Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

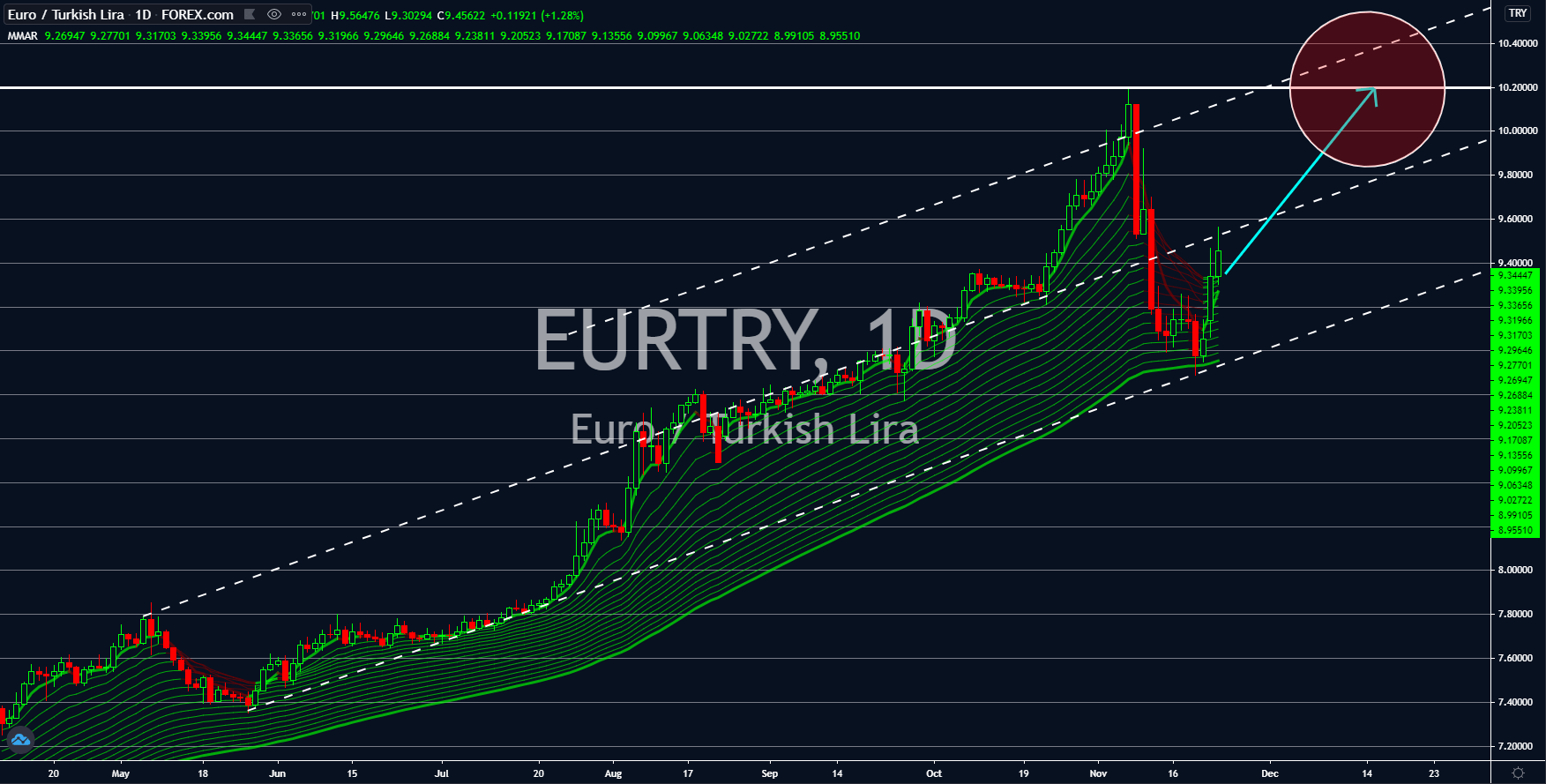

EURTRY

Optimism in the Turkish lira has faded. The Turkish currency saw its biggest advance against the single currency in November following the resignation of the country’s finance minister. The previous FM was son-in-law of President Recep Tayyip Erdogan and political analysts had repeatedly expressed their concerns that too much control in the country’s economy would lead to a decline in the lira. Despite the weak figures for Manufacturing and Services PMI reports from the EU member states, the bloc’s overall results were still moderate. Figures came in at 53.6 points and 41.3 points, respectively, although these figures were below the UK’s data. Meanwhile, investors had continuously expressed their concerns over Turkey’s mounting debts. The national government debts are now at $1.93 trillion compared to the previous month’s $1.86 trillion. The political differences between the EU and Turkey will also affect the EURTRY’s performance.

