Review of a broker with firm foundation and cutting-edge platform: ETFinance

General Information about ETFinance

ETFinance is a Cyprian online brokerage that began operating in 2019. The company’s offices found on Agias Fylaxeos Street, 3025 Limassol.

As soon as you open up ETFinance’s website, the Real Madrid Basketball Club sponsorship deal should draw your attention. Recently, many brokers have opted to chase such agreements with sports clubs as a marketing outlet. More specifically, they’ve been targeting European teams as a way to break into the continent’s market more efficiently. The sponsorships usually target football clubs, as the sport is more widespread across European countries, but basketball isn’t far behind. As such, a deal with such a recognizable name in sports is quite significant.

ETFinance: slick Website and smooth interface

On a related note, the thought ETFinance put into designing its website is quite commendable. Although looks aren’t the determining factor in whether you’ll use a brokerage, few can argue against good visual design is positive. In fact, not only does that make the website nicer to look at, but it also shows a degree of carefulness and attentiveness. ETFinance’s design is visually sound, with everything fitting together nicely, unlike many other brokerages that look like they have multiple templates mashed together.

Moreover, the pleasing visual design does not take away from the website functionality, either. There are no long loading screens between webpages. In fact, on the broker’s end, the site runs entirely smoothly. When searching for info about the broker, traders will have an easy time, as everything is readily presented. Whatever you need to know is always only a few button presses away, as the broker neatly sorted all relevant information into adequate categories.

Let’s take a look at some of the features the broker provides its customers with:

· EDUCATION

Educational materials are becoming more and more important as the finance world spreads further. The pandemic has left many with more free time to spend, and some have decided to try their hand at trading. That has led to many brokers to experience an increase in brand-new traders. As getting over the initial stages of trading is perhaps the biggest hurdle, having something to help with that is vital. ETFinance has an in-depth educational library, with articles, eBooks, VODs, and more.

· AWARDS

In a short time, ETFinance has been operating, it has already earned recognition as a globally competitive brand. Lastly, the brokerage has secured a deal with one of the biggest names in European sports, which is an achievement by itself. All that speaks volumes about the broker’s seriousness and devotion to providing a top-notch experience.

All you need to know about ETFinance Funds, Trading and Security

Security is among the most important factors to consider when looking at a new broker. It’s a vital component to good service, and you shouldn’t settle for a firm you do not feel safe with. The unease usually comes from somewhere, and if your gut is telling you something isn’t right, you’re usually correct.

Starting from the regulation, the broker adheres to strict CySEC license requirements. The Cypriot watchdog is quite stringent, and cooperation with them is usually a reliable indicator of security. Even if the broker were to misstep, which is unlikely, the regulator can step in.

The broker also follows the recent MiFID II regulation that aims to ensure a fair and secure trading experience. That means new traders have restrictions on their trading experience, preventing them from getting ahead of themselves.

Trading Accounts

Before investing anything into ETFinance, you can open a demo account. The account has some funds on it, meaning the trading experience you’ll get from it is authentic, minus the actual money going in and out. New traders can get quite some mileage out of the account, as they can use it to familiarize themselves with the trading process. On the other hand, seasoned traders will be able to inspect the overall experience and asset list in detail. Demo accounts are always a welcome feature and are a sign that the broker is proud of the service they crafted.

A live account requires the $250 investment that you’re probably already used to by now. That’ll get you the Silver account. If you want one of the two higher account tiers. That gets you a few additional features and improves certain conditions, such as leverages and spreads.

There’s one more significant distinction, between the retail and professional accounts. Retail is the default and targets new traders, with integrated risk-reducing procedures. However, those procedures also come with downsides in severely limited leverage rates, for example. The Professional account uncaps your leverage and comes with additional benefits but requires some documentation from traders. Both versions have their advantages, so the better one depends entirely on the trader.

Here are some of the specifications each account has:

· SILVER

750 Assets

0.07 Minimum Spreads

1:30 Maximum Leverage

Full 10-Hour Support 10 AM – 8 PM GMT

Islamic Account

· GOLD

750 Assets

0.05 Minimum Spreads

1:30 Maximum Leverage (Retail)

1:400 Maximum Leverage (Pro)

Full 12-Hour Support 7 AM – 7 PM GMT

Dedicated Account Manager

Webinars & Videos

Hedging

25% Swap Discount

Islamic Account

· PLATINUM

750 Assets

0.03 Minimum Spreads

1:30 Maximum Leverage (Retail)

1:500 Maximum Leverage (Pro)

Full 12-Hour Support 7 AM – 7 PM GMT

Dedicated Account Manager

Webinars & Videos

Hedging

50% Swap Discount

News Alerts

Free VPS

Islamic Account

Trading Conditions

ETFinance’s trading conditions offer reasonable leverage rates, and the spreads are tight. The depth of assets is quite impressive and allows for choice quality and diversification. Additionally, the platform the broker uses is quick and allows for precise and transparent trades.

The firm is covered by a strict regulator in CySEC and needs to adhere to MiFID II. That creates a situation where any misbehavior would be severely punished, and as such, wouldn’t be anywhere near worth it. However, the broker’s history shows us that it treats its customers well and wouldn’t even attempt any shady practices.

Even the brokers that are usually deemed as less important are great. For example, the broker provides Islamic accounts for traders that choose to follow Sharia, increasing its reach. Additionally, the demo account and educational materials ensure that new traders can smoothly get into the finance world.

The Trading Platform

ETFinance chose to use MetaTrader4 as a basis for their trading services. We commend the choice as the platform is among the most powerful and prominent finance tech solutions. There’s a reason it’s been the industry standard for years, and part of it success is its versatility. It can accommodate both newer and experienced traders, making it the perfect all-round platform.

It also has two significant convenience options in the Web and Mobile Traders. The first allows for download-less use of the platform from any desktop internet browser while only slightly slowing down. The second will enable you to download an app and trade anywhere by using your preferred mobile device.

