a decent profit.

Did you find this review helpful? Yes No

Long wait on withdrawals

Unbelievable, there is a very long wait on withdrawals.

Did you find this review helpful? Yes No

Poor forex broker

Do not be deceived by their strong marketing strategies, they will show you heaven but actual trading will give you hell. I have lost so much money on this, be careful.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals all the time. Worst customer service.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals all the time. Worst customer service.

Did you find this review helpful? Yes No

Poor services

Poor services. It is quite evident on my trading results.

Did you find this review helpful? Yes No

Poor trading services

I have no reason in keeping the services. Can not even recommend them. Although customer services are okay, the signals and the trading tools are really one of the worst I ever used.

Did you find this review helpful? Yes No

Poor trading conditions

Not so good trading terms.Very poor leverage and a lot of policies upon withdrawal.

Did you find this review helpful? Yes No

Unreliable signals

Not a good trading broker. Signals are very unreliable.

Did you find this review helpful? Yes No

Difficult withdrawals

I wonder why it is so difficult to request even a simple withdrawal. I am not trading with them again.

Did you find this review helpful? Yes No

Poor brokers

They seem good at the start but they really are not. Do not deal with them, I have lost so much on this.

Did you find this review helpful? Yes No

Warning! scammers

Stay away from them. I am a victim of their scam. I am writing these reviews to warn and help everyone to be safe from these notorious scammers.

Did you find this review helpful? Yes No

Poor signals

Not a good broker to deal with. Signals are not good at all.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. They are so unresponsive to emails and chats and are sounded very rude on the phone.

Did you find this review helpful? Yes No

Stay away

Stay away from this broker. They do chart manipulation, which I notice was a bit different from my research.

Did you find this review helpful? Yes No

Scammers

Scammers. Do not invest money here.

Did you find this review helpful? Yes No

Withdrawal issues

I had withdrawal issues with this company and they have never helped me. They are a fund of blame blames and pointed fingers towards my bank where in fact it is a problem from their side.

Did you find this review helpful? Yes No

Hard time on withdrawals

I regret joining this broker. I am having a hard time with my withdrawals.

Did you find this review helpful? Yes No

Poor forex broker

Do not be deceived by their strong marketing strategies, they will show you heaven but actual trading will give you hell. I have lost so much money on this, be careful.

Did you find this review helpful? Yes No

Frustrated with customer service

I am so frustrated with their customer service, they are unhelpful and unprofessional. I needed help with the platform but they have sent me an email tutorial instead that I can’t even understand. As if they are not willing to help me over the phone.

Did you find this review helpful? Yes No

Worst trading platform

This broker service has the worst trading platform I have ever used. It is very complicated and has a lot of technical issues all the time.

Did you find this review helpful? Yes No

Bad broker

Bad broker. They started ignoring me after I have deposited money.

Did you find this review helpful? Yes No

Poor broker

Poor broker performance. Not recommended.

Did you find this review helpful? Yes No

Bad people

Bad people, they stole money from innocent.

Did you find this review helpful? Yes No

Fake broker company

Fake broker company. If I knew from the start I could have avoided them.

Did you find this review helpful? Yes No

Poor company

Poor company. Do not deal with them.

Did you find this review helpful? Yes No

Bad brokers

Bad trading broker. I am not happy with the services.

Did you find this review helpful? Yes No

Bad services

Bad services. Tedious and slow withdrawals. I am not trading with them again.

Did you find this review helpful? Yes No

Not recommended

Unregulated and dishonest broker. Not recommended.

Did you find this review helpful? Yes No

Poor services

Poor services. I will never use this broker service again.

Did you find this review helpful? Yes No

Unreliable signals

The worst experience I ever had. Signals are so much unreliable.

Did you find this review helpful? Yes No

Bad broker

I activated an account and traded with this broker. They did not pay my profit and froze my account for no reason. Bad broker company.

Did you find this review helpful? Yes No

Bad people

Bad people, stole money from innocent.

Did you find this review helpful? Yes No

Bad broker

They hand up on me on topics of withdrawals but are very prompt on deposits. Bad broker.

Did you find this review helpful? Yes No

Poor trading tools

Poor trading tools. I had encountered so many technical problems.

Did you find this review helpful? Yes No

As if they are not well-verse about forex market

They are very convincing at what they say but they are very disappointed in the actual trading. As if they are not well-versed in the forex market.

Did you find this review helpful? Yes No

Fake broker

I warn everyone not to trade with this broker. They are unregulated and fake.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They are not accommodating and prefer to ignore trading concerns.

Did you find this review helpful? Yes No

Poor broker service

I can not depend on their service. Not worthy of my money and time.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. Every time I process withdrawals it is very slow.

Did you find this review helpful? Yes No

Rude brokers

They are very rude. That is my observation during the time that I am trading with them. Have even forced me to put in more money.

Did you find this review helpful? Yes No

Technical issues

Worst trading tools I have ever used. There are so many technical issues.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I am so frustrated with all the hassles I have gone thru.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process. I have waited too long for a simple withdrawal.

