Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

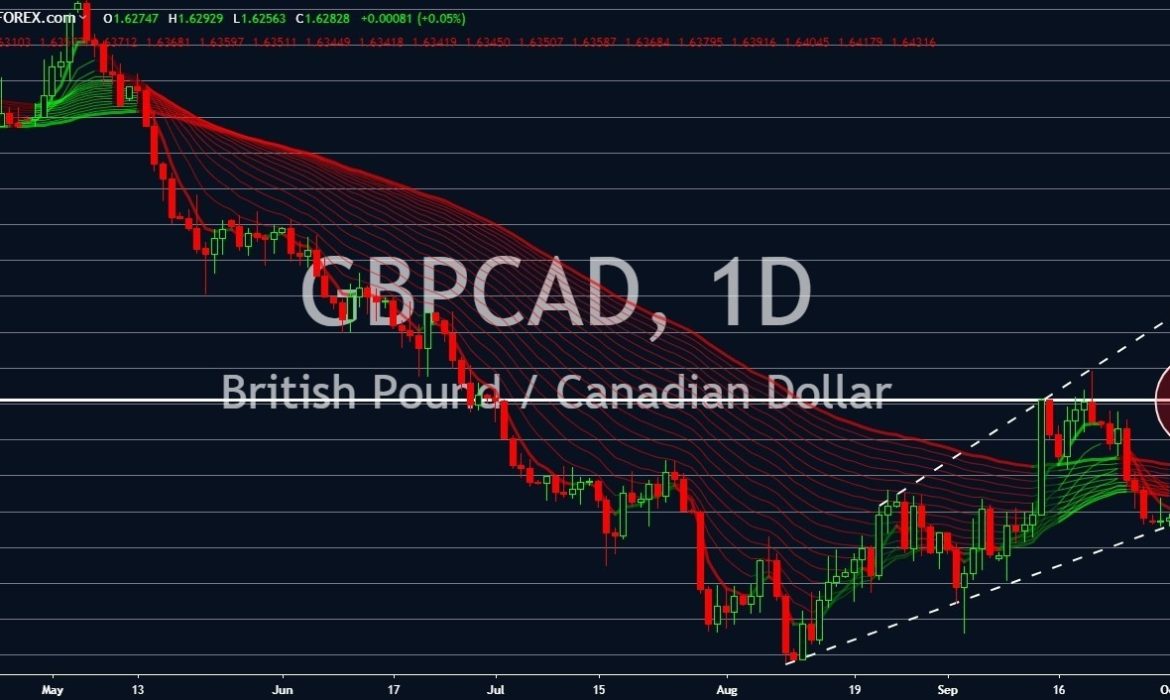

GBPCAD

The British Pound is expected to recover after the recent sell off. Data shows that the United Kingdom contracted 0.2% for the second quarter of 2019. Despite this, the country was able to top analysts’ expectations of 1.2% after it recorded 1.3% growth. Analysts were still wary of a possible recession amid the looming withdrawal of Britain from the European Union. The divorce is expected to cost the UK billions of dollars. Added to the pessimism was the possibility of Britain crashing out of the EU without a trade deal. Just a day before UK’s withdrawal from the EU, Bank of Canada will release its monetary policy and interest rate decision. Pressures from central bank around the world to cut interest rate is expected to weigh on BOC’s decision. The United Kingdom and Canada are also expected to draft a deal once the UK leaves the bloc on October 31.

NZDCAD

A possible interest rate cut from the Royal Bank of New Zealand (RBNZ) is expected. This was amid a disappointing figure, showing that business confidence with New Zealand’s economy is plummeting. The Australia and New Zealand Banking Group Limited (ANZ) reported that business confidence inched up by a mere 1.2% to 53.5%. However, analysts were looking that confidence should go up to 58.5%. The RBNZ had already cut its rate twice in just 5 months, from 1.75% to 1.50% and from 1.50% to 1.00%. The central bank, however, assured that it will keep New Zealand’s economy afloat even at the expense of New Zealand Dollar. The Bank of Canada on the other hand, will meet on October 30 to discuss monetary policy and interest rate decision. The BOC has yet to bend down to pressures from developed and developing economies amid rate cuts trend.

