Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

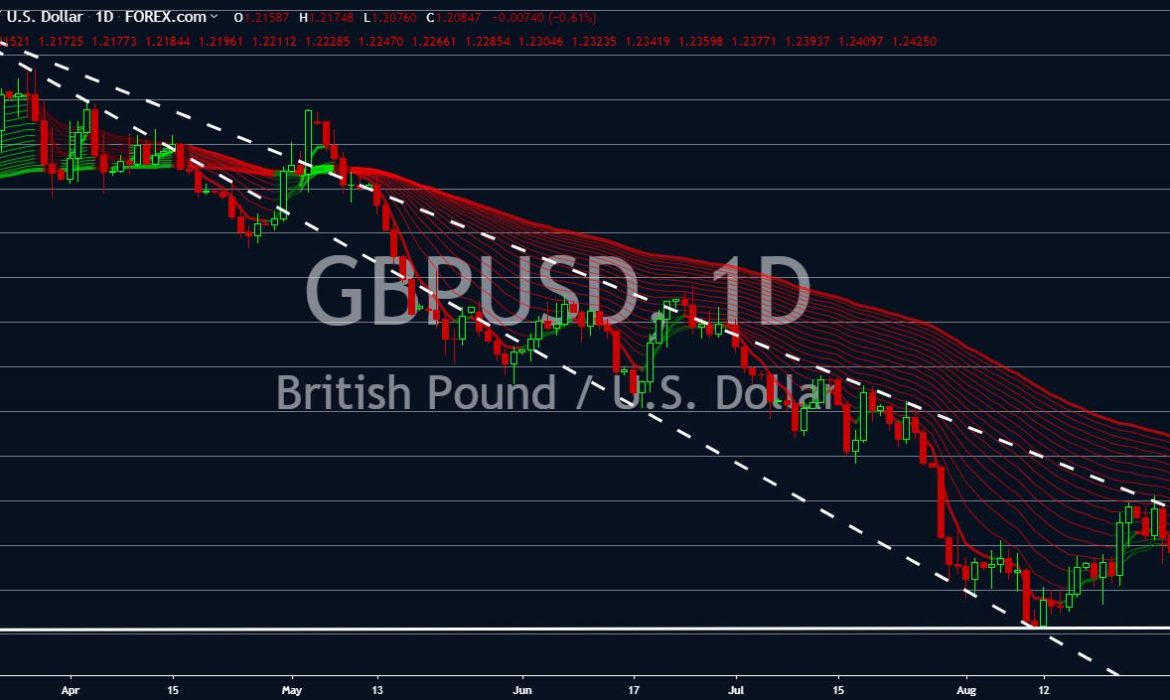

EURUSD

The Euro currency is being pressured amid political and economic uncertainty surrounding the European Union and the bloc’s largest economy, Germany. The 28-member states recorded its slowest growth in years amid the ongoing political and economic conflict between world powers – the United States, Russia, China, and the EU. The European Central Bank also expressed concerns that EU-member states’ central banks might try an unconventional method of negative interest rate to counter economic bubbles. The U.S. Dollar on the other hand, continue to rise sharply fueled by the renewed tension between the two (2) largest economies in the world, the United States and China. In his latest tweet, President Trump threatened to increase tariffs to 30% on $530 billion worth of Chinese goods. In a rare move, China said it will remain calm and will not retaliate in the coming days, which further boost the U.S. Dollar.

