Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

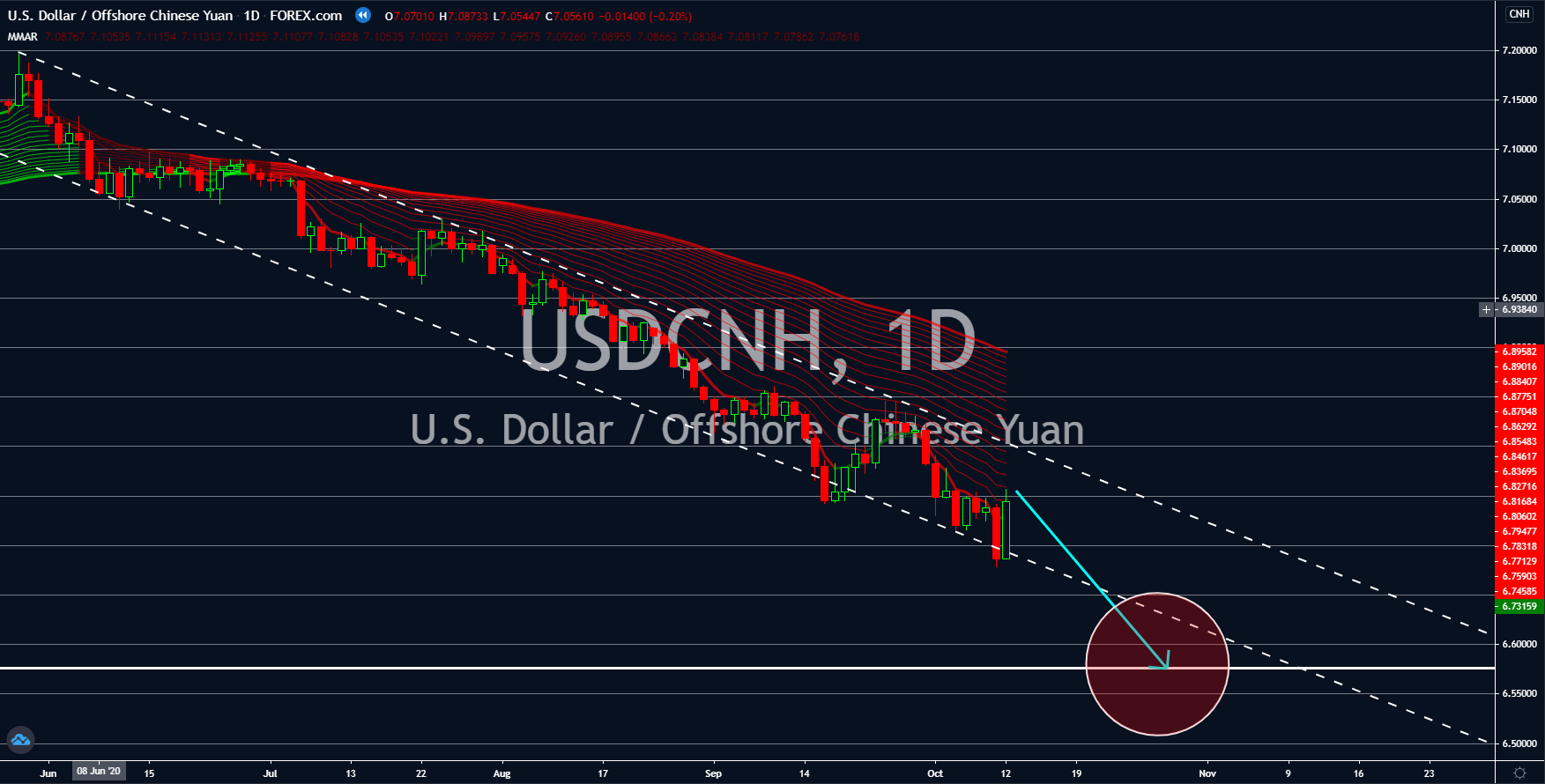

USDCNH

The US dollar will continue to lose its value against the Chinese yuan in the coming weeks. A major catalyst for this decline was President Trump’s announcement that he will postpone negotiations for the much-needed stimulus. Cumulatively, the US government and the Federal Reserve injected $6.6 trillion in the local economy. Despite this, many businesses still retrenched their employees to make their balance sheet look attractive. This resulted in the initial jobless claims report reporting an average of 850K additions for the past 6 weeks. At the onset of the coronavirus, China’s economy suffered a staggering loss. However, analysts still see the second largest economy in the world posting a positive GDP for the fiscal year. The International Monetary Fund is anticipating a 1.9% GDP growth for China’s fiscal 2020. Some reports are supporting this growth. Imports and exports grew by 13.2% and 9.9%, respectively.

