Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

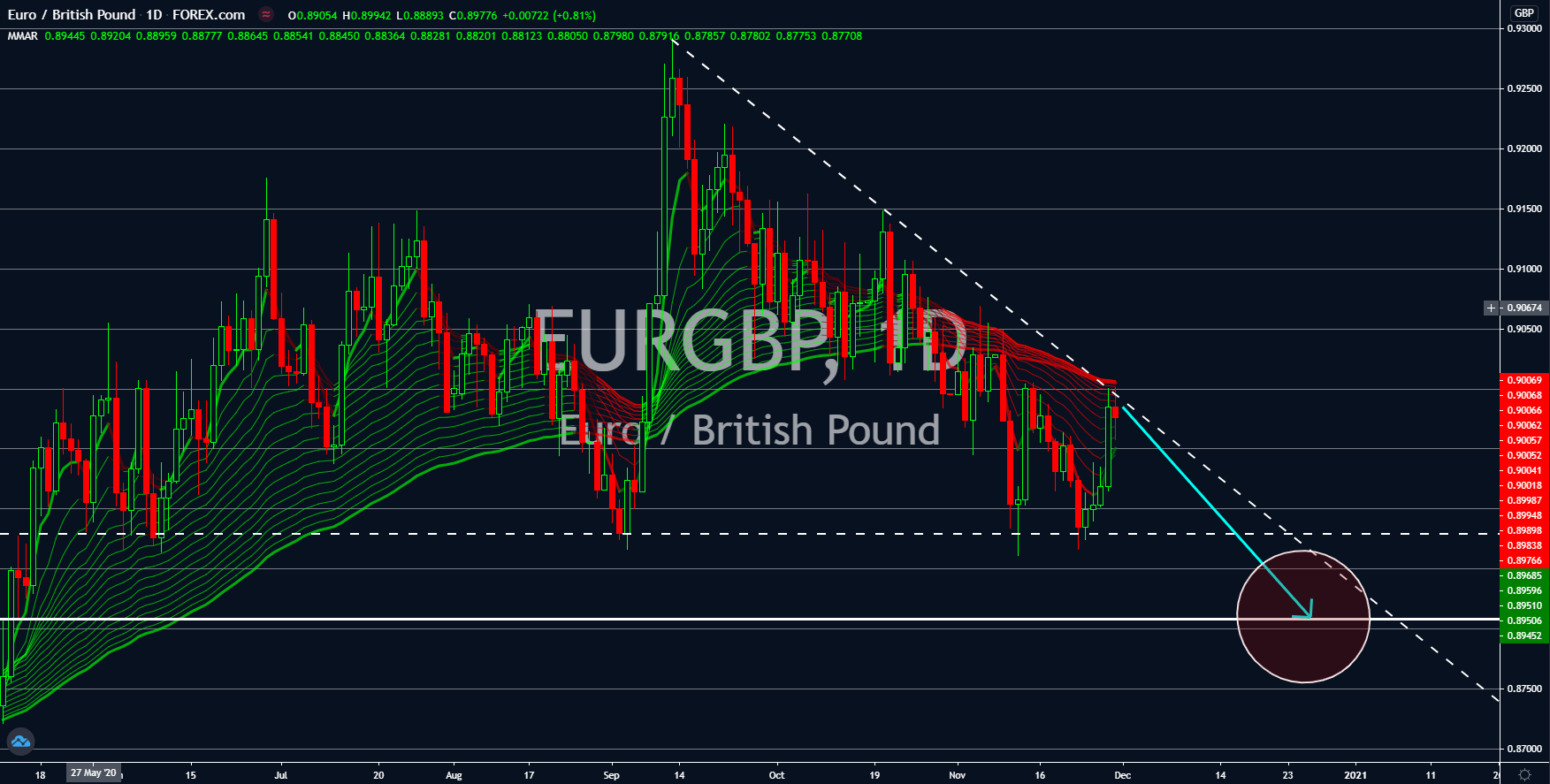

EURGBP

This week has been the third consecutive week of disappointing results from the EU and its member states. On Monday, November 30, Germany, Italy, and Spain, posted their consumer price index (CPI) for the month of November. Five (5) out of six (6) reports were a decline from their previous results while the remaining one (1) had the same result as its previous report. There were also five (5) negative numbers on these reports. Figures came in at -0.8% and -0.3% for MoM and YoY result of Germany, -0.2% and -0.1% for Italy, and 02% and -0.8% for Spain. On Friday, November 27, France posted its CPI reports of 0.2% and 0.2% results. However, not all figures from Friday were positive. The EU consumer confidence dropped anew to -17.6 points while business and consumer survey declined to 87.6 points. The industrial and services sentiments supported the bleak outlook for the EU with -10.1 points and -17.3 points, respectively.

