Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

GBPNOK

The British pound could benefit from investors offsetting the greenback’s safe haven rally after the United States unexpectedly reported an uptick in initial jobless claims this week. Norway’s central bank decided to keep its policy interest rates on hold at its record-low zero percent in recent trading as expected, which disappointed key economists in the country. The Norges Bank admitted that it’s still at risk of another contagion, but that holding its interest rate was risky for its economy as it is. Governor Oeystein Olsen expects the benchmark rate to increase only by December 2021, considering that oil prices are the most sporadic in the market with economies struggling to reopen. As its major economic driver, global oil prices and their shift to more sustainable energy are going to drive investors’ appeal away from its currency. It also looks like the outcome of Fed Chair Jerome Powell’s meetings this week will also be a catalyst for this pair’s trend long-term.

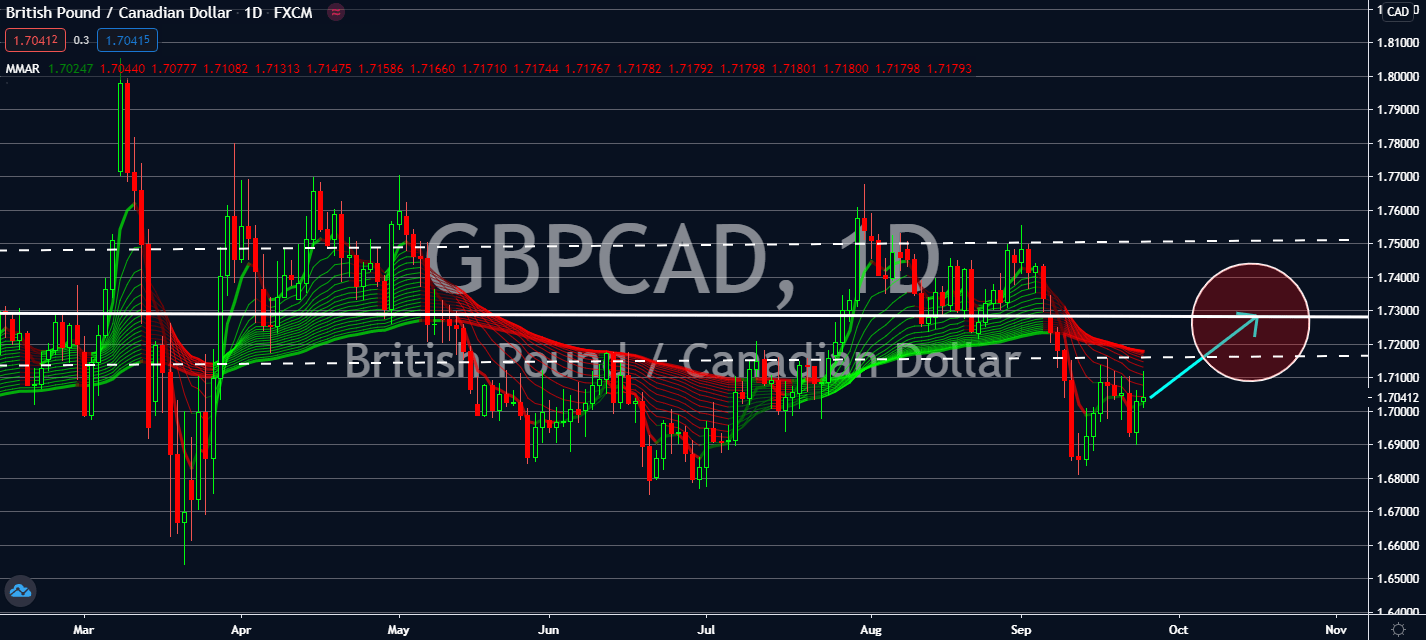

GBPCAD

Risk aversion is likely to benefit the relatively safer Canadian loonie thanks to its initial better recovery in comparison to the United Kingdom’s. Both economies are under the threat of a nationwide coronavirus lockdown, but only one of them is going to suffer for longer – the United Kingdom is struggling to find common ground with the European Union even as its end-year deadline overshadows most economic drivers in both economies. The struggle is projected to make the British pound suffer even if it manages to recover its losses from the pandemic, as more reports bring up the possibility that the cost of a no-deal Brexit will weigh on the City twice or even thrice as bad as the coronavirus will. Long-term worries will pull its currency low even if Canada will report an economic slump for the second quarter in its report later this week.