ETFinance’s Trading Products

One of the greatest strengths of ETFinance’s trading experience is the massive amount of assets they provide. Their trading instrument collection extends further than most other brokers and by quite a large margin. Namely, the broker has over 700 assets distributed across multiple categories. That volume allows for simple portfolio diversification, as well as increasing choice quality by increasing variety. The asset classes you can expect to see are CFD’s on:

- Forex

- Crypto Pairs

- Commodities

- Indices

- Stocks

- ETF

Customer Service

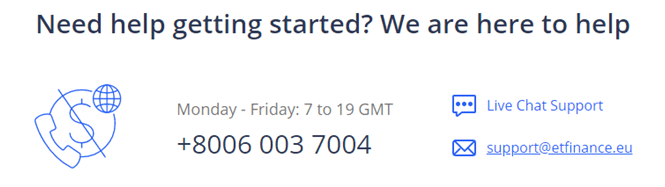

The support at ETFinance has a 12-hour per day work time, starting with 7 AM and ending with 7 PM. The customer service team works Monday to Friday, meaning you can reach them through the entire workweek. The methods you can use to contact them are the standard modes including email address, phone line, or live chat.

Phone number: +80060037004

Email: [email protected]

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage 83% of retail investor accounts lose money when trading CFDs with this provider.

Good broker company

Good broker company. Services are consistently good from day 1 onwards.

Did you find this review helpful? Yes No

Passive source of income

A good passive source of income. I wouldn’t have to spend more time on this, I just have to place trades and wait for results.

Did you find this review helpful? Yes No

Excellent broker

Excellent trading partner. They are responsible and they are expert in the forex markets.

Did you find this review helpful? Yes No

Good broker

Good broker to deal with. The signals are profitable and withdrawal is fast.

Did you find this review helpful? Yes No

Good broker

Good brokers to deal with. They attend to all my concerns right away.

Did you find this review helpful? Yes No

Smooth withdrawals

Fast and smooth withdrawals, great customer service and good profit are what I am getting from this broker. They have good tools, too. Good company.

Did you find this review helpful? Yes No

Good broker

I’ve got a skilled and attentive account manager. He guides me efficiently in order to become successful in trading.

Did you find this review helpful? Yes No

Fully satisfied

I’ve got no complaints with their services. I am truly satisfied with this broker service.

Did you find this review helpful? Yes No

Good broker

Good trading broker. Signals are always timely and profitable.

Did you find this review helpful? Yes No

Outstanding broker

Outstanding broker signals and good trading software. They’ve made trading easier and more productive for me.

Did you find this review helpful? Yes No

Good trading profit

Excellent spreads offered, minimal slippage and good trading profit. I will surely keep them as my forex broker.

Did you find this review helpful? Yes No

Good broker company

One of the best broker company. Easy to deal with support and skilled brokers.

Did you find this review helpful? Yes No

Attentive

They have attentive brokers and customer service. I get prompt and efficient support that I need to succeed in trading. All transactions are hassle-free and that includes withdrawals which are processed smoothly.

Did you find this review helpful? Yes No

Good services

Good services. Withdrawal is fast. I’ve got no complaints, all good.

Did you find this review helpful? Yes No

Fast withdrawals

Withdrawals are never delayed. There are many trading options and I profit from a few trades. Of the real-time executions as well.

Did you find this review helpful? Yes No

Good broker company

I’ve used this broker since I started trading. I am still learning after half a year. I had placed several trades and so far I am happy with my profit and with the services.

Did you find this review helpful? Yes No

Good forex broker

I am happy to leave a comment and let everyone know that this is one of the good forex broker. The company was just new but they deliver really awesome trading results.

Did you find this review helpful? Yes No

Skilled broker

I am thankful to this broker for being so patient with me. They have always shown compassion and genuinely helped me grow my investment.

Did you find this review helpful? Yes No

Good trading company

Good company for online trading. Trading software is easy to use with so many beneficial features. I gained profit and was able to withdraw smoothly.

Did you find this review helpful? Yes No

Highly recommended

Enthusiastic customer service and good signals. Trading term and consditions are fair and withdrawal is fast. Highly recommended broker company.

Did you find this review helpful? Yes No

Good trading services

So many trading instruments to choose from. Signals are good and so are the services.

Did you find this review helpful? Yes No

Great trading signals

I am using these trading services and got no problem so far. Signals are amazing.

Did you find this review helpful? Yes No

Highly recommended

Highly recommended trading services. Prompt customer service, fast withdrawals, and excellent signals.

Did you find this review helpful? Yes No

Trusted broker signals

I can trust on the signals, I am able to get a good profit from the signals. I can depend on the services too, they are always prompt and efficient.

Did you find this review helpful? Yes No

Pleasing services

I am delighted to trade with this broker. I get real good income and I am very pleased with the services.

Did you find this review helpful? Yes No

Highly recommended

Good services and great people. Highly recommended.

Did you find this review helpful? Yes No

Smooth withdrawals

Smooth deposit and withdrawal process. I did not encounter any issues for the past few months and I am looking forward to see consistency on good services.

Did you find this review helpful? Yes No

Good forex company

My trusted forex company. Signals are good as well as the services.

Did you find this review helpful? Yes No

Good services

Good broker and the best customer service. They’ve been my long-time broker. Services are always good.

Did you find this review helpful? Yes No

Happy with this broker

No problem with withdrawals, tools or even services. I am happy since day 1.

Did you find this review helpful? Yes No

Accurate analysis

Profitable trading signals. Their analysis are always accurate

Did you find this review helpful? Yes No

Affordable and worth it

There are plenty of good trading instruments to choose from. Very affordable and worthh to trade with.

Did you find this review helpful? Yes No

Good broker

Rare to find a good broker. This one is for keeps.

Did you find this review helpful? Yes No

Highly recommended

Highly recommended trading services. Prompt customer service, fast withdrawals, and excellent signals.

Did you find this review helpful? Yes No

Remarkable trading experience

I get a really remarkable trading experience from this broker. I gain profit huge enough to help me and my family.

