Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

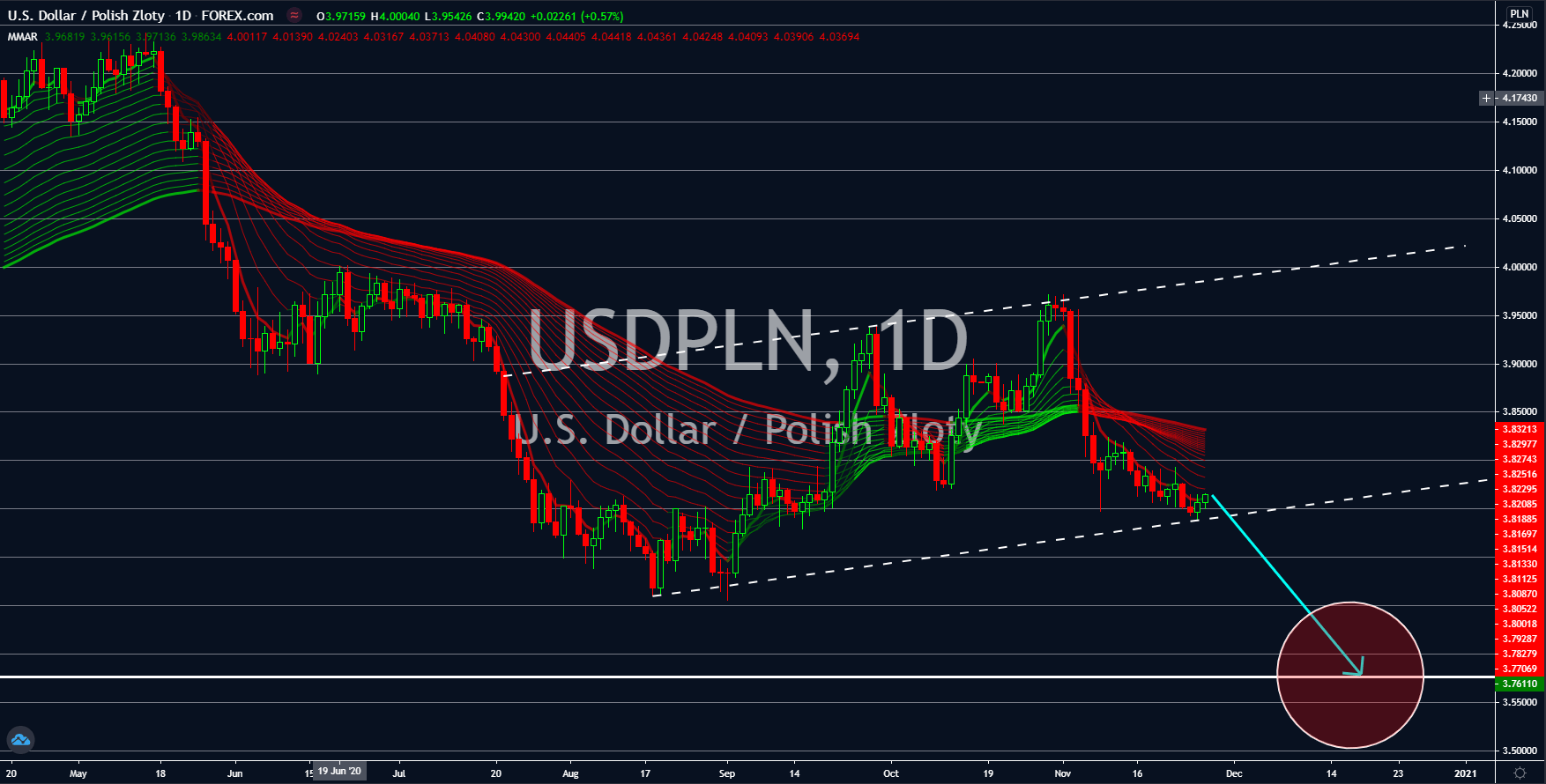

USDPLN

The unexpected increase in the number of unemployment claimants will hinder the US recovery. On Wednesday, November 25, initial jobless claims rose by 778,000, which was 48,000 more than what was expected by analysts at 430,000. This figure was also a 30,000 increase from the prior week’s result of 748,000. The Personal Income and Personal Spending reports also confirmed the mass layoffs happening right now in the United States. Figures came in at -0.7% and 0.5%, respectively. Although there were three (3) US pharmaceutical companies racing to get the approval from the Food and Drug Administration (FDA), it will take some time to produce it. Aside from this, the $2.2 trillion stimulus package is still pending, which might force companies to trim down their manpower. Thus, investors should expect higher numbers in the coming sessions until the virus is contained or until the new stimulus bill has been passed into law.