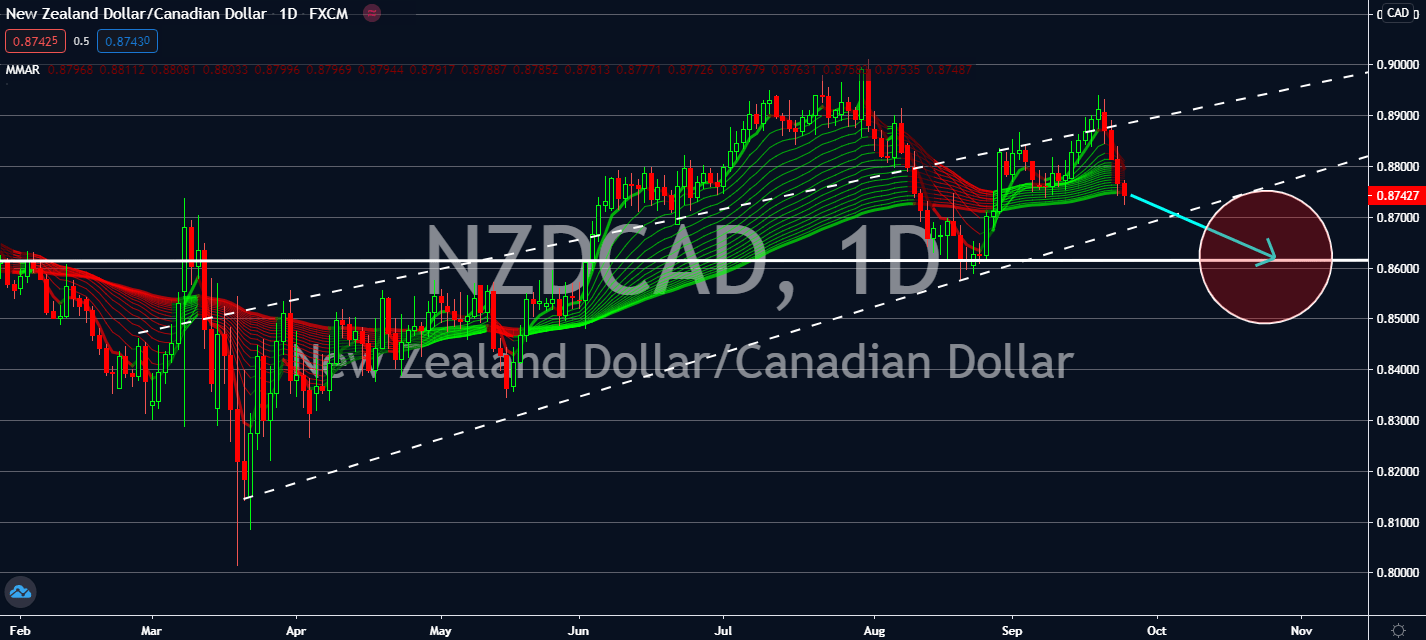

NZDCAD

Canada is projected to report its gross domestic product change for the second quarter this week, and it’s definitely not going to benefit the Canadian loonie. Prime Minister Justin Trudeau is struggling to keep investors’ trust in its economy as it goes through a second wave. He brought up that its new daily coronavirus count reached 1,000 yesterday, which was an amount much worse than what was seen during its first wave. He claims that most people won’t be able to gather for Thanksgiving. Worries about the relatively riskier economy could pull its currency down as its counterpart, the kiwi dollar, lifts alongside looser coronavirus restrictions in New Zealand. The corresponding Prime Minister, Jacinda Ardern, removed all domestic rules for much of the country after she announced that its health minister managed to “get the virus under control.” The resume in economic activity in the country will help keep its GDP afloat by end-2020.