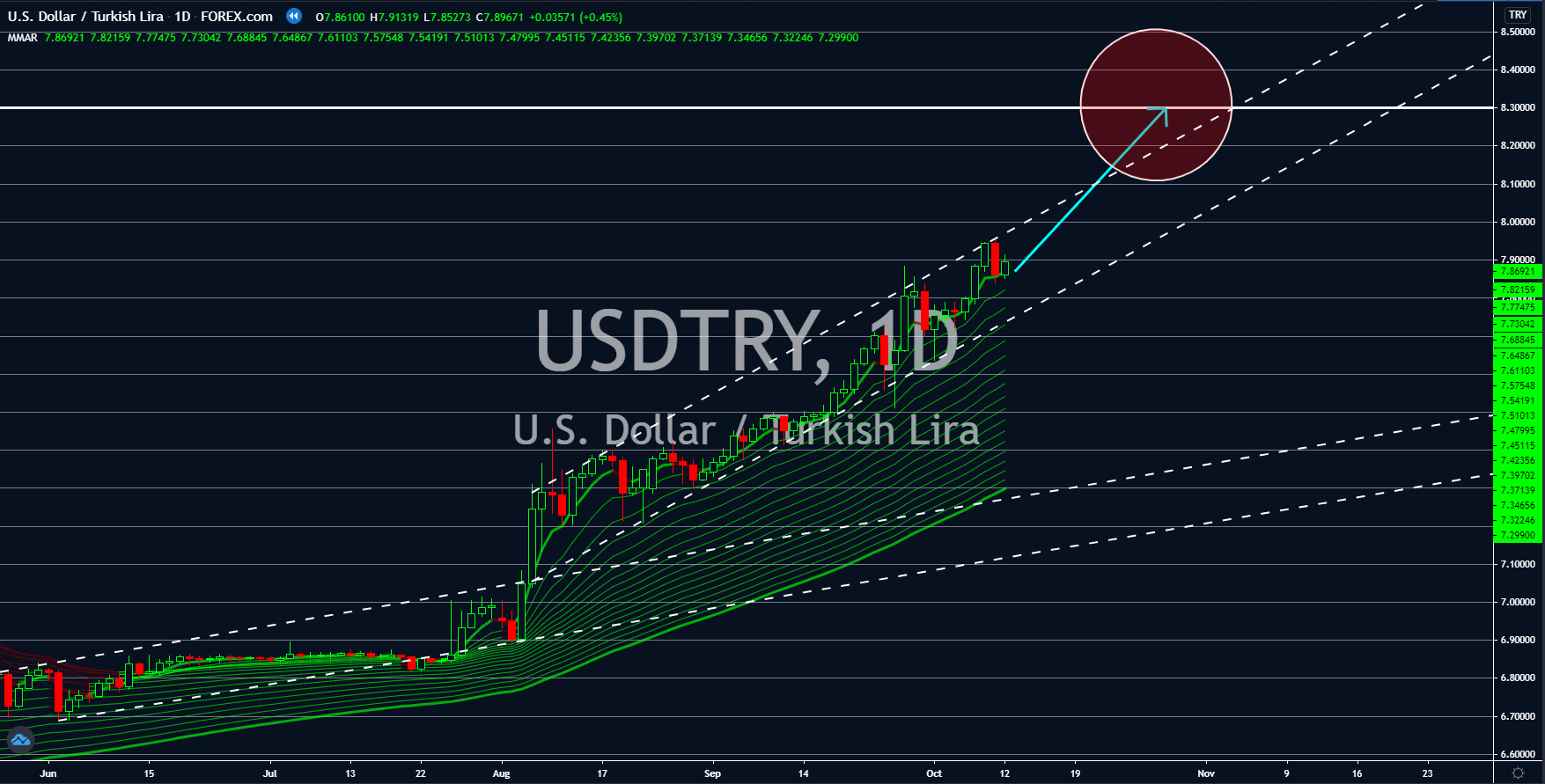

USDTRY

Analysts are giving their dire warnings for investors of the Turkish lira as more pain is expected in the coming sessions. Today, October 13, Ankara posted a major decline on its retail sales MoM and YoY reports. Figures came in at 1.4% and 5.8%, respectively. The previous numbers for these reports were 9.2% and 11.9%. Not only should investors be concerned with consumer’s confidence in Turkey’s economy but also with the government’s ballooning debt. The current account for the month of August was -$4.63 billion. In line with these concerns, Turkey raises its swap rate to prevent the lira from further falling. Two (2) weeks prior to this move, the country’s central bank increased its benchmark interest rate by 2.0 points. Investors should also be alarmed with the possibility of a US sanction to the country following its purchase of military equipment from Russia. The US-China trade war triggered the lira’s flash crash of 15% in August 2019.

