Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

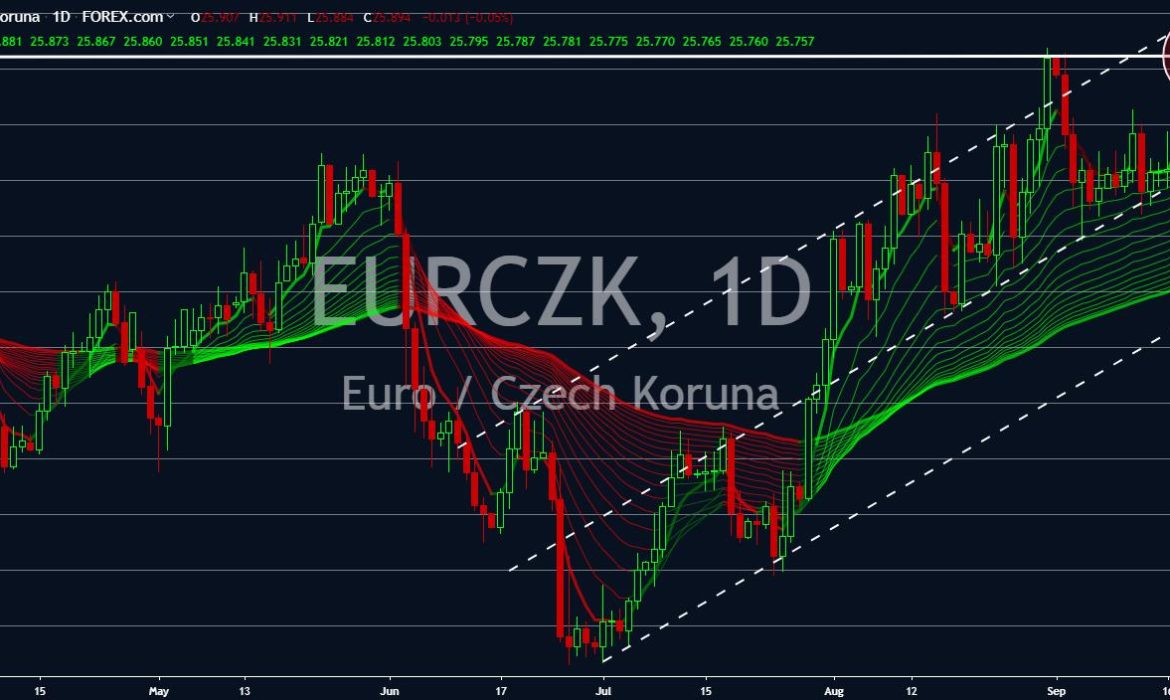

EURCZK

The EU and the Czech Republic is on a reconciliation following the visit of incoming European Commission president, Ursula von der Leyen. In line with this, charges against Czech PM Andrej Babis was dropped, ending what had become a major headache for the businessman-turned-politician. Aside from that, Vera Jourova was appointed as the commission’s Vice President for Values and Transparency, one of the eight biggest positions in the European Commission. The remaining representatives from the informal group of V4 also held high positions, increasing their influence inside the European Union. The move by Von der Leyen was timely following the hard Brexit stance of British PM Boris Johnson, which ignites separatist movement in the bloc, including the Visegrad group. Von der Leyen joined Angela Merkel and Emmanuel Macron of envisioning a “United States of Europe.”

