Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

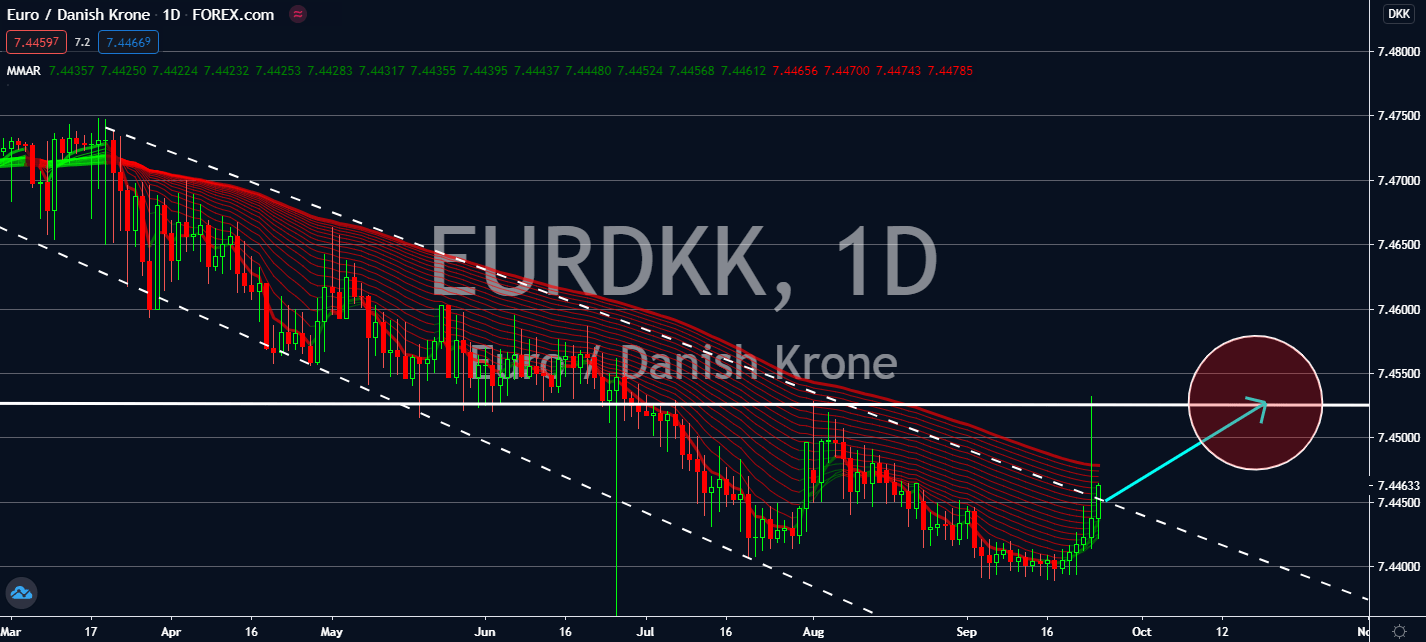

EURCAD

After Canadian oil prices fell by more than 50% last month, Canada’s technical indicators haven’t been looking so well. Just last week, it had reported a decline in core retail sales for the month of July, which is around the time it started to walk away from the too-tragic effects of the coronavirus. The relatively safer euro is projected to witness an increase as business sentiment in Germany continues to rise. Although the said figure upped lesser than the market expected, its jump from 71.5 to 77.4 will impress the market, largely due to the fact that the increase was seen amid its rocky relationship with Russia and the increasing coronavirus cases in the Eurozone. It looks like no-news Canada is going to fall as more investors worry about how fast the coronavirus infection is spreading in the country. The Bank of Canada will also reportedly report a fall in foreign asset reserves in July during a meeting to be held later today.

