Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

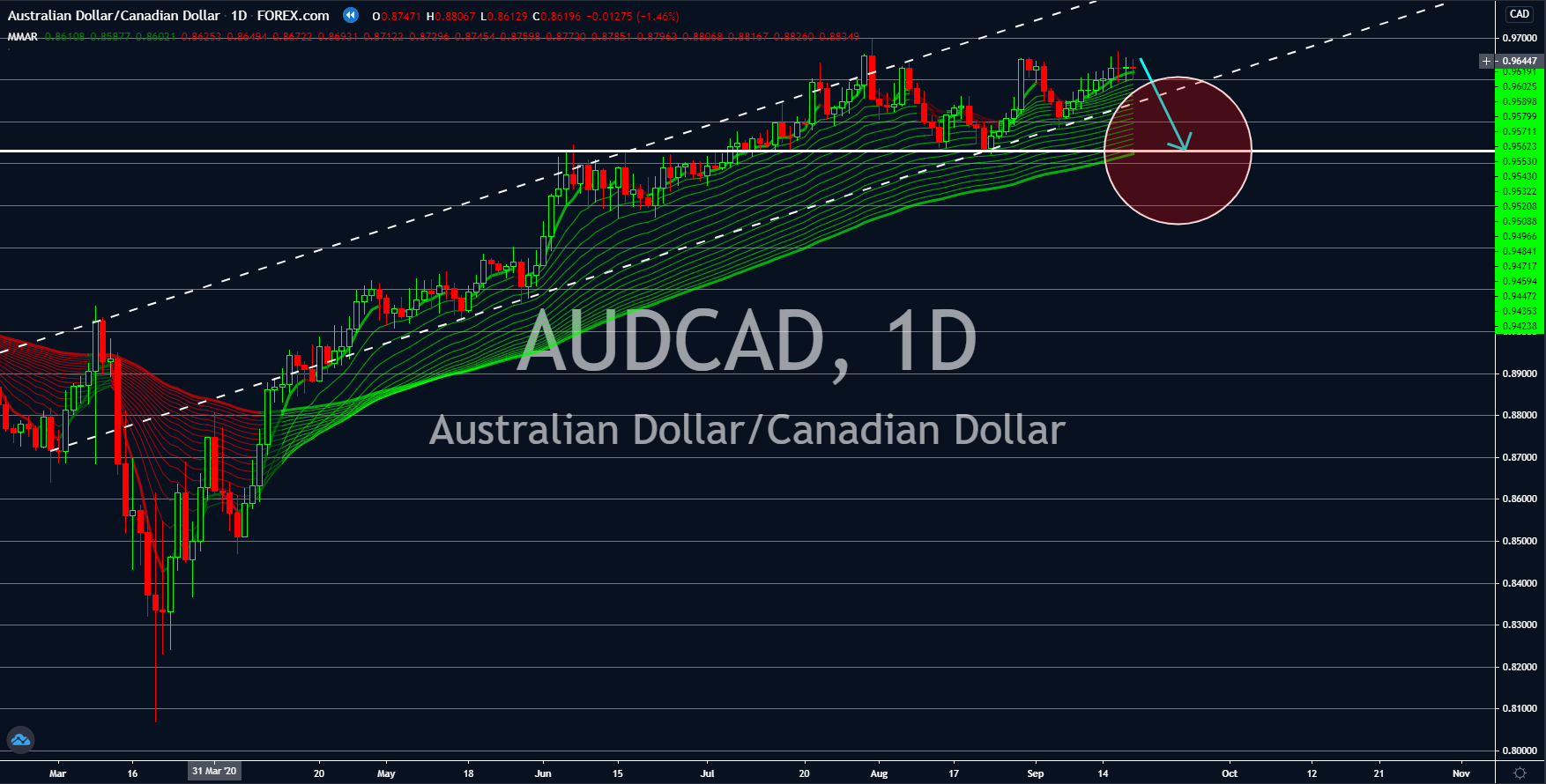

AUDCAD

Investors were mixed with the recent reports from Canada. The country’s retail sales report only grew by 0.6% for the month of July compared to prior month’s 22.7% growth. In addition to this, the report failed to beat estimates of 1.0% by analysts. On the other hand, Canada recorded a decline of 205.4K on its ADP nonfarm unemployment change. Despite publishing a lower decline than August’s report of 523.0K, investors were still disappointed with this figure. This was due to the fact that the labor market is yet to pick up despite the reopening of the global economy. However, there might be something to celebrate for CAD investors as Australia’s housing market is near collapsing. Australia is a prime destination for international students. In September 2019, there were 720,150 international students enrolled throughout the country. However, this figure is expected to decline due to the restriction in international travels due to COVID-19.