Did you find this review helpful? Yes No

Fully satisfied

I’ve got no complaints with their services. I am truly satisfied with this broker’s service.

Did you find this review helpful? Yes No

Happy and satisfied

Services are consistently good. It’s been a year since I joined them but services just keep getting better. Happy and satisfied.

Did you find this review helpful? Yes No

Great broker

I never worry of losing money. I confidently place my trades because I got the best advise from the greatest broker.

Did you find this review helpful? Yes No

Good brokers

Great trading options, very affordable and profitable. I gain good profit and I owe so much from these brokers.

Did you find this review helpful? Yes No

Good people

Good people. They explain all things clearly and process my withdrawals smoothly.

Did you find this review helpful? Yes No

Efficient services

Signals are always accurate and profitable. Services are good and efficient.

Did you find this review helpful? Yes No

Good profit

Happy to trade with them. I gain good profit.

Did you find this review helpful? Yes No

Excellent

Excellent broker for forex trading. I am contented with my profit and happy with the services.

Did you find this review helpful? Yes No

Satisfactory result

Satisfactory result. I am happy with everything.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker for online trading. Highly recommended services.

Did you find this review helpful? Yes No

Fast withdrawals

Fast withdrawals. I get my money earlier than expected. I never encounter any problem with any of my transactions.

Did you find this review helpful? Yes No

Good income

Two-thumbs up for this broker company. I gain a really good income for my family.

Did you find this review helpful? Yes No

Good broker services

Good broker services. I had so many trading tools to use that really make trading easier for me.

Did you find this review helpful? Yes No

Satisfied

I am more than satisfied with the services. I gain a good profit and I am happy with it.

Did you find this review helpful? Yes No

Excellent customer service

Excellent customer service. They have been really very nice to me since day 1.

Did you find this review helpful? Yes No

Reliable signals

Reliable trading advice. I never worry about my trades, I just need to follow their advice and I am safe.

Did you find this review helpful? Yes No

Highly recommended

Highly recommended trading services. Prompt customer service, fast withdrawals, and excellent signals.

Did you find this review helpful? Yes No

Reliable

Great source of market analysis and signals. Very reliable.

Did you find this review helpful? Yes No

Excellent broker

Excellent in all aspects. I have no problem with services or signals. They’ve always been so amazing.

Did you find this review helpful? Yes No

Good broker

Good broker to trade forex. They are experienced in the forex market. Signals are good are services are reliable.

Did you find this review helpful? Yes No

Efficient services

Signals are always accurate and profitable. Services are good and efficient.

Did you find this review helpful? Yes No

Excellent broker company

Excellent trading company. They do not guarantee a profit but I get good profits consistently.

Did you find this review helpful? Yes No

Great trading experience

I had a great trading experience with this broker. I was able to withdraw a profit of approximately 15 percent monthly. I never had any problem with any of their transactions.

Did you find this review helpful? Yes No

Excellent broker company

Excellent trading company. They do not guarantee a profit but I get good profits consistently.

Did you find this review helpful? Yes No

Great broker company

There are so many good things about this forex broker company. Aside from having great signals, people are very nice and friendly.

Did you find this review helpful? Yes No

Trusted broker

Seamless transactions. I see transparency on all trades, pricing and even market trends. I can trust this broker and I can rely on their signals.

Did you find this review helpful? Yes No

Good trading experience

I can not say that my trading experience is perfect but I can say that it is better that expected.I have losses but it’s very minimal. Signals are accurate and profit is quite good.

Did you find this review helpful? Yes No

Good broker

Good broker to deal with. They attend to all my concerns right away.

Did you find this review helpful? Yes No

Good brokers

Great trading options, very affordable and profitable. I gain good profit and I owe so much from these brokers.

Did you find this review helpful? Yes No

Worthwhile broker services

I never regret choosing them to be my forex broker. Signals are always worthwhile and profitable.

Did you find this review helpful? Yes No

Great trading company

Great trading company. Investment returns are good and services are awesome.

Did you find this review helpful? Yes No

Superb broker

Superb customer support and smart brokers. I am impressed with both signals and services, they outperform most of the brokers.

Did you find this review helpful? Yes No

Dedicated trading broker

Happy to leave a review for this trading broker. They are very responsible and dedicated in helping me succeed in trading.

Did you find this review helpful? Yes No

Good trading company

It is indeed a good trading company. Signals are accurate, withdrawal is fast and customer service are always prompt.

Did you find this review helpful? Yes No

Great broker

Exemplary broker performance. They excel in all of their trading services.

Did you find this review helpful? Yes No

Profitable offers

They have so many profitable offers. I took advantage of a few offers and am now successfully withdrawing bigger profits.

Did you find this review helpful? Yes No

Good broker

They are very good in providing trading advise. I get really good profit. If you are looking for source of income, this one is my recommendation. Worth my time.

Did you find this review helpful? Yes No

Hassle-free withdrawals

Very transaparent on all transations. They also process withdrawals swiftly and hassle-free.

Did you find this review helpful? Yes No

Love the services

I have been using this broker service for almost 3 months and I am loving the services.

Did you find this review helpful? Yes No

Good broker company

Good broker company. There are so many good trading instruments to chose from.

Did you find this review helpful? Yes No

Good trading company

Great trading tools and signals. I am overall satisfied with this broker performance.

Did you find this review helpful? Yes No

The best broker

One of the best broker with decent trading conditions.I can rate them excellent.

Did you find this review helpful? Yes No

Accurate signals

Signals are accurate and withdrawal is fast.Good broker company.

Did you find this review helpful? Yes No

Reliable

Great source of market analysis and signals. Very reliable.

Did you find this review helpful? Yes No

Reliable broker signals

Reliable trading signals. I am so thankful to have them as my broker, they’re really good.

Did you find this review helpful? Yes No

Good broker

Good to deal with. They never give me any problem on withdrawals or whatsoever.

Did you find this review helpful? Yes No

The best

The best trading broker. Highly recommended.