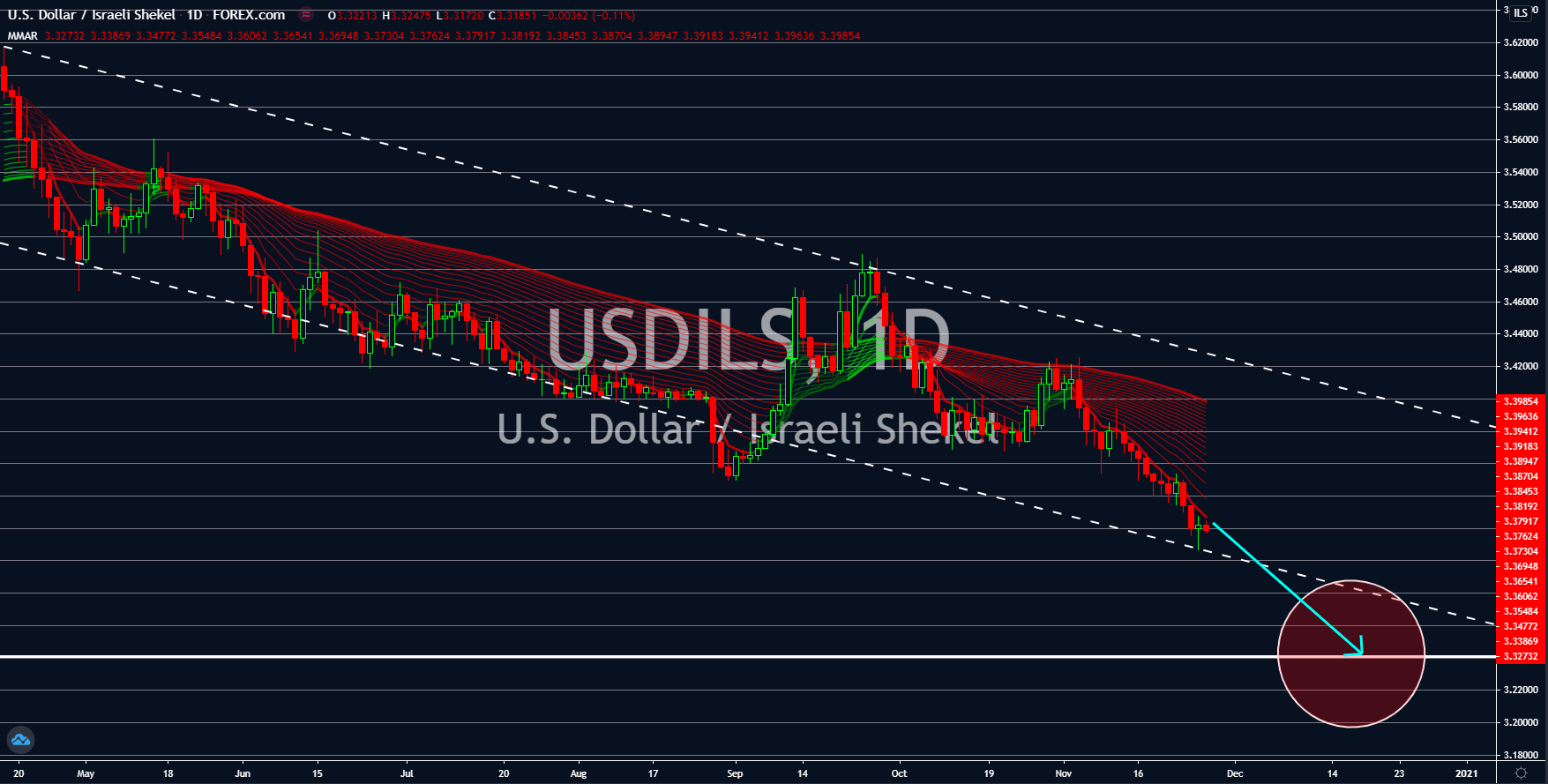

USDILS

Investors are looking forward to more stability in Israel following its Q3 GDP result and the recent development on its relationship with Arab countries. For the third quarter of the fiscal year, the Israeli economy rebounded by 29.7%. This was following the lifting of the first lockdown in the country. Hence, investors should expect a modest growth for Q4 as the country began to reopen from its second lockdown. In other news, the Palestinian Authority (PA) has signaled its willingness to restore peace in the region. This decision came after the United Arab Emirates held its first flight from Abu Dhabi to Tel Aviv. The normalization of ties between the Jews and the Arabs is expected to boost the Israeli economy. As for the US, the departure of US President Donald Trump could also mean the end of the close US-Israeli relations. Thus, any advancement in ties with Israel’s relations to the Arab countries will only benefit itself.