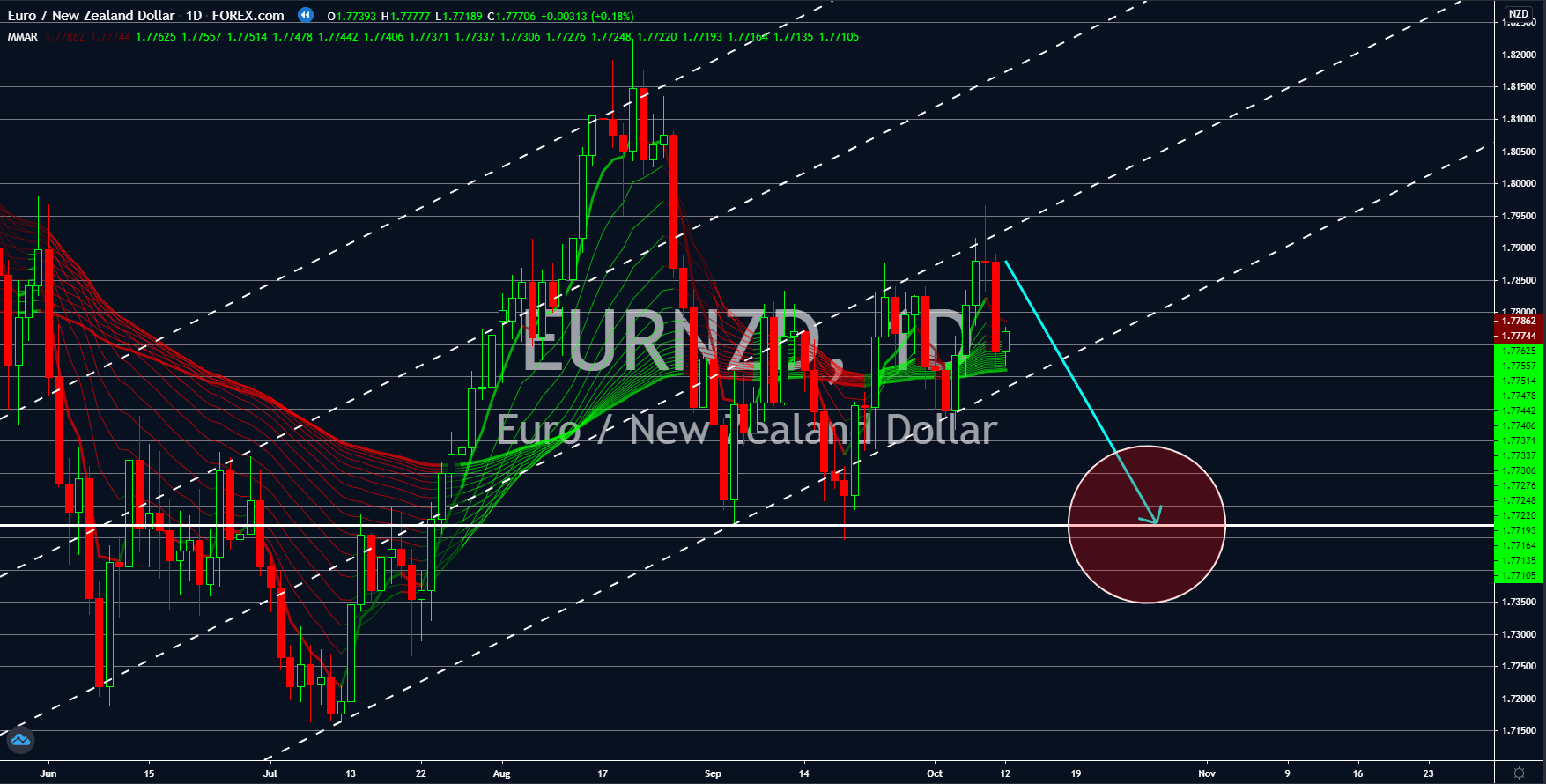

EURNZD

The hope for a robust economic recovery in the European Union might no longer be feasible. This was following the recent Consumer Price Index report from the EU’s largest economy – Germany. CPI MoM recorded -0.2% decline for the month of September from -0.1% slump in August. Meanwhile, the year-over-year report had the same percentage decline of -0.2%. This was following a zero percent growth in the prior month. A historical data chart for these reports suggests that Germany might not see any signs of recovery in the last three (3) months of the year. On October 13, the same day when CPI MoM and YoY reports were published, the ZEW Economic Sentiment report was also posted. Germany’s Zentrum für Europäische Wirtschaftsforschung in anticipating a weaker economy for Germany in the next six (6) months. Between September and October, the figure for the report went down by 21.3 points.

