Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

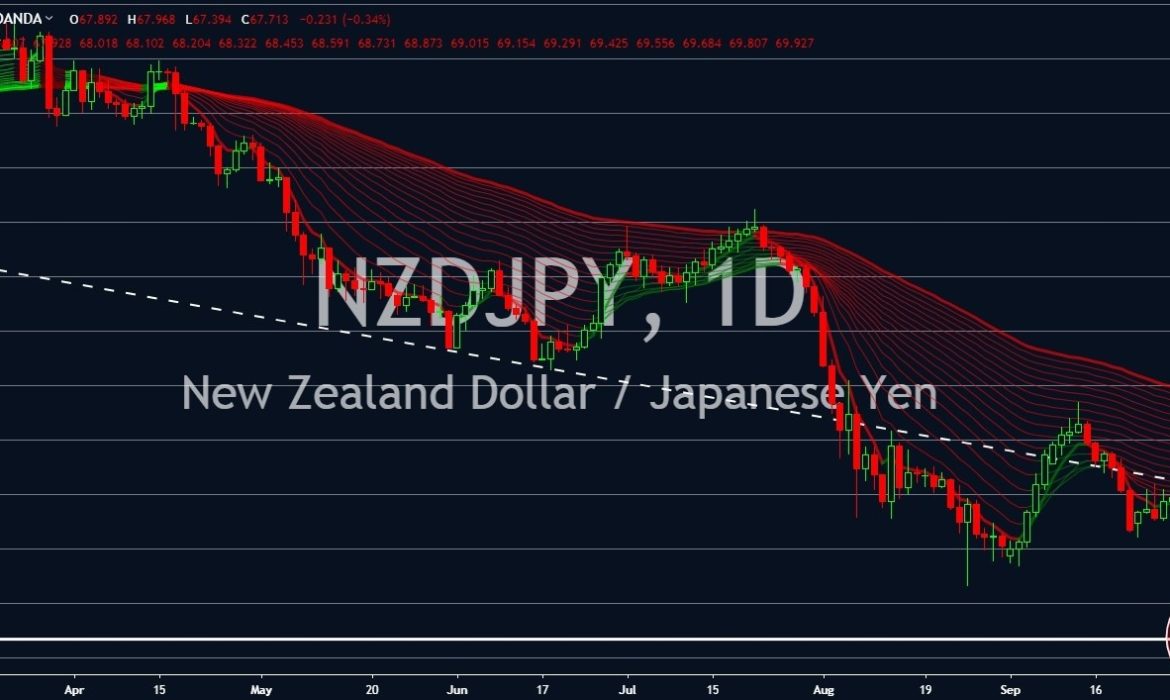

NZDJPY

New Zealand Dollar continue to weaken against the Japanese Yen. The country announced yesterday that business confidence inched higher compared to last month’s result. Its previous record was at 52.3% compared to the actual result of 53.5%, indicating that investors are optimistic about the country’s economic trend. However, this was way lower on what analysts forecast of 58.5%. Meanwhile, Japan will publish reports tomorrow, October 01, regarding the country’s employment rate and Bank of Japan’s (BOJ) projection for inflation and economic growth. This is expected to affect the central bank’s decision on whether to keep its current interest rates. The country is already sitting to negative rates since 2016. Pressure to further cut rates increases following its trade war with South Korea and the escalating trade war between the United States and China.