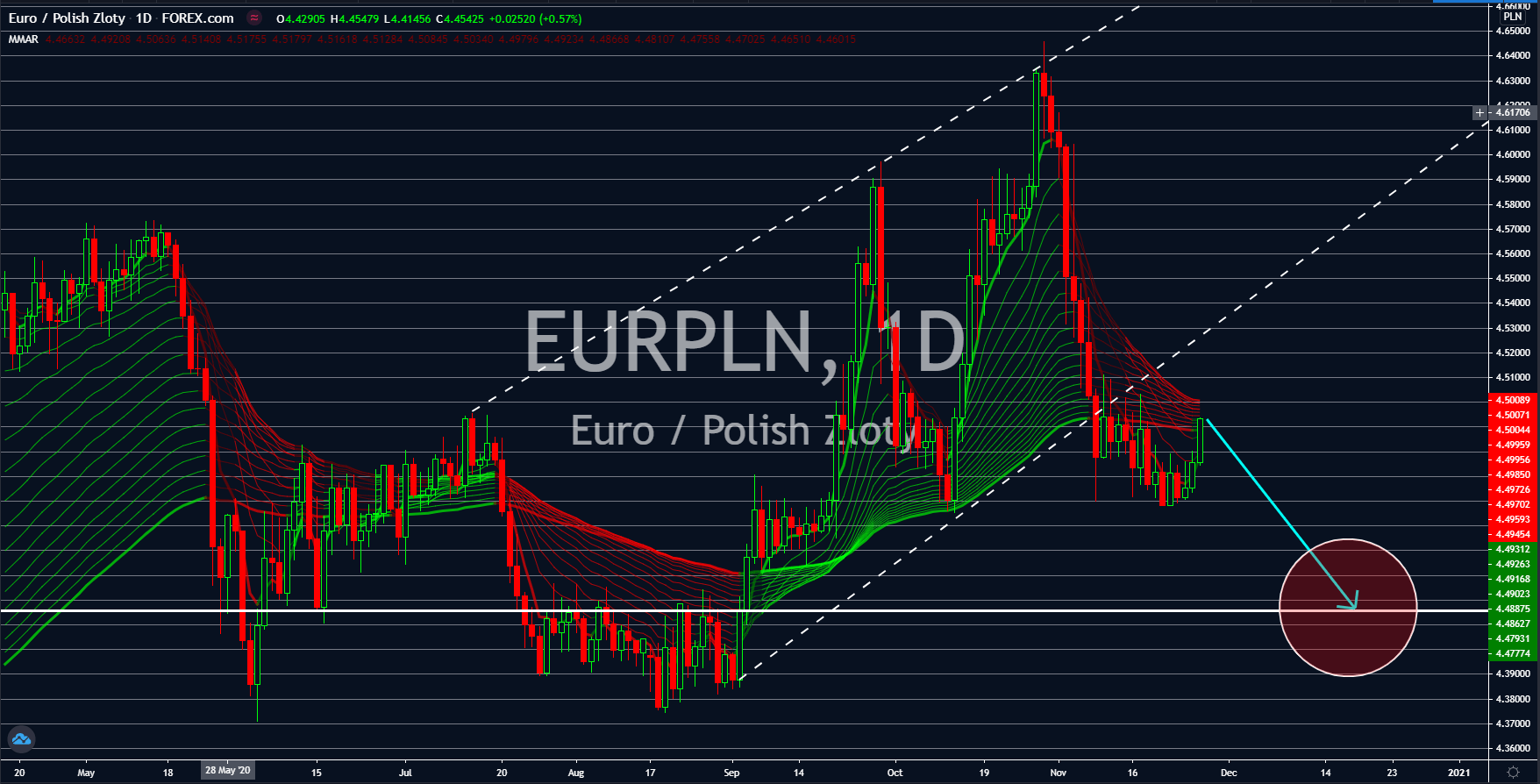

EURPLN

Poland and Hungary refused to back down from the ongoing tension between these countries and the European Union. The two (2) countries vetoed the proposed $2.15 trillion budget for 2021 to 2027, which was aimed at helping the member states to recover from the pandemic. The tension arises from the agreement between the European Commission and the European Council to tie the budget of each country with their compliance to the EU rule of law. The eastern countries have been repeatedly accused of violating these rules in their territories. Although Poland and Hungary will be affected by their decision, other members who are using the euro as their national currency will be hurt the most. In a separate stimulus package, Poland unveiled its $10 billion stimulus package that will help business operations to resume. The Polish Development Fund said that the national economy could contract by 3.0% to 4.0% in the fourth and final quarter of fiscal 2020.