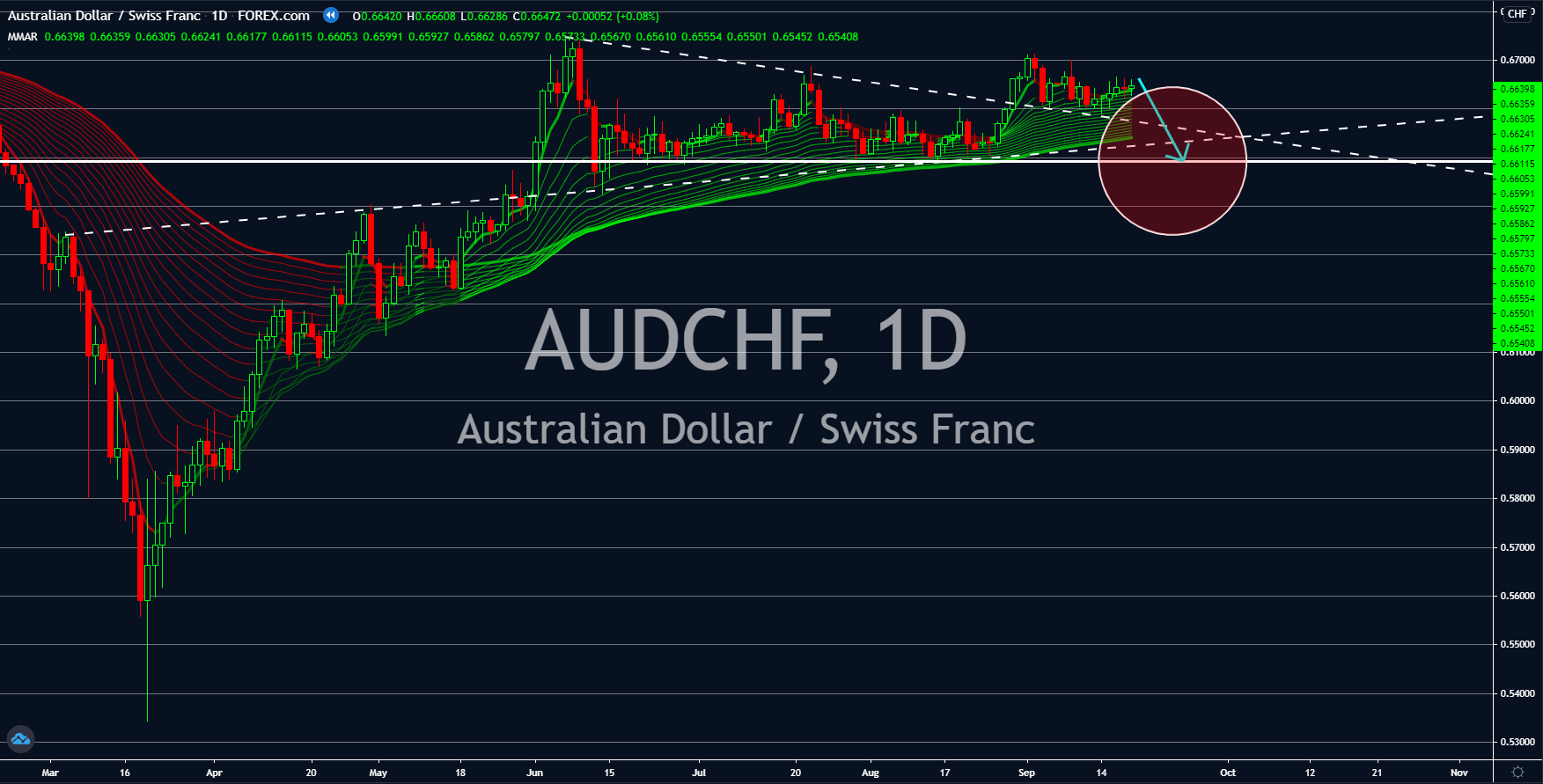

AUDCHF

Switzerland’s trade balance is remarkably stable despite the ongoing trade disruption across the globe due to the pandemic. For the month of August, the figure recorded was $3.583 billion, lower than previous month’s $3.341 billion. This represents a 7.24 percent decrease in growth. This report is expected to reaffirm investors confidence of the safe-haven status of the Swiss franc. On the other hand, Australia’s success in containing the virus could be overshadowed by a recent report. The National Housing Finance and Investment Corporation (NHFIC) is anticipating a decline in the property market by 232,000 over the next three years. This was due to international students dropping out from universities in Australia. The figure by NHFIC represents almost 33% of Australia’s international students in September 2019. Furthermore, this could largely impact the economy as the growth of rent prices and constructions were expected to slow down.

