Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

USDHKD

Hong Kong Dollar has been battered amid the ongoing political conflict in the country triggered by the extradition bill that seeks to turnover people in Hong Kong to China to face trial. Pressure also mounts as President Trump uses the issue to its advantage as U.S. and China seeks to draft a deal to end their trade war. Worsening Hong Kong crisis could further darken clouds over U.S.-China trade talks and further escalate trade tension on emerging economies. With months of protests, Hong Kong was heading to a recession as private sector activity plunged to a decade-low in August. Hong Kong purchasing manager’s index (PMI) sank to 40.8 in August from 43.8 in the previous month. Any figure below 50 indicates contraction, and two (2) consecutive months of recession will put a country into technical recession. Today, September 04, Hong Kong Chief Executive Carrie Lam is set announce the formal withdrawal of the extradition bill.

EURDKK

The Danish Krone is facing pressure over a no-deal Brexit with British PM Boris Johnson considering shutting down the UK Parliament to deliver the Brexit, with or without a divorce deal, until October 31. Denmark is heavily reliant on British trade and is the largest exporter of pork to the United Kingdom. Now, this position is under threat if no deal is struck between Britain and Brussels. In line with this, the EU declared a “no-deal” Brexit a major natural disaster, which will allow the European Union to use £544 million from emergency funds to minimize the impact of Brexit. Aside from this, Jyske Bank, one of the largest lenders in Denmark, has announced that it will start charging wealthy clients depositing money to their account. The bank said that customers with more than $1.1 million will receive interest rate of negative 0.6%.

EURTRY

Economists are becoming more positive about Turkey’s economic outlook, but still predict no growth this 2019. Turkey entered a recession in March, its first time in a decade, following its decision to purchase Russia’s S-400 missile defense system which angered Washington and considering its narrowing relationship with the European Union. This results to several sanctions by the United States against Ankara, which sent Turkish Lira down by 30%. In turn, the central bank was prompted to raise interest rates and make borrowing more expensive. In the second quarter, Turkey’s economy shrank 1.5% while its economic growth rate was at negative 2.4%. While the risk of a double-dip recession is receding, the government’s 2.3% for 20149 may be out of reach. Still, Treasury and Finance Minister Berat Albayrak said he expects Turkey to post positive growth for the year.

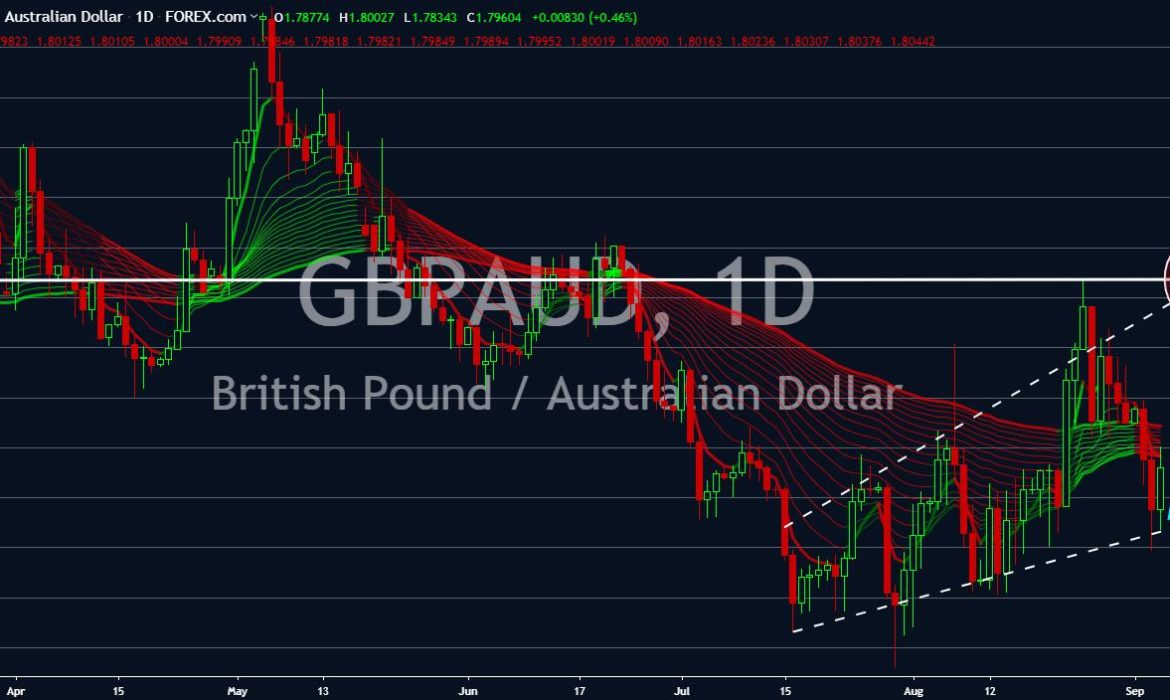

GBPAUD

Australian Dollar’s recovery could further be derailed following recent reports showing Australia’s economic growth hitting 10-year low, expanding only 0.05% in the second quarter. Australia has avoided recession for almost 28 years but figures fuel concerns about the country’s economic outlook with growth falling to its lowest since the 2008 Global Financial Crisis. Added to the concern was British Prime Minister Boris Johnson’s decision to shutdown the UK Parliament to deliver the Brexit. Despite the “no-deal” Brexit triggering the post-Brexit trade agreement between signatories, the $16 billion cost of UK crashing out from the EU without a deal will be catastrophic for all parties involved in the said agreement. The volatility and uncertainty of the post-Brexit world could also cripple the British Pound and will make the Australian Dollar stronger, which will further hurt Australia’s economy.