Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

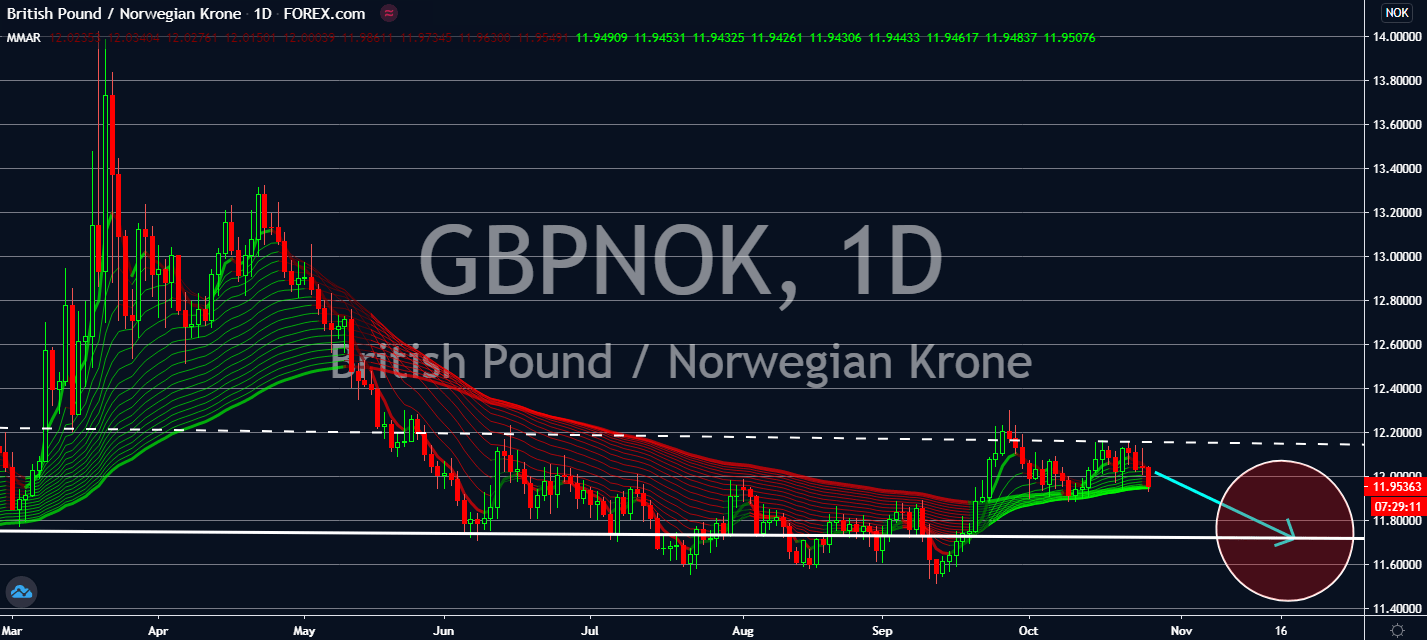

GBPNOK

The UK calendar is going to be quiet today, but it looks like it’s bound to lose. After its economy skidded to a halt brought by the second wave of coronavirus cases across the country, British analysts claim that it’s now at risk of a double-dip recession. IHS Markit/CIPS Flash UK Composite PMI fell to 52.9 for October, which was a dip from 56.5 seen in September. This could fall further through the rest of the year, a factor that will be advantageous to its currency opposites. Meanwhile, despite the recent resurgence in infection rates in Norway, the country still has one of the least coronavirus cases in Europe to date. Although the pair’s longer-term track will depend on whether or not the European Union and the United Kingdom will reach a middle ground with Brexit by the time the deadline arrives by the end of the year.

