Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

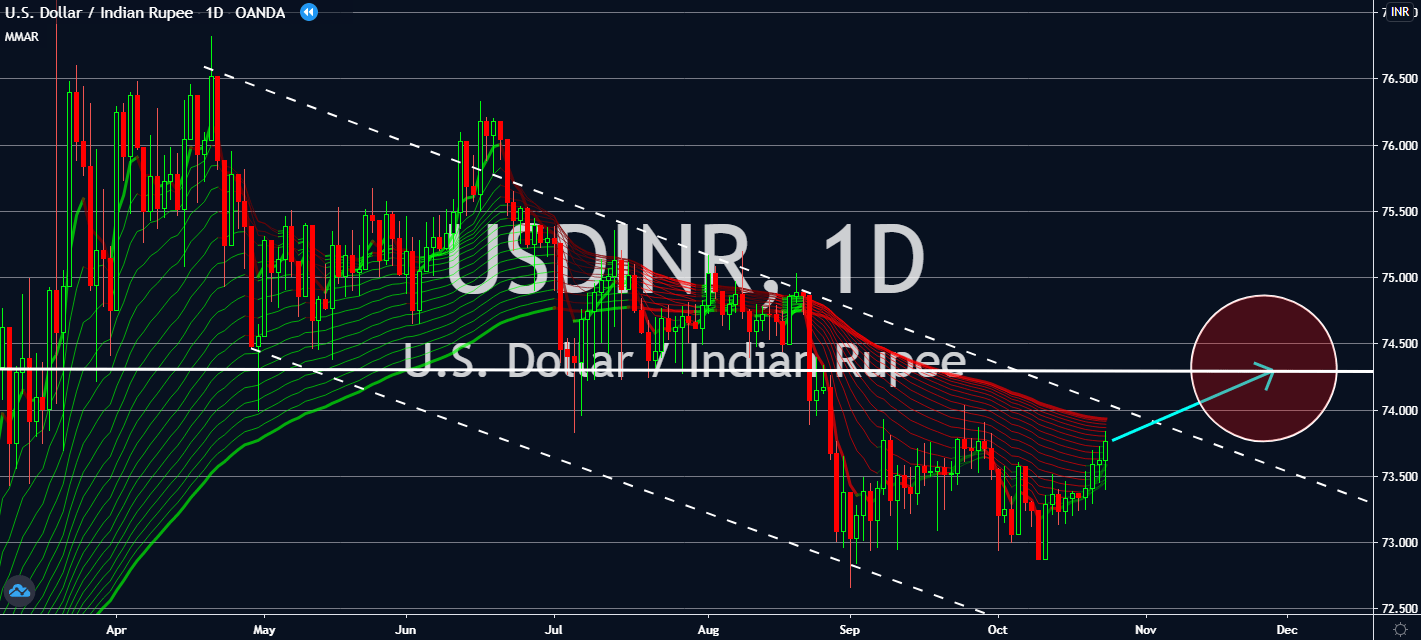

USDINR

Economists claim that the Indian economy will suffer its steepest contraction on record in the current year. Recent stimulus in the county won’t be enough to boost economic activity brought by the coronavirus pandemic, especially now that it has over 7.6 million infections total. India is only second to the United States for having the most cases of the virus with no signs of stopping within the near future. What makes matters worse is the contraction will take place even after the government had removed most restrictions on businesses that were imposed to suppress the spread of the virus. The Reserve Bank of India announced pessimistic economic forecasts because of it, but kept interest rates at a standstill over fears of over inflation. Now that more economic analysts are anticipating a worse economic outcome than they initially projected months ago, the country’s currency is projected to suffer against the greenback.