Did you find this review helpful? Yes No

Withdrawal issues

I had withdrawal issues with this company and they have never helped me. They are a fund of blame blames and pointed fingers towards my bank where in fact it is a problem from their side.

Did you find this review helpful? Yes No

Not an ideal broker

They are not my ideal broker for trading forex. The signals give very minimal profit, just a waste of time.

Did you find this review helpful? Yes No

Slow withdrawals

Ridiculous spreads and withdrawal process. Instead of waiting for the standard number of banking days, with this broker, you will have to wait for a few weeks.

Did you find this review helpful? Yes No

Worst company

Worst company. Do not invest money here, they are very unprofessional.

Did you find this review helpful? Yes No

Expensive trading options

Very expensive trading options. They have so many trading assets to choose from but all seem very expensive. I am trying a few for the first time and will post another review soon.

Did you find this review helpful? Yes No

Unreliable signals

Deposit and withdrawals are fine. But signals are not good. I lost even more than I won.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. Services are not ideal for gaining good profits.

Did you find this review helpful? Yes No

Inefficient broker

I do not recommend trading with this broker. Very inefficient.

Did you find this review helpful? Yes No

Bad forex broker

They have so many marketing strategies just to hook you up in their trading schemes. Do not be deceived by their sweet words.

Did you find this review helpful? Yes No

Worst company

They are one of the worst companies I have ever traded with. Not a good company to trade with.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They are not accommodating and prefer to ignore trading concerns.

Did you find this review helpful? Yes No

Do not invest

Do not invest money here. You will never get any returns.

Did you find this review helpful? Yes No

Poor signals

Poor signals from the brokers. I can’t recall getting at least a decent profit.

Did you find this review helpful? Yes No

Not recommended

Worst trading signals and poor services. Not recommended.

Did you find this review helpful? Yes No

Worst withdrawal process

Poor customer service and the worst withdrawal process I have ever observed.

Did you find this review helpful? Yes No

Slow responses

Slow responses from them caused me so much trouble. I even had losses because of slow responses.

Did you find this review helpful? Yes No

Fraudster

Do not trade with this company. They are fraudsters.

Did you find this review helpful? Yes No

Not profitable

Although customer service and brokers are good, I will have to quit trading with them because it is not profitable and fees are huge.

Did you find this review helpful? Yes No

Poor trading brokers

Poor trading terms. They adjust it to cheat traders, do not trade with them.

Did you find this review helpful? Yes No

Do not pay profit

They collect and collect money but never pay a profit. Do not deal with them.

Did you find this review helpful? Yes No

Bad brokers

Do not fall for this broker’s scheme, some promotions are just a trap. It is a way for them to lure you and deposit money. But once you did, you will never get anything back, no withdrawals or refunds.

Did you find this review helpful? Yes No

Did not pay my profit

Did not pay my profit. They have accused me of violation making my account frozen, Can’t do anything about it.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals all the time. Worst customer service.

Did you find this review helpful? Yes No

Poor trading platform

Poor trading platform. There are so many technical problems.

Did you find this review helpful? Yes No

Bad customer service

Irresponsive brokers and bad customer service.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals all the time. Worst customer service.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process and poor customer service. I am not trading with them again.

Did you find this review helpful? Yes No

Poor signals

Poor trading signals. I would rather do my own research. Always leads me to losses.

Did you find this review helpful? Yes No

Poor signals

Against the market movement trading signals. I do not recommend trading with them.

Did you find this review helpful? Yes No

Harassing

Harassing brokers. They keep on calling asking for personal and financial information.

Did you find this review helpful? Yes No

Poor services

They are just after our hard-earned money. Poor services.

Did you find this review helpful? Yes No

Worst experience

Worst experience of my life. I’ve lost a fortune on this.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals all the time. Worst customer service.

Did you find this review helpful? Yes No

Poor signals

Poor trading signals. Do not deal with this broker company.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. I always feel harassed every time I talk to them.

Did you find this review helpful? Yes No

Poor services

Poor trading services. Withdrawal is very slow and customer service is very unresponsive.

Did you find this review helpful? Yes No

Unreliable

The services are very unreliable. Do not deal with them.

Did you find this review helpful? Yes No

Poor services

Poor trading services. Withdrawal is very slow and customer service is very unresponsive.

Did you find this review helpful? Yes No

Expensive

Expensive trading instruments. Too many charges, less profit.

Did you find this review helpful? Yes No

Scam offers

Scam offers. Their goal is to hook you into putting money, no other than that.

Did you find this review helpful? Yes No

Delayed execution

There is a great delay in execution causing so many losses. I did not continue trading with them due to this problem.

Did you find this review helpful? Yes No

Poor services

They are just after our hard-earned money. Poor services.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and unresponsive customer service. They suddenly become difficult to contact when requesting a withdrawal.

Did you find this review helpful? Yes No

Slow withdrawals

Very slow withdrawals. I even waited for a few weeks and thought that my money was lost.

Did you find this review helpful? Yes No

Bad services

Bad trading services. THe do not process withdrawals and ignore you after the deposit stage.

Did you find this review helpful? Yes No

Stay away from them

Stay away from these people. It is a game of chances and the chance to win is very little.