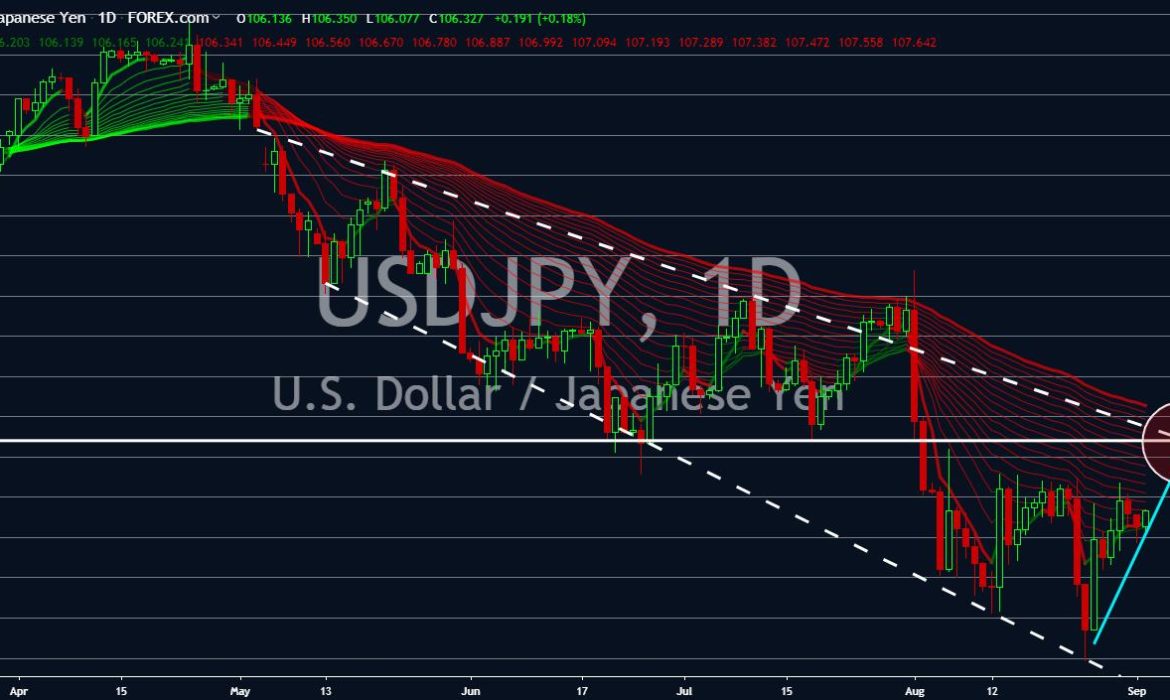

USDJPY

The Japanese Yen weakens against the U.S. Dollar as Japan is alarmed by the ongoing trade tension between the United States and China. Japan said its corporate profits sank by 12% in the second quarter after being hit by the U.S.-China trade war. Japan’s capital spending fell 6.9% to ¥3.62 trillion, down for the first time in eight (8) quarters. Meanwhile, investment by all non-financial sectors rose by 1.9% to ¥10.87 trillion, up for the 11th consecutive quarter, after expanding 6.1% in the previous quarter. In a shocking move, the United States slapped additional 15% tariffs on a variety of Chinese goods on Sunday, including footwear, smartwatches, and flat-panel televisions, while China imposed new duties on U.S. crude oil. In another news, Japan and the United States were able to reach a broad agreement towards a future trade deal during their sideline meeting at the Group of Seven (G7) Summit.

NZDCAD

The New Zealand Dollar is expected to recover this month after investors selloff at the beginning of August following the decision by the Royal Bank of New Zealand (RBNZ) to cut its benchmark interest rate. The rare move by the central bank was made to offset the recent Fed Chair Jerome Powell 25-basis point interest rate cut followed by President Trumps 10% additional tariff on $350 billion worth of Chinese goods to which China retaliates by devaluing the Chinese Yuan to $6.90 per $1 Dollar, its lowest to date. On the other hand, investors and traders were betting for a weaker Canadian Dollar a month before its federal election. Justin Trudeau will run again for Canada’s premiership, but this election was expected to be tough for him after he was accused of pressuring the country’s Attorney General to drop cases against SNC-Lavalin. The Canadian Dollar will continue to weaken until election results are released.

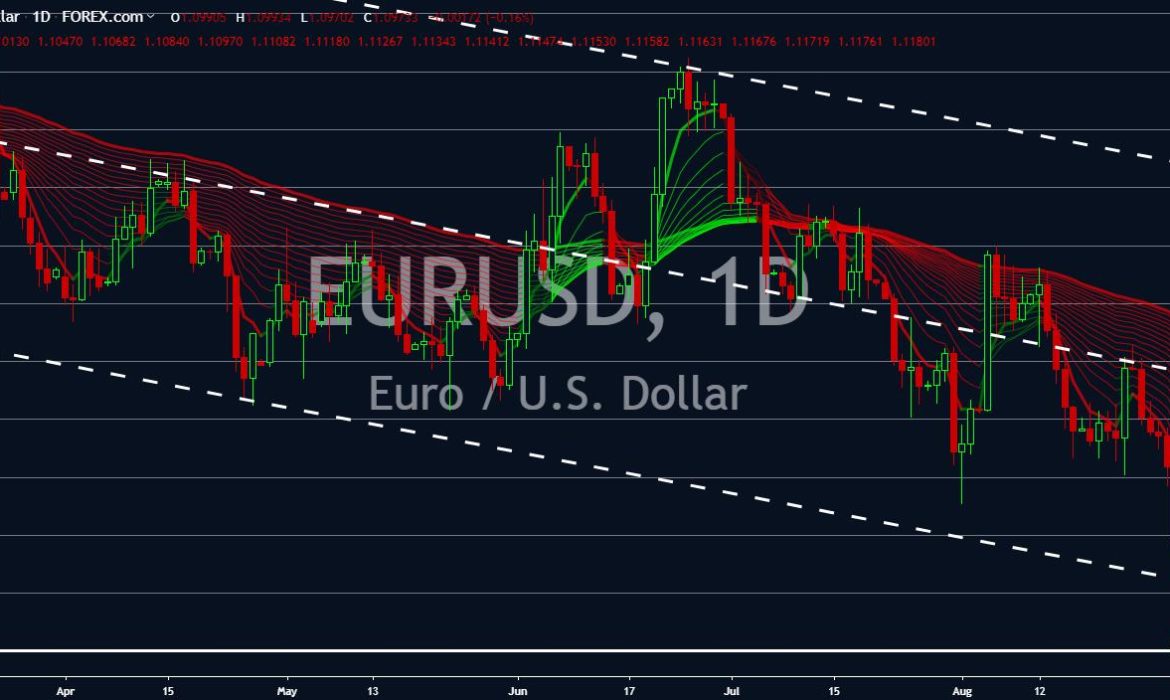

GBPUSD

British Prime Minister Boris Johnson is staying true to his promise of delivering Brexit even in the case of a “no-deal” Brexit scenario. However, the dream of an independent United Kingdom is also killing the British Pound who had suffered from the messy Brexit negotiations. The Pound lost 18.63% since the 2016 British Referendum and is expected to continue to be sold down by investors and traders who worries that the unpreparedness of the UK for a withdrawal without a deal could potentially bring the country into recession. Johnson is now in talks with allies, particularly the United States. However, analysts see two (2) months as not enough for the UK to draft a bilateral trade agreement with the United States. The UK is set to withdraw from the European Union until October 31 and Johnson has now finalized his plan to deliver the Brexit by asking Queen Elizabeth II to suspend the British Parliament.