Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

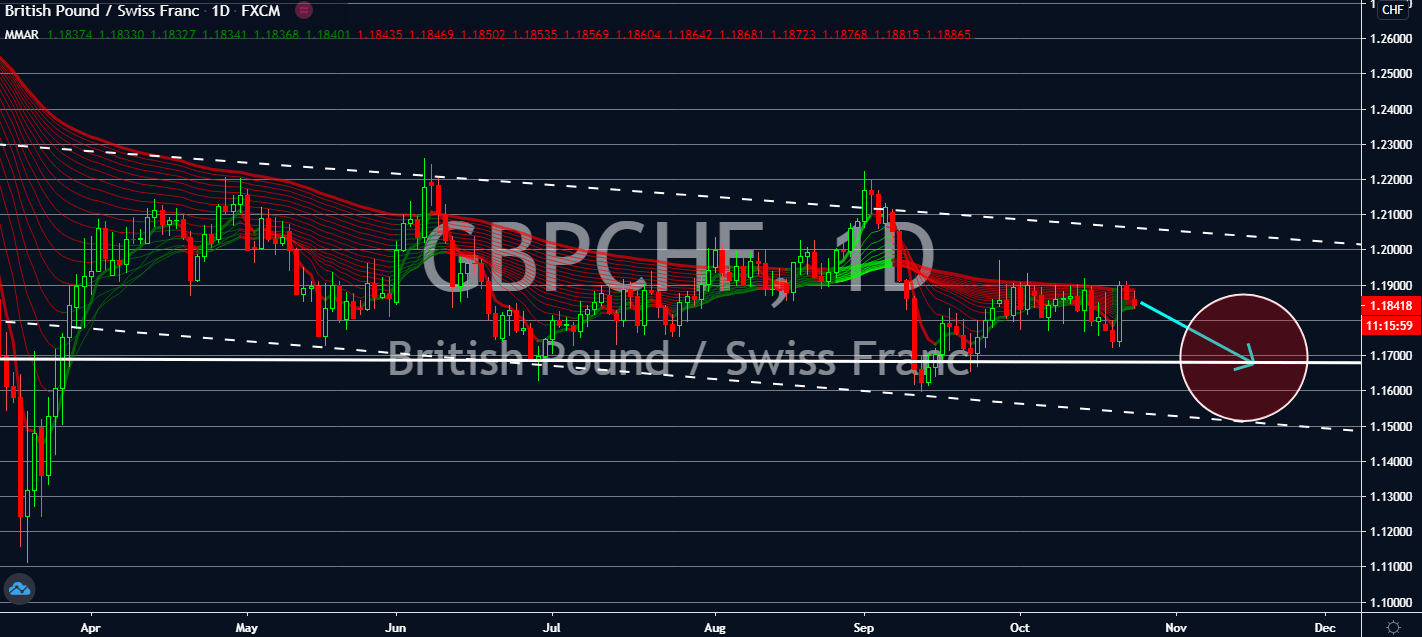

GBPCHF

The Swiss economy might pump out more than CHF 7,500 to every person with Swiss citizenship. This proposal is looming over its currency in the longer term as it loses value amid its attempt to recover from the coronavirus. Fortunately for the franc, the UK has a more urgent problem: several of its indicators and economic activity had stifled worse than initially expected, now that all Composite, Manufacturing, and Services PMI figures have all been reported lower than expected. Composite PMI fell farther below the 50-point goal after it declined from 48.0 in September to 52.9 in October, which was lower than the decrease already expected at 47.0. Manufacturing went down to 53.3 instead of the lift to 54.3 expected prior, while services fell further down to 52.3 in the same month, lower than both 55.0 projections and much lower than the 56.1 points seen in September. Hospitality and transport sectors have suffered most.