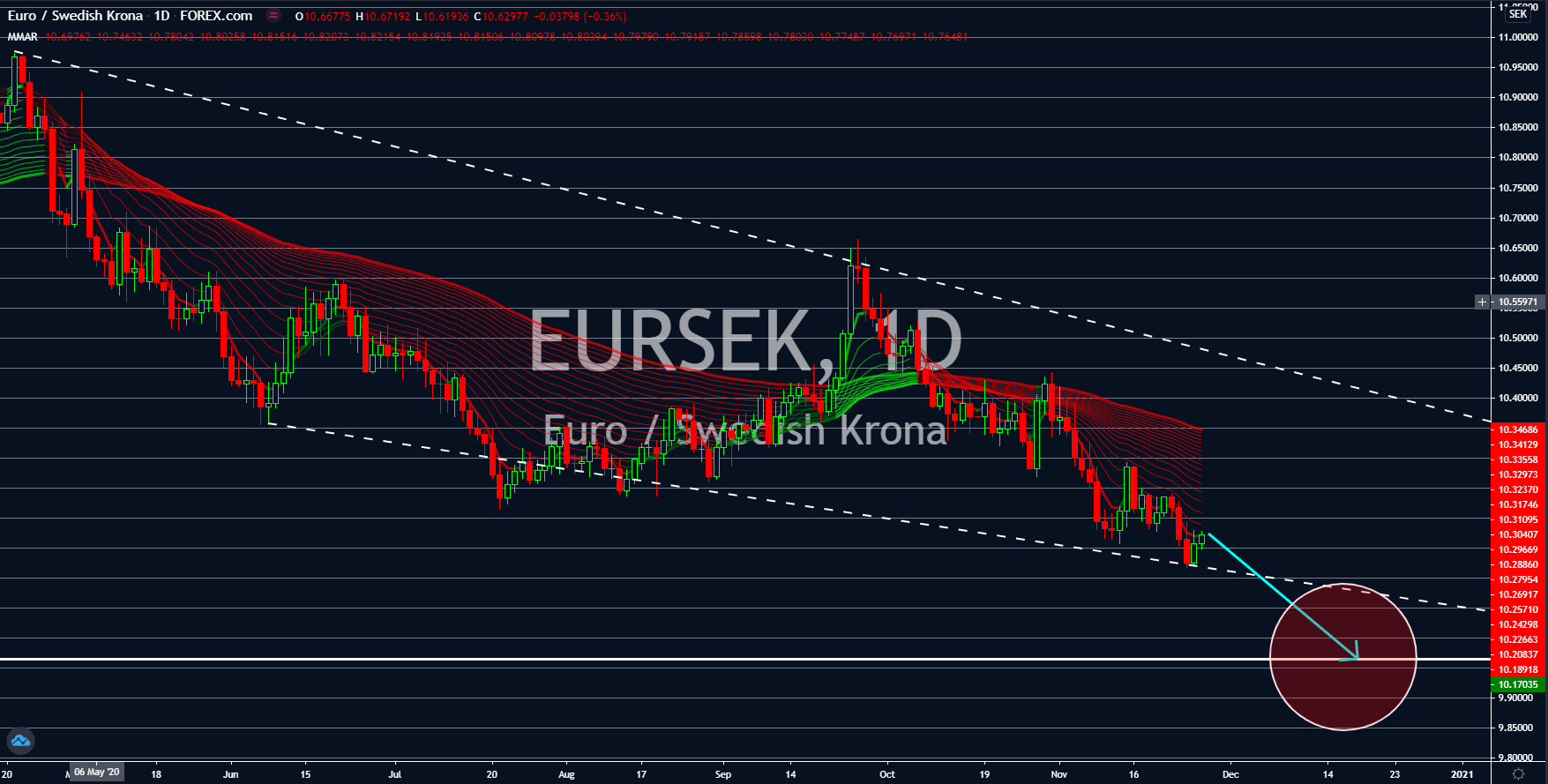

EURSEK

The economic outlook for the EU and its member states turned bleak following the resurgence of COVID-19 in the region. Confidence from both the consumers and businesses falters with the German Gfk Consumer Climate shrinking by -6.7 points from -3.2 points last month. Meanwhile, the French Consumer Confidence report declined to 90.0 points from 94.0 points. As for Italy, both business and consumer confidence plummeted with 90.2 points and 98.1 points, respectively. The EU bloc was not spared from the disappointing results. Consumer confidence for the month of November massively declined by -17.6%. The services and industrial sentiment also dropped anew. Figures came in at -17.3 points and -10.1 points. Sweden’s consumer confidence also declined on Thursday, November 26, to 88.3 points. However, this is only a minimal decrease from last month’s 89.2 points. Meanwhile, manufacturing confidence increased to 110.6 points.