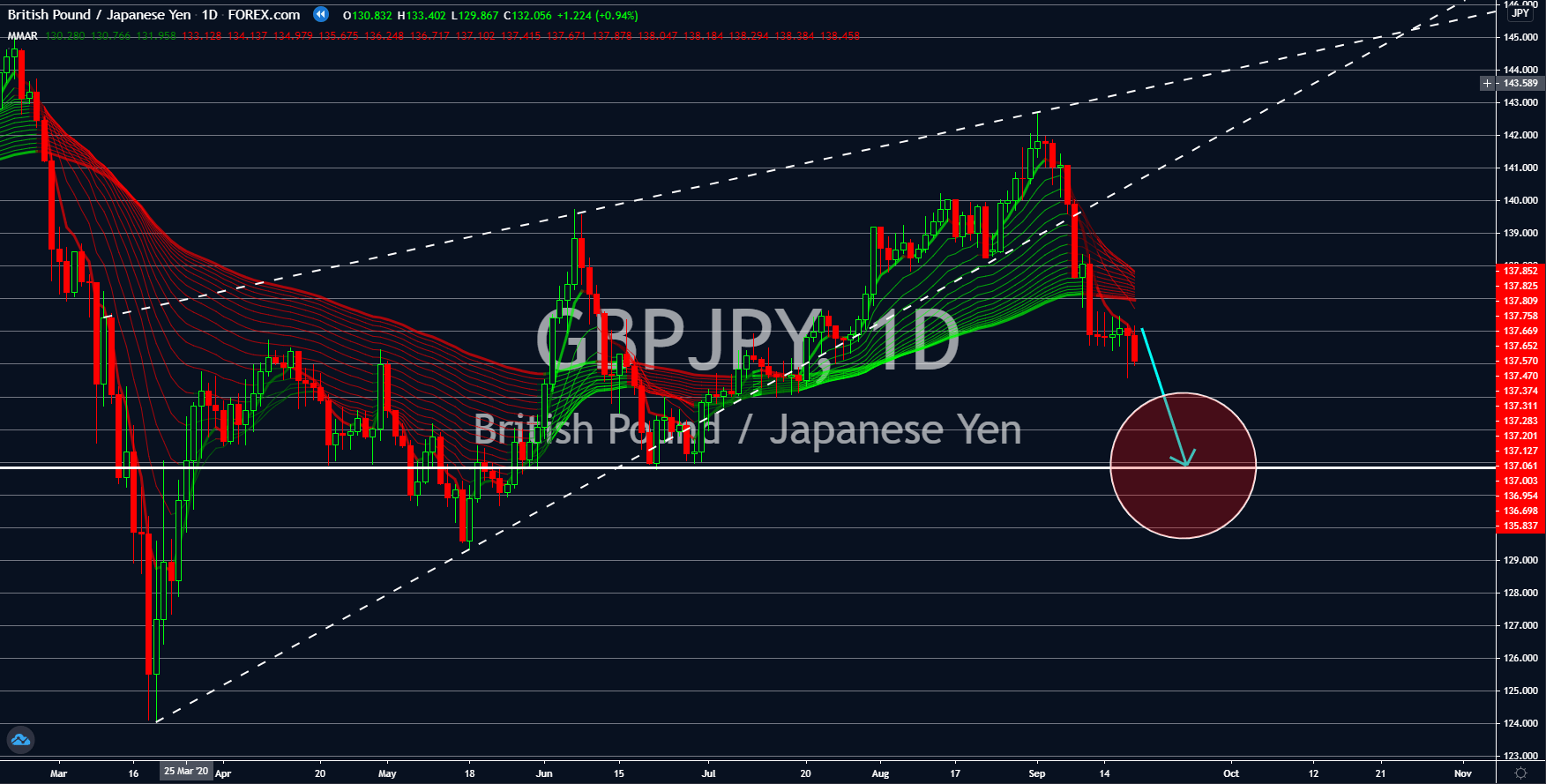

GBPJPY

The bears were caught up in the unusual strength of the Japanese yen. Many analysts claim that the immediate resignation of Shinzo Abe might trigger a sell off in the current. Instead, the yen saw its biggest rally this year. Apparently, many investors were relieved with the smooth transition of responsibilities to the new Japanese Prime Minister, Yoshihide Suga. With the continuous recovery in the Japanese economy, the Bank of Japan (BOJ) maintained its current benchmark interest rate of -0.10%. This is the same case for the Bank of England (BOE) after it held on its current benchmark interest rate of 0.10% during the recent meeting. The catalyst for shorting the British pound this month was its slow retail sales. Since the 12.3% recovery in July, the report continued to disappoint investors. Its report for August published last Friday, August 18, was 0.8%. It’s car registration report for September also fell by 50.1%.