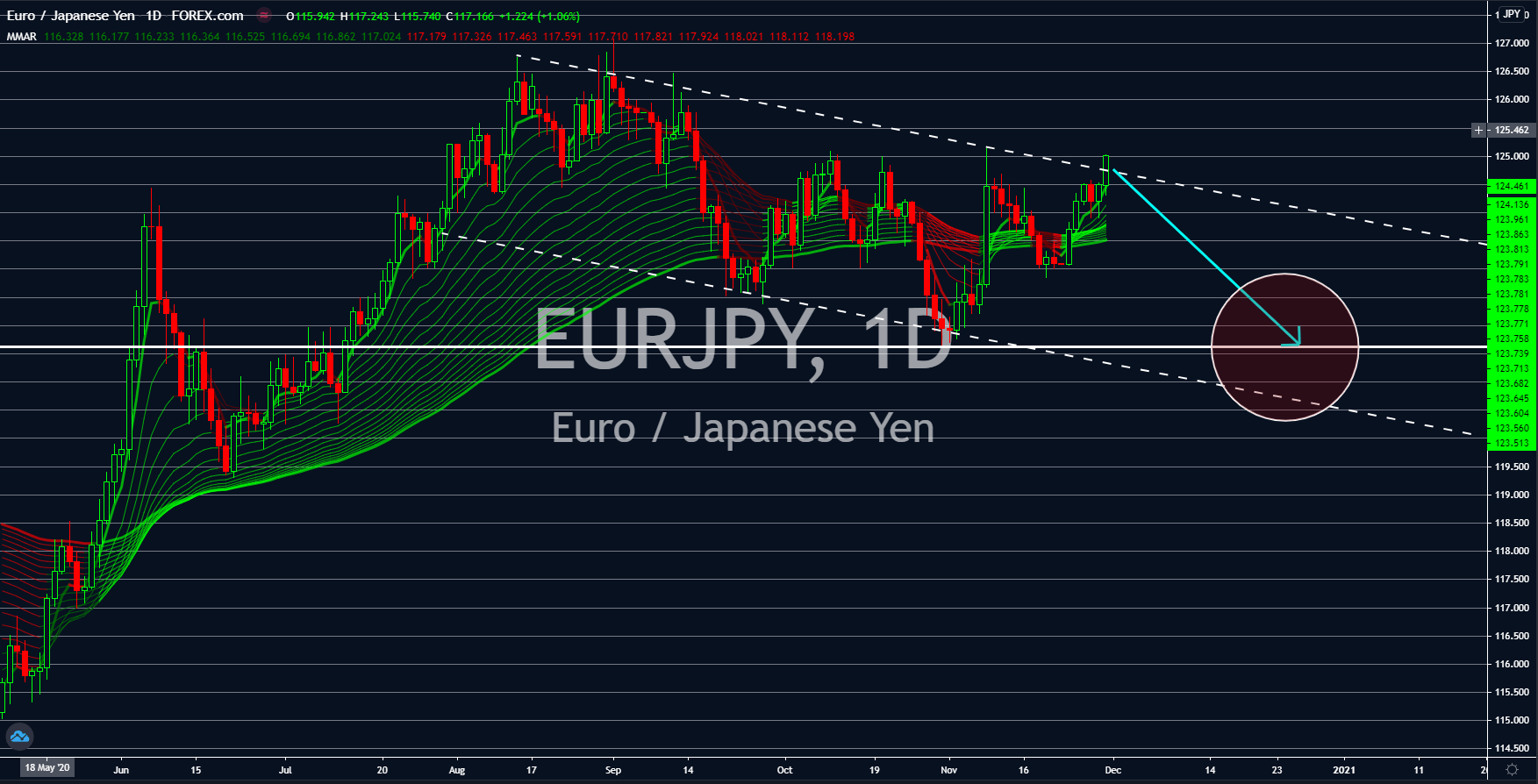

EURJPY

The Japanese yen will continue to outperform the single currency in coming sessions following its positive results on its most recent reports. Among these reports was the leading index, a collection of difference indices that measures Japan’s economic performance in the next six (6) months. The result on Thursday’s report, November 26, was 92.5 points, up from last month’s 88.5 points. Hopes are high for the country’s manufacturing sector following the construction orders in October which saw a decline of -0.1%, a major improvement from last month’s contraction at -10.6%. Also, Housing Starts YoY report on Monday, November 30, of -8.3% was better than the prior month’s -9.9% figure. There are also some fundamentals that will support Japan’s recovery in the near team. First, Japan and China had several meetings in hopes of resuming flights between the two (2) countries. Second, Japan and China were members of the newly formed trading bloc.

