Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

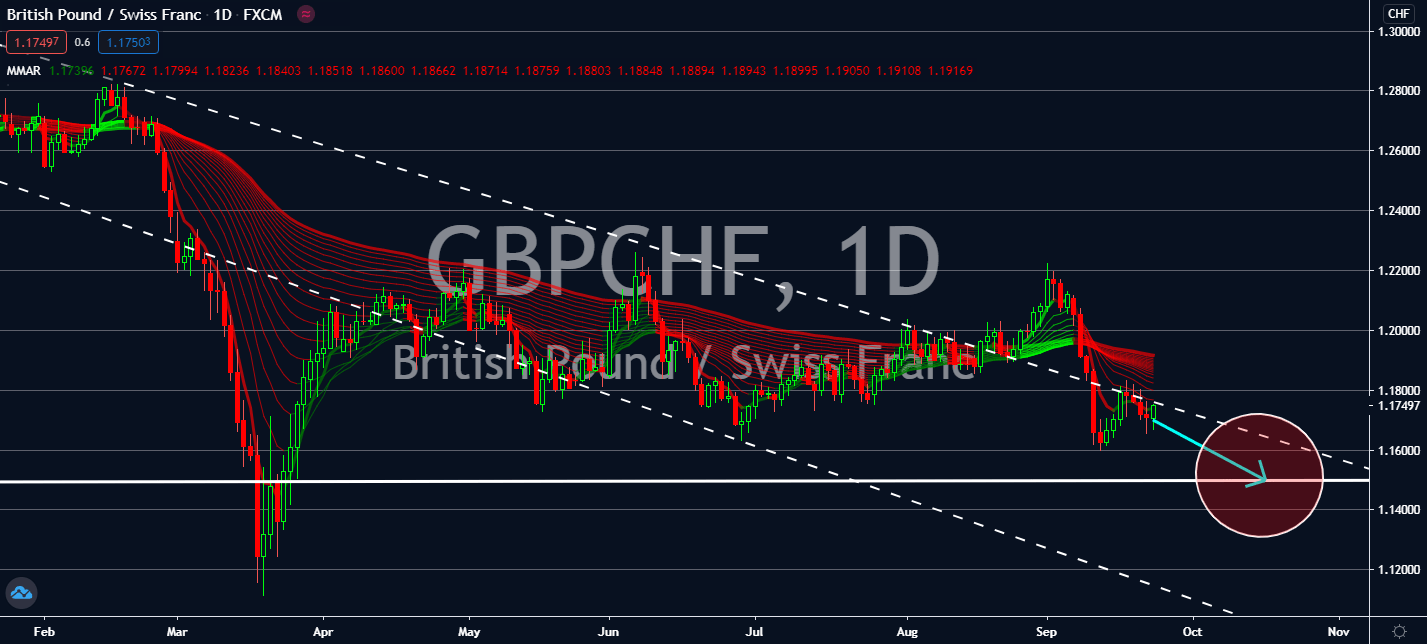

GBPCHF

The forex market is in a correction. The pair is projected to continue its unexpected upwards track as investors await the Swiss National Bank’s monetary policy decision on Thursday. The central bank has always intervened in the forex market and has the lowest interest rate in major economies, which sits at -0.75. Although the bank is projected to buy more CHF to help its currency, risk aversion is projected to assist its increase. The bulls are projected to take advantage of the 50-day moving average touching its current levels and test its near-month resistance level to approach prices last seen in mid-June. Its 200-day moving average is gradually lowering to meet its prices, as well. Risk aversion is projected to keep the dollar high in the global market as investors react to Federal Reserve Chair Jerome Powell’s comment on quantitative easing, in which he had promised to keep its economic package “for as long as it takes.”