Did you find this review helpful? Yes No

Great broker

Friendly and approachable customer service. Brokers are skilled too. I get good profit.

Did you find this review helpful? Yes No

Great broker

I stay with this broker for more than a year, I have no problem with their services. Very fast trade execution, friendly customer service, easy deposit, and withdrawals.

Did you find this review helpful? Yes No

Good broker

Great trading services, good tools, and good signals.

Did you find this review helpful? Yes No

Great trading tools

I enjoy technical error-free trading. Signals are so much more accurate and all the trading tools are very efficient.

Did you find this review helpful? Yes No

Reliable broker

A reliable source of market information. I am trading with this broker for a few months now and they’ve always been very reliable.

Did you find this review helpful? Yes No

Efficient tools and signals

I am trading with ease and confidence. Tools and services are both efficient. I will be keeping this broker for good.

Did you find this review helpful? Yes No

Exceptional broker performance

Exceptional broker performance. I get really awesome trading results.

Did you find this review helpful? Yes No

Good trading broker

Fast and reliable services. Been a good trading broker for me.

Did you find this review helpful? Yes No

Good services

I am trading currency pairing and so far it’s good. I haven’t tried other offers but the services are all good.

Did you find this review helpful? Yes No

Great experience

Great trading experience. I was able to gain good profit from the offers.

Did you find this review helpful? Yes No

Trusted broker

Trusted trading broker. Their advise are proven effective.

Did you find this review helpful? Yes No

Superb broker

Superb customer support and smart brokers. I am impressed with both signals and services, they outperform most of the brokers.

Did you find this review helpful? Yes No

Awesome services

Very good at what they do. The services are extremely awesome.

Did you find this review helpful? Yes No

Good forex broker

There are so many good reasons to keep this broker service. Profitable signals, good customer service, and fast withdrawals.

Did you find this review helpful? Yes No

Good broker services

Fast execution, swift withdrawals, and good services are just among the good things I like about this broker.

Did you find this review helpful? Yes No

Great customer service

Great customer service and highly skilled forex brokers. I will surely keep the service and recommend them to other traders I know.

Did you find this review helpful? Yes No

Recommended broker

This broker has been recommended to me. Have tried trading several commodities and I get good returns. So far, the services work for me.

Did you find this review helpful? Yes No

Responsible and professional

Responsible and professional people. They are very transparent on all transactions. I am gaining good profit and satisfied with the services.

Did you find this review helpful? Yes No

Recommended

I do suggest this broker to all traders. I get good profit here. No problem with transactions, I get the support I needed.

Did you find this review helpful? Yes No

Good broker

Good broker to deal with. They are very professional and have treated all of my concerns with high importance.

Did you find this review helpful? Yes No

Great broker company

They are a new broker company in the forex industry but they outperform most of the tenured broker companies.

Did you find this review helpful? Yes No

Good broker

I have traded with this broker for about a few months and based on my observation, they’re good.

Did you find this review helpful? Yes No

Good signals

Good trading signals. I always gain good profit from the trading advice.

Did you find this review helpful? Yes No

Fully satisfied

Good trading platform and trading services. I am happy I chose the right broker this time. I am fully satisfied with the services.

Did you find this review helpful? Yes No

Exceptional broker service

Exceptional broker services. I am impressed with broker signals and even services.

Did you find this review helpful? Yes No

Great broker

This broker has been very good to me. They even provided me with good deals for a great start. They’ve guided me since then until these days and I am so thankful, I gain good profit.

Did you find this review helpful? Yes No

Love the services

I have been using this broker service for almost 3 months and I am loving the services.

Did you find this review helpful? Yes No

Great broker

This broker has been very good to me. They even provided me with good deals for a great start. They’ve guided me since then until these days and I am so thankful, that I gain good profit.

Did you find this review helpful? Yes No

Accurate signals

Signals are accurate and withdrawal is fast. Good broker company.

Did you find this review helpful? Yes No

Quick withdrawals

Quick withdrawal and excellent services. I have been trading with them for a year and got no complaints. Awesome brokers.

Did you find this review helpful? Yes No

Great broker

Great tools, instruments, and market analysis are offered by this broker. Signals and services were also excellent.

Did you find this review helpful? Yes No

Good broker company

Good broker company. There are so many good trading instruments to choose from.

Did you find this review helpful? Yes No

The best broker

One of the best brokers with decent trading conditions. I can rate them excellent.

Did you find this review helpful? Yes No

Efficient services

Signals are always accurate and profitable. Services are good and efficient.

Did you find this review helpful? Yes No

Happy and satisfied

Services are consistently good. It’s been a year since I joined them but services just keep getting better. Happy and satisfied.

Did you find this review helpful? Yes No

Decent profit

Dependable trading services. I get a good result and decent profit from this broker.

Did you find this review helpful? Yes No

Reliable

Great source of market analysis and signals. Very reliable.

Did you find this review helpful? Yes No

Highly recommended

The opportunities I had from this broker have greatly helped me gain good profit. Highly recommended.

Did you find this review helpful? Yes No

Good trading experience

Good trading experience. I had a very positive trading experience with this broker. I get good trading results all the time.

Did you find this review helpful? Yes No

Great trading options

I have so many great trading options. All are affordable and profitable.

Did you find this review helpful? Yes No

Quick support

Very quick and understanding trading support and professional brokers. recommended.

Did you find this review helpful? Yes No

Highly recommended

Highly recommended brokers, especially to newbies. They are really very effective trading partners.

Did you find this review helpful? Yes No

Good trading signals

They have a wide array of profitable trading instruments to choose from. Signals are also good.

Did you find this review helpful? Yes No

Good trading company

Great trading tools and signals. I am overall satisfied with this broker’s performance.

Did you find this review helpful? Yes No

Perfect forex broker

Perfect broker for online trading. They have so many good things to offer.

Did you find this review helpful? Yes No

Better than other brokers

This broker performs far better than the several brokers I have traded with in the past. I get better profit and better services, too.