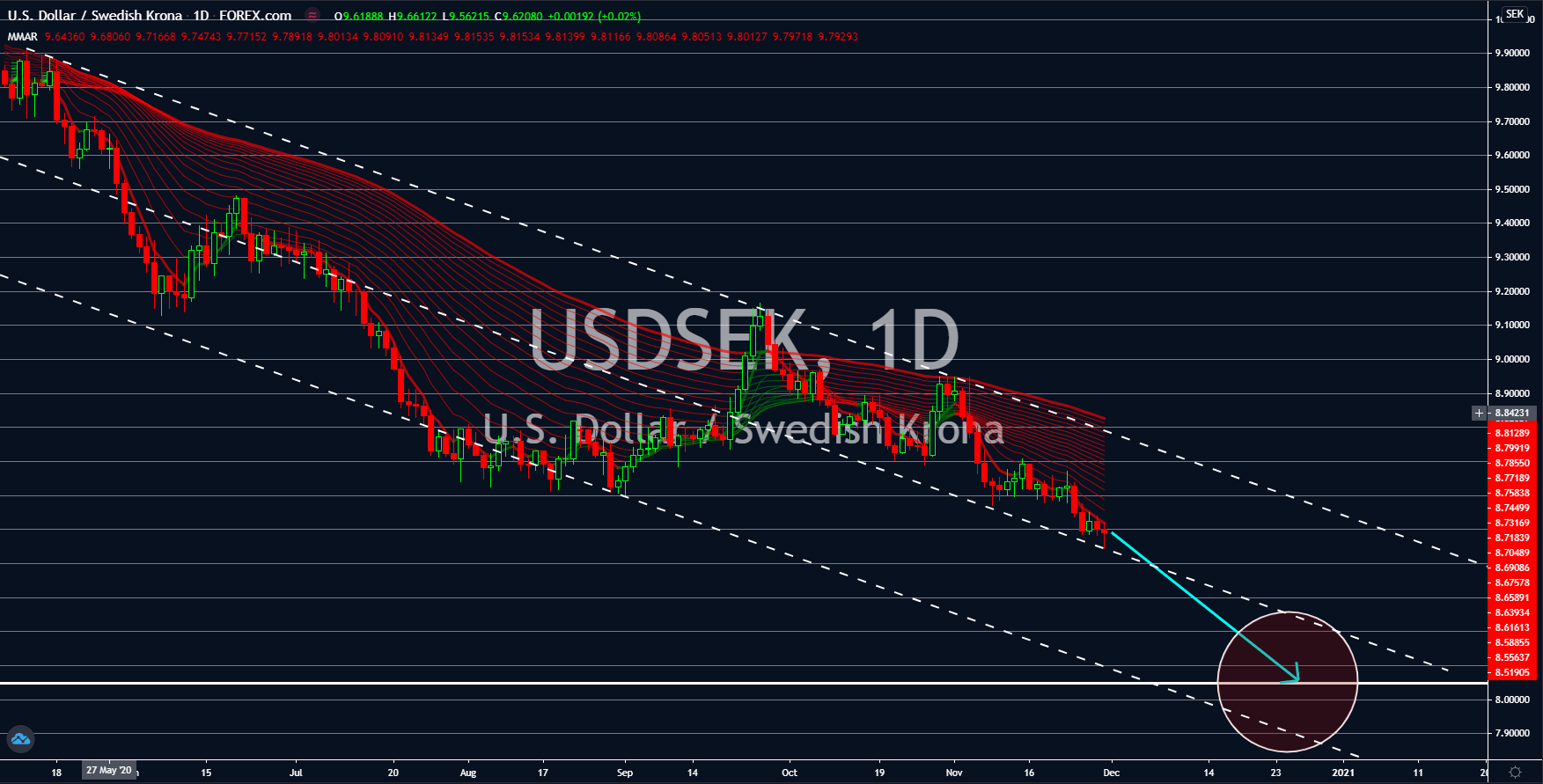

USDSEK

Sweden ended last week with positive results from its reports. The first on these reports was the country’s third quarter GDP result which increased by 4.9% against the previous month’s result of -8.0%. On a yearly basis, the Q3 GDP was down by -2.5% but was a major improvement from the second quarter’s -7.5% decline and against analysts’ expectations of -3.6%. In addition to this, the country’s retail sales for the month of October continue to impress investors as October marks the start of the second wave of coronavirus cases in the region. The report was up by 3.6%. Retail sales in September was 2.7% while analysts expected a slower growth at 1.6%. Sweden has also a higher trade surplus in October compared to the prior month. The surplus reached $4.70 billion in October. The economic aid by the Swedish government also successfully stimulates the economy with a 5.3% household lending growth in November.

