Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

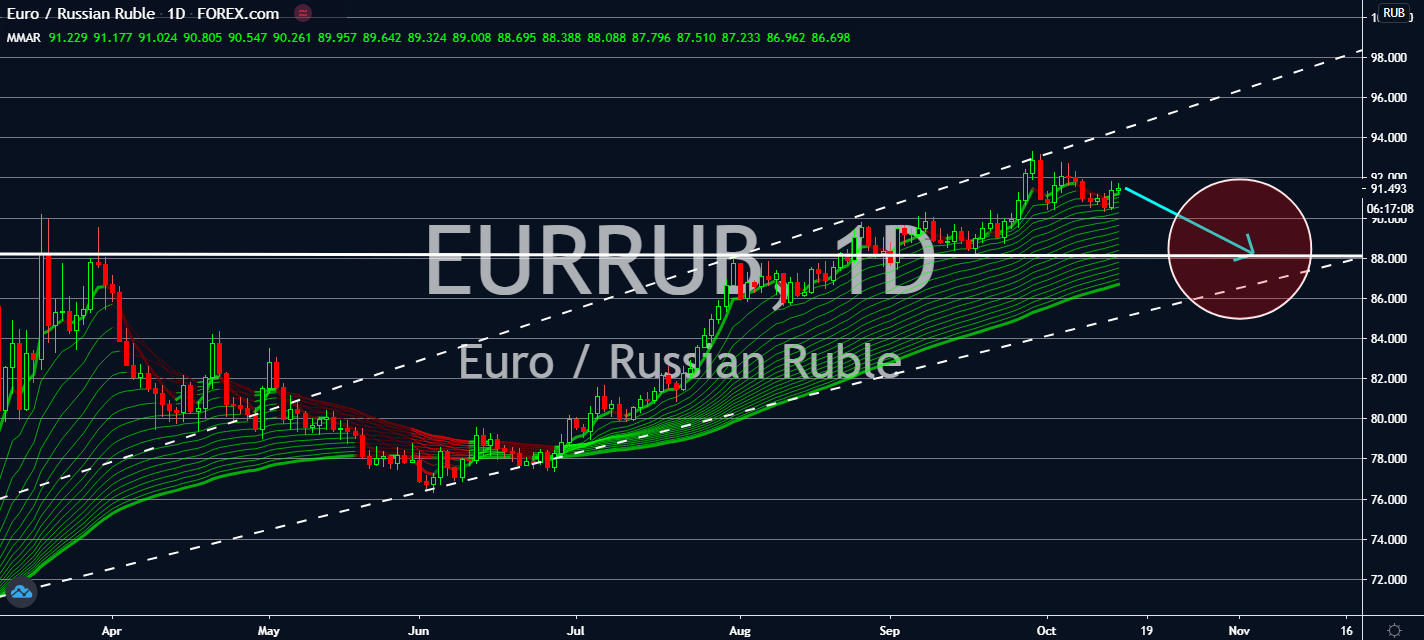

USDRON

Romania is on high alert. Its government implemented another pressing lockdown across the nation for another 30 days after health authorities confirmed more than 600 infections in a day for seven consecutive days, bringing its total to more than 164,000. The lockdown, which was told to start today, is going to pull optimism away from the Romanian leu and to the safety of the greenback. Investors have been increasing their purchasing of safe haven assets as of late, and it looks like this will continue despite overall near-term greenback weakness over fears that the US government will be unlikely to vote on a stimulus deal before the presidential elections on November 3rd. Fortunately for the currency, many investors are still counting on one after the election, which the Democratic presidential candidate Joe Biden is still likely to win. Traders have also been optimistic about his win despite the possibility of raising taxes on corporate profits.

