Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

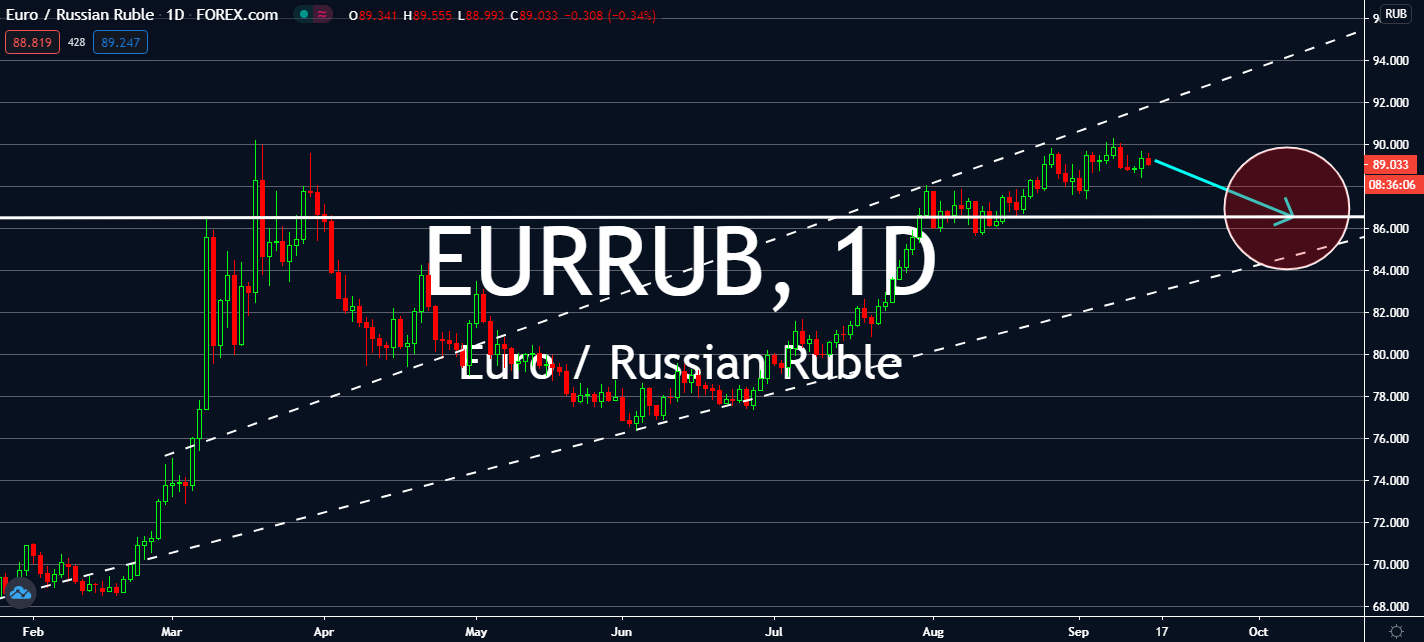

EURRUB

It’s been a busy day for the Eurozone’s economic calendar, and almost everything was in line with market expectations. But the news is far from positive: manufacturing took an upturn in July at about 4.7%, but that was after double-digit gains for two consecutive months before it. The IHS Markit Eurozone PMI survey found that this could be a sign of “manufacturing exhaustion” in the region as the coronavirus outbreak takes over its activity once again. Factory output is still almost 8% lower than its pre-pandemic peak while production remains about 7.7% against the same period. Meanwhile, economists believe that Russia’s economy could be faring better than expected. Renaissance Capital is looking forward to a short contraction for its gross domestic product of 3.3%, which could then rebound to 3.8% by next year. Some economists also claim that the Russian government now expects half the contraction of what was predicted prior.