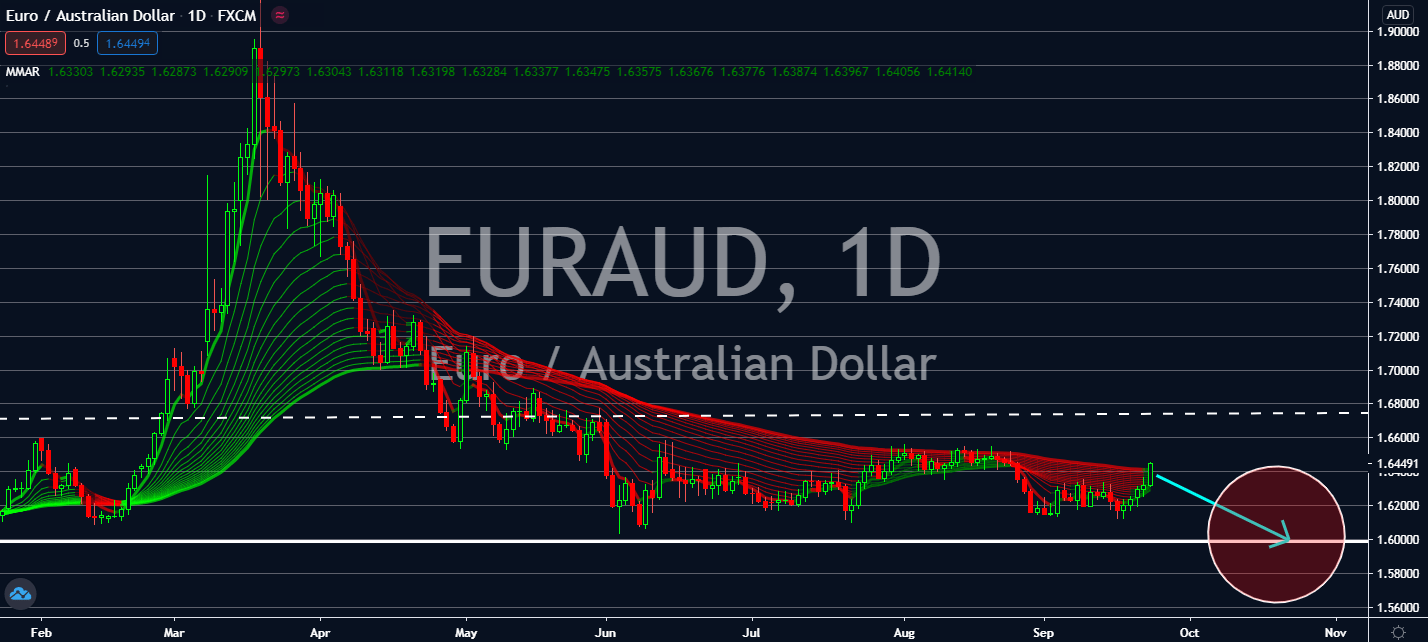

EURAUD

Several economic figures in the United States are projected to push the dollar lower than its rupee counterpart. Risk aversion will benefit India’s economy with surges in gold prices, instead. The US is projected to report a decline in three key figures: Composite PMI, Manufacturing PMI, and Services PMI for the month of September. As the pair’s 200-day moving average approaches its 50-day average, bearish investors are almost certain the pair could only fall near-term. This is despite a looming possibility that India could have seen a double-digit contraction for its gross domestic product in the previous quarter. Economic activity is expected to keep itself at a slow pace in the Indian economy throughout the year. But investors are a little more optimistic about its upcoming activity: its federal data confirmed that it has just seen the lowest count of new coronavirus infections in the country, now on its fourth day of more recoveries than new infections.