Did you find this review helpful? Yes No

Reliable

Amazing trading software. It has so many opportunities to make money. Easy to use s well.

Did you find this review helpful? Yes No

Highly recommended

Such a good broker for forex trading. Signals are always profitable and withdrawal is always fast and smooth. Highly recommended forex broker.

Did you find this review helpful? Yes No

Profitable signals

Profitable trading signals. They always come up with sound trading advice.

Did you find this review helpful? Yes No

Easy withdrawals

Easy to withdraw money here. I never had any hassle dealing with them, they listen and are very flexible to match trader needs.

Did you find this review helpful? Yes No

Good brokers

A good broker and excellent customer service. I have recommended them to all my friends.

Did you find this review helpful? Yes No

Excellent services

Excellent services for forex trading. Tools are also awesome.

Did you find this review helpful? Yes No

Reliable

Great source of market analysis and signals. Very reliable.

Did you find this review helpful? Yes No

Offers great deals

Choose this broker company. They got really good deals and services to offer.

Did you find this review helpful? Yes No

Excellent brokers

Excellent is not enough to describe their services. I am impressed with their support, their broker signals as well as their platform.

Did you find this review helpful? Yes No

Good signals

Good signals and very useful trading tools. Trading is easier and more productive thru their help.

Did you find this review helpful? Yes No

Good company

Good trading company. They pay profit on time.

Did you find this review helpful? Yes No

Good broker

Extremely good customer service and fast withdrawals. Good broker

Did you find this review helpful? Yes No

Happy to recommend

Never had any issues with the services so far. Happy to recommend it.

Did you find this review helpful? Yes No

Commendable brokers

Commendable brokers and customer service. I am glad they are my brokers.

Did you find this review helpful? Yes No

Excellent

Excellent signals and services. Commendable customer service.

Did you find this review helpful? Yes No

Awesome trading results

I am happy to leave a comment and let everyone know that this is one of the best forex brokers. The company was just new but they deliver really awesome trading results.

Did you find this review helpful? Yes No

Good offers

Awesome trading experience. I’ve got no idea how trading works. They have introduced everything to me. I am seeing potential profits on the offers.

Did you find this review helpful? Yes No

Smart trading tools

Smart trading platforms and tools for day trading. I have traded with several companies in the past but this one got the best tools.

Did you find this review helpful? Yes No

Highly recommended

This exactly is what I am looking for. Very good trading services, fast withdrawals, and enthusiastic people to work with. Highly recommended.

Did you find this review helpful? Yes No

New broker but excellent services

This broker is new in the forex market. Little did I know, they are very great in market analysis and signals are very effective. The moment I tried the services, I am so much impressed.

Did you find this review helpful? Yes No

Good broker

My favorite trading broker. They always laid good opportunities to make money.

Did you find this review helpful? Yes No

Good services

A good broker and has the best customer service. They’ve been my long-time broker. Services are always good.

Did you find this review helpful? Yes No

Excellent trading services

Excellent trading services. Customer service attends to trading needs promptly.

Did you find this review helpful? Yes No

Good services

Great people. They are very effective and the services are all good.

Did you find this review helpful? Yes No

Good broker

I appreciate their extra effort to gather market news. It really helped me a lot in coming up with the right decision and placing the right trade.

Did you find this review helpful? Yes No

Great test results

Good profit. I am happy that I am trading with the perfect broker for online trading.

Did you find this review helpful? Yes No

Smart trading tools

Smart trading platforms and tools for daytrading. I have traded with several companies in the past but this one got the best tools.

Did you find this review helpful? Yes No

Fast withdrawals

Offer a wide range of markets, tight spreads, and fast withdrawals.

Did you find this review helpful? Yes No

Great brokers

Smooth trading transactions. For over six months of trading with them, I never encounter any problems with any transactions including withdrawals.

Did you find this review helpful? Yes No

My favorite broker

This is my favorite broker company. Services are all efficient and results are always in my favor.

Did you find this review helpful? Yes No

Spot on signals

Spot on trading signals. I gain good profit and I am happy with the services.

Did you find this review helpful? Yes No

Competitive broker

Competitive broker services and signals. I am glad to have picked the perfect broker to help me with all my trading needs.

Did you find this review helpful? Yes No

Good platform

Good platform. I never encounter any technical problems. Because of the great features, organizing my trading account is easier.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker in forex trading. They are reliable and very professional.

Did you find this review helpful? Yes No

Outstanding broker

Oustanding broker services. They outperform most of the big broker companies.

Did you find this review helpful? Yes No

Fast withdrawals

Withdrawals have always been easy and fast. They’ve been my broker for over a year and I never had any problem with withdrawals.

Did you find this review helpful? Yes No

Satisfied

I am fully satisfied with what I get from this broker. It is a good source of income.

Did you find this review helpful? Yes No

Accurate analysis

Profitable trading signals. Their analysis are always accurate.

Did you find this review helpful? Yes No

Perfect broker

I found a perfect broker to trade with. Signals are accurate and profitable. The services are great.

Did you find this review helpful? Yes No

Affordable and profitable

I have a lot of options here to trade with. The assets are very affordable and profitable.

Did you find this review helpful? Yes No

Good forex broker

I am getting good trading advice and good trading services from this broker. Happily trading with them for about six months and will surely recommend it.

Did you find this review helpful? Yes No

The best broker

The best choice to trade forex with. Signals and services are all worthwhile.

Did you find this review helpful? Yes No

Outstanding broker

Oustanding broker services. They outperform most of the big broker companies.

Did you find this review helpful? Yes No

Great trading experience

My overall trading experience with this broker is great. I get good profit and I have no problem with the services so far.

Did you find this review helpful? Yes No

Excellent brokers

I am getting excellent trading as always from the brokers. I owe so much to this company and would gladly recommend them.

Did you find this review helpful? Yes No

Professional brokers

A forex broker company with very professional brokers and customer support. Always prompt on all trading needs.