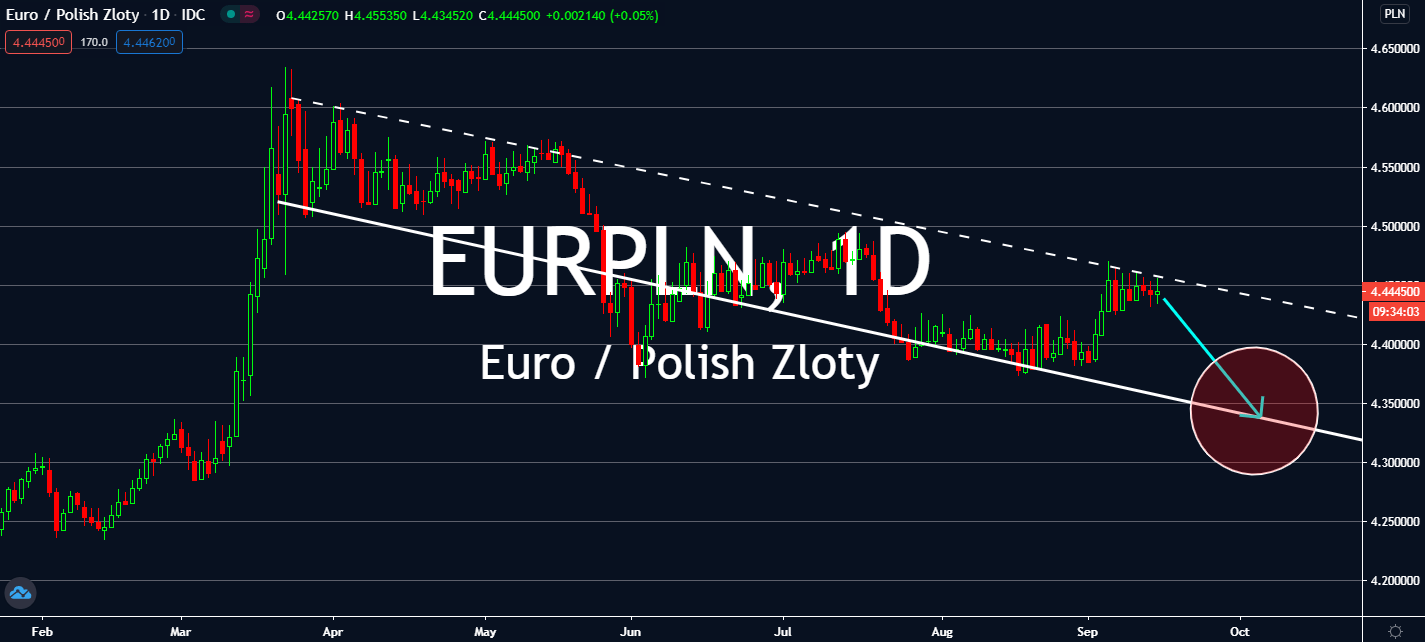

EURPLN

The euro isn’t technically doing well against anticipated Polish figures. Investors are looking forward to a series of positive figures for the Polish economy during the month of August. The National Bank of Poland announced that it doesn’t seek to alter its interest rates any lower after it cut the benchmark rate by three times by a total of 1.4 percent year-to-date. Its current rate now sits at 0.1, which the central bank’s president Adam Glapinski claimed was “at the right level.” Investors expect the figure to remain unchanged until next year. Industrial production and labor market figures are also projected to please the markets this week with annual increases. The eurozone is at a loss as its economy seems to have slowed down due to its current lockdowns. But if EURPLN investors want to change this course, they should watch out for the US Fed’s FOMC meeting later this week, which has proven to be one of the pair’s main drivers.