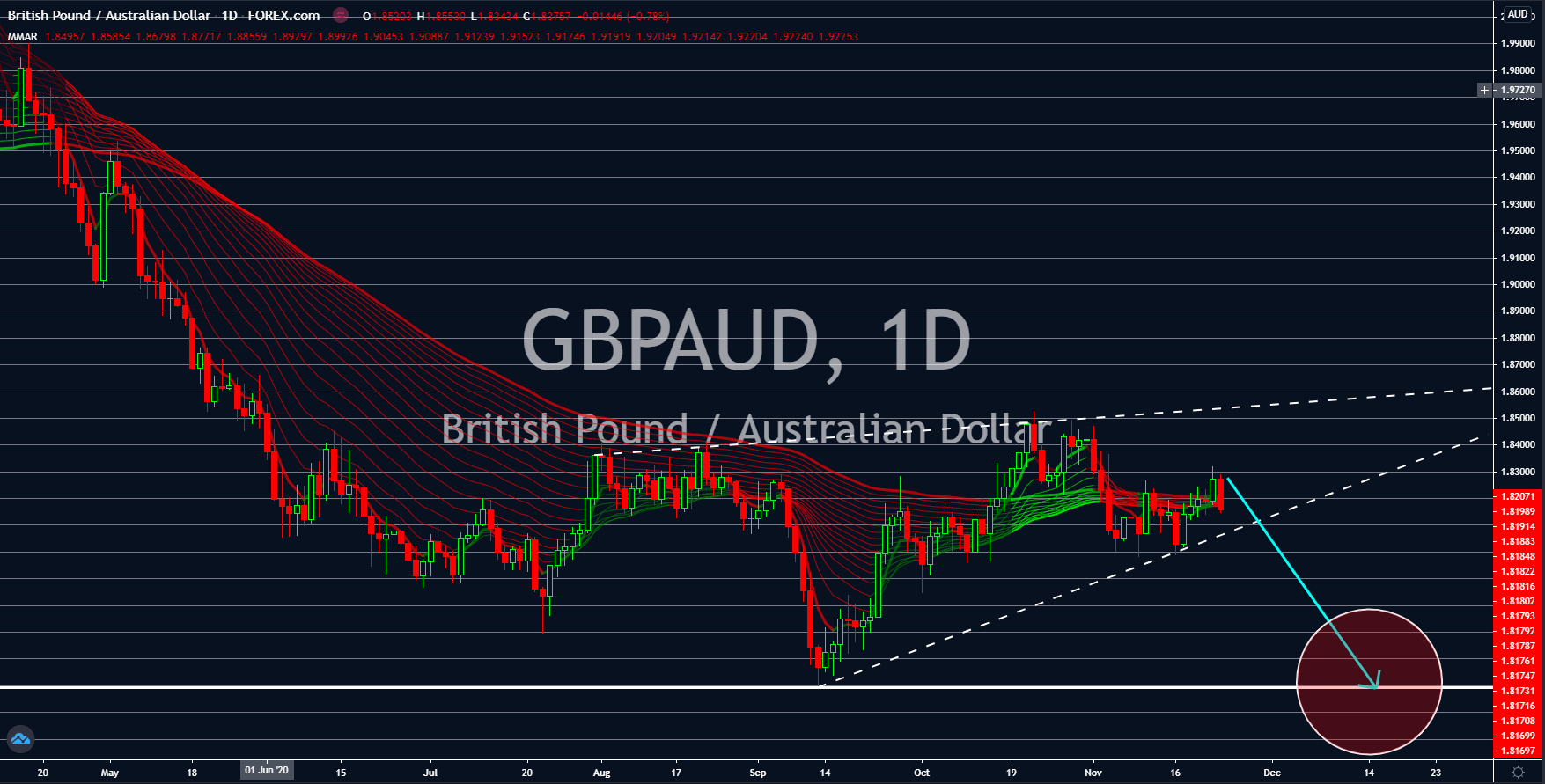

GBPAUD

Australia showed a consistent recovery following the upbeat results for its Manufacturing and Services PMI reports. Figures came in at 56.1 points and 54.9 points, respectively. Both numbers beat their previous records of 54.2 points and 53.7 points. Analysts are anticipating more optimistic numbers in these reports once Melbourne, Australia succeeded in containing the virus. On the other hand, the United Kingdom was among the outperformers in the region when it comes to each country’s economic data. The second largest economy in the EU who is set to leave the bloc next year posted 55.2 points and 48.5 points for Manufacturing and Services PMI. Meanwhile, France, who is the third-largest economy in the EU bloc, dragged Germany’s positive data with its weak figures. France had 49.1 points and 38.0 points results for these reports while Germany beat the UK with its 57.9 points and 46.2 points results.

