Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

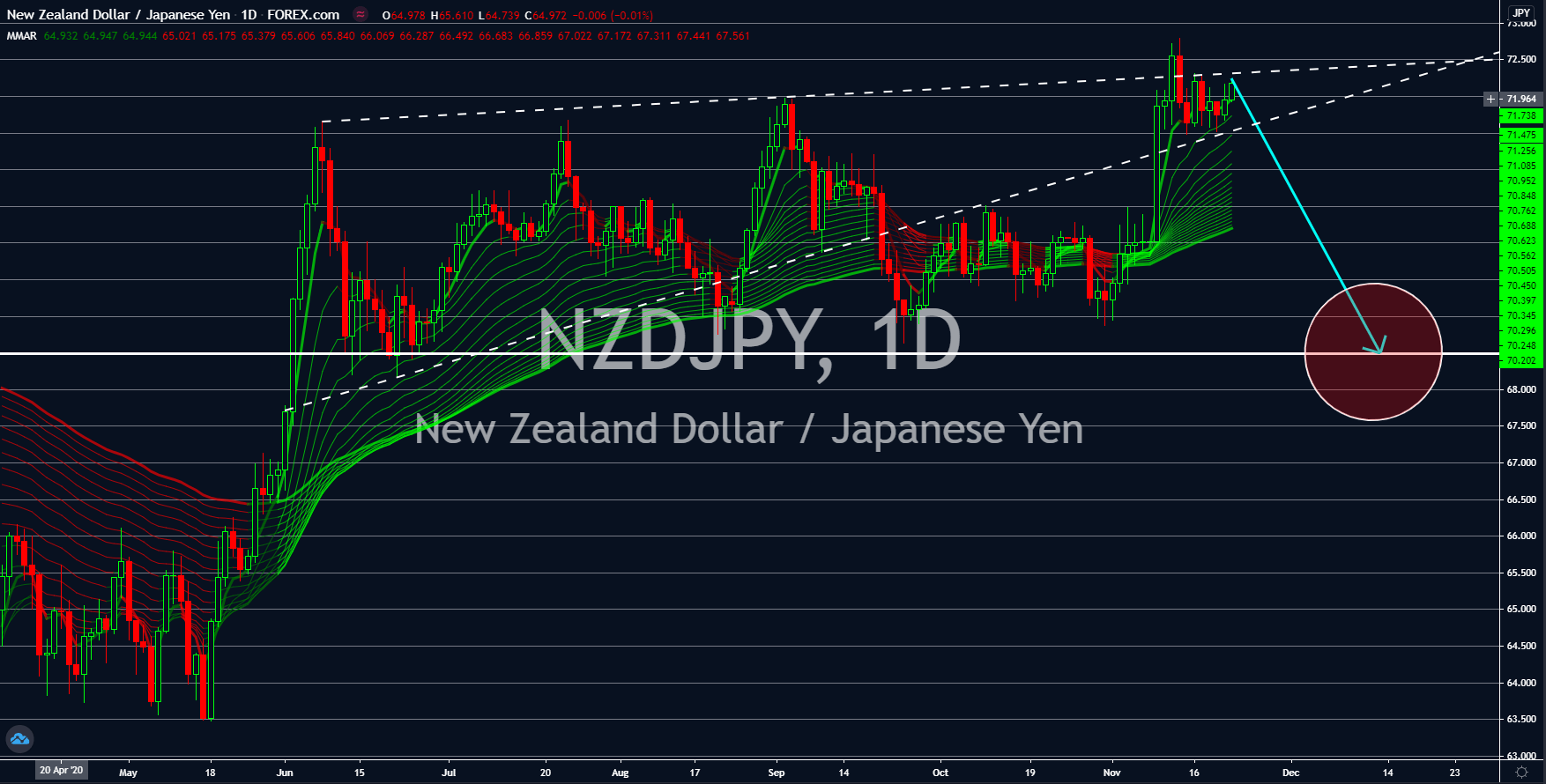

NZDJPY

The 28.0% increase in New Zealand’s retail sales for the third quarter was seen as a quick bounce back from its recent slump instead of a solid recovery. Most economies saw a massive decline in their Q2 reports as the COVID-19 cases started to soar between April to June. The theory of a quick recovery instead of a full recovery was further supported by the disappointing credit card spending. The report declined by 6.3% on a yearly basis despite the country successfully containing the virus. Meanwhile, Japanese Prime Minister Yoshihide Suga has a different strategy. Despite the skyrocketing cases of coronavirus in the country, he is still promoting Japan for tourism. Analysts had expected this move by most economies as their economies grappled with rising unemployment and corporate bankruptcies. Despite being bad for the Japanese equities, this move will help the Japanese yen to recoup its losses against the New Zealand dollar.

