Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

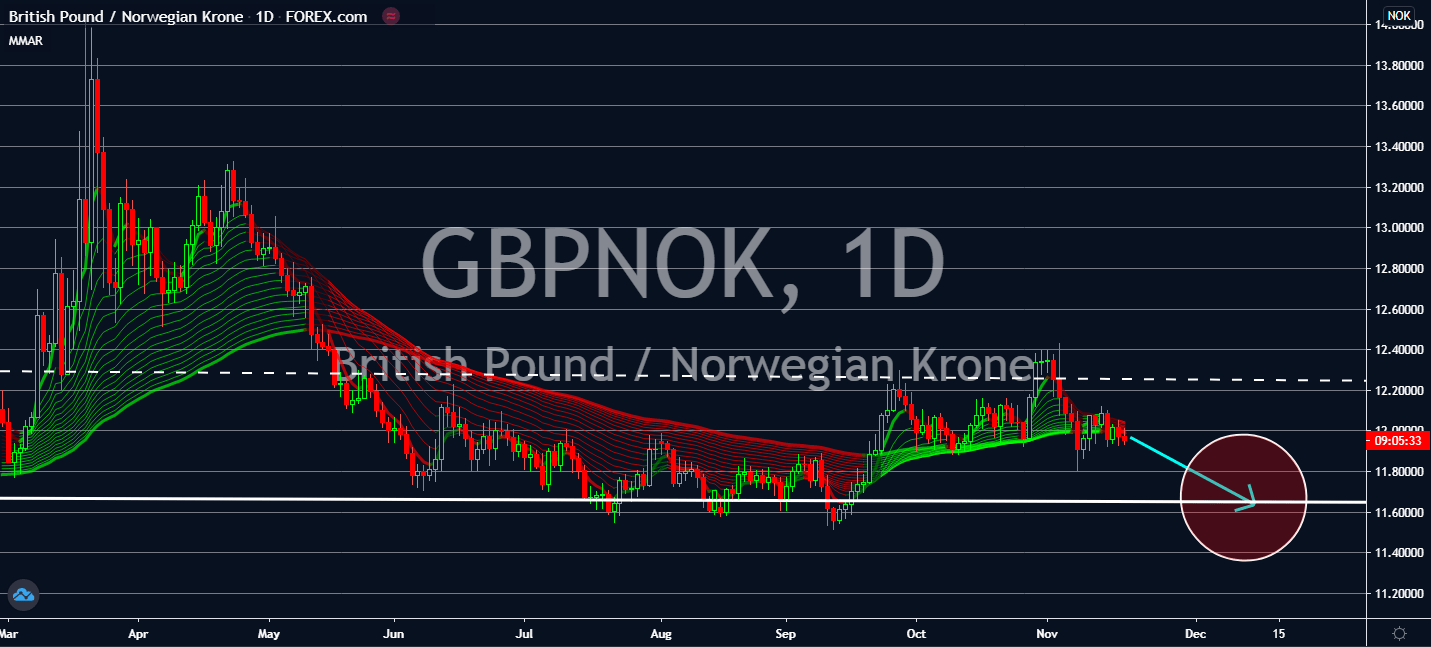

GBPNOK

The United Kingdom had just been presented a series of problems it needs to juggle amid the pandemic. The Bank of England claimed that unemployment is currently doubling across the country. The rate is projected to rise up to 7.75 percent by 2021. The country hit a high of 50,000 deaths from the coronavirus with more than 17,000 cases per day. The number of people in hospitals with the disease just peaked up to 16,000, only 2 thousand cases away from its highs back in April. These numbers are projected to pull the sterling in the near term, considering that the recent budget veto for the European Union will drag the market’s attention away from the currency. Meanwhile, oil and gas firms in Norway have seen recent developments and boosted their 2021 investment plans, indicating that the overall economy could face a better 2021 with higher oil prices, which are projected to reach 166,3 billion crowns by then.