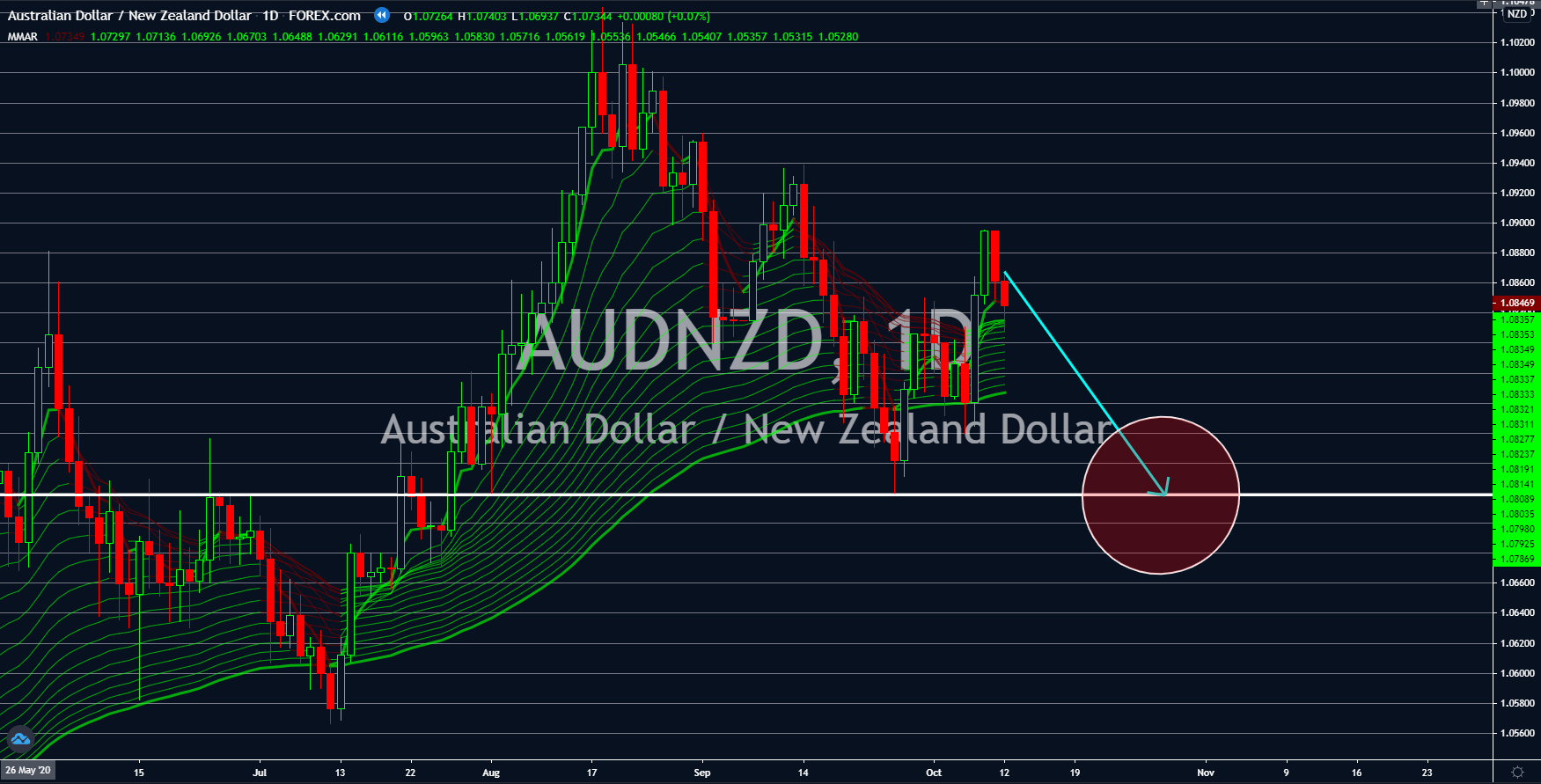

AUDNZD

Investors and consumers’ confidence in the NZ economy is well reflected in its recent report. Electronic card retails sales MoM and YoY reports showed a major improvement from their recent reports. Month-over-Month report posted 5.4% growth from -8.9% in August. Meanwhile, the report’s YoY figure also posted a positive growth of 7.3% from a slump of -0.8%. Aside from that, New Zealand has been opening its borders to the rest of the world. Visitor arrivals from last Sunday’s report, October 11, increased by 104.7%. New Zealand’s incumbent prime minister, Jacinda Ardern, is also anticipated to win in the upcoming October 17 elections. On the other hand, a huge gap between September and October’s report was clearly visible in Westpac Consumer Sentiment. Figure for the month of October came in at 11.9%. This was a huge decline from the prior month’s result of 18.0%, which suggests that the pair will continue its downward movement.