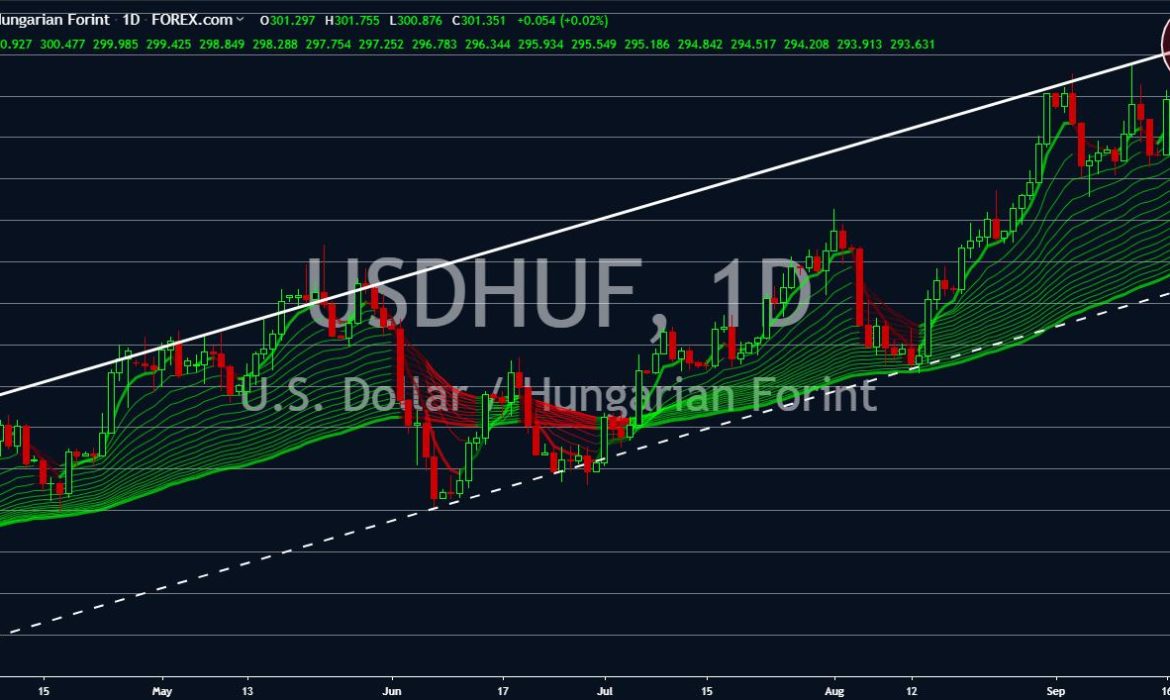

USDHUF

It’s a bitter-sweet victory for Hungarian PM Viktor Orban as the new commission under Ursula von der Leyen has softened their stance against the V4. Members of the Visegrad group found their representative holding high positions in the European Commission. Hungary’s commissioner designate, László Trócsányi, was appointed to handle the EU Enlargement portfolio. Hungary was part of the enlargement back in 2003 until its accession in 2004. The EU plans to make the Western Balkan a part of the bloc, with some members of the former Socialist Federal Republic of Yugoslavia were already part of the 28-member state bloc. This, however, is a double-edged sword. Hungary threatened the EU that it will follow moves by the United Kingdom following the successful 2016 British Referendum. The EU Commission on the other hand, cut V4s development funds by 20% in 2021-2027.

USDMXN

Pressure is mounting on President Trump to pass key policies relating to promises he made during 2016 Presidential Election. However, the Congress is divided between the Senate (Republican) and the Representative (Democrat). Added to the pressure is the looming election on which Trump seeks to be reelected. One crucial policy to Trump’s presidency was the ratification of the NAFTA (North American Free Trade Agreement). This was amid Mexico gaining the top spot as the largest U.S. exporter. The proposed NAFTA, also known as USMCA (United States-Mexico-Canada), was supposed to limit the export of neighboring countries, Mexico and Canada, as well as increase tariffs to some exports found unfair to U.S. industries. Another issue that increased his vote and put him to presidency in 2016 was immigration. However, Trump still failed to get his budget to build a wall between the U.S.-Mexico border.

USDNOK

The United States appear to benefit from the global economic uncertainty it created. The slowdown in Europe prompted the world’s largest sovereign wealth fund, Norway’s 1 trillion-dollar fund, to divest in Europe and invest in the Americas and Asia. Added to Norway’s decision was the possibility that the United Kingdom might join the EFTA (European Free Trade Agreement), which currently a bilateral trade agreement with the European Union. Bringing UK back to the group will increase scrutiny among EU-member states as Britain will have a direct access to EU’s Single Market. During the EU-May government negotiations, the EU reiterated that the UK will never have the same benefits just like member countries once it decided to officially leave the bloc. Norway’s relationship with the U.S. also enters a new high as it increased its dependency for U.S. protection to raise claims on the Arctic region.