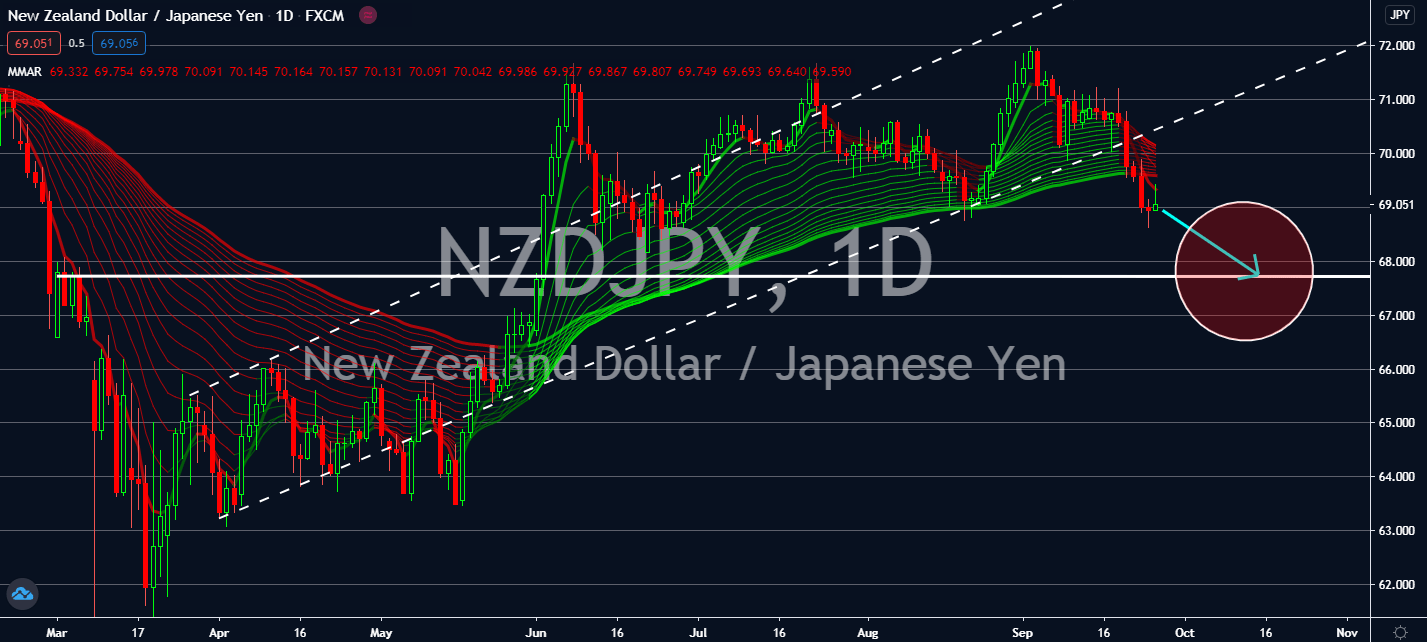

NZDJPY

The safety-driven pair is projected to trade relatively neutral, but it looks like Japan’s strength could lift its status near-term. The Federal Reserve Open Market Committee is expected to wrap its meetings up today, which will leave the market reliant on its results for the safety of the dollar. As a byproduct of the US dollar’s increase, the yen could also increase as an ally. New Zealand hasn’t reported any economic indicators lately, since it has been having a difficult nationwide lockdown earlier this month. Japan also hasn’t been able to report much of note today, but its new Prime Minister Yoshihide Suga’s determination to strengthen Japan’s geopolitical relationships could also assist the pair’s bearish movements near-term. Investors should wait for how much NZ PM Jacinda Ardern impacted the kiwi economy by the controversial allegedly unnecessary restrictions, which was implemented when large cities saw an unforeseen daily infection uptick.

