Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

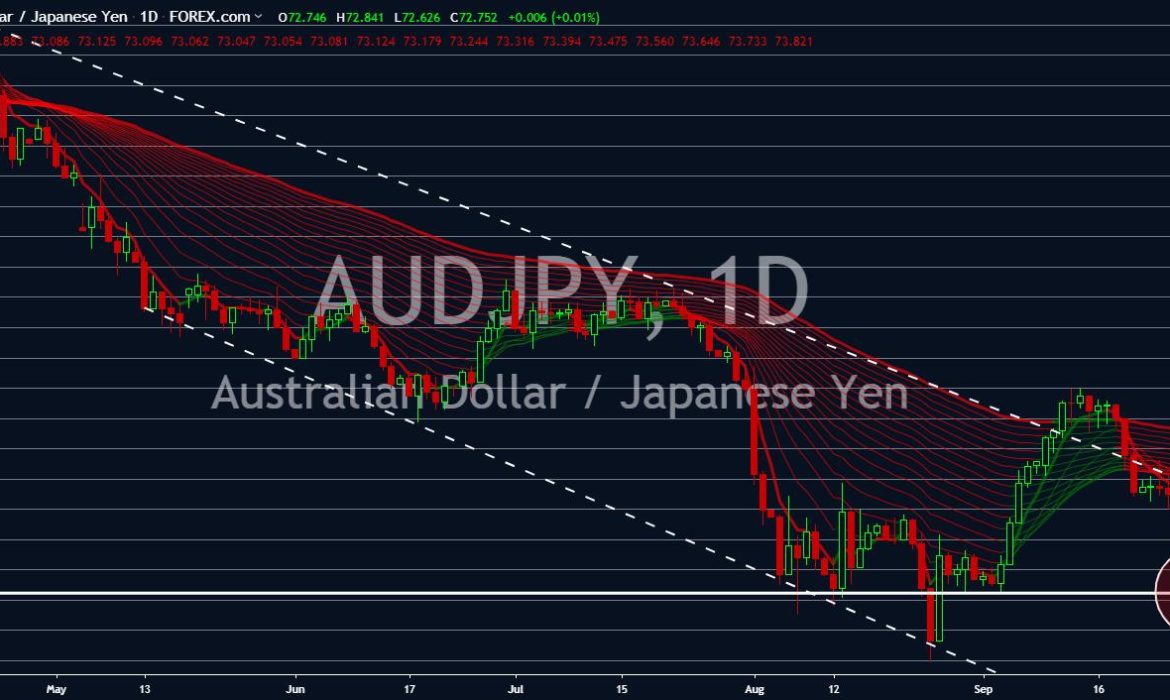

AUDJPY

Japan kept its benchmark interest rate of negative 0.10% amid pressure from the rest of the central banks to cut rates. Despite this, BoJ Governor Haruhiko Kuroda warned against heightening risks from the global economy and dropped few clues on the central bank’s next move. In line with this, BoJ is aiming to ease monetary policy further, aiming to push down short and medium-term interest rates without flattening the yield curve too much. Stability added to the Japanese Yen being a safe-haven asset in times of political and economic uncertainty is expected to push the price up. Japan is in the negative territory on interest rates since 2016. The Reserve Bank of Australia (RBA) on the other hand, had recently cut rates. The central bank had further commented that it might enter a historical low, or possibly even a negative rate. The U.S.-Japan trade agreement is expected on America-reliant Australian economy.

AUDUSD

The U.S. is holding Australia on its neck. America was able to pressure Canberra to join the U.S.-led coalition on the Strait of Hormuz. This was following the seizure of western power’s ship by Iran, which triggered countermeasure from the United States. In addition to this, Australia joins the U.S. in calling China to drop its “developing economy” status on the World Trade Organization (WTO). Having this status gave China some privileges against trading partners, particularly the United States. Australia is also losing some influence with the U.S. following the meeting by President Trump and New Zealand Prime Minister Jacinda Ardern. This will advance New Zealand on trade priorities for Trump compared to Australia. The two (2) British Commonwealths suffered from the trade war between the United States and China, prompting them to cut their interest rates.