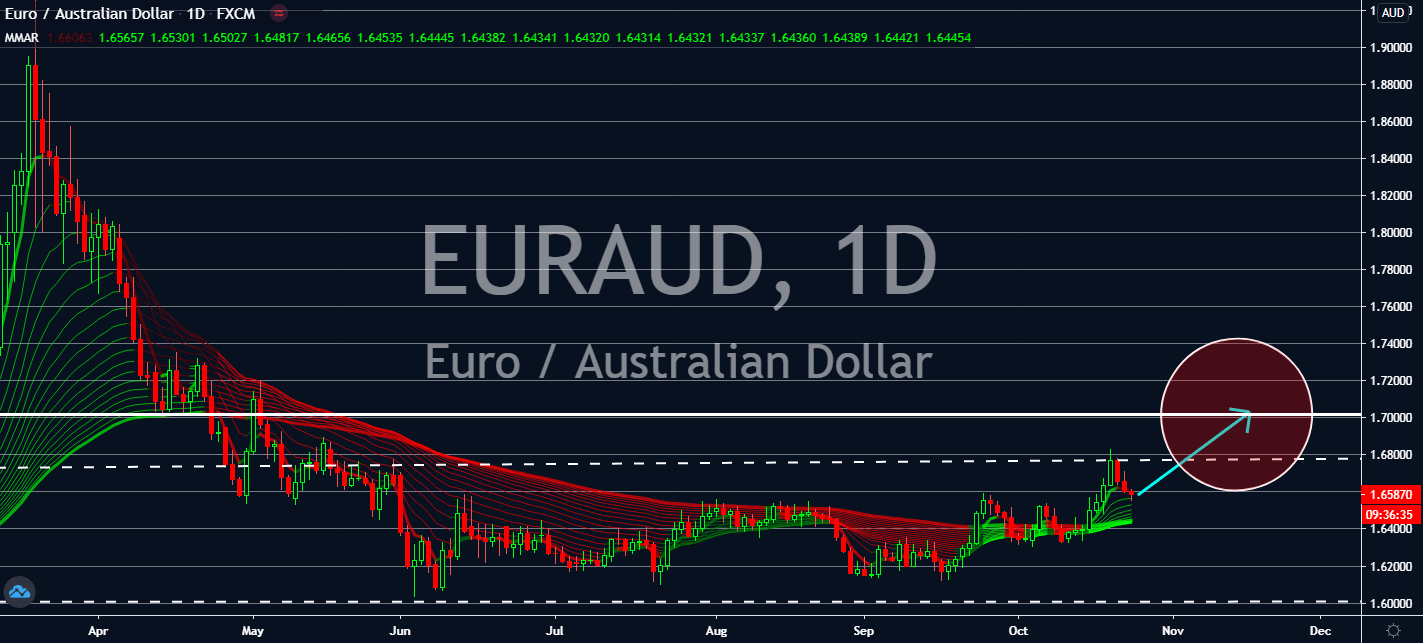

EURAUD

The eurozone reported mixed results for its economic indicators, but it looks like it could benefit more in the near-term. French Services PMI reportedly fell to 46.5 in October, notably a larger fall from 47.5 prior, and the expected fall to 46.8. But its overall Markit Composite PMI had fallen shallower than expected from 50.4 to 49.4 in October. Its Manufacturing PMI also unexpectedly lifted from 53.7 to 54.4, showing that the sector has been faring better than expected, while the German Manufacturing PMI also increased from 56.4 to 58.0 instead of falling to 55.1. Down under, the Reserve Bank of Australia suggested that both its government and the central bank are in discussion to extend its fiscal and monetary policies until 2022. This could mean that it could suffer an even longer recession than most of its peers as it tries to recover from the coronavirus, led by analyses that claim inflation hasn’t been able to catch up to its employment rates.