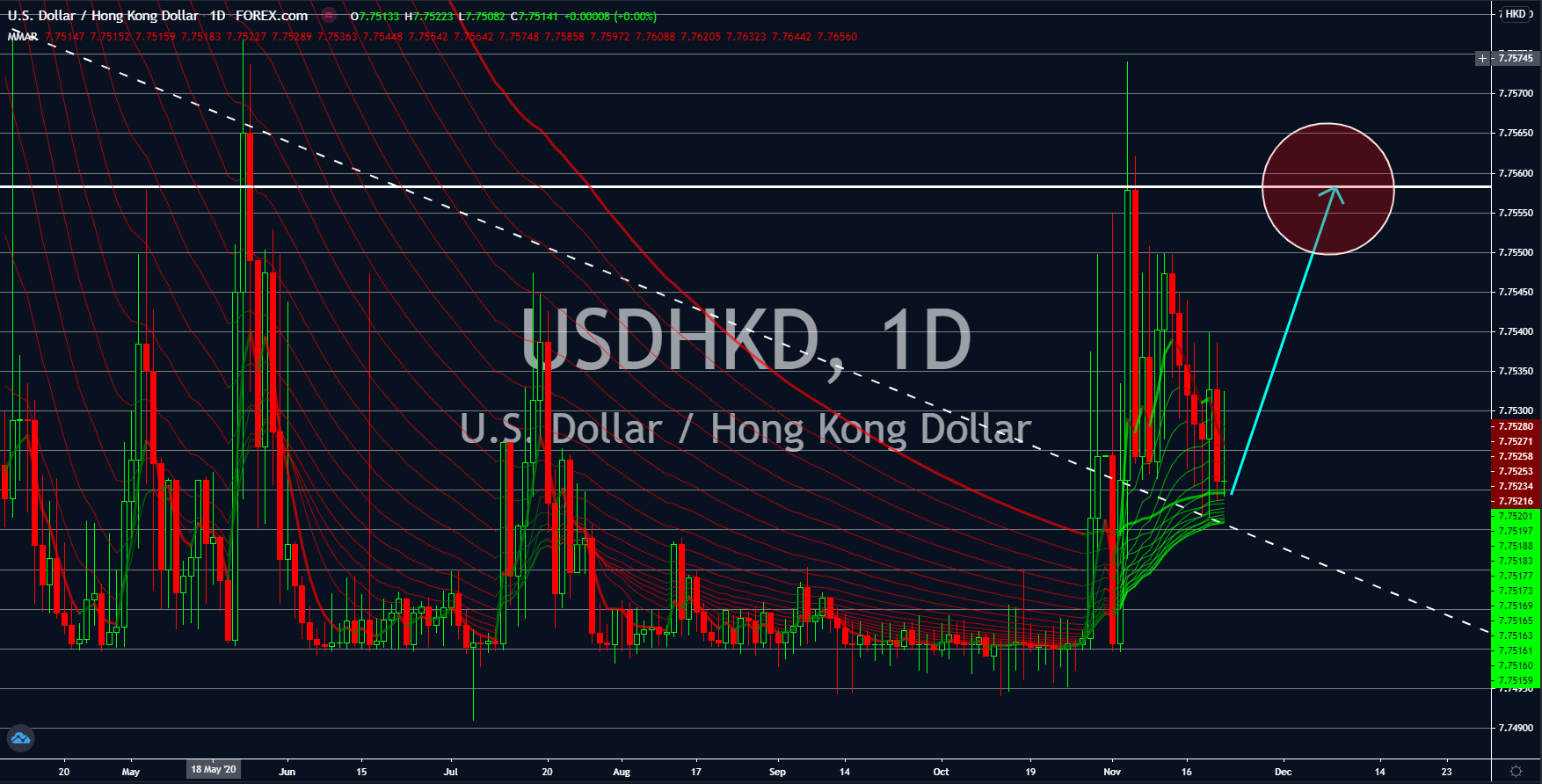

USDHKD

The US Manufacturing and Services PMI are expected to continue to expand on the upcoming report on Monday, November 23. Expectations for the reports were 53.0 points and 55.0 points, respectively. Although these figures represent a decrease in their prior reports, analysts are still optimistic that this is sufficient for the greenback to continue to recoup its losses against the Hong Kong dollar. Meanwhile, the 742,000 additional claimants last week had caused the greenback to plummet against the basket of major currencies. On the other hand, the rising exposure and continued dependency of Hong Kong to mainland China’s economy could hurt its own economy in the medium to long-term. Hong Kong is one of Asia’s financial hub and China’s Shenzen replace it if Hong Kong continues to integrate itself with China. Investors should keep an eye on Biden’s policy towards China once he assumes the office on January 2021.