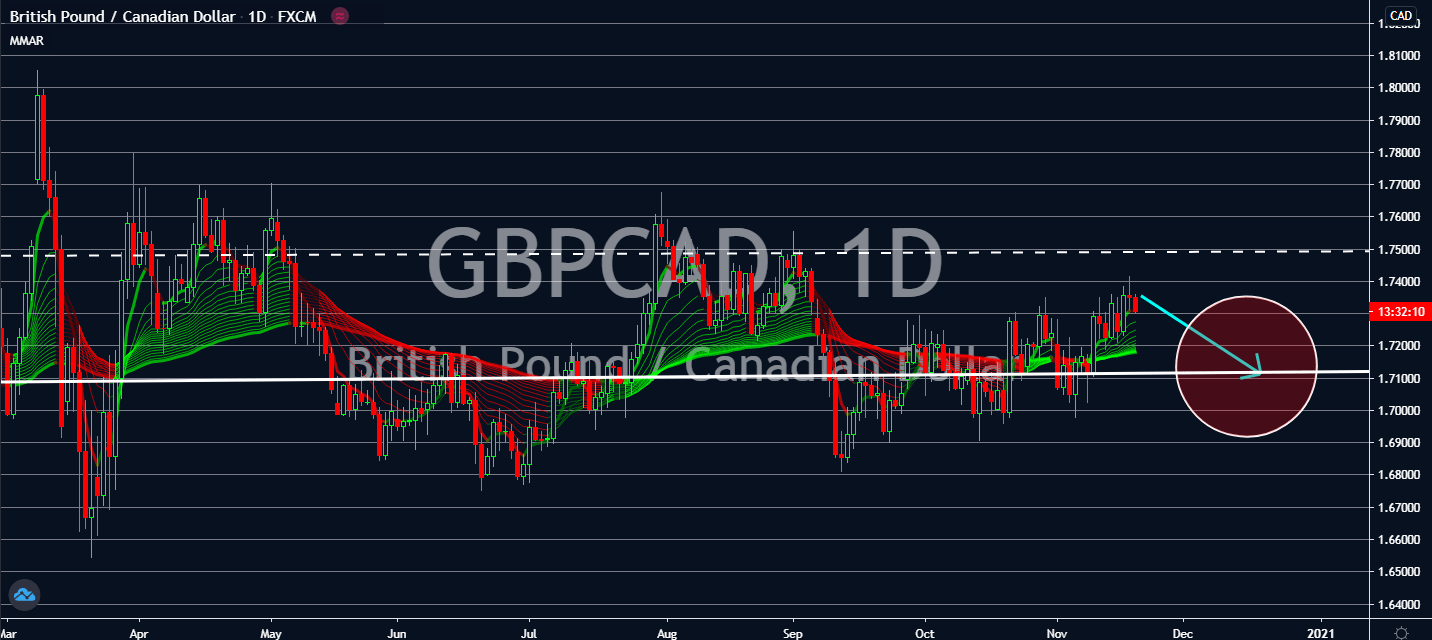

GBPCAD

Both the United Kingdom and Canada are projected to see their economies struggle over the second wave of coronavirus infections. Canada might be on track to a federal debt worth 350 billion Canadian dollars, and it’s expected to jump to $350 billion by the end of 2021 despite the positivity revolving around the new effective vaccine for the coronavirus. However, economists claim that the Canadian economy was able to escape depression because of the massive support from the government that had raised confidence in it crawling out of it. The more pressing troubles came in after the market had considered the implication of Hungary and Poland from the recovery budget towards the fiscal and trade relationships between the European Union and the United Kingdom. A no-deal Brexit could cost its economy half of much it could gain than with a deal. Estimates claim that post-Brexit growth would hit 10% while no-deal Brexit growth would be 4%.