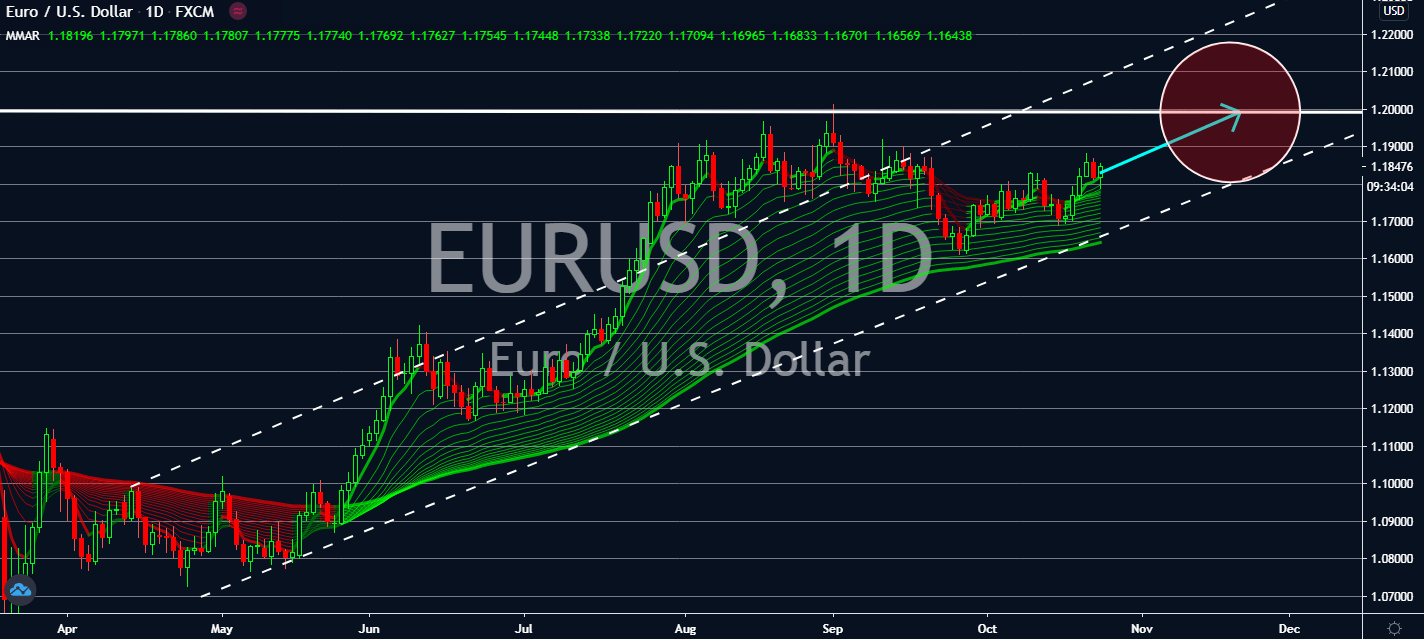

EURUSD

The European Union and the United Kingdom are back on the table after EU Brexit Negotiator Barnier emphasized the meeting’s importance earlier this week. Both economies are now pressured to reach an agreement with compromise on both sides. Optimism will likely pile on the eurozone’s recovery from its Manufacturing PMI readings in October, a figure that increased from 53.7 to 54.4. Notably, its manufacturing capital Germany had seen an uptick in the same month despite having witnessed the market expect a decline to 53.2 from 54.7 prior. The figure came in by nearly 2 points at 58.0, indicating greater growth than most economists and its government expected. These figures are likely to offset the recent gains seen by the greenback as the market grows pessimistic of fiscal stimulus packages in the United States. The pair’s trend will depend on progress for Brexit or the US presidential elections next month.

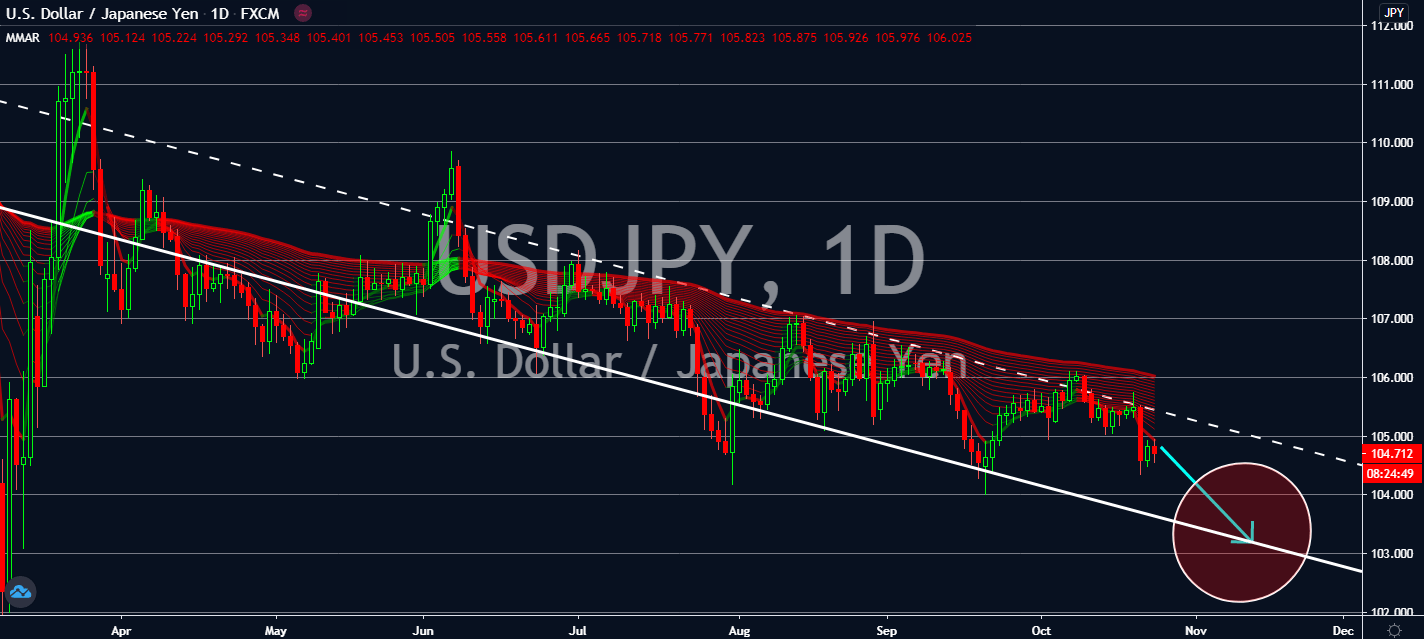

USDJPY

It’s a stale day in the US economic calendar, and most fundamentals are calling for dollar weakness near-term. A Biden victory will most likely drive the greenback down as he’s expected to spend more on coronavirus aid than his Republican counterpart. Investors have also been pulling the dollar low over hopes of a stimulus package before November 3rd. Despite having a more recent improvement in its home sector and employment figures recently, both the US economy and its currency are projected to fall over hopes that Japan’s own recovery has been better than its peers. Any signs of an expensive fiscal package in the US will only make the dollar suffer despite the Bank of Japan’s call to lower its economic outlook for the full year 2020. Moreover, the BOJ is considering another policy change to help its banking system throughout the crisis. The pair will rise once the central bank does make the decision, potentially igniting a volatile but bearish pair.