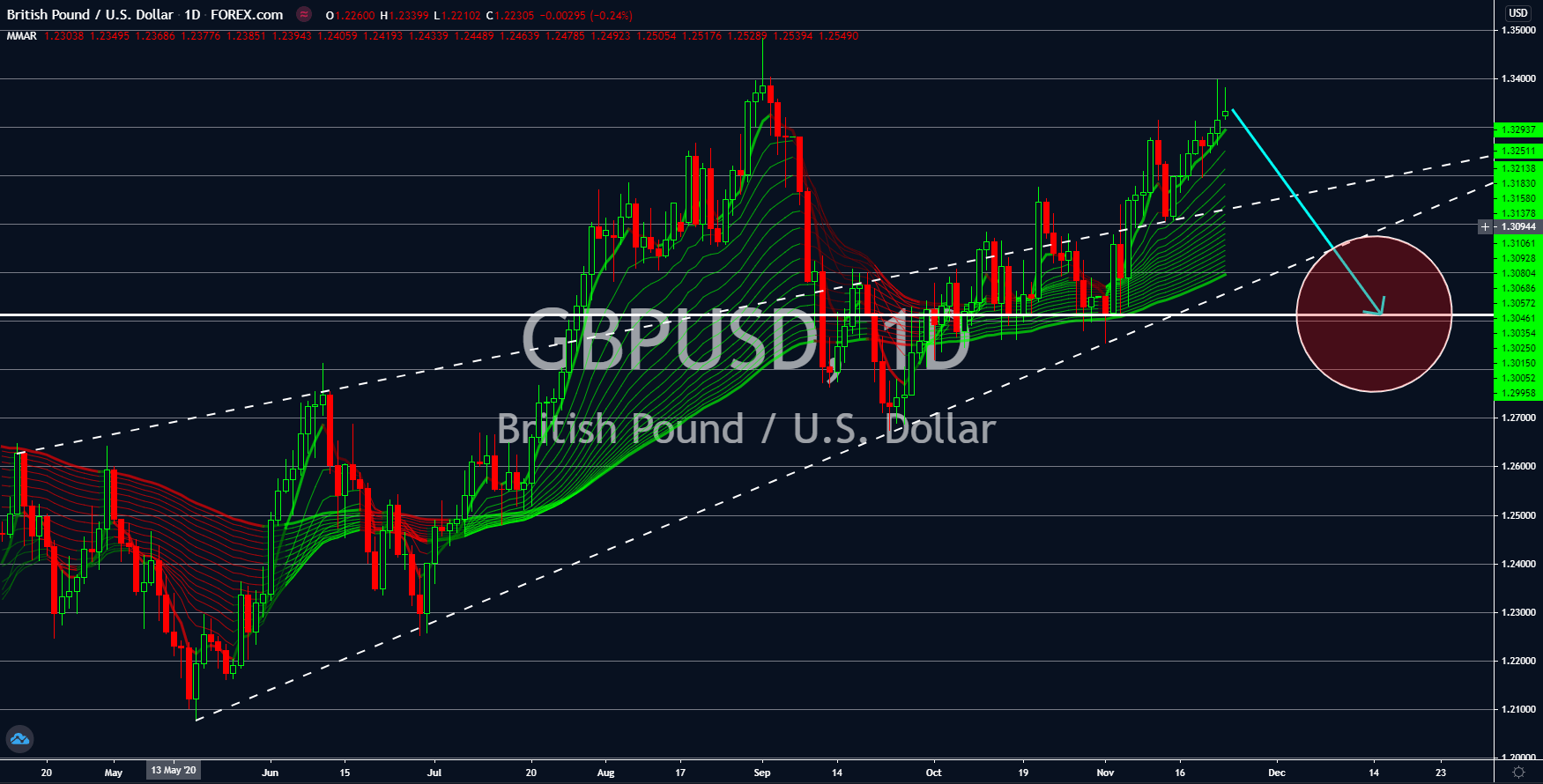

GBPUSD

The unexpected strong figures for the US’ Manufacturing and Services PMI reports will send the GBPUSD lower. The 56.7 points and 57.7 points results for these reports beat analysts’ expectations of 53.0 point and 55.0 points, which are below last month’s reports. The numbers for October data were 53.4 points and 56.9 points. Following the U-turn in the initial jobless claims report on Thursday, November 19, many analysts had expected that the upcoming reports will be below their prior records. The number of individuals filing for unemployment benefits rose by 742,000 last week. Now that the manufacturing and services sector proves to be expanding amid the rise in the number of COVID-19 cases in the country and the spike in the number of claimants, analysts are expected to revise their expectations to upbeat with the upcoming reports. Investors should also monitor the developments in the Brexit negotiations.