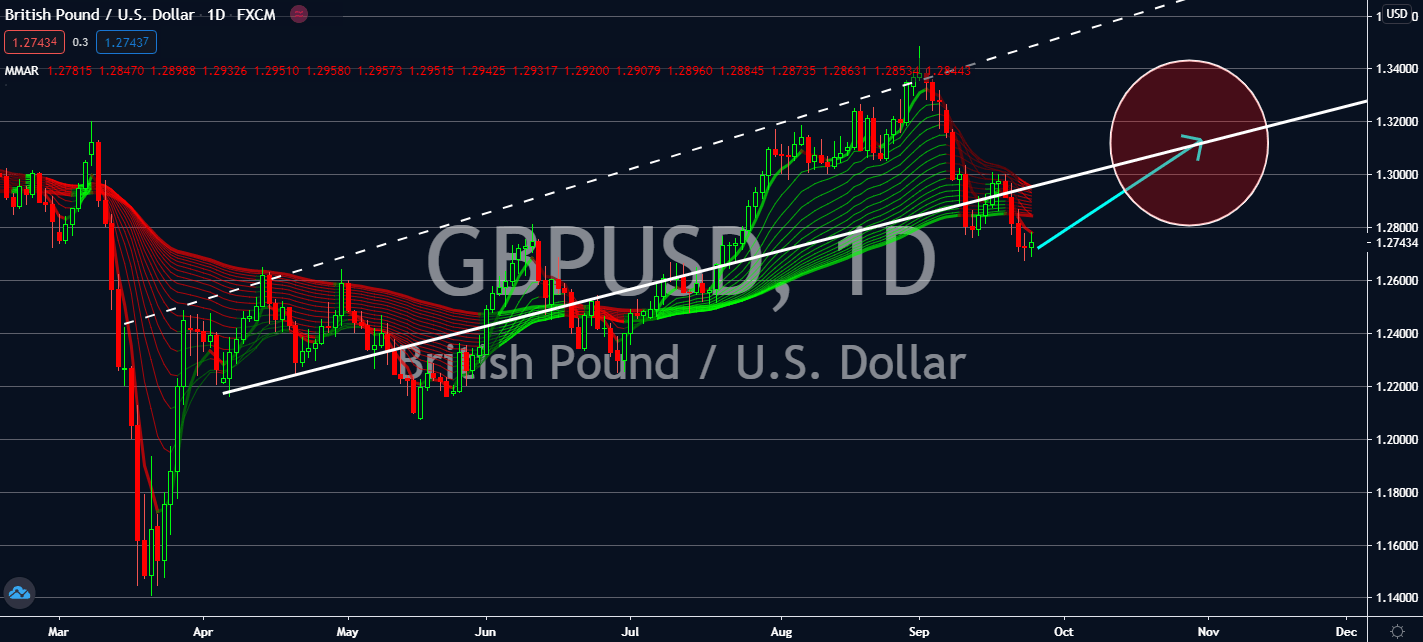

GBPUSD

Initial jobless claims in the United States came in much worse than Main Street expected. The total now sits at 870,000, which was way up against last week’s measurement by 10 thousand. Key economists initially claimed that it would decline to 850,000 this week. But some analysts reported that the increase came in for seasonal fluctuations – which could muffle the greenback’s apparent decline in the longer term. But as of writing, it looks like the currency would decline after Fed Chair Jerome Powell called for more economic support from both the agency and the US Congress earlier this week. Meanwhile, Bank of England governor Andrew Bailey denied urges to push its interest rates down to negative territories in the immediate future. This should assist its increase against the greenback in particular as investors anticipate the effects of the impactful figure seen in the United States, or if no-deal Brexit will come true by the end of this year.