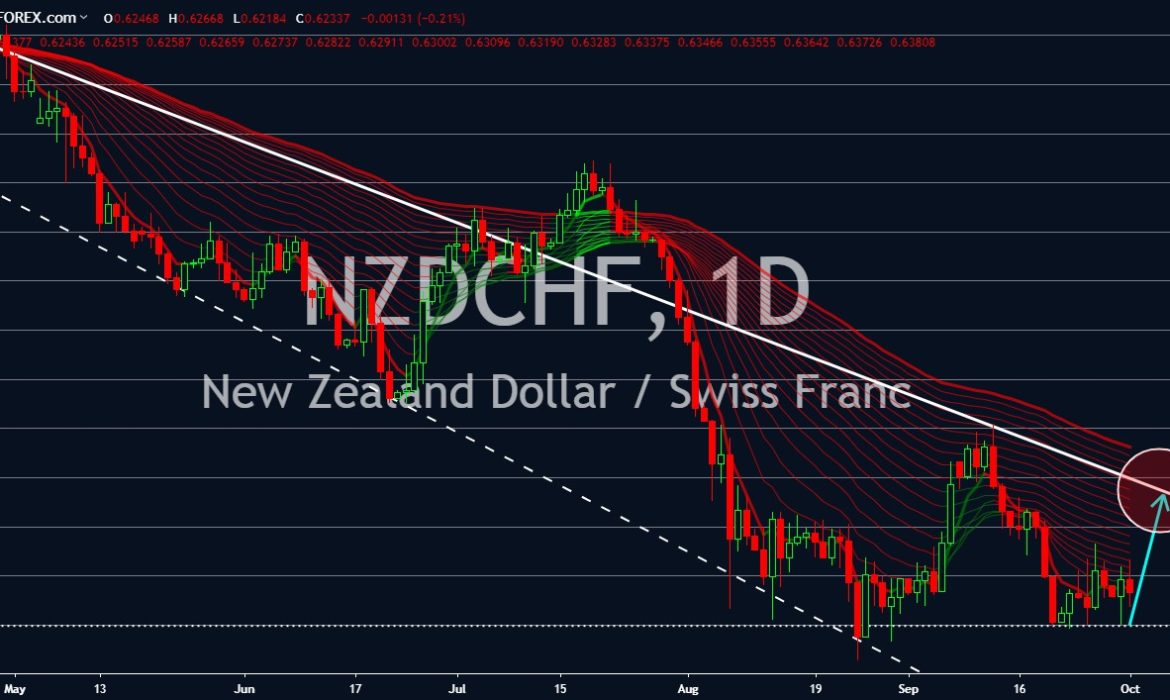

NZDCHF

Switzerland retail sales for the third quarter dropped to negative 1.4% compared to positive 1.5% from a year ago. The data confirms analysts’ speculation that the country might be affected by the slowing growth in the European region. The slowdown is said to be the result of failed Brexit negotiations and rising protectionism across the world. Switzerland was Europe and one of the world’s most stable economy. In addition, the Swiss Franc and the Japanese Yen are the world’s stable currency. A weak reading for the Swiss economy will affect the Swiss Franc, which in turn will signal a global recession. New Zealand Dollar on the other hand, will remain stable. The rates will remain unchanged until the RBNZ will once again convene to discuss monetary policies and interest rate cuts. The next meeting will be on November 12, meaning the current strength of NZD will remain for this month.

USDHKD

Hong Kong Dollar will continue to weaken against the U.S. Dollar amid the country’s depleting USD reserve. The drop will put the country’s reserve to its 6-month low. Moreover, the actual reserve was way lower compared to what analysts forecasted. Data shows Hong Kong USD reserve dropping to $432.80 billion from $448.40 billion by August. This is also lower compared to analysts’ estimate of $442.00 billion. Aside from this, the country’s retail sales for the third quarter of 2019 dropped to negative 11.4% from negative 6.7%. The drop on retail sales was attributed to weeks of protest in the country’s capital. On the other hand, FOMC will speak this week regarding the economic health of the U.S. This is expected to be followed by hints on Fed’s future move regarding the country’s interest rate. Aside from this, the U.S. will report jobs addition for August on Friday. NFP is a good economic indicator of the U.S. Dollar.