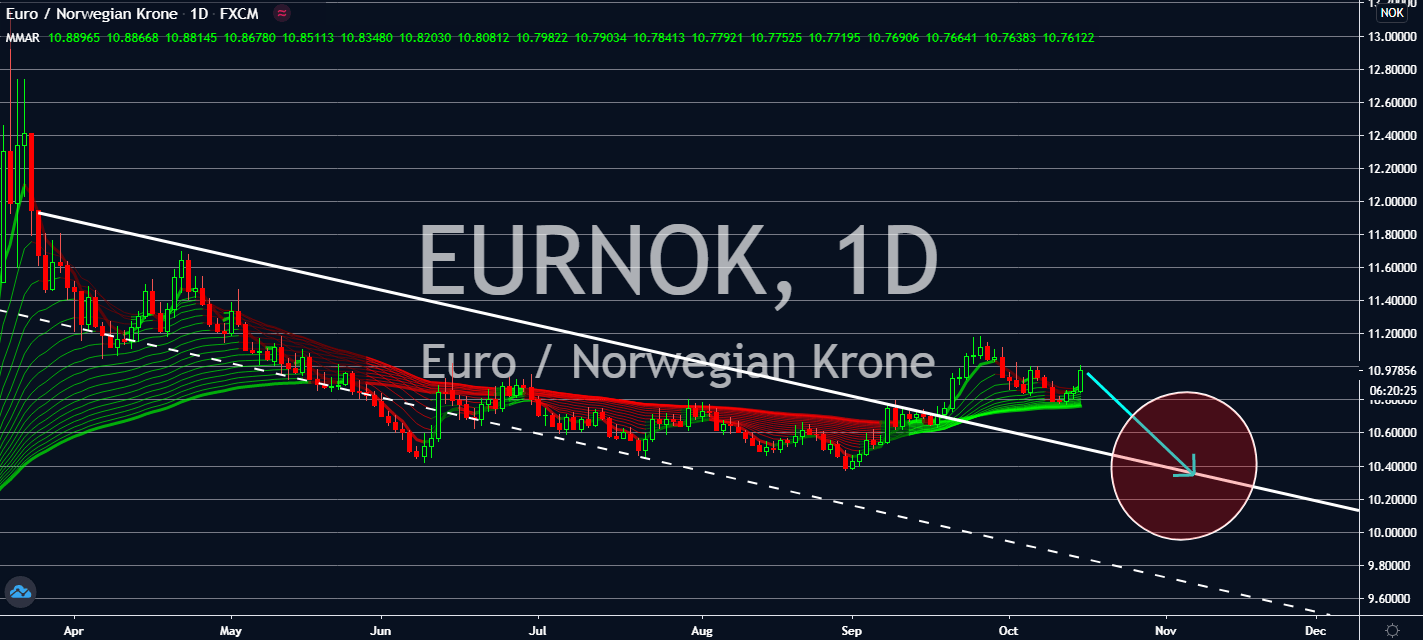

EURNOK

Leaders in the European Union are projected to participate in the EU Summit today. The representatives will discuss proposals to upgrade climate targets and discuss how the bloc will compensate for the losses gained from the recent reinstated nationwide lockdowns across its biggest economies. Now that investors are in fear that the eurozone’s GDP would drop by 7.9% at the end of the year, it looks like the leaders will have to decide on a stimulus package to help keep the rate low. Meanwhile, Norway’s $1.16 trillion sovereign wealth fund, the world’s largest, is projected to gain another $44.31 billion by the end of the year thanks to boosts in US technology stocks throughout the economic crisis brought by the coronavirus pandemic. The Fund’s overall value will have lifted it to approximately $217,000 per Norwegian citizen, bringing about optimism that upcoming stimulus packages won’t damage as much of its economy.