Did you find this review helpful? Yes No

Good trading services

Prompt and great services. I am happy and felt like I had picked the best broker to trade forex with.

Did you find this review helpful? Yes No

Good broker

Friendly customer service and very professional brokers. I am happy to deal with them, results are always good.

Did you find this review helpful? Yes No

Happy to trade with

Happy to trade with them. I get good trading profit and great services, too.

Did you find this review helpful? Yes No

Excellent signals

Excellent trading signals and services. I am fully satisfied and happily trading with this broker for quite some time now.

Did you find this review helpful? Yes No

Withdrawal problems

Good broker, Except for slow email replies, the rest of the services work fine.

Did you find this review helpful? Yes No

Recommended broker

I am very happy with this brokerage. No issues with execution or anything. Recommended highly!

Did you find this review helpful? Yes No

Good trading broker

I am happy to see progression in my trades. It is one of the best brokers I have dealt with. Signals are always good and services are, too.

Did you find this review helpful? Yes No

Waste of time

Regulated brokers and affordable I may say but not that profitable. I feel like it is just a waste of time.

Did you find this review helpful? Yes No

Good forex broker

My broker for over a year and I will definitely keep the services. Fast execution and withdrawals. Prompt and helpful customer service also.

Did you find this review helpful? Yes No

Good services

The services are good so far. I was able to gain profit and I am satisfied.

Did you find this review helpful? Yes No

Good customer service

Good customer service. They always think outside the box to make sure everything works perfectly fine for me.

Did you find this review helpful? Yes No

My favorite trading broker

They always come up with something new and profitable. My favorite trading broker.

Did you find this review helpful? Yes No

Great offers

Their offers are really great. I gain good profit from it.

Did you find this review helpful? Yes No

Good broker signals

Exactly what I am looking for in a broker. Signals are good and withdrawal is quick.

Did you find this review helpful? Yes No

Satisfied

I’ve had no issues encountered so far. Been dealing with them for almost a year and I am satisfied with the services.

Did you find this review helpful? Yes No

Affordable trading options

Affordable initila deposit. Will let you deposit and trade for as low as $100. I am happy I did start with minmum deposit but now earning really good profit after a few months.

Did you find this review helpful? Yes No

The best forex broker

It is probably the best broker for forex trading. I have used so many brokers in the past but I prefer to keep this one.

Did you find this review helpful? Yes No

Profitable trading

Profitable trading. I find it worth my money and time because the return on my investment is really great.

Did you find this review helpful? Yes No

Satisfactory

Satisfactory trading services. I get good returns, worth my time.

Did you find this review helpful? Yes No

Swift withdrawals

Good broker for online trading. Signals are reliable and withdrawal is swiftly done.

Did you find this review helpful? Yes No

Good services

I am a happy and satisfied customer. Services are all good, I am gaining profit.

Did you find this review helpful? Yes No

Great forex company

Good trading tools and helpful educational materials. Overall, a great forex company.

Did you find this review helpful? Yes No

Reliable broker service

Forex trading broker services that are truly reliable. I am satisfied with the profit I am getting for the past few months.

Did you find this review helpful? Yes No

Good services

Good service for forex trading. No problem with any of the services, all good.

Did you find this review helpful? Yes No

Great broker

Fun to deal with. They are skilled and have a sense of humor. They are also very patient making sure I understand everything.

Did you find this review helpful? Yes No

Accurate signals

Signals are accurate and withdrawal is fast. Good broker company.

Did you find this review helpful? Yes No

Good options to make money

Overall, a good broker for CFD’s. They have so many good options to make money here.

Did you find this review helpful? Yes No

Great partners

Great trading partner. They care and are genuine in helping me.

Did you find this review helpful? Yes No

Smooth transactions

Withdrawals are always taken care of in a timely manner. Smooth transactions.

Did you find this review helpful? Yes No

Good profit

The best broker company. I love to trade with them, I gain good profit consistently.

Did you find this review helpful? Yes No

The best broker

One of the best brokers with decent trading conditions. I can rate them excellent.

Did you find this review helpful? Yes No

Skilled broker

Highly skilled brokers. They seem well-versed in the forex market.

Did you find this review helpful? Yes No

The best

The best trading broker. Highly recommended.

Did you find this review helpful? Yes No

One of the best

I can consider this broker as one of the best forex brokers. I get good profit and was able to withdraw it quickly. All services from this broker are always good.

Did you find this review helpful? Yes No

Good trading results

They offer so many trading instruments. I am currently trading currencies that are very volatile but I still manage to get good results.

Did you find this review helpful? Yes No

Amazing brokers

Very good service, high leverage, and low spreads. I am truly amazed all the time.

Did you find this review helpful? Yes No

Great broker

Great broker to deal with. They are skilled and well-experienced in forex trading.

Did you find this review helpful? Yes No

Good brokers

Fast and easy withdrawals. People here are very cooperative and professional. I do not have any problem dealing with them.

Did you find this review helpful? Yes No

Friendly customer service

I am very happy with the services so far. their customer service is awesome and nice. I am trading with a very friendly atmosphere.

Did you find this review helpful? Yes No

Transparent transactions

Explain things clearly. All transactions are very transparent.

Did you find this review helpful? Yes No

Great trading services

Great trading services. I enjoy the benefits I am getting by trading with this broker company.

Did you find this review helpful? Yes No

Highly recommended

I am happy within the past six months of dealing with them. Highly recommended brokers.

Did you find this review helpful? Yes No

Good company

Profit and services are both great. No issues for the past six months and I am hoping for consistency.

Did you find this review helpful? Yes No

Effective trading advise

My investment has been growing a lot. They have been very dedicated to helping me. Trading advice is all very effective.

Did you find this review helpful? Yes No

Worthwhile signals

The best trading partner I have dealt with. Signals are worthwhile.

Did you find this review helpful? Yes No

Great broker company

Great broker company. Withdrawal is always swift and hassle-free.

Did you find this review helpful? Yes No

Very professional

I am delighted with this broker’s services. They’ve been very professional and easy to deal with.

