Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

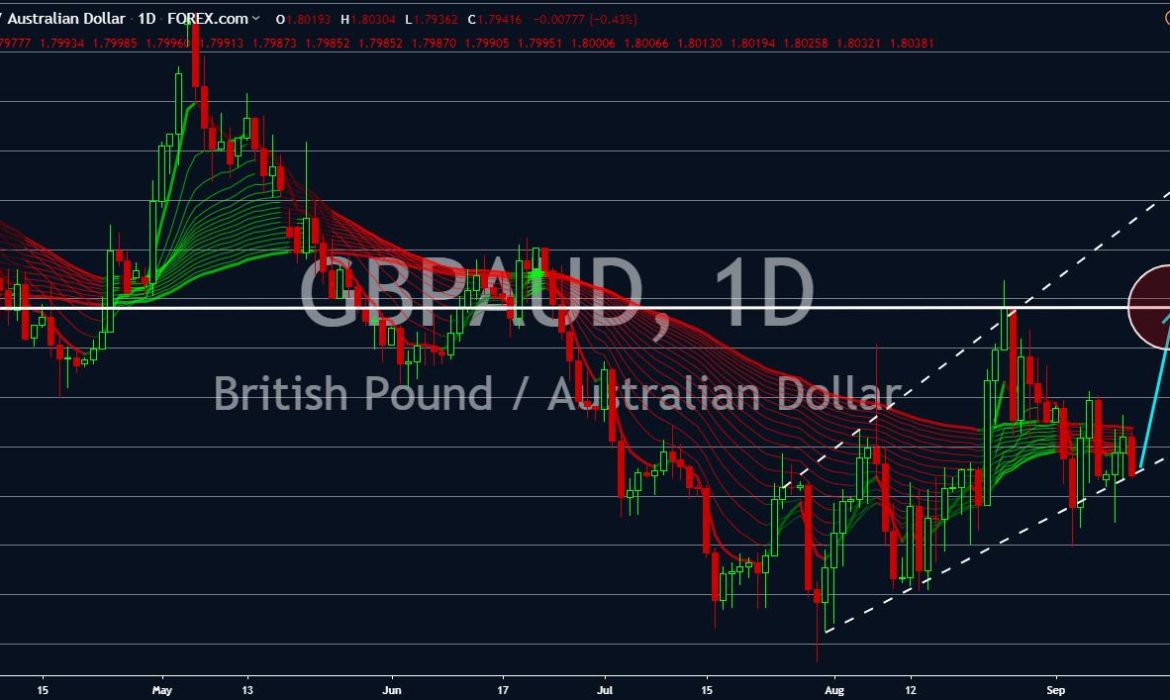

GBPAUD

The United Kingdom, with the help of the United States, was able to pressure Australia to join the U.S. led coalition in the Strait of Hormuz. The coalition was aimed at countering any efforts by Iran to control the chokepoint. The strait between Yemen and Iran hosts 33% of global oil exports. Recently, Iran attacked a British oil tanker and accused them of sailing on its territory. The issue was big for the United States who is the largest oil consumer and considering the military support it is giving to the Kingdom of Saudi Arabia. Saudi Arabia is a historical enemy of Iran. Australia, though exporting crude oil, was not political affected and minimally economically affected from the tension in the Middle East. Despite this, the country was dragged to join to continue receiving the benefits of American presence in the disputed waters of the South China Sea.

GBPCAD

Canada is expected to retaliate economically to the United Kingdom following the latter’s move to strip Jack Letts of its British citizenship. Letts is a British-Canadian man who traveled to Syria to join the Islamic State (IS). Striping his British citizenship will automatically make Canada its home country. This will also put pressure to Canada if it did the same thing that the UK just made. Canada is expected to side with the European Union in making a bilateral trade agreement following the Brexit. This will be catastrophe for the United Kingdom who had only Australia among its Commonwealths that strongly support its post-Brexit trade agreements. Aside from this, an interest rate cut is expected from the Bank of England (BoE) to encourage economic activity in the post-Brexit UK. This will in turn weaken the British Pound, while the Canadian Dollar is seen to continue to surge amid a strong CPTPP ties.

USDDKK

The tariffs imposed by President Donald Trump is expected to offset bad impacts of a negative interest rates that he is proposing, which means a continuous upward movement for the U.S. Dollar. Trump expressed his disappointment on the performance of the Federal Reserve despite cutting 25-basis point for the first time since the 2008 Global Financial Crisis. Aside from economy, Trump also want to expand its military presence as evident on his selling and installation of military equipment in Eastern Europe. Aside from this, the U.S. President expressed his interest in buying Greenland from Denmark. Aside from Greenland being the nearest country to the United States in the Atlantic Ocean, it will also be an advantage for the U.S. once it lay claims in the Arctic region. Claimants includes Russia, Canada, Norway, the United States, and Denmark (through Greenland).

GBPNZD

A more accommodative United Kingdom is seen following the appointment of British Prime Minister Boris Johnson. This will further be strengthened by the withdrawal of the UK from the European Union until October 31. The divorce will bring back the ability of Britain to negotiate trade agreements on its own. In an interview, New Zealand Prime Minister Jacinda Ardern is heard saying the country is ready to negotiate trading deals with the United Kingdom once it officially withdraws from the bloc. A no-deal Brexit is a double-edged sword. The UK will leave the bloc and negotiate trades on its own terms but might also result to the country having no proper trading relations with the largest trading bloc in the world. The British Pound will experience short-term strength until a decision will be made whether the country will extend Brexit or it will crash out of the EU without a deal.