Did you find this review helpful? Yes No

Do not trade

Worst customer service and slow withdrawals. Do not trade with them.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. All of the withdrawals I had with them are really slow.

Did you find this review helpful? Yes No

Bad company

Bad broker company. Do not trust them.

Did you find this review helpful? Yes No

Stay away from them

Stay away from them, first, they don’t reply to emails, second, it is very difficult to request withdrawals and lastly, it is not so profitable, you will end up just wasting your time.

Did you find this review helpful? Yes No

Impossible to withdraw

There are so many documents needed to withdraw. It is almost impossible to withdraw money.

Did you find this review helpful? Yes No

Poor signals

Against the market movement trading signals. I do not recommend trading with them.

Did you find this review helpful? Yes No

Bad brokers

Do not waste your time on this. They will only collect your deposits but will never give you anything in return.

Did you find this review helpful? Yes No

Worst trading company

They are the worst trading company I have ever used. Not recommended.

Did you find this review helpful? Yes No

Good broker

They seem to be a good broker but they are really not. I will never recommend this broker service to anyone.

Did you find this review helpful? Yes No

Thieves

Thieves. They steal all my money from my bank account.

Did you find this review helpful? Yes No

Poor services

Poor trading services. Withdrawal is very slow and customer service is very unresponsive.

Did you find this review helpful? Yes No

Unreliable signals

Trading signals are very unreliable. Not a good broker company to deal with.

Did you find this review helpful? Yes No

Poor services

Poor trading services. Withdrawal is very slow and customer service is very unresponsive.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and poor customer service. I am not trading with them again.

Did you find this review helpful? Yes No

Poor services

Poor trading services. Withdrawal is very slow and customer service is very unresponsive.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and unresponsive customer service. They suddenly become difficult to contact when requesting a withdrawal.

Did you find this review helpful? Yes No

Slow customer service

Slow customer service. I end up losing so much due to late responses. This is something that they need to improve on.

Did you find this review helpful? Yes No

Slow customer service

Slow customer service. They attend to trading needs a bit late and so it causes so many losses.

Did you find this review helpful? Yes No

Bad experience

Bad experience. Have lost so much money here.

Did you find this review helpful? Yes No

Not a good broker

This ain’t a good broker to trade with. Signals are not accurate and withdrawal is very slow.

Did you find this review helpful? Yes No

Horrible broker service

This company is a fraud, stay away from them. Horrible broker service.

Did you find this review helpful? Yes No

Not a good deal

Not a good deal. I lose more money.

Did you find this review helpful? Yes No

Worst tools

Worst trading tools. There are so many glitches.

Did you find this review helpful? Yes No

Poor trading services

Poor trading tools and software. It keeps on freezing and there are so many software issues.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. Always unwilling to help.

Did you find this review helpful? Yes No

Slow withdrawals

I had trouble processing withdrawals. It happens most of the time. I will never trade with them again.

Did you find this review helpful? Yes No

Lose huge money here

I notice that all people with huge funds end up losing. I and my friend lose huge money here.

Did you find this review helpful? Yes No

Poor trading tools

Poor trading tools. There is latency and glitches and it happens all the time.

Did you find this review helpful? Yes No

Lose money here

I have lost huge money here. I simply followed their advice and place my trades as they say so but have lost my money instead.

Did you find this review helpful? Yes No

Poor signals

I am very unhappy with the services. Signals are inaccurate and most of the time go against market movements.

Did you find this review helpful? Yes No

Do not trade with them

Do not trade with them. There seems to be e problem with their legitimacy.

Did you find this review helpful? Yes No

Slow withdrawals

This broker does not work well. I notice so many issues with services. Withdrawal is also very slow.

Did you find this review helpful? Yes No

Unreliable signals

Bad trading company. Signals are unreliable.

Did you find this review helpful? Yes No

Poor services

Poor broker service. Do not trade with them.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process and poor customer service. I am not trading with them again.

Did you find this review helpful? Yes No

Not a good broker company

It is really very difficult to secure approval on withdrawal requests. Not a good company to deal with.

Did you find this review helpful? Yes No

Slow withdrawals

Performance is never impressive nor good. I am not recommending them. Poor signals and slow withdrawals and most of the services are not good.

Did you find this review helpful? Yes No

Unreliable

I will never trade with this broker again. I can not rely on the signals not even on the services.

Did you find this review helpful? Yes No

Unhappy with trading results

I am not happy with my trading results. I have used the service for a month, I wonder if I need a longer time to see good results, but I really have to quit because I am afraid to incur so many losses.

Did you find this review helpful? Yes No

Services sucks

If I can only put zero as a rating, I would. I have traded with them in the past and none of their services is okay. Platform, broker signals, withdrawal, and customer service, they all suck!

Did you find this review helpful? Yes No

Poor profit

Not getting good profit. The trading services are useless as if it is better to trade on my own.

Did you find this review helpful? Yes No

Poor trading services

Poor trading services. Choose other brokers, this is not good to deal with.