Did you find this review helpful? Yes No

Wise choice

This is really a wise choice. Signals are profitable and withdrawal is easy.

Did you find this review helpful? Yes No

Professional broker

They are enthusiastic and very friendly. Assist me to gain good profit and are very professional.

Did you find this review helpful? Yes No

Highly recommended

I feel their sincerity to help and dedication to making my trades successful. Highly recommended.

Did you find this review helpful? Yes No

Trusted broker

A company I can always trust. Been trading with them for a few months now and I am satisfied with all of the services as well as my profit.

Did you find this review helpful? Yes No

Smooth withdrawals

Smooth and fast withdrawals. I never worry about losing much here because I got my brokers to back me up with good advice.

Did you find this review helpful? Yes No

Interesting forex broker

Interesting forex broker. I gain approximately 12percent in my first month and it progresses every month.

Did you find this review helpful? Yes No

Reliable broker service

Forex trading broker services that are truly reliable. I am satisfied with the profit I am getting for the past few months.

Did you find this review helpful? Yes No

Good profit

I’ve got no regret choosing this broker over a few options. They can consistently help me gain good profit.

Did you find this review helpful? Yes No

Highly recommended

The best trading platform and signals. Highly recommended broker.

Did you find this review helpful? Yes No

Expert brokers

Expert brokers. I find this trading company good and the services are efficient.

Did you find this review helpful? Yes No

Happy customer

Happy customer here. I have traded with this broker for the past few months and they really did well in providing sound investment advice.

Did you find this review helpful? Yes No

Great forex broker

They have helped me understand how forex trading works. At first, I started trading with zero knowledge. They have patiently thought me everything and best of all they have helped me gain profit.

Did you find this review helpful? Yes No

Good broker

I am glad I found the perfect broker for me. I gain good profit and I am truly happy with the services.

Did you find this review helpful? Yes No

Great profit

This is a broker with a very good service, if there are concerns, they always resolved quickly. I get desirable profit and I am overall satisfied with the services.

Did you find this review helpful? Yes No

Helpful brokers

They have helped me understand how trading works and most importantly had guided me to gain profit. They are always available to assist whenever I call or send them messages.

Did you find this review helpful? Yes No

This broker has change my lifestyle from good to great.

This forex broker has really changed my lifestyle from good to great. I am a bit skeptical at first when they offer forex trading to me but I still striped their services and invested minimum deposit. After a year of trading with them, I was able to gain huge profit, I bought a new car and a house of my own.

Did you find this review helpful? Yes No

Best brokers

One of the best brokers that provide accurate and profitable signals. I personally recommend this broker.

Did you find this review helpful? Yes No

Fully satisfied

Fully satisfied with this broker’s performance. There are losses but very minimal, it only happens on times that I traded on my own. The moment I notice it, I never place trades on my own but rely on their trading advice instead.

Did you find this review helpful? Yes No

Efficient brokers

Efficient broker services. Withdrawal is fast and easy. Customer service is prompt and friendly. All good, no complaints so far.

Did you find this review helpful? Yes No

Profitable

This has been a very good trading partner to me for almost a year now. Aside from the good profit and great services, I am also getting excellent trading education from them.

Did you find this review helpful? Yes No

Good broker

There is a wide variety of instruments to trade with. Very accurate and profitable signals. Withdrawals are also fast and smooth process always.

Did you find this review helpful? Yes No

Good signals

One of the forex brokers with excellent services. I never worry about trading forex I have strong trading advice from them.

Did you find this review helpful? Yes No

Excellent broker

Great broker signals and good customer service. I am glad I traded with the right broker.

Did you find this review helpful? Yes No

Fast and easy withdrawals

Fast and easy to withdraw money. Good services also. I will keep their service and recommend it for sure.

Did you find this review helpful? Yes No

Good profit

I am very happy with my profit. In just 2 months of trading with them, I am gaining real good profit.

Did you find this review helpful? Yes No

Good signals

A good place to trade forex. Signals and tools are great.

Did you find this review helpful? Yes No

Good profit

They have great trading terms and their customer service is readily available to assist in all my trading concerns. I gain a good profit and nothing to complain about.

Did you find this review helpful? Yes No

Good profit

I am satisfied with this broker service. I get good profit.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker performance. I always get a desirable trading result. They always go beyond what is expected.

Did you find this review helpful? Yes No

Good trading company

Good trading company. They are very professional in whatever transaction I have with them.

Did you find this review helpful? Yes No

Awesome signals

The best among the brokers I have tried. Awesome signals.

Did you find this review helpful? Yes No

Good broker company

I had a hard time learning forex trading but they’ve been very patient with me. Have sat with me on a session of multiple training and coaching. All worth it, I get a good profit from their offers and really good services too.

Did you find this review helpful? Yes No

Favorable trading results

In general, it is great to deal with this broker. The services are all efficient and trading results are favorable.

Did you find this review helpful? Yes No

Commendable broker company

I get consistently good services and I am happy with my profit. Highly commendable broker company.

Did you find this review helpful? Yes No

Excellent services

Excellent services from this broker company. I can confidently trust them with my money.

Did you find this review helpful? Yes No

Professional broker

Offers a wide range of affordable forex assets to trade with. Also, offer excellent services and very professional brokers.

Did you find this review helpful? Yes No

Fast withdrawals

I get my withdrawals on time and sometimes earlier. Their customer services are very friendly and brokers are highly skilled in the forex market.

Did you find this review helpful? Yes No

The best broker company

The best broker company. I love to trade with them, I gain good profit consistently.

Did you find this review helpful? Yes No

Honest broker

Honest and decent trading broker. Good in what they do.

Did you find this review helpful? Yes No

Prompt customer service

Prompt customer service. Attend to trading concerns right away.

Did you find this review helpful? Yes No

Satisfied customer

Happily trading for more than a year. I’ve got no plans of switching to a different broker, I am satisfied with both services and profit they are giving me.