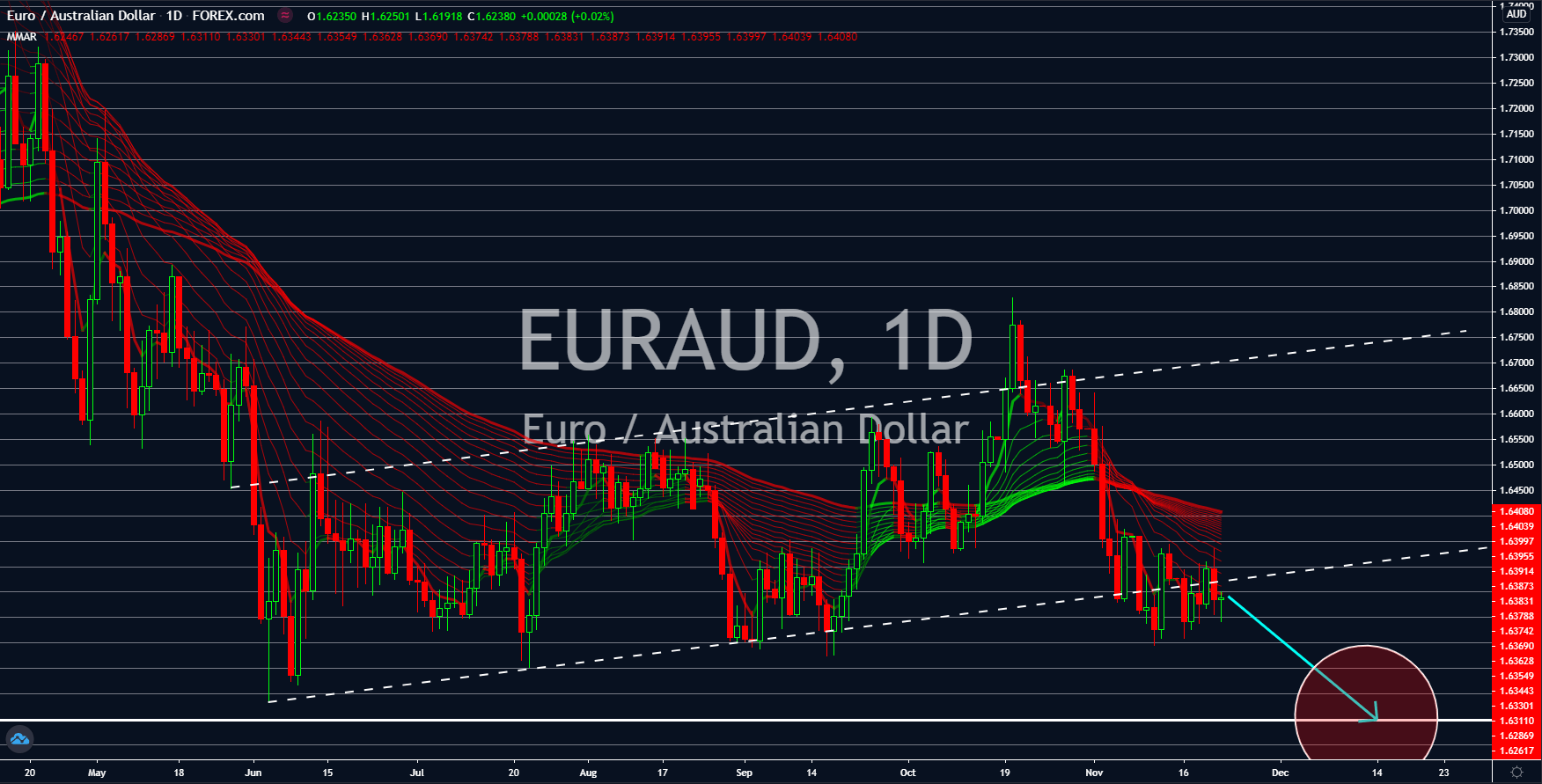

EURAUD

Australia was among the few countries who reported positive results this past few days. The country’s Manufacturing and Services PMI reports managed to beat their previous records. The figures were 56.1 points and 54.9 points against the previous records of 54.2 points and 53.7 points, respectively. Aside from this, retail sales in the country continue to expand at 1.6% for the month of October. Meanwhile, New Zealand had slowed down following its impressive Q3 retail sales data. On the other hand, the EU and its member states are worried that the recovery they made following the end of the first lockdown could vanish with the resurgence of COVID-19 in the region. Germany, the EU’s economic powerhouse, returned a second lockdown but in a lighter version. Despite this, investors are still expected to look out for new markets with greater opportunities other than the ones that are inside the EU bloc.

