Chinese civilians fought with the police in several cities, including Beijing and Shanghai, over the weekend. Public dissatisfaction with the zero-coronavirus policy peaked behind a deadly fire in western China last week. This also arrives after riots in Zhengzhou over the government’s refurbishment of a lockdown in the city.

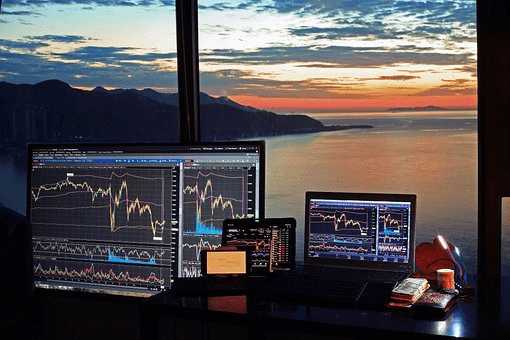

China’s blue-chip Shanghai Shenzhen CSI 300 index dropped 2.2%. Meanwhile, the Shanghai Composite index slipped by 1.6%. Selling also dribbled over into Hong Kong, with the Hang Seng index plunging 3.6%.

The yuan declined 0.8% to 7.2281 to the dollar. Meanwhile, the offshore yuan tumbled 0.6% to $7.2415. Currencies and the Chinese indexes traded at their most fragile level in over two weeks.

The protests keep an extreme reversal in market sentiment towards China behind hopes that the country would loosen its strict zero-coronavirus policy, producing some buying into local markets before this month.

More Cases of COVID

But China narrowed its anti-coronavirus measures in recent weeks as it grapples with a record-high rate of daily infections.

While the peak in infections is still diminutive compared to other countries, Chinese officials repeated their commitment to the zero-coronavirus policy because of low vaccination rates and a lack of healthcare infrastructure.

The strict zero-coronavirus measures severely considered Chinese economic development this year, as the country shut down several industrial hubs to curb increasing infections. While the government rolled out a slew of incentive measures to help support development, they have had a restricted economic impact.

Data over the weekend conducted China’s industrial profits fell further in October. Meanwhile, PMI data expected later this week should deliver continued business activity deficiencies.