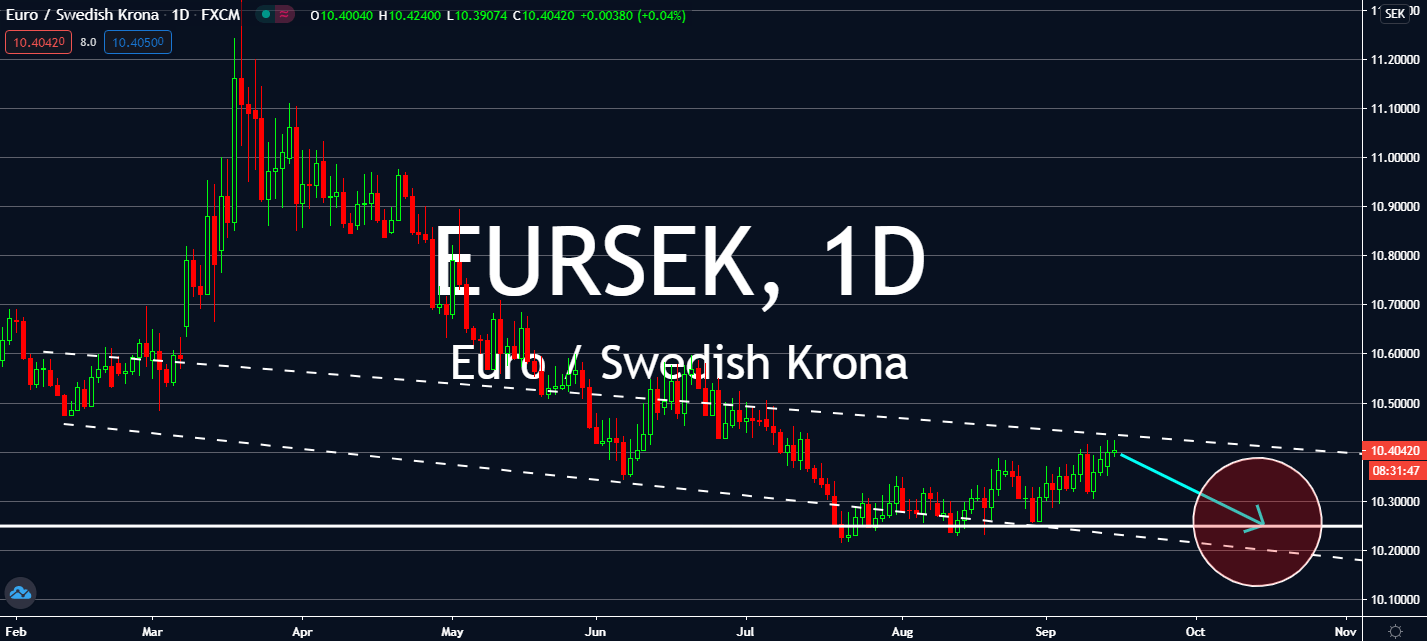

EURSEK

Scandinavia’s biggest economy is recovering. Sweden’s labor market saw an improvement in August with a lower-than-expected unemployment rate seen at the period. Seasonally-adjusted jobless rate had dropped to 9.1% form 9.2% seen prior. The unadjusted rate also declined to 8.8% against 8.9% the month beforehand. Chief economist of Danske Bank Michael Grahn said that the figure might be forming a peak as of writing. This could mean that Swedish unemployment could retain the 6.8% employment figure it had lost in March. Some investors are also looking forward to continuing its upward trajectory even though it might not be as high as previous forecasts of 11%. By then, the country’s central bank will assess whether it should implement more fiscal policies to help buoy business throughout the pandemic. The euro is projected to depreciate near-term brought by negativity in monthly CPI figures in Italy and France.

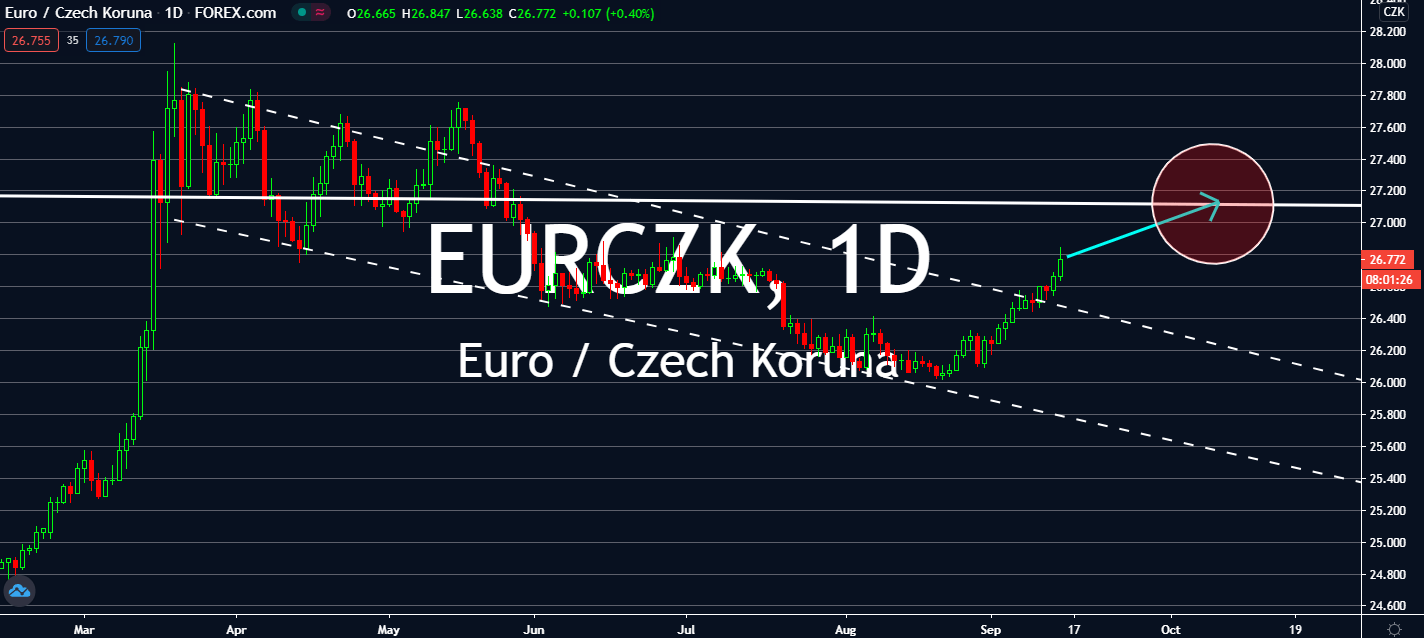

EURCZK

Food prices pushed the Czech republic’s inflation slowdown in August. The figure fell by 0.5% compared to July and fell by 0.3% at an annualized rate to its lowest since October of last year. Housing prices in the Czech Republic also slowed down from 2.9% to 2.6%. These slowdowns led the overall CPI to decrease from 3.4% in July to 3.3% in August. But recently, the Czech National Bank reported that the country does not need to ease its monetary policy, and that the steps taken to help its economy will have to be milder than its previous movements. The central bank had pushed down its interest rates by 200 basis points to 0.25% for the past few months in hopes to help its lockdown economy, but it looks like the figure will have to stay for, as the central bank said, “an extended period of time.” The optimism in contrast to ECB’s uncertainty and the recent slowdown in the EU will help the koruna near-term.