Did you find this review helpful? Yes No

Slow customer service

Slow customer service. There is a great delay in email and chat replies. Due to late responses some times I even get losing trades.

Did you find this review helpful? Yes No

Poor trading experience

I did not have a good trading experience with this broker. Responses from support are always delayed and withdrawals as well.

Did you find this review helpful? Yes No

Slow withdrawal process

Trading terms are okay. The only thing that made me decide to change my broker is the slow withdrawal process. Aside from the difficulty in securing approvals, the process of credit is very slow.

Did you find this review helpful? Yes No

Bad broker

Bad broker service. I always had that normal runaround on withdrawals, as if it is a part of their withdrawal process.

Did you find this review helpful? Yes No

Poor signals

Nothing positive to describe them but all negative. Do not trade with this. I have lost so much money, poor signals.

Did you find this review helpful? Yes No

Amazing returns

The best broker I have ever trade with. The return on investments is amazing.

Did you find this review helpful? Yes No

Great broker services

Great services for forex brokerage. They are professional and skilled.

Did you find this review helpful? Yes No

Lost so much money on this

I advise everyone to take the time to read reviews prior to trading. I have traded with this broker and have lost so much money.

Did you find this review helpful? Yes No

Worst platform

Worst forex platform. I can not tolerate the lags and glitches causing trouble in trading.

Did you find this review helpful? Yes No

Great signals

I have so many great trading options. Signals are spot on and services are really good.

Did you find this review helpful? Yes No

Fast withdrawals

Fast and hassle-free withdrawals. I have no complaints about the services, I get good profit.

Did you find this review helpful? Yes No

Not profitable

Not profitable trading with. I feel like I have just wasted my time on this.

Did you find this review helpful? Yes No

Highly recommended

I get really great support and accurate signals. Highly recommended broker.

Did you find this review helpful? Yes No

Great signals

Great signals and services. I will definitely keep this broker service and will surely recommend it.

Did you find this review helpful? Yes No

Poor signals

The signals are unreliable and customer service is inefficient. I will never trade with them again.

Did you find this review helpful? Yes No

Do not trade

Do not trade with them. I started smoothly until I began to request for withdrawal, they started to be different and had given me hard time.

Did you find this review helpful? Yes No

Excellent signals

Excellent trading signals. I’ve gained a lot from this broker company.

Did you find this review helpful? Yes No

Wonderful services

Wonderful trading services. I love the signals and I am happy with the support I am getting from them.

Did you find this review helpful? Yes No

Unable to withdraw

I am so frustrated. I am unable to withdraw my profit. Do not deal with these people.

Did you find this review helpful? Yes No

Do not deal

Do not deal with them. They keep on collecting money from me but do not let me withdraw.

Did you find this review helpful? Yes No

Commendable customer service

Commendable customer service. They are available to assist round the clock and are really very helpful.

Did you find this review helpful? Yes No

Great broker

Great broker. Customer service is great too. I get a good profit from the signals and never had any problem with withdrawals.

Did you find this review helpful? Yes No

Worst broker

The worst trading broker I have ever dealt with. Aside from signals that aren’t that much profitable, instruments are very very expensive.

Did you find this review helpful? Yes No

Not a good broker

Do not even try to trade with them. Not a good broker.

Did you find this review helpful? Yes No

Worth it

Thankful to be a part of this company. Signals are all worth it.

Did you find this review helpful? Yes No

Amazing brokers

They’ve got all the good qualities of an outstanding forex broker. Profitable trading signals, fast withdrawals, good customer service, and amazing tools.

Did you find this review helpful? Yes No

Inefficient

Poor trading advice and inefficient trading tools. I have lost huge money.

Did you find this review helpful? Yes No

Poor services

Poor services. I did not find any good reason to keep this broker service.

Did you find this review helpful? Yes No

Happy with this broker

Have been using this broker for automated Forex trading and must say that I am very happy so far!

Did you find this review helpful? Yes No

Smooth withdrawals

Smooth withdrawals and trading transactions. I have used this broker for more than 2 years and I am fully satisfied with the results.

Did you find this review helpful? Yes No

Extremely worst

Extremely worst. Do not dare to put your money here.

Did you find this review helpful? Yes No

Awesome broker

Awesome customer service and broker signals. I never had any problem dealing with them for the past 6 months.

Did you find this review helpful? Yes No

Worst trading services

The worst trading service I have ever used. It was introduced to me by an experienced trader. And yes, true to his words, this broker is very reliable.

Did you find this review helpful? Yes No

Great signals

Great signals and goos trading platform. Have been using their services for a few months and it is really one of the best brokers.

Did you find this review helpful? Yes No

Poor signals, do not like this broker 🙁 Need to try different one

Poor customer service

Poor customer service. They cannot even resolve any concerns.

Did you find this review helpful? Yes No

Fast withdrawals

Fast withdrawals. No hassle and not many requirements to provide.

Did you find this review helpful? Yes No

Good customer service

Good customer service. Promptly replies on messages.

Did you find this review helpful? Yes No

Poor trading platform

I am pissed off with their trading platform. It has so many technical problems.