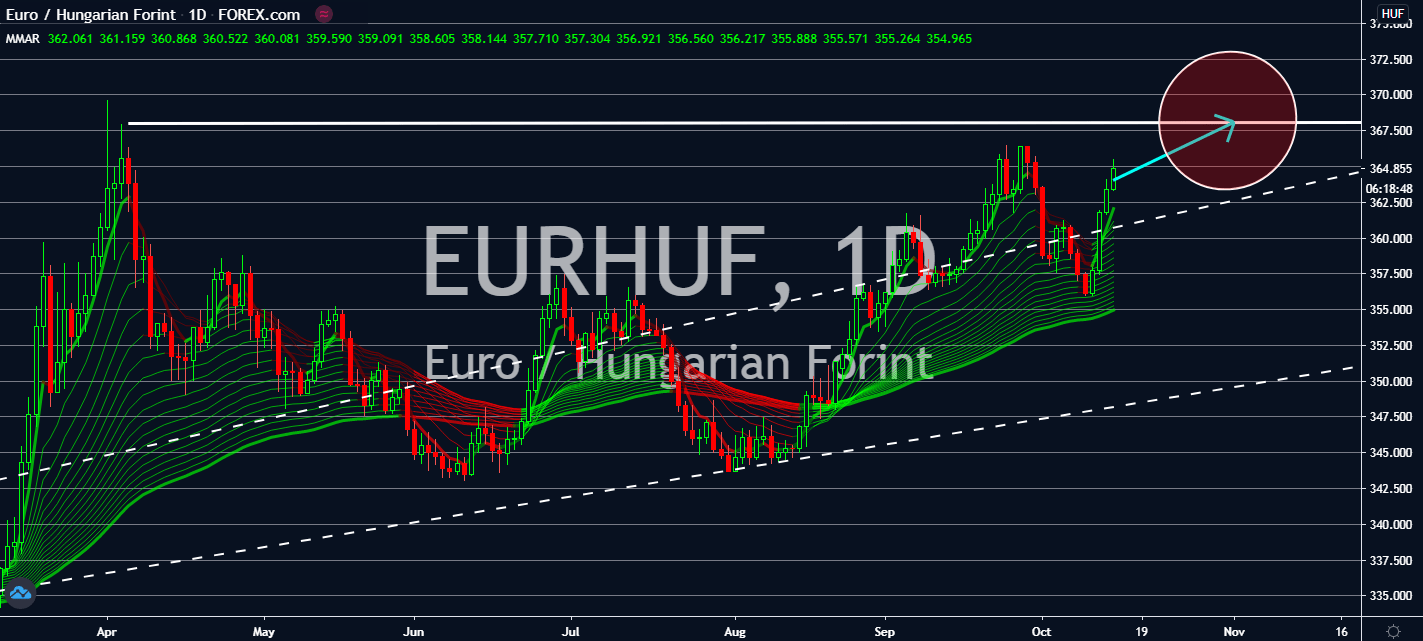

EURHUF

Hungary surpassed 40,000 coronavirus cases this week. As a result, its government will give up $9,693 to families in order to help renovate homes by next year. The offer brought about the pressing issue of its health crisis and slowing economic recovery a week after its Prime Minister Viktor Orban said Hungary would introduce a lower value-added tax of 5% on housing projects until the end of 2022 as his assistance to the construction sector. Moreover, Hungary’s 27% VAT rate is still the highest in the European Union. The news is projected to help the euro currency while the market awaits the EU Summit to wrap up on Friday, which is expected to discuss climate targets, Brexit, and another possible stimulus package for participating countries in the bloc. Any progress made in the meetings will lift its currency, even in the long run, as it continues its effort to keep its economic activity afloat amid the pandemic.

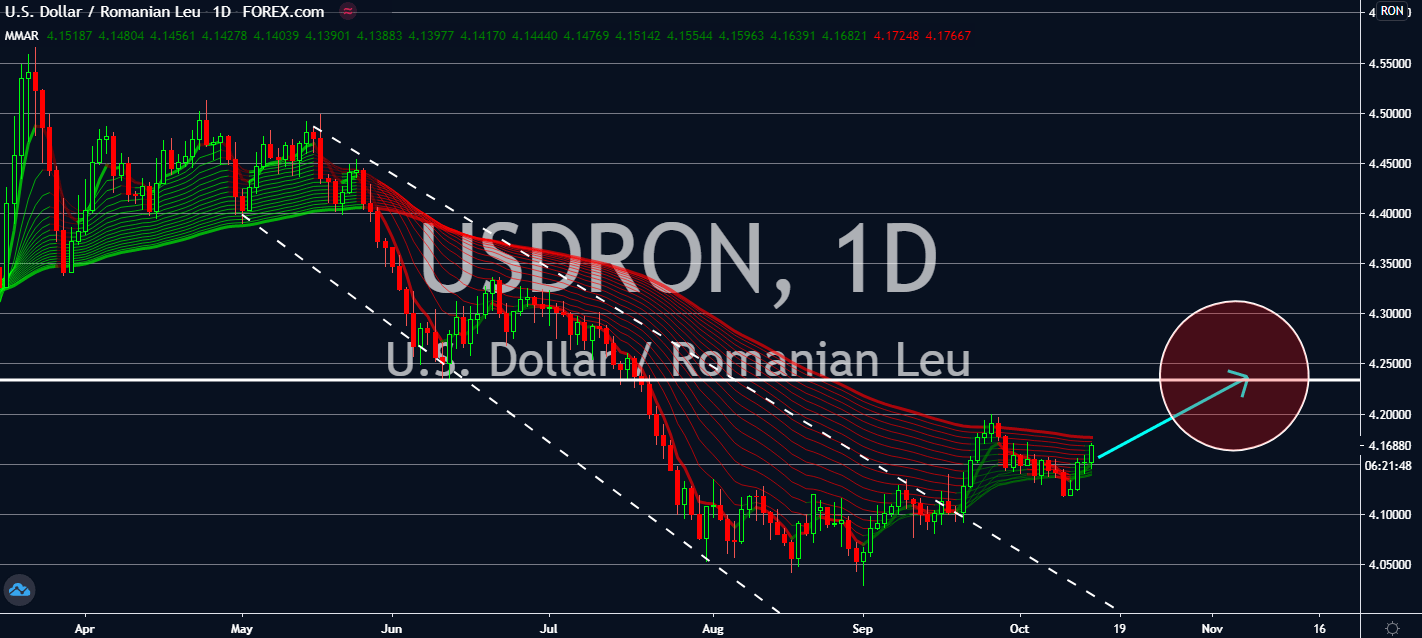

EURRUB

Economists fear that the eurozone’s overall economy would fall by 7.9% by the end of the year over fears that the coronavirus might have taken over its activity more they had estimated prior. This could be beneficial for the ruble, especially after it had declined to one of its worst performance for the past months while global oil prices fell earlier this year. Economists are now claiming that the ruble is undervalued – this could be enough to help investors recover the currency in the near-term, especially now that its economy is expected to experience a fall shallower than the eurozone. The country’s industrial production is projected to shrink not more than 4.5% by the end of the year, while manufacturing will contract by 2%. Germany’s manufacturing is projected to remain depressed for months and will have to catch up with the rest of the economy, but only once until coronavirus measures have been dropped by next year.