Copper is in a supercycle that only goes up. After taking a breather earlier in the week, the metal continues with its ride to the top.

Earlier in the week, China announced plans to sell 20,000 tons of the industrial commodity stored in its stockpile.

This move is an attempt to cool down on the overheating prices, which consistently hit record-highs in the previous month.

The major catalyst of the surge is China’s strong demand. With this, regulators thought that the only way out of the labyrinth is also from their initiative.

However, such might be the case as even after the announcement, the copper price for front-month delivery added 2.6%.

It managed to settle at $4.34 per pound or $9,552.00 a ton in the New York Comex.

Analysts from a financial juggernaut noted that supply and demand ceased to dictate the trajectory of prices for long.

The main price driver now rests at market expectations and speculations, especially on the flow of economic recovery.

In London Metal Exchange, a three-month contract of the precious metal managed to gain 0.5% for the day.

As of this writing, it exchanges hands at $9,461.50 per ton. This came after the positive update on the United States’ infrastructure thrust.

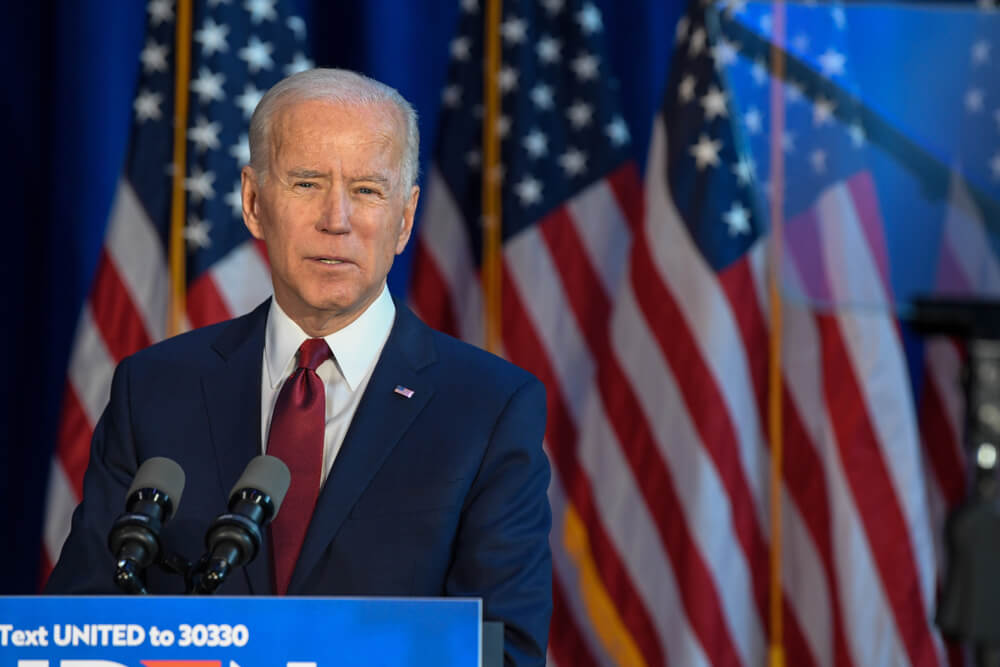

In the latest update from the White House, President Biden now plans to put into play another support for citizens.

The mechanism will be labeled “human infrastructure bill,” proving healthcare and child care safety nets for citizens worth $500 billion.

The original program will go ahead as planned, currently valued at $1.2 trillion. This lifted the metal’s prices as copper remains an important component of infrastructure building.

Update on Nickel, Other Metals

In an update on other metals, Indonesia recently announced plans to put restrictions on nickel pig iron production.

The commodity is known as a low-grade ferronickel which is an imperative component in the production of stainless steel.

The country’s policymakers are looking into taking down the construction of new smelters involved in the field.

This is an attempt to optimize Indonesia’s deteriorating nickel ore reserves, to pave the way to high-value and higher profit products.

Despite the announcement, the metal still managed to clock in a 2.9% jump in the Shanghai Futures Exchange during the session. It currently exchanges hands at RMB 138,450 per ton.

In LME, nickel hiked by 0.6% to $18,525.00 per tonne.

In an update on aluminum in the same bourse, the contract jumped by 1.1% to nearly RMB 19,000 a ton.