AUDCAD

Canadian Dollar is holding back against the Australian Dollar. Canada has been benefiting from the ratification of the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). In particular, Canada was able to export its beef to Japan after China banned some Canadian exports to the country. This was due to Canada arresting Huawei’s heiress and CFO as part of the extradition treaty with the United States. Canada is also expected to get a better deal with the United Kingdom or European Union, whichever the country chooses. This was compared to Australia signing a post-Brexit trade agreement with the UK, which in turn backfired to the country with a stricter EU. EU banned names on Australian exports that directly relate to any of its member countries’ locations. Or sort of banning products that directly competes with domestic products.

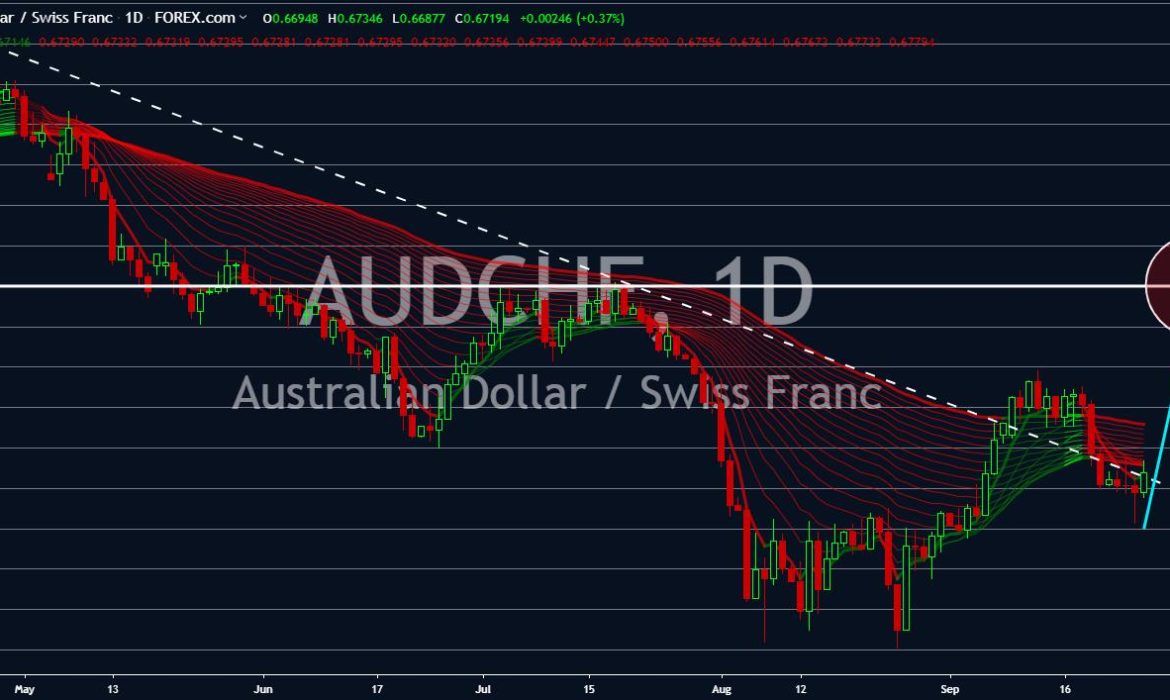

AUDCHF

The Swiss economy is decelerating resulting in a weaker Swiss Franc. The deceleration was in line with the slowing growth in the European region. Germany, the EU, and Europe’s largest economy are also expected to experience a recession in the next 12 months. Norway’s sovereign wealth fund is also moving its investment from Europe to Asia and the Americas. This is expected to further drag Europe already thirsty for foreign direct investments. Australia is also experiencing an economic downturn. However, unlike Switzerland, the country has several trading deals. This includes a deal with European Union, a potential post-Brexit trade deal with the United Kingdom, and a deal with CPTPP. Australia, together with Japan, headed the pacific rim trade pact CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). Both middle power countries will continue to be affected by the U.S.-China trade war.