A remarkable technical indicator is OBV. It shows us if the real money is selling the Bitcoin or buying. Their situations when Bitcoin swing high or is failing to break above resistance and the Ethereum is already broke. In this situation, we want to see the OBV increase in the direction of the trend. In that case, we want OBV to move beyond the level it reached when Bitcoin was trading previously at this resistance level.

When the OBV indicators give us a green signal, we must place a buy limit order. In other words, place the order at the resistance level in anticipation of the possible breakout.

It is no surprise for the bitcoin price to break higher than expected and see this trade getting triggered. OBV is an excellent indicator.

Now we need to establish when to take profits for the best Bitcoin trading strategy and where to place our protective stop loss.

The smart way to trade is to place the stop loss below the breakout candle.

Usually, when the OBV indicator is above 105,000, it’s an extreme reading that signals at least to pause in the trend, when it comes to our take profit. It is when and where we want to take profits.

Way to Reduce Risks of Trading

You know that bitcoin day trading involves some risks. Nevertheless, there are some to reduce risks. Here we provide some top ways to enhance your Bitcoin trading strategy.

Never forget:

- Use stop losses – start with a profit loss ratio of 2:1. Set stop-loss orders on every trade.

- Use technical analysis – That will help you to justify each of your trade. Like OBV, use reliable technical indicators.

- Follow Bitcoin News – Set up alerts and other kinds of notifications. To stay ahead of the market, pay attention to cryptocurrency news stories.

- Watch Trading times – Bitcoin trade never stops. It is available 24 hours a day. Thus, it’s different from the 9-5 NYSE. Plan your trading times, which are compatible with your daily schedule.

- Minimize trading costs – Choose a trustworthy exchange that has low fees to minimize the trading cost. It affects your daily ROI to open multiple positions every day.

- Diversify your trades – Combining Ethereum, Litecoin, Ripple, Bitcoin, and other currencies will help to reduce the daily risk associated with a specific coin.

There is a possibility that our fiat money will go under and be replaced with the cryptocurrencies. We live in a digitalized world. The potential of cryptocurrencies or Bitcoin to replace the way we pay for the services and goods is not beyond the realms.

Breakout Trading Strategy

Now I will talk about the breakout trading strategy. Professional traders are using trade breakouts. To minimize the losses, it tells you the right way if you are making a mistake.

One of the hardest parts of trading is to minimize losses. Nevertheless, thanks to the breakout strategy, it is not impossible. Being a professional trader means to maximize profits and minimize losses.

For the trading breakout, first, you need to understand what breakout trading is. Usually, many traders forget about the core principles of breakout trading.

Types of Trading Breakouts

There are two types of breakouts.

- Swing Low and Swing high breakouts.

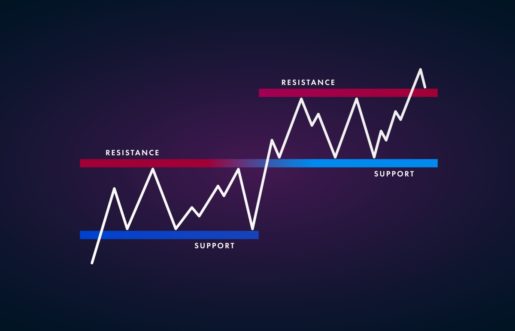

- Resistance and Support breakouts.

When you try to enter the market when the prices move outside a defined price range (resistance or support), that is called breakout trading.

A big, bold candle follows the genuine breakout, in breakout trading. Above the support resistance level, the candle closes. The bigger the breakout candle is, the better.

In terms of the Swing High and Swing low breakouts, we apply the same rules as the support and resistance breakouts. Nevertheless, in this case, that is an additional filter. We want to breakout trade the setups that are offering us the best outcome. That is because not all swing lows and swing highs are created equal.

The thing to remember is that there are too many false breakouts.

Volume Weighted Moving Average

But there is a strategy for differentiating a genuine breakout and a false breakout. For that, the indicator which is called Volume Weighted Moving Average (VWMA).

Volume Weighted Moving Average is a simple technical indicator used for volume analysis. One of the most underused technical indicators that only professional traders employ is the VWMA. Even though VWMA looks like a moving average, it is based on volume.

On most trading platforms, the Volume Weighted Moving Average is available.

The best breakout trading strategy’s first step is to identify the price level. It is your breakout trading level. When attempting to breakout trading, it is the most crucial part. Thus, we only want to recognize clear and significant levels.

It is just a game of waiting and patience, once the resistance level has been identified.

To close above our resistance level, we need a breakout and breakout candle. It is a sign that bulls are under control.

Nevertheless, we are not done yet. We need a confirmation from the VWMA indicator. That will give us the approval to pull the trigger on this breakout trading. We need to see the stretch up of Volume Weighted Moving Average visually.

Before the breakout, the VWMA only gradually moves higher. After the breakout, the VWMA will move aggressively higher. It shows a strong presence of volume behind the breakout.

After the bought, we still need to define where place our protective stop loss. Also, we need to sake somewhere out profits. Thus, here comes the next step for the breakout trading strategy.

Last Part

It is obvious to place our protective stop loss just below the breakout candle. That is because once we are breaking below the candle that initiates the breakout, it is proving us that this is a false breakout. It means that no real buying takes place, so we need to back out of the trade.

Sometimes our profit technique is intuitive because a break below the VWMA suggests there are no more buyers for sustaining the current rally. We want to book the profits at the early sign, of course.

Now I will talk briefly on how to use currency strength for trading success. The only objective we have here is the pairing the currency that is losing value with money that is gaining importance. That way, we increase profits.

For example, if the Euro is gaining value (strong), when the dollar is losing cost (euro), it means that the EUR/USD will move upward exponentially, which creates profit potential.

What moves is the difference in strength. It is required to make money in the markets of currency. Nevertheless, it’s complicated to scan through price charts for determining which currencies are the best to pair with another.

In the case mentioned above, the only reason EUR/USD is rising is that the Euro is gaining value. In case Euro quite gain the benefit, the pair will quit rising. Nevertheless, in that case, the couple still can raise. The Euro can even lose strength, but if the dollar continues the weakening, the pair will continue to rise.

So, today’s lesson involved various things: Bitcoin trading strategy, breakout trading strategy, and a bit of how to use currency strength for trading success. I think it’s enough for this week’s material. Read it carefully, remember the main issues and things, and we will continue next week.