Did you find this review helpful? Yes No

Poor forex broker

It’s not good to trade with this broker. Aside from the limited trading options, it is very difficult to get approval for the withdrawal requests.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and worst platform. I encounter so many technical problems and also I got problems with services.

Did you find this review helpful? Yes No

Not a good broker

Not a good broker for forex trading. Signals are very unreliable and withdrawal is very slow.

Did you find this review helpful? Yes No

Bad brokers

Do not waste your time on this. They will only collect your deposits but will never give you anything in return.

Did you find this review helpful? Yes No

Huge transaction fees

Trading broker with so many transaction fees.

Did you find this review helpful? Yes No

Slow withdrawals

I have noticed that it is taking them a longer time to process withdrawals compared to other brokers I have traded with.

Did you find this review helpful? Yes No

Poor trading results

They seem to be a good broker because they are a big trading company. But the trading result says otherwise.

Did you find this review helpful? Yes No

Bad broker

I’d like to know more about the company’s background. I am a bit suspicious because of the processes, I feel like something is wrong.

Did you find this review helpful? Yes No

Delayed responses

Not a good trading company. Responses are always delayed.

Did you find this review helpful? Yes No

No good

No good. Signals are poor. I lost huge money out of the signals.

Did you find this review helpful? Yes No

Terrible support

Terrible online support. I can’t even rely on them to provide me good resolution.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and poor services. No good reason to keep their services.

Did you find this review helpful? Yes No

Poor signals

Poor trading signals and market assessments. I got huge losses trading with this broker.

Did you find this review helpful? Yes No

Unresponsive customer service

Brokers are very good, signals are profitable. However, their customer service is not responding most of the time.

Did you find this review helpful? Yes No

Not satisfied

I am not satisfied with this broker service. They are not good brokers.

Did you find this review helpful? Yes No

No intentions of giving your money back

They will make it look like the investment is really very good but will only take your money away. They do not have intentions of giving your money back.

Did you find this review helpful? Yes No

Sarcastic and rude customer service

For a couple of months trading with this broker, everything is fine except for their customer service. They sounded very sarcastic and they are rude as well, for this reason, I closed my account with them.

Did you find this review helpful? Yes No

Poor services

Poor trading services. Withdrawal is very slow and customer service is very unresponsive.

Did you find this review helpful? Yes No

Inaccurate signals

Do not trade with this broker company. The signals are not accurate.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. I am very frustrated with the way they treat me.

Did you find this review helpful? Yes No

Long wait on phone queue

Wait time over the phone is really long. Most of the time, I end up hanging up the phone and not getting support instead.

Did you find this review helpful? Yes No

Worst customer service

Worst customer service I have ever dealt with. They are unresponsive and always ignore my trading concerns.

Did you find this review helpful? Yes No

Poor signals

I am not happy with the overall performance. I did not get a decent profit from the signals.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. They are not accomodating and always sounding irritated.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. They are having a hard time comprehending my concerns.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawal process. I am not happy with any of their services either.

Did you find this review helpful? Yes No

Unreliable signals

Poor customer service. Unreliable signals.

Did you find this review helpful? Yes No

Charge too much

I have paid so many charges when I traded with this broker. I feel like I was charge too much.

Did you find this review helpful? Yes No

Annoying customer service

Very annoying customer service. They can not even assist me on simple concerns.

Did you find this review helpful? Yes No

Poor support

I never get the support that I needed in trading. They always ignore my messages.

Did you find this review helpful? Yes No

Waste of time

I have just wasted my time on this. Have gain profit but just minimal.

Did you find this review helpful? Yes No

Not recommended

I do not recommend trading with this broker. Signals are inaccurate and advice is irrelevant.

Did you find this review helpful? Yes No

Slow customer service

Slow customer service. They attend to trading needs a bit late and so it causes so many losses.

Did you find this review helpful? Yes No

Slow withdrawals

They are not a good trading company to deal with. Signals are poor and withdrawal is really slow.

Did you find this review helpful? Yes No

Low profit

Not a recommended trading broker to deal with. Profit is very low, expenses are higher.

Did you find this review helpful? Yes No

Unreliable signals

I am not going to recommend this broker service. The signals are unreliable.

Did you find this review helpful? Yes No

Slow withdrawal process

They have a very slow withdrawal process. So many requirements and terms.

Did you find this review helpful? Yes No

Not a good broker

I have lost so much money on their trading schemes. It is not a good idea to trade with them.

Did you find this review helpful? Yes No

Unreliable signals

Trading signals are very unreliable. Not a good broker company to deal with.

Did you find this review helpful? Yes No

Withdrawal issues

They have withdrawal issues, with a few months of trading with them I have noticed it happens consistently on all of my withdrawals.

Did you find this review helpful? Yes No

Poor customer service

No phone call base customer support available. I always have to wait in the queue, having no idea when the call is answered.

Did you find this review helpful? Yes No

Inaccurate signals

This for me is the worst broker for online trading. Signals are not even accurate.

Did you find this review helpful? Yes No

They ignore me

Worried about my money. I just deposited last week and now I notice them ignoring me.