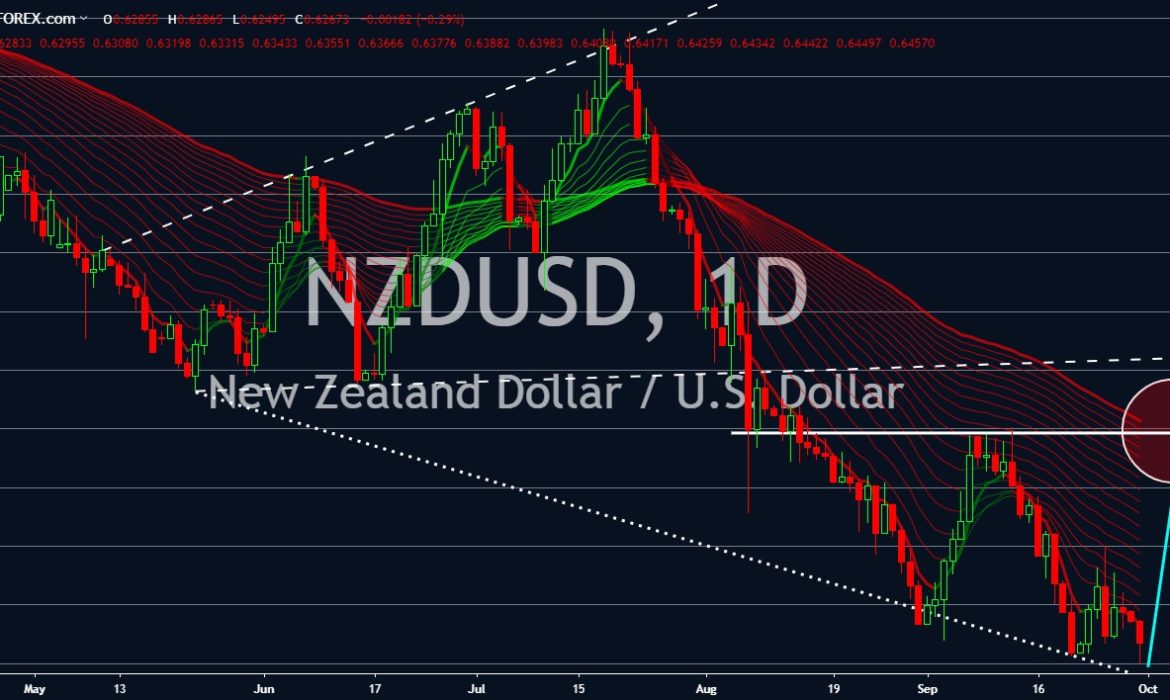

NZDUSD

The looming Non-Farm Payrolls (NFP) report is weighing down on the U.S. Dollar. The greenback recently surged against New Zealand Dollar despite the interest rate cut by the Federal Reserves. However, a disappointing NFP report could reverse all gains made by the U.S. Dollar. Worries that America’s economic growth had stalled increases following August’s NFP report showing a three consecutive declines in jobs creation. This could pressure the Federal Reserves to hold its third interest rate but this year. In turn, the U.S. Dollar is expected to lose its value against basket of currencies. Aside from this, investors are also worried about the country’s crude oil inventories. This was after Saudi Arabia’s oil facilities were attacked, cutting the country’s production by half and 5% of global oil production. The U.S. is a major consumer of crude oil. Instability in oil import could affect the American economy.

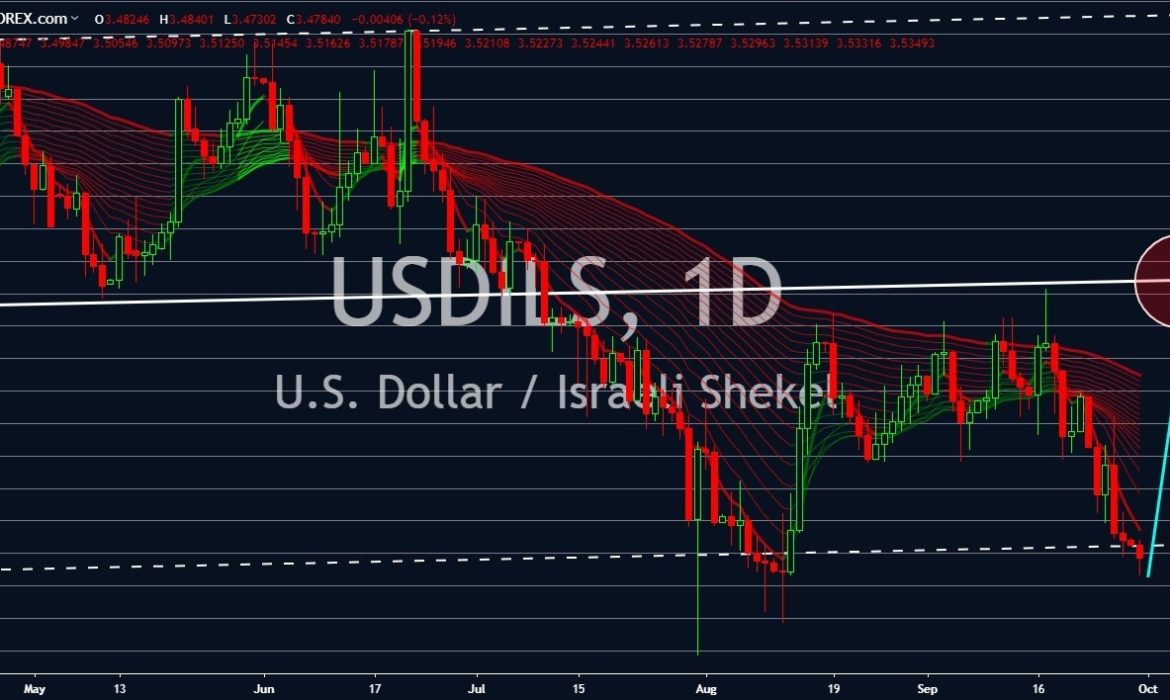

USDILS

Israel is likely to hold its third election as negotiations between the Likud party and the Blue and White party failed. Likud party is led by the incumbent prime minister, Benjamin Netanyahu. The Blue and White party on the other hand, is led by ex-military general Benny Gantz. On September 25, Netanyahu was asked by Israeli President Reuven Rivlin to forge a coalition government. Rivlin is hoping that the two (2) leaders could make a power-sharing deal to end the political deadlock. The deadlock on the country’s election is expected to affect Israel’s draft and potential trade deals. Moreover, asking Gantz to form a government, given that a third election proceeds and Netanyahu lost, could end the U.S.-Israel economic partnership. This could push the greenback to regain its strength and end the downtrend pattern since the beginning of the year. Israel’s special trade status from America is rooted from PM Netanyahu’s leadership.

USDCZK

The U.S. Dollar might take a hit from Czech Republic reintegration to the European Union and increased cooperation with China. Optimism about a “United States of Europe” revitalized Czech Koruna as demand is expected to increase. This was amid the looming adaptation of EU member states to the single currency. This could weaken the demand for the U.S. Dollar, especially that Russia and China are also ditching the U.S. currency. In turn, the demand for Euro, Yuan, and Ruble is expected to increase. In addition, U.S. economy is expected to enter recession within 12 months, which further affect the stability of the currency. The Non-Farm Payrolls report on October 04 is expected to reflect the current state of the American economy. In another news, Czech Republic reached 22nd position among the 178 countries included in Economic Freedom Index list.