Did you find this review helpful? Yes No

Good trading terms

Good trading terms, even allow scalping. Their customer service as well as the brokers are very dedicated to providing good services. I gain good profit here, there are so many opportunities to earn.

Did you find this review helpful? Yes No

Good services

Overall, the services are good. profitable signals, fast withdrawals, and good customer service.

Did you find this review helpful? Yes No

Recommended brokers

No delays on withdrawals and prompt on all responses. I am overall happy with this broker service and will truly recommend it.

Did you find this review helpful? Yes No

Accurate signals

Skilled brokers. Signals are reliable and accurate.

Did you find this review helpful? Yes No

Good profit

I really enjoy the services. I have traded with them with just the minimum amount and in just a span of few months, I gain real good profit.

Did you find this review helpful? Yes No

Great trading services

Great trading services. Fast withdrawal and the best customer service. Lblv has my broker for a long time and services are just getting better.

Did you find this review helpful? Yes No

Reliable signals

This broker is clear on all policies. They share reliable signals and market news. Plus the response rate is greater than other brokers I have dealt with in the past.

Did you find this review helpful? Yes No

Worth trading with

Worth trading with. They have really great trading platform with good features. Services are also awesome and people are very professional.

Did you find this review helpful? Yes No

Great trading advise

Great trading advice. I gain a huge profit thru the help of this broker.

Did you find this review helpful? Yes No

Awesome broker

Awesome broker for forex trading. They are highly skilled in trading forex. I was able to gain a huge profit.

Did you find this review helpful? Yes No

Reponsible brokers

This broker’s services never settle for less. They are very responsible for doing some extra effort to look for more opportunities.

Did you find this review helpful? Yes No

Great customer service

Very attentive and prompt customer service. Fast replies even on chat and email.

Did you find this review helpful? Yes No

Reliable brokers

The most reliable broker signals. I have been getting really good profit. Will surely recommend them and will stay with the service.

Did you find this review helpful? Yes No

Fast and easy withdrawals

This has been my forex broker for years and I’ve got problems with withdrawals, it is fast and easy.

Did you find this review helpful? Yes No

24 hour customer support

I am truly satisfied with the 24 hours customer support who are always ready to help me.

Did you find this review helpful? Yes No

Easy withdrawals

Easy to withdraw money, I never had any problem requesting for my profit.

Did you find this review helpful? Yes No

Happy and satisfied

Services are consistently good. It’s been a year since I’ve joined them but services just keep getting better. Happy and satisfied.

Did you find this review helpful? Yes No

Good signals

Good signals and services. I am thankful for having such a good broker as them.

Did you find this review helpful? Yes No

Fast withdrawals

Fast withdrawals. I never encounter any hassle in the withdrawal process.

Did you find this review helpful? Yes No

Good broker to trade with

I have been trading with this broker for almost a year and so far I am very happy with the services. Good broker to trade with.

Did you find this review helpful? Yes No

Great services

Great services. They are always very efficient. In fact, I get very minimal losses and great profit from these broker signals.

Did you find this review helpful? Yes No

Top notch services

I have a live account with Vlom and I found the service level to be top-notch, these guys there are super responsive and you can have personal service. No wait time, they’re very prompt.

Did you find this review helpful? Yes No

Excellent services

The services are all excellent throughout. Have been trading with them for almost six months and I am very happy and satisfied.

Did you find this review helpful? Yes No

Good broker service

One of the best brokers I have ever dealt with. Signals and services are both good.

Did you find this review helpful? Yes No

Good company

Good company. Been trading with them for a year now and I get a really good profit.

Did you find this review helpful? Yes No

Good broker

I am getting my profit on time. Good trading broker.

Did you find this review helpful? Yes No

Good broker company

Good broker company. There are so many good trading instruments to choose from.

Did you find this review helpful? Yes No

Good trading partner

Good trading partner. The offers are really amazing and so are their services.

Did you find this review helpful? Yes No

Excellent signals

Excellent trading signals. I’ve gained a lot from this broker company.

Did you find this review helpful? Yes No

Good broker company

I had a great trading experience overall. Signals are accurate, services are reliable and people are very professional to deal with.

Did you find this review helpful? Yes No

Impressive services

They are fairly new in the forex industry but are highly skilled in online trading. I am impressed with the services and with my trading profit.

Did you find this review helpful? Yes No

Effective trading signals

Effective trading signals. I have gained real good profit and I am happy with the services.

Did you find this review helpful? Yes No

Affordable trading instruments

Affordable trading instruments to choose from. Signals are also good and profitable.

Did you find this review helpful? Yes No

Happy to trade with this broker

Signals are accurate and profitable. I am happy to trade with this broker.

Did you find this review helpful? Yes No

Great broker

Great trading broker. I was able to withdraw profit smoothly and they are very transparent on all transactions.

Did you find this review helpful? Yes No

Fast withdrawals

Fast and easy withdrawals. I had a really good trading experience with this broker.

Did you find this review helpful? Yes No

Excellent chat support

Excellent live chats. They can resolve concerns via chat, that good. I don’t need to call them most of the time. They also respond quickly.

Did you find this review helpful? Yes No

Excellent offers

Excellent trading offers. I am gaining a good profit on all of my trades.

Did you find this review helpful? Yes No

Smooth withdrawals

So far deposits and withdrawals were done smoothly. And the customer service is superb.

Did you find this review helpful? Yes No

Great broker

I stay with this broker for more than a year, I have no problem with their services. I am satisfied with my profit and am very happy with all of the services.

Did you find this review helpful? Yes No

Best place to trade

The best place to trade currencies. Very volatile-yes, but really very profitable.

Did you find this review helpful? Yes No

Good

ETFinance overall performance is good. They have provided me good service, accurate signals and awesome profits. Withdrawal is convenient and fast.

Did you find this review helpful? Yes No

The broker I've been looking for

This is a wonderful broker that provided me with the advice and help that i needed in my trading advances. Would recommend).

Did you find this review helpful? Yes No