Did you find this review helpful? Yes No

Troubled with withdrawals

I have experienced so much trouble requesting for withdrawal. They always deny my request.

Did you find this review helpful? Yes No

Poor trading tools

Poor trading tools. There are latency and glitches and it happens all the time.

Did you find this review helpful? Yes No

Poor trading services

Not worth trading with. They charge too much but services are not that efficient.

Did you find this review helpful? Yes No

Worst trading platform

Worst trading platform. I always encounter lags and glitches

Did you find this review helpful? Yes No

Misinforms

Customer service always misinforms. I always get false information from their customer service, especially about pricing. As if they are not well trained and are unaware of their products and services.

Did you find this review helpful? Yes No

Bad broker

This is a bad broker. They make it difficult to withdraw profit. Customer service is rude and unhelpful.

Did you find this review helpful? Yes No

Frustrating experience

Frustrating experience. I deposited my money hoping to get good returns as promised but right now I am unable to withdraw anything.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They do not attend to trading needs and sounded very lazy over the phone.

Did you find this review helpful? Yes No

Bad experience

Bad experience. Have lost so much money here.

Did you find this review helpful? Yes No

Useless trading signals

Extremely useless trading signals. I felt like, I’d rather trade on my own than follow their instructions.

Did you find this review helpful? Yes No

Blocks withdrawals

I am having trouble requesting for withdrawal. I have request for it several times but they block it and keep on asking to replace documents.

Did you find this review helpful? Yes No

Terrible services

Terrible trading service, not recommended at all. It is almost impossible to withdraw.

Did you find this review helpful? Yes No

Horrible broker service

This company is a fraud, stay away from them. Horrible broker service.

Did you find this review helpful? Yes No

Extremely unhappy with this broker

Extremely unhappy with this broker service. They took my money and I was not able to get even a single cent.

Did you find this review helpful? Yes No

Annoying withdrawals

Profit withdrawal is very annoying. The process and requirements are terrible. I was asked to comply which I did but after all, I still have the runaround.

Did you find this review helpful? Yes No

Unreliable forex broker

Unreliable broker services. I have traded with them for a month-long and can not even recall getting a winning trade not even once.

Did you find this review helpful? Yes No

Worst trading software

I notice slippage becoming bigger and spreads wider. I reported this to my broker and to the customer service and I was told it is a system glitch. However they did not do something about it, it has blown up my account big time.

Did you find this review helpful? Yes No

Huge slippage

I notice slippage becoming bigger. I started trading with them with minimal slippage but it grows bigger as I trade along. I felt like it is cheating in a way so I decided to quit.

Did you find this review helpful? Yes No

Slow customer service

Very slow and inefficient customer service. The trading platform and terms are fine but trading profit is not.

Did you find this review helpful? Yes No

Unable to withdraw

They said I can transform the $100 bonus they’ve offered to me into real profit. Yes, I can, I surely can but I can not withdraw them. It is useless as if everything here is virtual.

Did you find this review helpful? Yes No

Avoid this broker

Avoid this broker by all means. They will just keep on collecting money but will never pay a profit.

Did you find this review helpful? Yes No

Worst forex company

The worst forex broker company I have ever dealt with. Signals are not profitable. They also have poor customer service.

Did you find this review helpful? Yes No

Bad forex broker

They claim to be good forex brokers and have projected fair income. But on the actual trading, they are very rude. I never got a good profit but have several losses instead.

Did you find this review helpful? Yes No

Trouble n withdrawal process

They gave me so much trouble in processing my first withdrawal. I thought transactions are smooth as they seem nice at the start. But all problems start upon withdrawal.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They are unhelpful and re very rude to me. I will not recommend this broker to anyone.

Did you find this review helpful? Yes No

Expensive to trade with

$1 initial deposit is nonsense. It seems affordable but the truth is you can not trade with the initial deposit. It is even very expensive to trade with this broker.

Did you find this review helpful? Yes No

Worst forex broker

I regret trading with Fbs, I never get anything not even the money left on my trading account. They do not process withdrawals instead they keep on asking for deposits even if I am losing so much.

Did you find this review helpful? Yes No

Slow withdrawals

Very very slow withdrawal process. I end up closing my trading account because of this.

Did you find this review helpful? Yes No

Block withdrawals

Trading with this broker is a nightmare. They will do all the possible ways they can just block withdrawals. I still have unclaimed money on my trading account, they keep ignoring my calls and messages.

Did you find this review helpful? Yes No

Unreliable signals

Do not trust this broker service, they aren’t good for forex trading. Signals are not reliable.

Did you find this review helpful? Yes No

Poor customer service

Their customer rep doesn’t have a clue about their own regulations, has limited knowledge of their products and services. It seems like they are not well informed.

Did you find this review helpful? Yes No

Slow responses

Slow response from the brokers and customer service. I have several losses because of this. I Will not trade with them again.

Did you find this review helpful? Yes No

Poor forex broker

I am trading with this broker for almost a month. In the first week I got some winning trades and really good profit but on the succeeding weeks, I notice consecutive losses. I will be closing my account before losses increase.