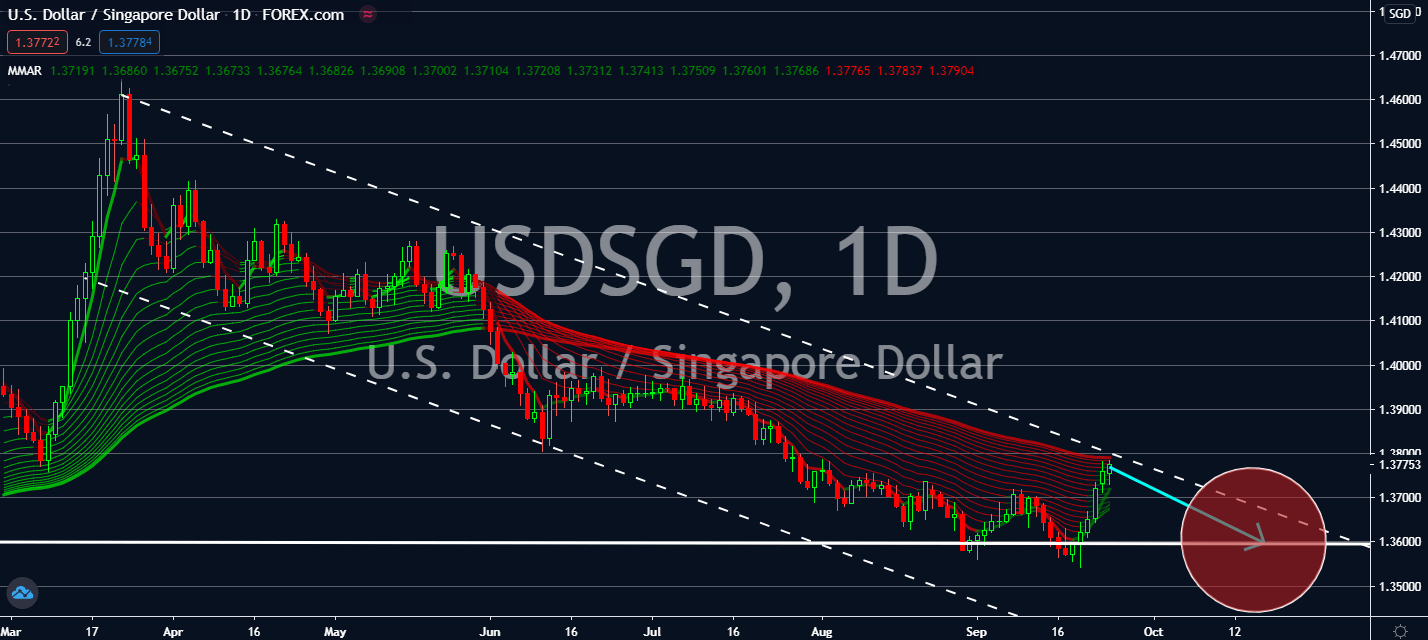

USDSGD

Singapore’s industrial sector pleasantly surprised the market today. It turns out that the sector had skyrocketed in August on both monthly and yearly comparisons. According to Singapore Economic Development figures on Friday, the country’s strong growth in electronics led production to grow by 13.7 percent year-on-year in August. Investors are now much more optimistic about how this would help its GDP increase in the third quarter. Electronics output showed a 44.2 percent annual increase thanks to products like superconductors, data centres, and 5G markets. Moreover, if not for its biomedical sector, the figure could have shown an increase to 15.3 percent. The figures are projected to pull the Singaporean dollar up against the greenback, especially after the fact that the latter is expected to report a fall for its Core Durable Goods Orders for the month of August, which could come in at 1.2% against and 2.6%.

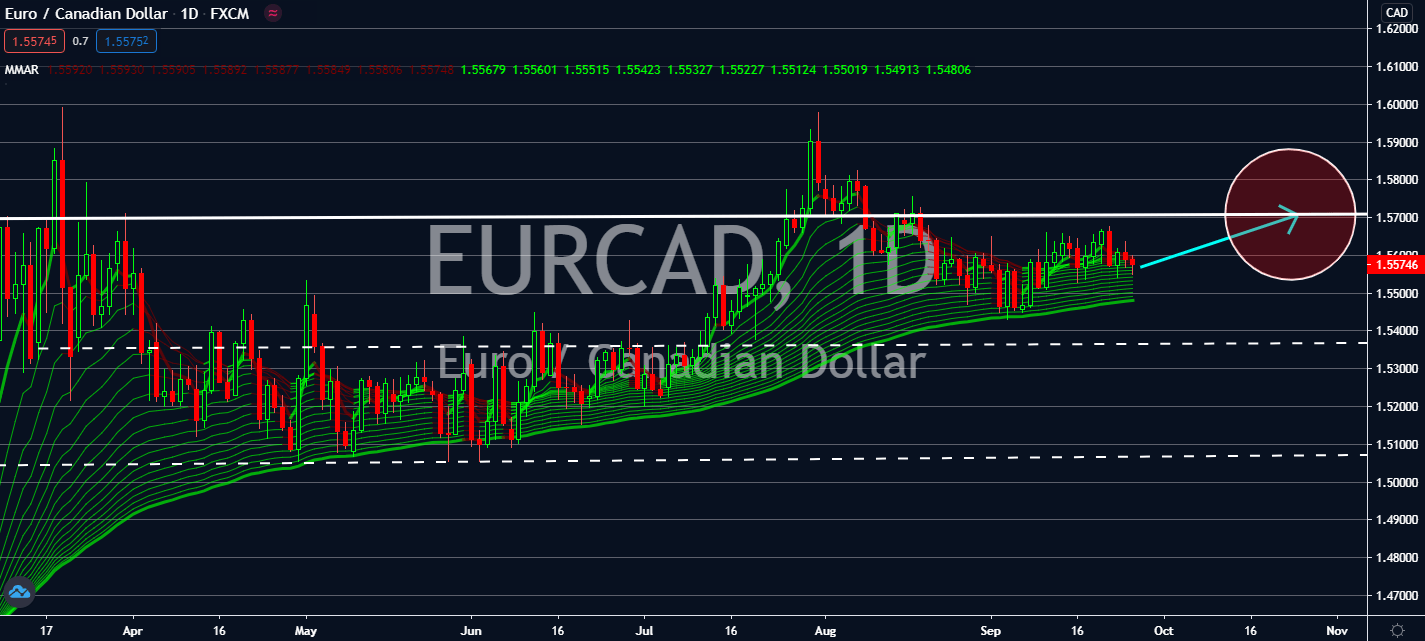

EURDKK

Risk aversion will generally help bigger currencies like the euro against those like the Danish krone. The pair is expected to offset its late-June slump thanks to investors’ faith in the bigger economies in the eurozone, such as Germany’s business sector, thanks to its effective measures against the spread of the coronavirus earlier this year. After it had seen a never-before-seen low in April, the figure had jumped from 93.4 points in September from August’s 92.5. The figure’s fifth consecutive increase was proof that its economy has been stabilizing despite the rise in coronavirus infections. Construction also boosted to its highest level since March, although its outlook is pessimistic. The country might also help muffle its unemployment rate surge until the end of the year. The business climate in the eurozone’s largest economy is projected to continue the euro’s upward track as Denmark’s economic indicators remain quiet.