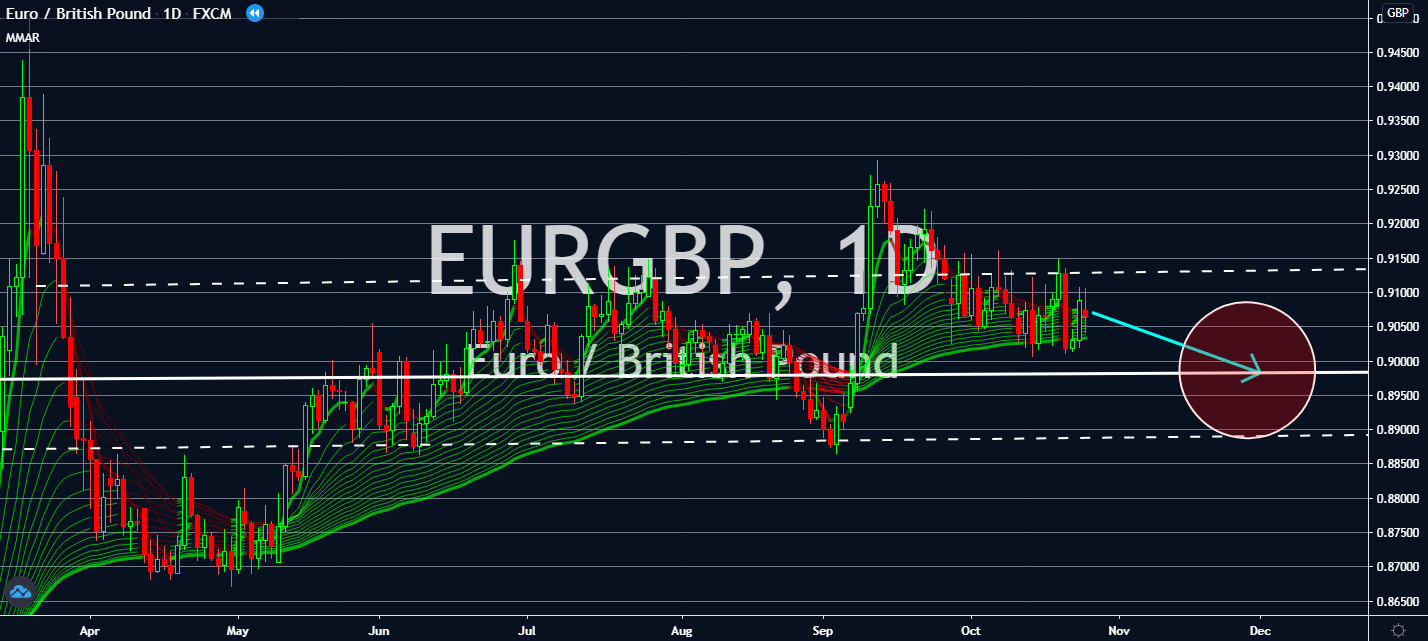

EURGBP

The Pound is projected to go through a hesitant increase against the euro in the near-term. Fears that Prime Minister Boris Johnson will push through his claim that the United Kingdom would need to prepare for an Australia-style trade deal with the European Union while economists claim that the Bank of England is also considering negative interest rates. The sentiment towards the euro was offset by the central bank clarifying that it’s more possible that it won’t happen. On the other hand, the Eurozone’s latest purchasing managers’ index claimed that business activity in the bloc shrank in October, indicating that the eurozone’s economy has become more vulnerable to the pandemic than initially projected. The overall Markit Composite PMI came in at 45.1 for the month of November, which was lower than both its previous record of 50.0 and the market’s projection of a decrease to 45.8. Germany’s equivalent won’t be enough to stop the euro’s decline.