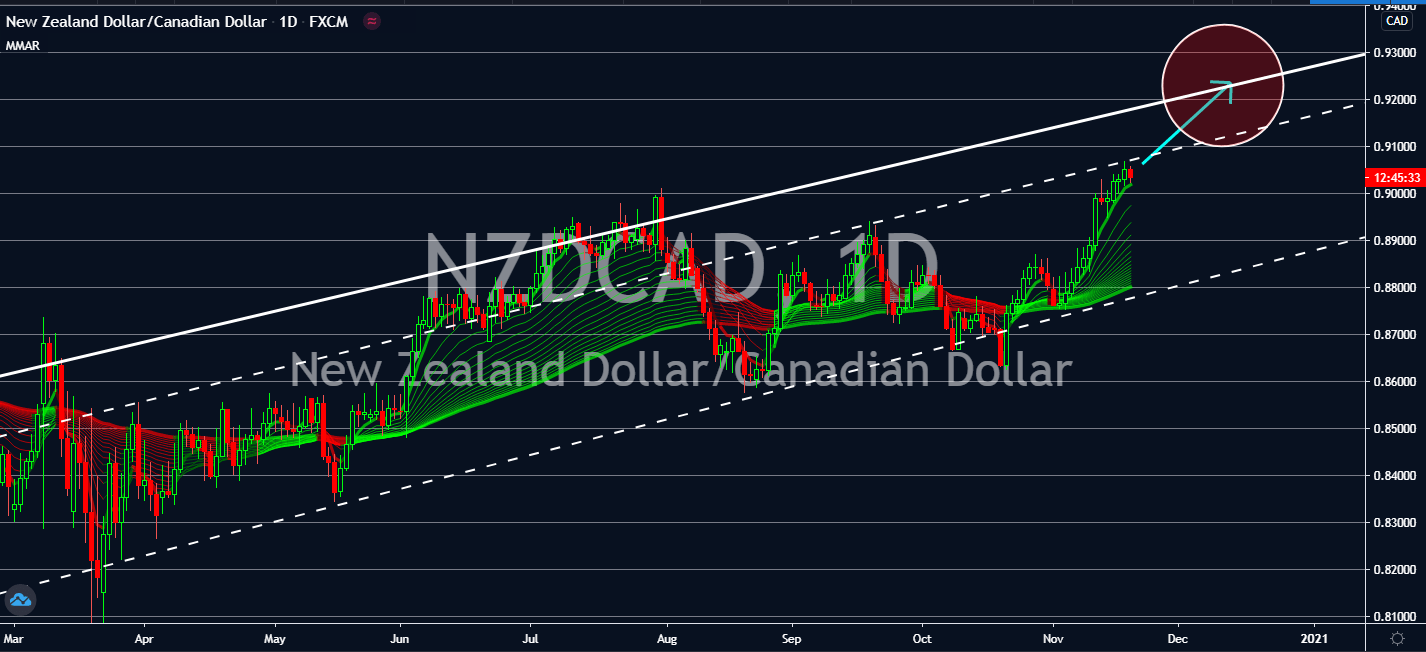

NZDCAD

Canada is projected to suffer over fiscal deficit over the next two years as after-effects of the coronavirus pandemic. Canada’s federal deficit is projected to reach about 350 billion Canadian dollars in 2021, which could rise even into 2022. Economists claim that the deficit could be so big that it could go back into a recession even after a coronavirus cure has been found. Critics claim that the biggest reason why the economy escaped a depression was that the Bank of Canada was able to pump out aggressive fiscal and monetary policies earlier in the year. Now that the loonie economy is projected to suffer over the new coronavirus outbreak in the country, its loonie dollar could fall against its New Zealand counterpart. In fact, now that New Zealand has finally recovered two of its coronavirus wave, the market will be more likely to invest in its currency even in the long-term thanks to the leadership of its Prime Minister Jacinda Ardern.

EURCAD

The eurozone is under threat of a double-dip recession. Economists believe that the bloc’s gross domestic product will shrink back by 2.5 percent in the current quarter after having expanded a record 12.5 percent in the third quarter, which was a turnaround from initial expectations of a 3.1 quarterly growth predicted in July, which is also below the 2.1 percent growth anticipated most recently. Now, markets expect the rate to shrink by 7.4 by the end of the year, which is less than -8.0 percent seen in the latest predictions. Moreover, the repercussions of a no-deal Brexit have become more demanding after Poland and Hungary officially revoked their approval for the European Union’s seven-year recovery plan against climate change and the coronavirus over claims that they should be able to abuse their political powers. A no-deal Brexit could cause more economic pain than the coronavirus, or as economists claim – worries are going to pull down the euro with them.