Did you find this review helpful? Yes No

Unreliable trading signals

The worst forex signals I have ever used. It causes too many losses. Do not use their signals, it is very unreliable.

Did you find this review helpful? Yes No

Unreliable broker

Not a reliable broker service. Customer support is unresponsive and difficult to contact. And trading results are poor.

Did you find this review helpful? Yes No

Long withdrawal process

Long withdrawal process. There are so many documents to produce and very difficult terms to adhere to prior approval.

Did you find this review helpful? Yes No

Unreliable

Useless to trade with. As if I am trading on my own. And I guess, it is better trading on my own, services aren’t reliable at all.

Did you find this review helpful? Yes No

Annoying withdrawal process

I am so annoyed waiting for them to process withdrawals. Unlike others that only takes 3 to 5 business days, this broker takes weeks to process.

Did you find this review helpful? Yes No

Bonus prevents withdrawal

I am happy at first try because of the $100 bonus which I think is very helpful. However, by the time I tried requesting for my first withdrawal, I had a hard time. The bonus offered prevents me from fro getting my first withdrawal, they ask me to trade for more to fulfill the required terms in getting my withdrawal.

Did you find this review helpful? Yes No

Difficult withdrawal process

Somehow a good broker. People are nice and accomodating but they couldn’t really resolve withdrawal issues. I always had trouble with withdrawals during the time I am trading with them.

Did you find this review helpful? Yes No

Cent account is not true

Funny how they come up with a cent account. Reality is you can not trade with cent account. This is just a mere scheme to hook you in activating for an account and later on they will force and convince you to add more money.

Did you find this review helpful? Yes No

Do not deal with this broker

Do not deal with this broker service. They do not allow withdrawals that easy. Once you start requesting for one, they will start asking for so many things.

Did you find this review helpful? Yes No

Bad broker

Not a good broker, I have traded with them some time ago, deposited but never get any withdrawals until this day that I am no longer unable to contact them.

Did you find this review helpful? Yes No

Poor broker service

I was enticed to join this broker because of their strong marketing however I have so much regret finding out later on how slow withdrawal is. Poor broker services.

Did you find this review helpful? Yes No

Impossible withdrawals

Impossible to withdrawal funds. They will make it hard that no one will be able to get their money.

Did you find this review helpful? Yes No

Troubled with withdrawals

I wonder why it is taking them longer than normal time to process withdrawals. I regret trading with them, I had so much trouble with withdrawals.

Did you find this review helpful? Yes No

Unreliable broker

Unreliable broker signals. I have traded with them for a couple of months but I got more losses than winning trades.

Did you find this review helpful? Yes No

Confusing platform

The trading platform is very confusing. Pattern indicators are very difficult to understand.

Did you find this review helpful? Yes No

Unresponsive

Terrible support line. So many attempts to call them but always unanswered. Very unresponsive and irresponsible.

Did you find this review helpful? Yes No

Poor brokers

Be careful not to deal with this broker service, there are more losses than winning trades.

Did you find this review helpful? Yes No

Poor broker services

Poor broker signals. I have used their services for 3 months and I did not get a good result at all. I thought it’s normal for the first month but all three months, I lost money.

Did you find this review helpful? Yes No

Poor trading signals

Slow withdrawal process and poor trading signals. I am not trading with them again. I have lost huge money on them.

Did you find this review helpful? Yes No

Not a good broker

Don’t trust this small brokerage firm that offers fabulous promises. I have traded with them and got nothing but losses. They are not good enough.

Did you find this review helpful? Yes No

Poor trading signals

Not a good broker for forex trading. Signals seem like signals are mere speculations and are not so effective.

Did you find this review helpful? Yes No

Poor customer service

Do not deal with this forex broker, withdrawal is slow. Poor customer service as well.

Did you find this review helpful? Yes No

Poor signals

This is not a good broker service. Poor signals and rude brokers. The withdrawal process as well is very slow.

Did you find this review helpful? Yes No

Do not use their services

Do not use them by all means. They will just rip you off. Worst forex broker. Poor signals.

Did you find this review helpful? Yes No

Bad customer service

I can hardly connect to their customer service. Waiting on the queue is so annoying. Customer service is not accomodating and are very unhelpful.

Did you find this review helpful? Yes No

Be careful with this broker

Be careful with this broker. They will normally tell you good features available but will eventually not let you use it. I experience it most of the features offered at first are not really available.

Did you find this review helpful? Yes No

Extremely unhappy

I am truly disappointed when I traded with this broker. They have set very high standards as if services are all great. But extremely unhappy on actual trading, false promotions.

Did you find this review helpful? Yes No

High transaction fees

High transaction charges and fees. Kinda frustrating to get minimal profit with huge charges.

Did you find this review helpful? Yes No

Delayed withdrawals

Delayed withdrawal process. I even file for missing withdrawal thinking that my money was lost because it took them several weeks to process before it hits my bank account.

Did you find this review helpful? Yes No

Poor broker service

Poor brokers and worst customer service. Nothing is really good about this broker.

Did you find this review helpful? Yes No

Aggressive and rude

Aggressive and rude customer service. Always come up with excuses just to delay withdrawals.