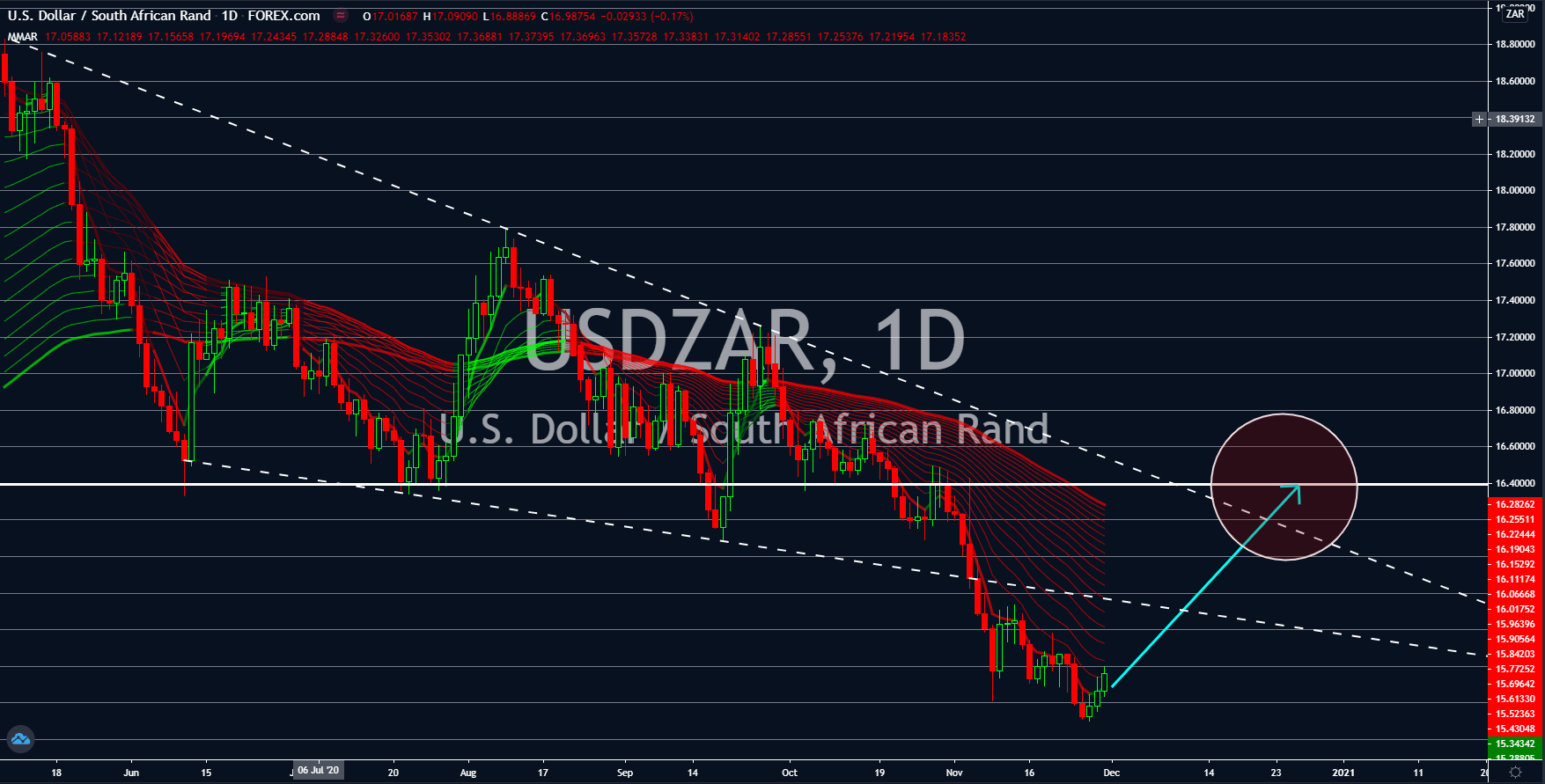

USDZAR

The US dollar will recoup back its losses against the South African rand after the SA backed securities were labeled “junk” by Moody’s and Fitch Ratings. The country’s Long-Term Foreign-Currency Issuer Default Rating (IDR) was given a BB- with a Negative Outlook by Fitch Ratings. The same grade was also given by the credit rating agency to South Africa’s five (5) largest banks. Fitch Ratings cited the coronavirus pandemic and the increasing reliance of South Africa from Chinese loans as the main catalysts for these ratings. In addition to this, the credit rating agency said that the economy will not see its 2019 levels even after the year 2022. South Africa’s economy has been contracting since the third quarter of 2019. The hard lockdown in Q2 2020 further pushed SA’s economy to the brink. Meanwhile, analysts are expecting Africa’s largest economy to grow by 4.8% in 2021 but will slow down to 2.5% in 2022.