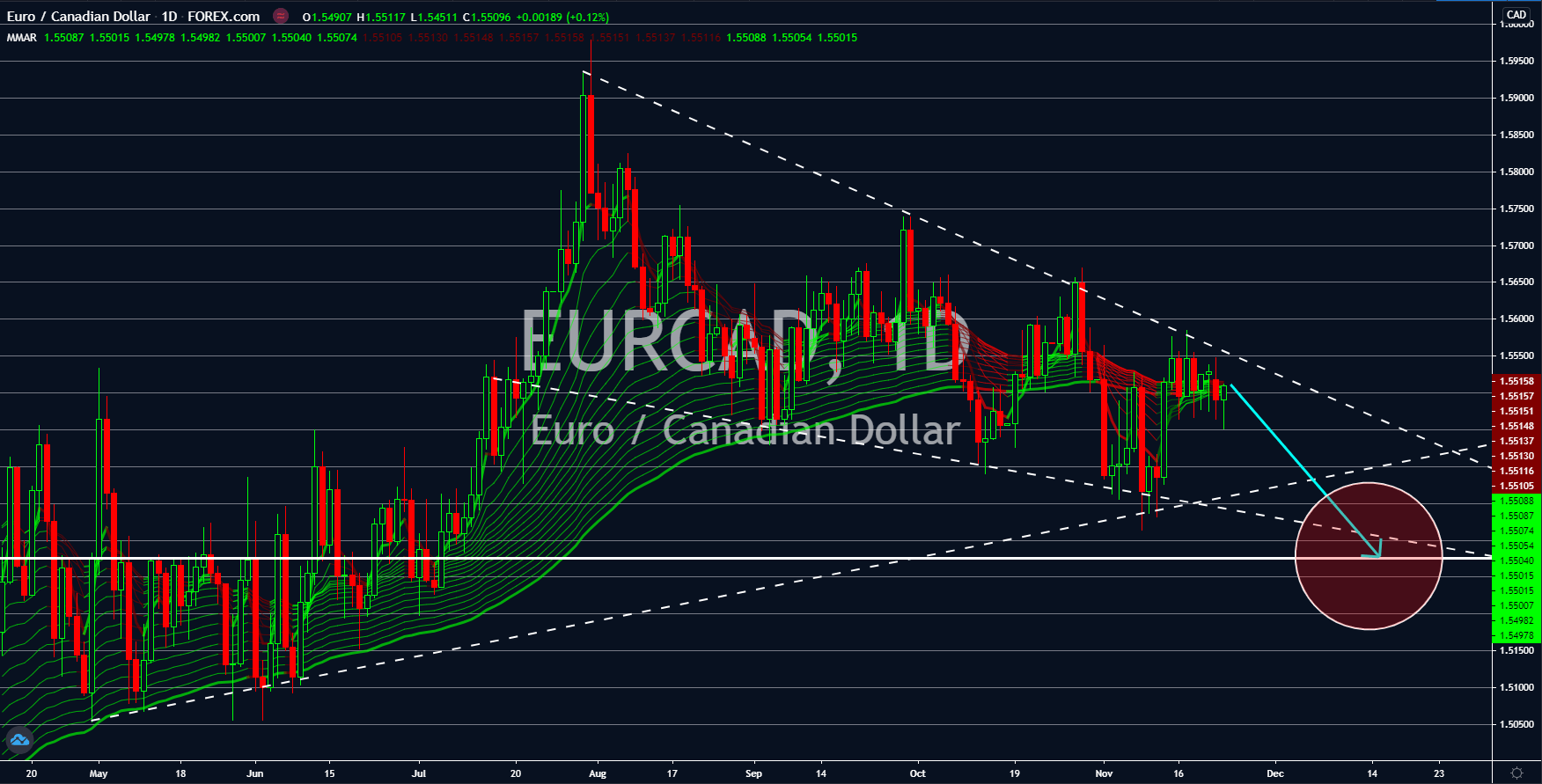

EURCAD

On last week’s ADP Nonfarm Employment Change, Canada posted a -79.5K in jobs creation for the month of November. Despite this, analysts are optimistic that the succeeding reports will be positive following the trend that was formed since May 2020. The reported figure is now the second lowest number through the duration of the pandemic. The top spot goes to June’s report when the world began to lift their lockdown. The opposite is true for the European Union and its member states. The resurgence of COVID-19 in the region is expected to regain back the recent recoveries that each economy made following the end of the first lockdown. In addition to this, the EU had devastating results for its manufacturing and services sector. France, which has the largest cases of coronavirus in the region, took the most hit from the resurgence of the deadly virus. Its figures for these reports were 49.1 points and 38.0 points, respectively.