Did you find this review helpful? Yes No

Bad forex broker

I have used their services for just 3 months. They will lure you by showing your profits and possible income once you increase deposit but they will never let you withdraw. And if you insist withdrawals, the next thing you will see are losing trades, as if all here are programmed.

Did you find this review helpful? Yes No

Disappointing signals

Disappointing broker signals. It is not effective and accurate.

Did you find this review helpful? Yes No

Do not pay profit

Do not deal with this broker. They do not pay off the profit. They will give you lame excuses.

Did you find this review helpful? Yes No

No good

No good. Signals are poor. I lost huge money out of the signals.

Did you find this review helpful? Yes No

Bad customer support

Support is not picking up the phone most of the time. They are even unresponsive to chats and emails.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and poor customer service. Not worth trading with.

Did you find this review helpful? Yes No

Slow withdrawals

I had to fight with them so many times before getting my withdrawal credited to my bank account. Slow withdrawals.

Did you find this review helpful? Yes No

Annoying broker

Annoying broker for forex trading. They are only interested in deposits and never pay attention to trading concerns.

Did you find this review helpful? Yes No

Poor customer service

Customer service is most of the time unavailable to assist in my trading concerns. I could have been a good broker since signals are accurate.

Did you find this review helpful? Yes No

Poor customer service

Poor customer service. They don’t even care about urgent matters, very unresponsive.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They ignore messages and hardly pick up the phone.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals and unresponsive customer service. Do not deal with them.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. I waited for so long before I got my money.

Did you find this review helpful? Yes No

Difficult withdrawal process

The most difficult withdrawal process I have ever experience. Very slow and there are so many requirements to submit and terms to observe.

Did you find this review helpful? Yes No

Support does not answer

Support does not answer. They constantly write “we will take a look at your problem and get back to you”. But nothing has been resolved on all my trading concerns for a couple of months.

Did you find this review helpful? Yes No

Do not trust

Do not trust your hard-earned cash to this broker service. Your money will surely go nowhere but on losses.

Did you find this review helpful? Yes No

Very unprofessional

Very unprofessional. They always missed schedule calls and appointments.

Did you find this review helpful? Yes No

Keep away from them

Keep away from this forex broker, they will rip you off. No one really wins in their trading.

Did you find this review helpful? Yes No

Do not trade with them

Difficult to request for withdrawal, they hardly approve the request. Do not trade with them.

Did you find this review helpful? Yes No

Bad service

I would like to share my experiences with this broker, customer service is very hard to contact and don’t reply on time on messages. I also have lost so much money, signals are very unreliable.

Did you find this review helpful? Yes No

Troubled with their withdrawals

I am always troubled with their withdrawal process and so I decided to just close my account with them.

Did you find this review helpful? Yes No

Don't approve withdrawal request easily

There are so many documents to provide in order to request a withdrawal. Worst they don’t approve easily.

Did you find this review helpful? Yes No

Frustrated with withdrawal

I am so frustrated with the withdrawal process and so I closed my trading account with them.

Did you find this review helpful? Yes No

Faulty platform

I suggest to improved their platform. Signals are fine but platform is faulty.

Did you find this review helpful? Yes No

Useless customer service

Useless customer service. They are available when you need them but can’t help you anyway.

Did you find this review helpful? Yes No

I lost all my money

I have lost all my hard-earned money with this broker. I feel so sorry for myself.

Did you find this review helpful? Yes No

Bad forex company

Bad company for forex trading. They will gladly take your money but won’t let you withdraw a single cent.

Did you find this review helpful? Yes No

Stay away from this broker service

I am seeing a profit on my trading account but I can not withdraw. Stay away from this broker service.

Did you find this review helpful? Yes No

Weak broker signals

Really fast execution. But there are more losses than wins as if signals are weak.

Did you find this review helpful? Yes No

Do not invest money with them

Just do not invest money with this online broker, the total loss is inevitable. There are so many people who lose money because of them.

Did you find this review helpful? Yes No

I am miserable due to losses

I was skeptical at first but I decided to give it a shot, I could have listened to my intuition instead. Now I am living a miserable life due to losses.

Did you find this review helpful? Yes No

Expensive to trade with

Very expensive to trade with. Prices of trading instruments are soaring high.

Did you find this review helpful? Yes No

Hard to withdraw

They will give you a hard time withdrawals. Do not deal with this broker as much as possible.

Did you find this review helpful? Yes No

No one can help me about my missing withdrawal

I have been calling them over and over again about my missing withdrawal but no one can give me a good resolution, no one can’t even explain why.

Did you find this review helpful? Yes No

Lose all my money

This broker service calls you promising so many good things just to convince you to trade with them but once you deposit a huge amount, you will lose them in an instant.

Did you find this review helpful? Yes No

Poor services

Poor intrapersonal skills for both brokers and customer service. They are skilled enough to have the right behavior they need in performing thier job.

Did you find this review helpful? Yes No

I've got so many losses

I am not too confident with this broker service. I have traded for a month but I got so many losses.

Did you find this review helpful? Yes No

There is a great delay on withdrawal