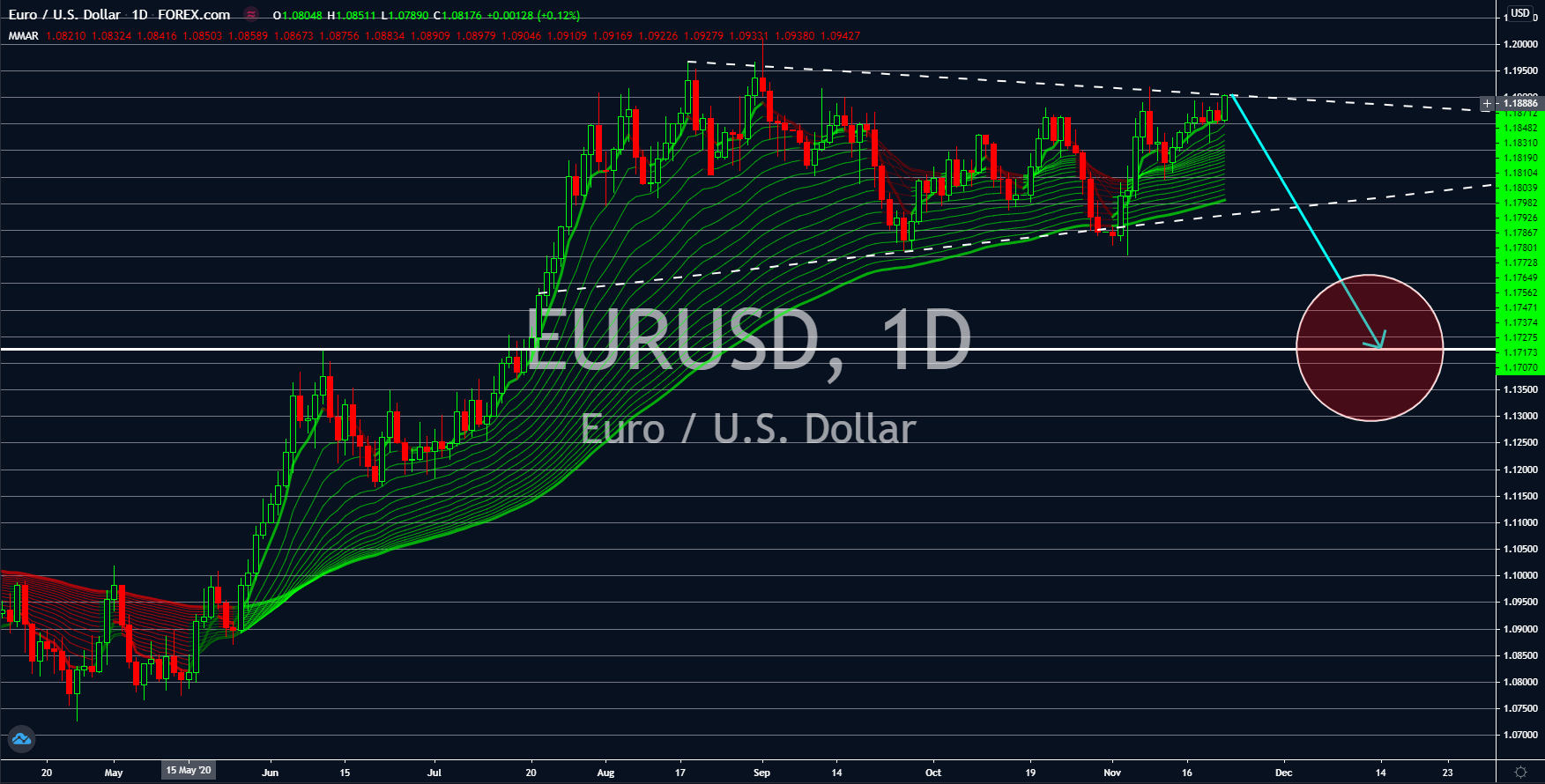

EURUSD

Both the EU and the US had disappointing results for their reports last week and these gloomy results are expected to continue in the coming sessions. On Thursday, November 19, the US said there were 742,000 individuals last week who filed for the unemployment benefits. This number was higher than the prior week’s 711,000 result. Moreover, the country’s Manufacturing and Services PMI reports are expected to post lower figures on Monday’s report, November 23. Analysts forecasted 53.0 points and 55.0 points on these reports. Despite the lower estimates, these figures are a lot better than the analysts’ outlook for the EU and its member states. France, the second-largest economy in the EU is expected to take the most hit on Monday’s report. Expectations were 34.0 points for Markit Composite, a modest outlook for Manufacturing PMI at 50.1 points, and a massive decline to 37.7 points for the Services PMI.