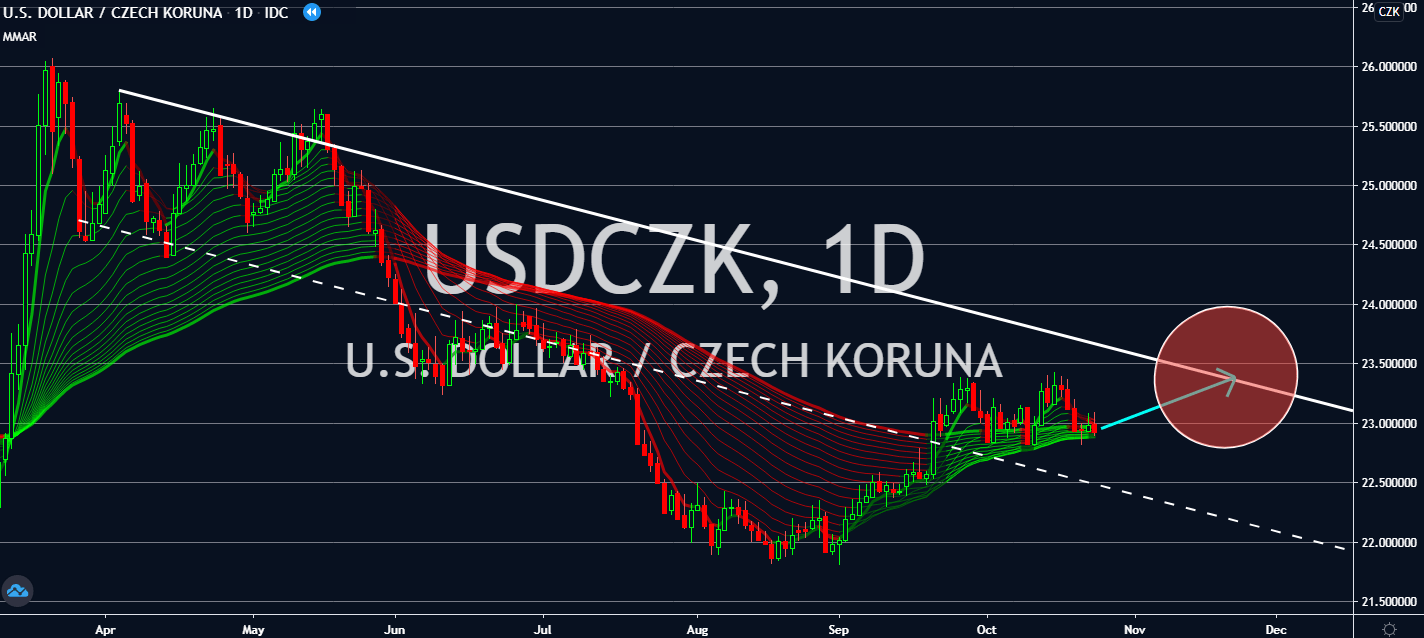

USDCZK

Daily new coronavirus infections in the Czech Republic hit a record high of 15,000 earlier this week for the first time. The previous record was 14,968. The record surge is projected to continue despite tight restrictions in transportation, retail, schools, leisure activities, and sports competitions of more than two people. News of the misfortune came after Prime Minister Andrej Babis fired his health minister for violating his own lockdown implementations. In response, the country had set up a 500-bed field hospital, showing the extent of the state of alarm across the nation. Earlier efforts are expected to get trashed for the next months of the year as confidence in its economy waivers as quickly as it came. Czech Health Minister Roman Prymula is also expected to resign as soon as his successor is named no thanks to his irrevocable damage done to both his career and the confidence in the government’s responses to the pandemic.

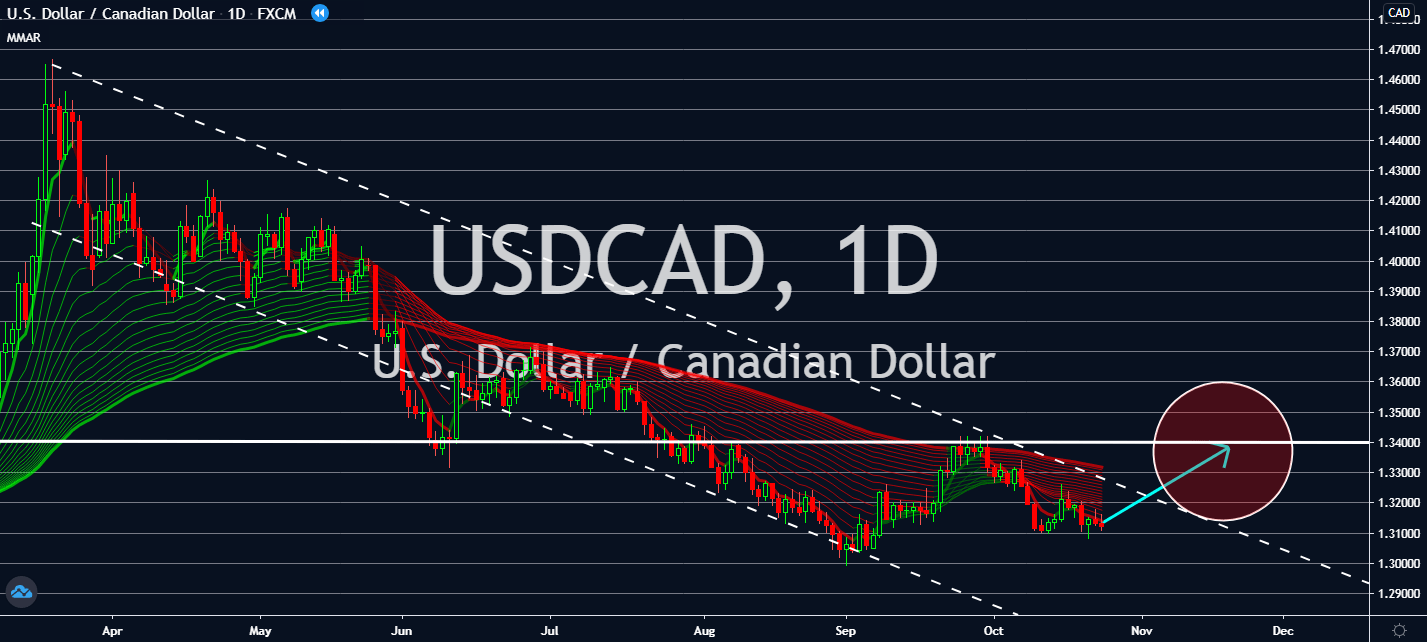

USDCAD

With Canada’s second wave aligning with global uncertainty that brought the oil market down, the loonie is projected to fall against its greenback counterpart. The Bank of Canada is expected to report its monetary policy within the week, which could also keep worrying bearish bets for the Canadian currency. Not only that, economists are also claiming that its economy won’t do well for the rest of the year even after it had seen growth in the initial months of the coronavirus. The effective and relatively quick recovery won’t be enough to pull its GDP down to slow by 5 percent in the fourth quarter this year, which could slow even further by 5.2 percent by the first three months of 2021. The greenback should rise in the near-term mostly thanks to risk aversion while the market awaits the presidential election next month, as well as progress for stimulus packages that could launch before a new administration could be announced.