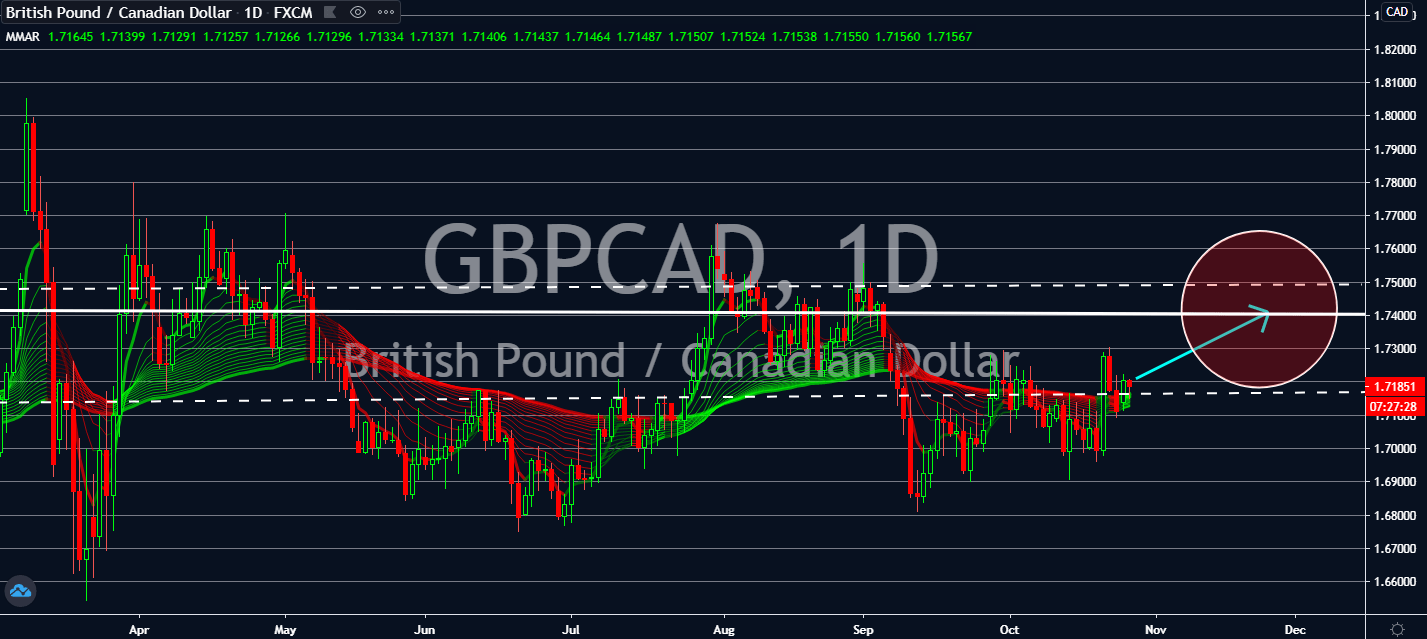

GBPCAD

Only 12.9 percent of Canadian respondents claim that the country’s economy will strengthen in the next six months. Economists have also lowered their confidence in the country, bringing the Canadian Confidence Index lower to 51.8 from 53.2 last month. Although the United Kingdom is at risk for a double-dip recession for the rest of the year, it looks like confidence for its economy was much less than how the market is confident towards the UK. Fortunately for the home of the Sterling, its IHS Markit/CIPS Flash UK Composite PMI data is still above 50, which means that the country is still experiencing growth in activity. Manufacturing businesses bounced back, thanks to trade with countries that have managed to suppress the virus. Although its economic growth has been increasingly slowing through the months, especially in October, progress for Brexit is likely to be a better bet for GBPCAD traders.