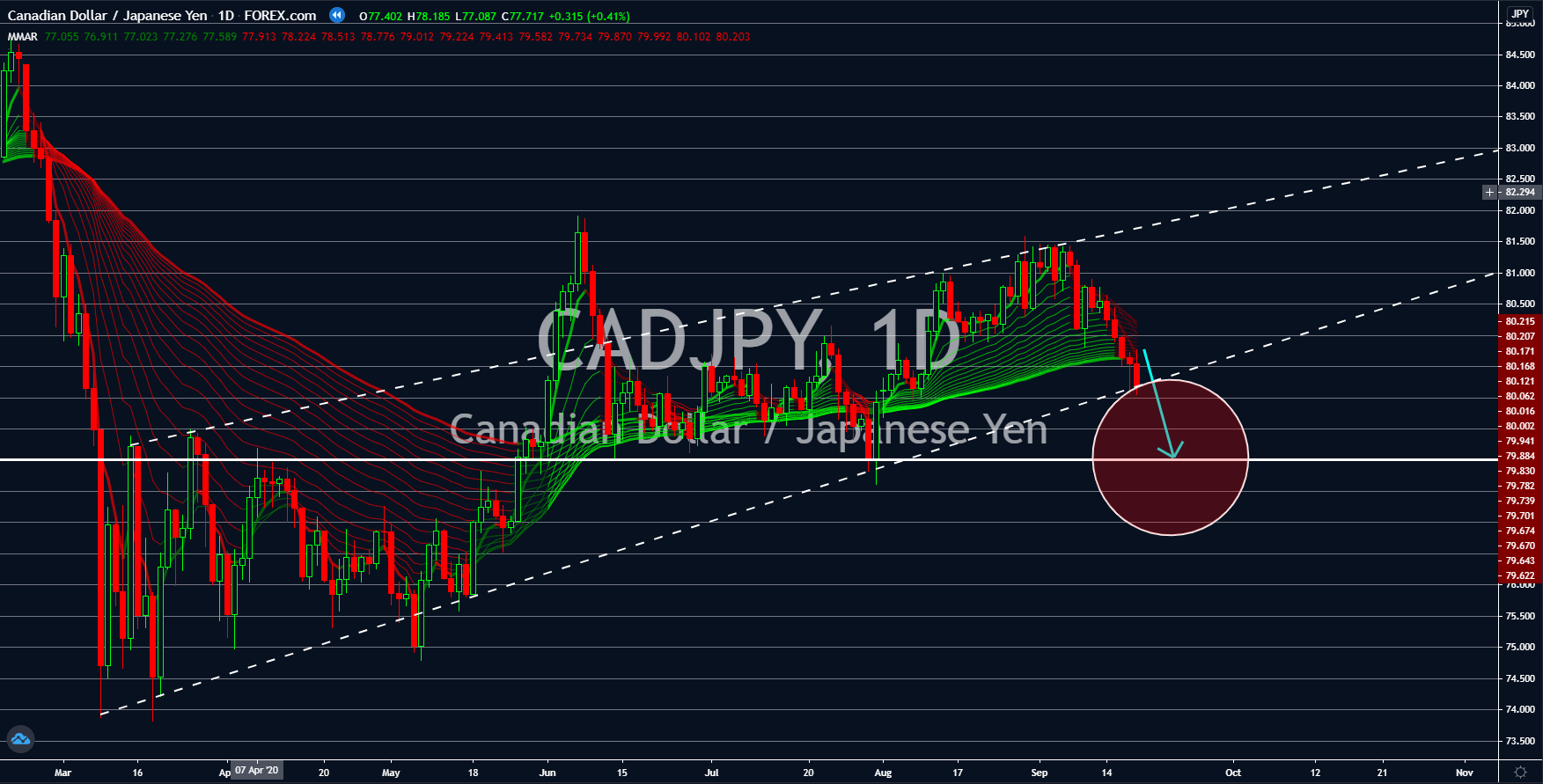

CADJPY

The Canadian dollar will continue to be dragged by mixed results from its recent reports. Despite recording the second-lowest figure for ADP nonfarm unemployment change, investors were still disappointed with the result. Many analysts were expecting the report to post positive figures as the Canadian economy began to reopen in June. The September report posted a -205.4K unemployment change, lower than previous month’s -523.0K. On the other hand, its retail sales remained in the positive territory with 0.8% growth. However, this was way lower than last month’s increase of 22.7%. With the disappointing results from Northern America’s report, investors were now looking with the impressive recovery in Asia, particularly in Japan. The country was able to smoothly transition from Shinzo Abe to Yoshihide Suga as its new prime minister in the middle of the pandemic. Suga was a moderate ally of the former Japanese minister.