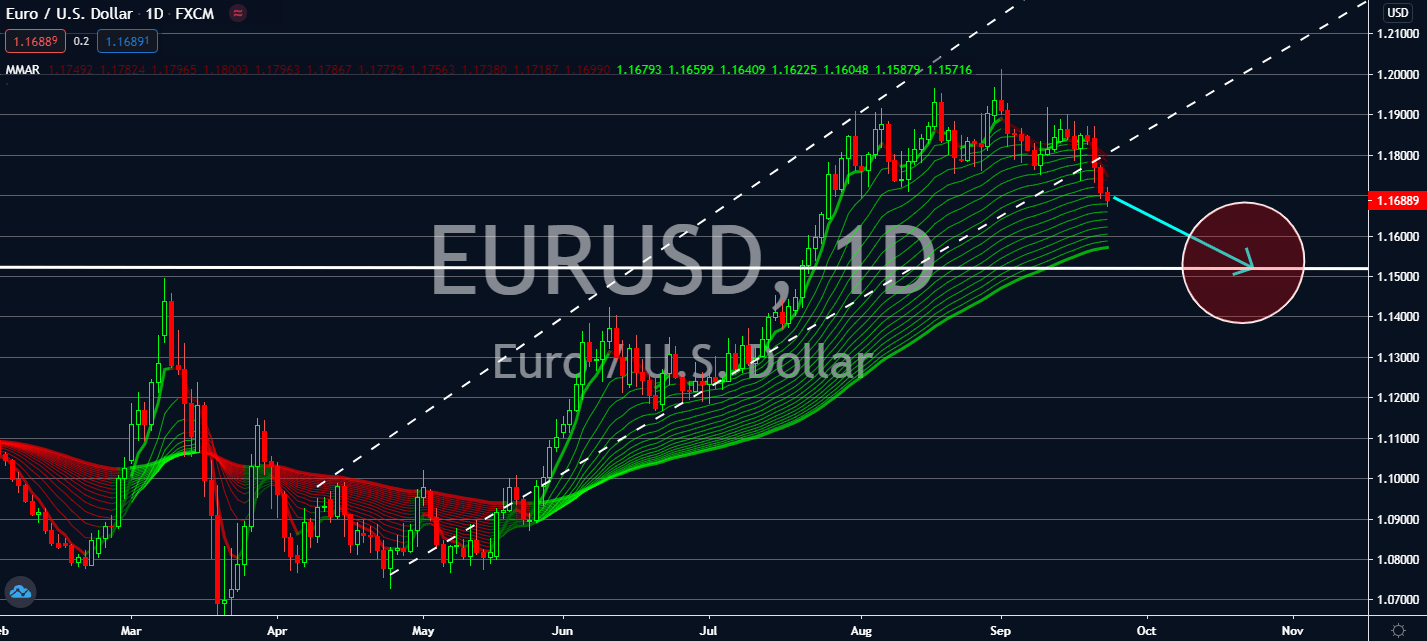

EURUSD

The crown strengthened against the dollar by 14% since European currencies began to witness consecutive rallies against the greenback in May. It looks like the market is in risk aversion, which could bring the dollar back up to correction. Its 50-day moving average inched slightly upward to its 200-day moving average as the European Central Bank keeps investors on edge for an over-appreciation for European currencies like the crown. Moreover, the growth of new coronavirus cases in the Czech Republic just ticked up, which posed a downside risk to its economic recovery. Currencies opposite to the greenback will find it hard to increase as the US nears its nationwide election, which is projected to lift the dollar the closer it gets to the event. The US Federal Reserve also promised its businesses that it would extend its bond-buying program as long as it takes, increasing sentiment for the greenback in order to help its businesses.

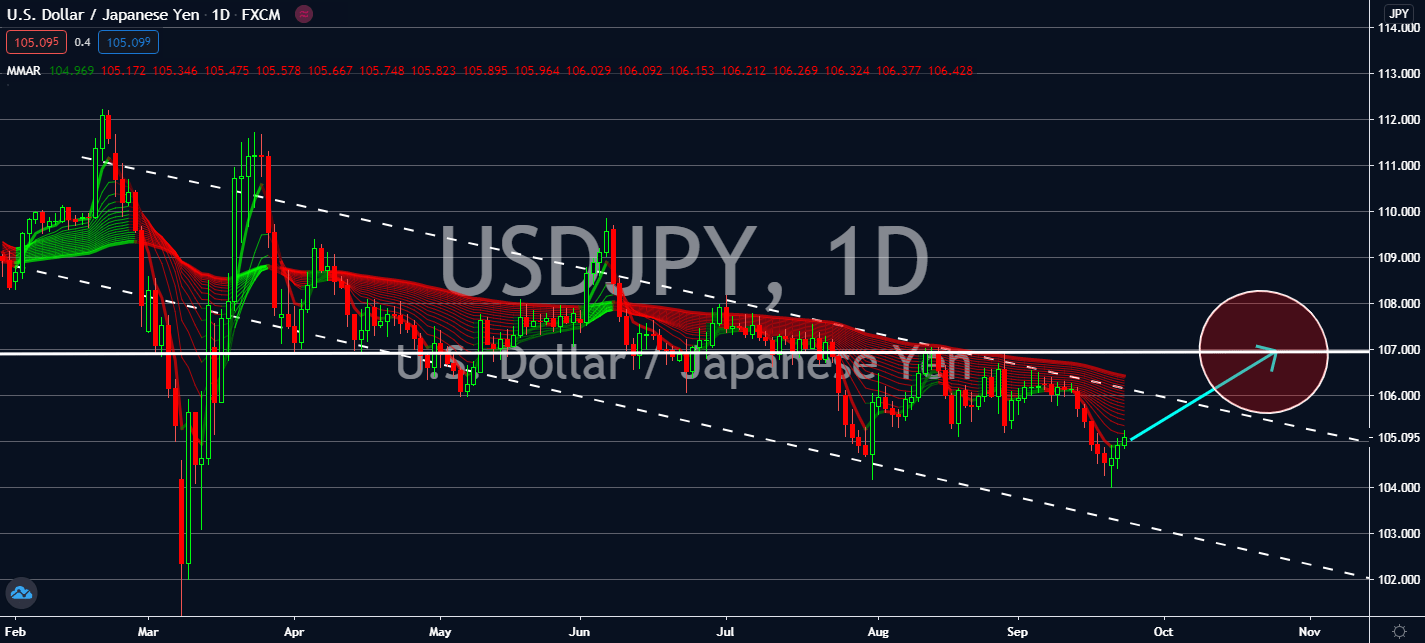

USDJYP

The Swiss Bank will meet to judge its monetary policies on Thursday, and surveys claim that it will keep its ultra-loose interest rates at -0.75%. The negative rate, now the lowest across all major economies, proves that its central bank is paying close attention to its value against other currencies. This focus is projected to help the crown boost against the euro currency. The pair is projected to test its current support levels now that its 50-day moving average had touched its current levels. This could trigger the pair to eventually decrease into levels last seen in the pandemic’s first few months. Optimistic economic figures in the eurozone won’t be able to offset the rising coronavirus cases in the bloc, especially now that economists have claimed that it could destroy 100 million jobs worldwide by the end of the year. More European countries are now also likely to impose stricter lockdowns in the coming months.