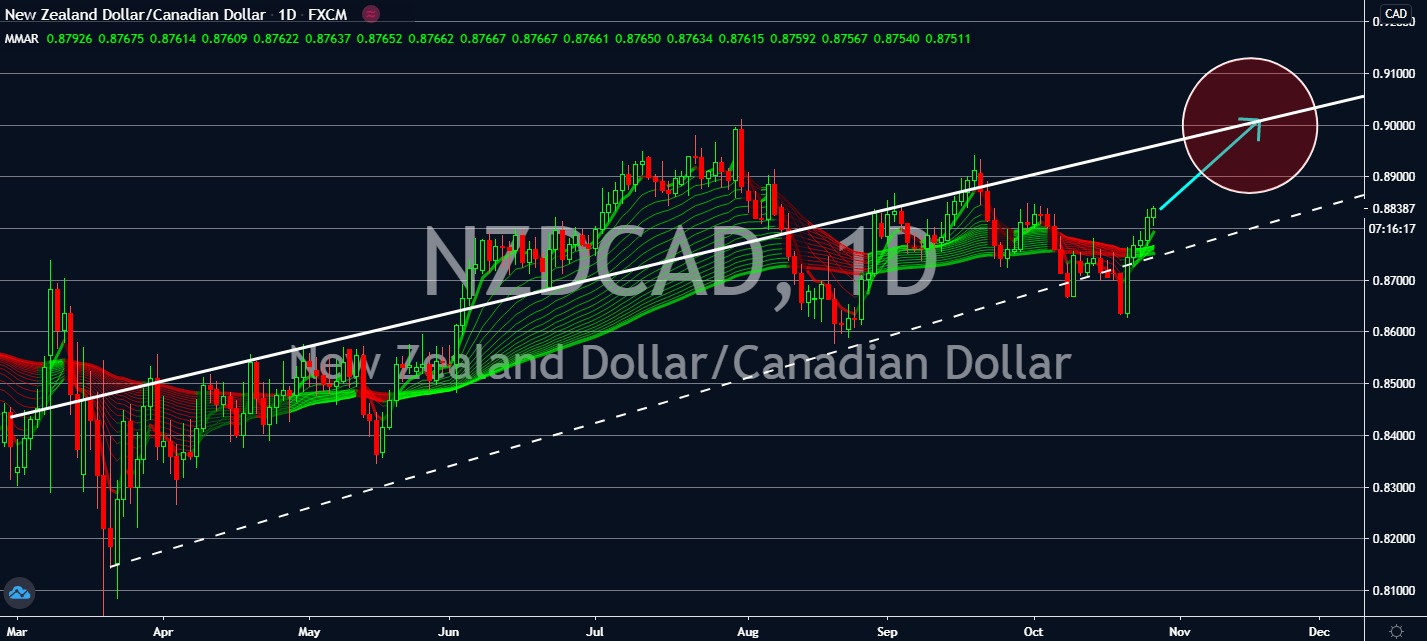

NZDCAD

After being one of the countries that have had the most successful economic run throughout the initial stages of the coronavirus pandemic, the Canadian economy is sinking deeper into peril. Markets are now getting increasingly pessimistic of its economic growth throughout the year led by the alarming second coronavirus wave in many of its parts. Only 12.9 percent were found confident in the strength of the Canadian economy of strengthening throughout the next wave over a maximum of six months, which had been its lowest since the beginning of May. This led its Canadian Confidence Index to fall to 51.8% after dropping for four consecutive weeks. It had reached as far as 53.2 in September. Meanwhile, the quiet New Zealand economic calendar won’t stop its investments from increasing. It looks like its response to its own second wave has been well – its safe haven status will be the pair’s major factor, nonetheless.

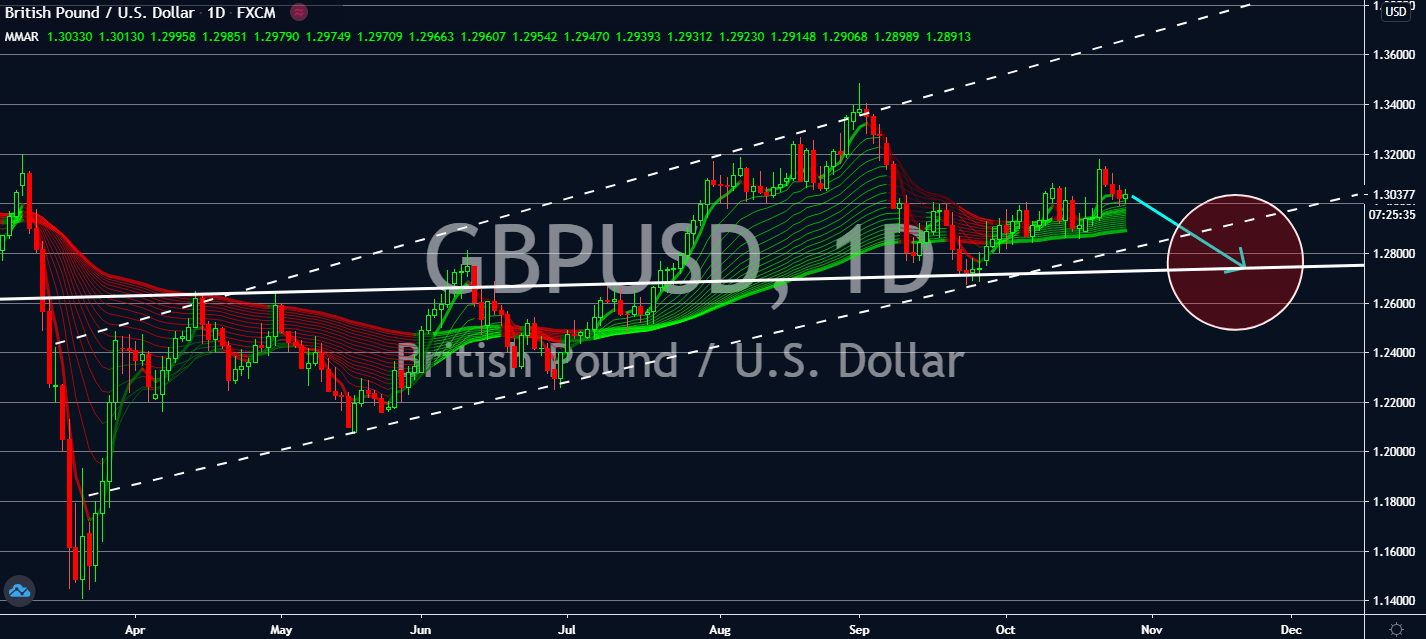

GBPUSD

Economic data have been good to the United States today, thanks to Core Durable Goods Orders results seen in the month of September. The total value of new orders for long-lasting manufactured goods has stepped up against expectations throughout the whole month, despite having a shorter reading than in August. From 1.0% the month prior, September had apparently seen a shallower decline to 0.8 percent in comparison to the 0.4 percent expected by the market. Investors are expected to be more optimistic towards the economic growth seen in the United States despite its struggle before it manages to pump out a stimulus package come November. That said, the figure is expected to push the greenback up against its stagnant alternatives, including the Pound Sterling, in the near-term even after daily coronavirus cases had surged above a record high of 70,000 in the United States earlier this week.